Why Choose Paycor

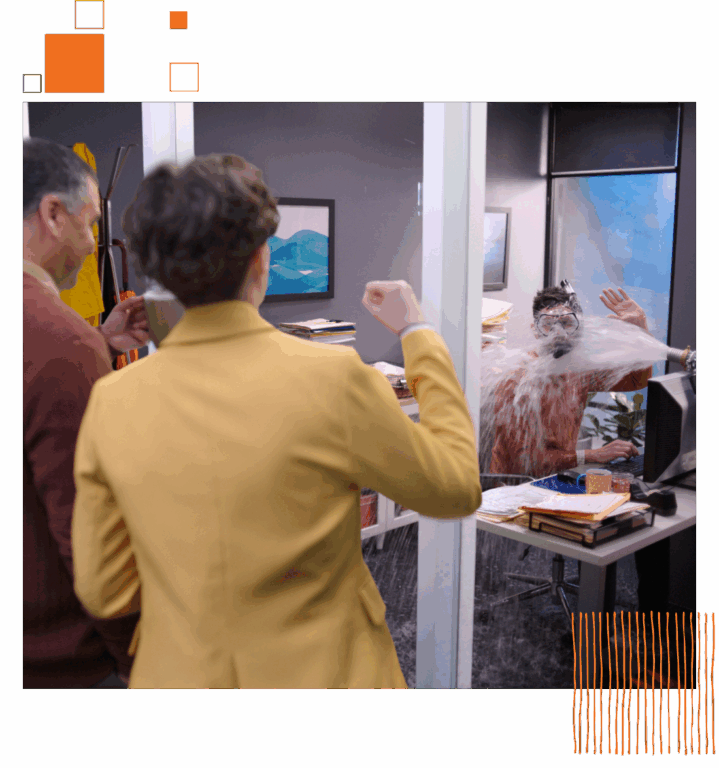

Don’t drink from a fire hose.

Paycor’s AI-powered HCM platform automates routine tasks and turns the flood of HR admin into a flow.

Empower Leaders to Drive Business Results

Paycor’s HR, payroll, and talent platform connects leaders to people, data, and expertise.

Trusted & Vetted

With more than 30 years of experience as a leader in the HCM industry, we are now trusted by nearly 800,000 customers.

Hundreds of Apps

& Tech Partners

Seamlessly integrate and sync data between Paycor and your favorite apps.

Unrivaled Expertise & AI

Unrivaled AI-enabled technology supported by world-class service and advisory capabilities.

HR shouldn’t be… like this.

A survey of more than 1,000 business owners found that processing payroll requires up to five hours per pay period or 21 days each year when done manually. (Paycor)

Paycor throws you a lifeline.

Paycor’s AutoRun feature lets administrators schedule payroll to process automatically—no login required—while the system scans for errors and sends alerts if anything needs attention. Time data flows directly into payroll without re-keying, and Intelligent Tax Recommendations automatically calculates withholdings based on where each employee lives and works, eliminating manual research and multi-state complexity.

Don’t just tread water when you can swim.

Every correction to a timesheet is time you’re not getting back—and manual time tracking is riddled with errors, buddy punching, and location guesswork that eats hours every pay period.

Paycor steers you to dry land.

Paycor’s mobile punch capabilities let employees clock in and out from their phones, with geofencing to verify they’re actually on-site before the punch counts. AI-powered analytics flag overtime trends and scheduling gaps before they become problems, so you’re managing proactively instead of cleaning up after the fact.

Compliance can leave you soaked.

Labor laws shift constantly across states and localities. One missed update, one incorrect filing, and you’re staring down penalties—plus the hours spent researching what went wrong.

Paycor is your umbrella.

Paycor’s compliance dashboard sends proactive alerts when regulations change and flags missing information before it becomes a violation. Real-time reporting keeps documentation audit-ready, while self-service onboarding moves new-hire paperwork online—reducing manual entry and ensuring employee records are accurate from day one.

The Most Trusted Names in HCM Software Rave About Paycor

Discover the Paycor Difference

Are your leaders buried? Paycor can help.

Resources

In our resource center you’ll find articles, guides, webinars, infographics and more — all designed to help education leaders unlock the true power of HR.

Article

Read Time: 1 min

SOX Compliance Checklist & Requirements

Are you SOX compliant? Download our SOX compliance checklist to help you prepare for your next SOX internal audit.

Article

Read Time: 18 min

16 Payroll Software Features You Need to Have

Looking for a list of payroll features? Here are 16 payroll software features you should look for in your next payroll provider.

Article

Read Time: 28 min

20 Tax Write Offs For LLCs: LLC Expenses Cheat Sheet

Want to know how tax write offs work for LLCs? Here’s an LLC expenses cheat sheet that lists 20 tax write offs for LLC businesses, both large and small.

On-Demand Webinar

Why and How to Switch HR & Payroll Providers – ServiceMaster

67% of franchisees say wages are a top driver of their labor challenges (IFA). Are you one of them? In this industry, effective HR and Payroll tools aren’t just nice to have—they’re essential for business success.

Only Paycor Builds HCM Tech for Leaders

From recruiting to talent development, Paycor helps leaders create great places to work.