HR & Payroll Solutions

HR Solutions that Empower Leaders to Drive Business Results

We’re helping businesses succeed and empowering leaders with the most comprehensive, flexible, and innovative HCM solutions in the market.

(532 Reviews)

(2,065 Reviews)

Unrivaled Technology & Expertise

Paychex and Paycor have joined forces to reimagine how companies address the needs of today’s workforce. This groundbreaking partnership raises the bar in HCM with unrivaled AI-enabled technology supported by world-class service and advisory capabilities. We are among the most trusted providers in the business, serving nearly 800,000 customers. Together, we’re delivering the future of HCM.

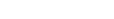

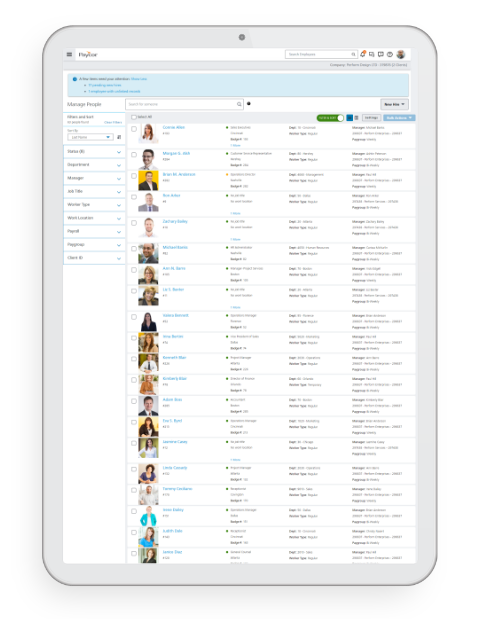

HR + Payroll Software

A single source of truth for all employee data makes your life so much easier — just imagine never having to manually update information in multiple places.

Talent Acquisition

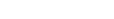

All great places to work have at least two things in common: employees feel their voices are heard, and they have access to meaningful learning opportunities.

Talent Management

If your people are more engaged than your competitors’ workforce, you win. Paycor makes all aspects of talent acquisition and retention a competitive advantage.

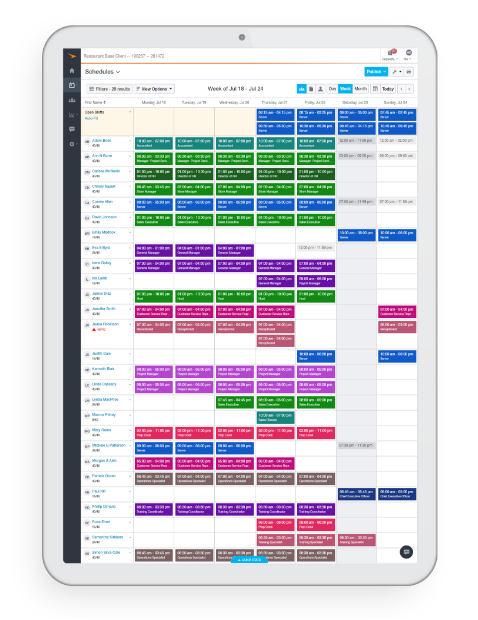

Workforce Management

Drive bottom line results by mastering all aspects of your labor spend, starting with accurate scheduling and time management.

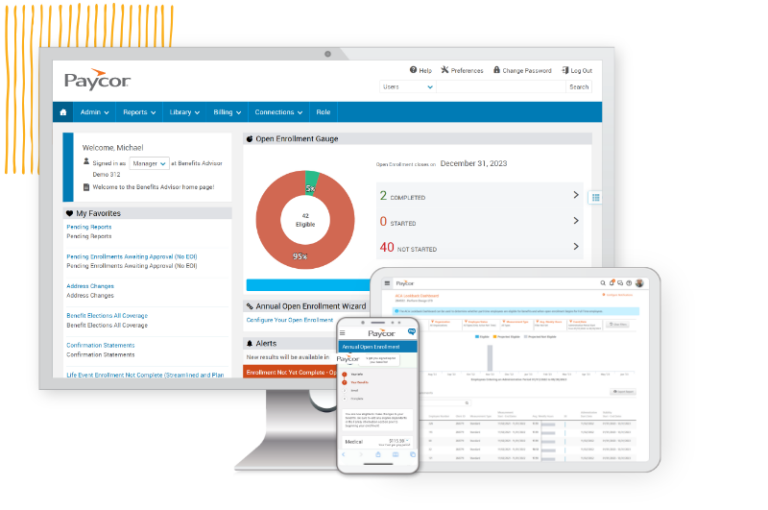

Benefits Administration

Make open enrollment a breeze and leave employees feeling well informed about their selections. Paycor’s Benefits Advisor also helps leaders find ways to save money, without compromising quality.

HR Solutions Tailored to Your Needs

Recruit and hire skilled nurses, dynamically schedule staff, and boost engagement and retention with Paycor’s configurable software.

Recruit skilled labor, optimize coverage, and track and analyze labor costs with Paycor’s configurable software.

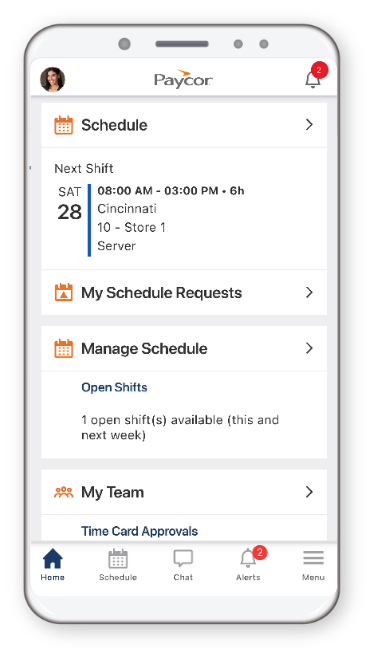

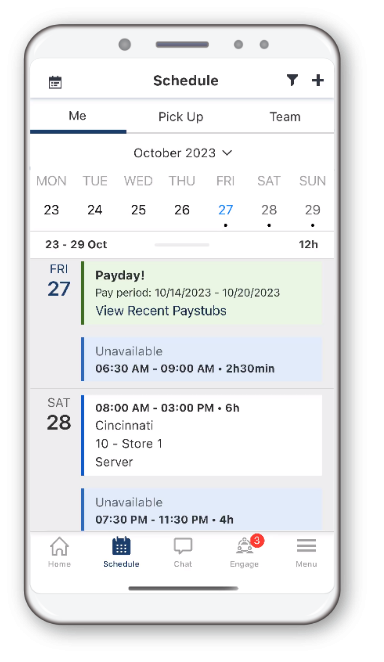

Speed up the recruiting process with same day hire, streamline with custom hiring workflows, offer workers OnDemand Pay and self-service on an award-winning mobile app.

Save time with a unified, mobile-first experience intuitively designed for leaders and gain deeper insights about your business with powerful analytics.

Trusted by nearly 800,000 customers.

Hundreds of Apps & Tech Partners

Seamlessly integrate and sync data between Paycor and your favorite apps.