Why is it important to get payroll right?

When it comes to employee engagement, there’s no need to overcomplicate things. This is the one question quiz every HR leader can pass:

What is the absolute best way to keep employees happy? Pay them on time!

Nowadays, with more job openings than available workers, top performers have options. Naturally, they’ll gravitate towards a company they can rely on. So, it’s wise to prioritize prompt payment if you want to build trust and retain your best talent.

of all workers have had paycheck errors.

(Intuit)

of workers say they’ll look for a new job after two payroll errors.

(HR Dive)

However, getting payroll right is not always as simple as it sounds. Especially when you’ve got a to-do list a mile long.

Managing payroll in-house means you’ve got to make sure your employee classifications are accurate, accruals are set up appropriately, and your taxes are sent in on time. It also means making sure employees turn in vital forms, following appropriate tax rules for each location, and you’re compliant with paystub, overtime and PTO laws. Managing this manually could mean several hours of work for each pay run; not to mention the risk of costly fines (or lawsuits) for getting something wrong. And, even if you’ve chosen to work with a third-party, you’ve got to know the rules and ensure your employees are having a seamless experience. That’s a lot of work; especially when everyone expects you to have the answers.

We’ve got good news. We’re sharing our notes.

If you’re new to payroll and have questions; if you’re a payroll veteran and curious about how to do it better; or if you just want to learn about how everyone else is doing it; we’ve got you covered.

We’ve combed our large library of resources to bring you the Complete Guide to Payroll Services. Get answers to your pressing payroll-related questions and links to more payroll information you might need.

How to Get Payroll Right

Now that you know how important payroll is to the employee experience; let’s cover off on a few basics. Whether you manage payroll manually, with a provider or through a PEO; you may have had the urge to check your work. In terms of a dictionary definition: payroll -in the simplest terms- is the process of providing compensation to employees for the work they complete on behalf of their organizations.

Did you know According to the Fair Labor Standards Act (FLSA), a workweek is a fixed period consisting of seven consecutive 24-hour periods, 168 hours in total.

For a full list of payroll vocabulary, check out our helpful payroll glossary. (Here’s a tip: Bookmark this link!)

The act of processing payroll refers to how a company handles paying its employees. It includes keeping track of when employees work, figuring out how much they should be paid based on their hours and pay rate, filling out tax forms, giving employees their paychecks, and sending taxes to the government on behalf of the company. This responsibility often falls on HR.

You’ll probably never be quizzed on this, but just in case you need to know, payroll processing includes several steps; compliance requirements; local, state and federal taxes to consider and more. To help, we’ve created a simplified version key details you need to know to get it right:

Here is the payroll process explained in 10 steps.

- Obtain Proper Paperwork: Get an Employer Identification Number (EIN) from the IRS and determine employee classifications. Collect legal forms such as I-9 and W-4 from employees before they begin work.

- Research state and local income tax requirements: Know how much to withhold for employer-only taxes (FUTA, SUTA, state disability, and workers’ compensation) and employee taxes (Social Security and Medicare).

- Choose a pay schedule: Decide how often employees will be paid, such as biweekly, semi-monthly, or monthly.

- Determine employee pay information: Set up pay rates, benefits, deductions, and calculate taxes and withholdings.

- Calculate employee hours: Keep track of the number of hours each employee works and import timesheets if using time and attendance software.

- Review the payrun: Double-check the numbers, including employees’ net pay and the company’s total cash requirements.

- Pay taxes: Withhold and remit payroll taxes and federal income tax based on various factors. Schedule and deposit taxes on time to avoid penalties.

- Deliver pay: Distribute paychecks or initiate direct deposits, taking into account banking processing times and provide physical pay stubs where required.

- Run Reports and maintain records: Keep detailed records of hours worked, overtime, and wages to comply with regulations and track payroll information.

- Complete Year-End Requirements: At year-end, provide necessary forms to employees (W-2 and 1099-MISC).

For the complete list of payroll processing steps and explanations, check out our article: How to Manage Payroll

How Can Payroll Services Help Your Business?

What are Common Payroll Watchouts?

of medium and small-sized business as fined for failing to deposit withholdings, miscalculating taxes or submitting incorrect fillings (IRS)

No one likes to see red marks, especially not when it comes from regulatory groups like the IRS. Because payroll compliance is a moving target, it’s very important to be aware of key watchouts and common missteps. With all the steps, rules, and nuances of the payroll process, it can be easy to overlook something, especially if you have more than just a few employees. However, keeping your organization on the right side of the law doesn’t have to be stressful.

Here’s your cheat sheet.

Top 5 Payroll Watchouts

- Misclassifying Employees

- Incomplete Records

- Overlooking Fringe Benefits

- Wage Garnishment Noncompliance

- Missing Deadlines

Paycor keeps an updated content library full of resources (and hosts webinars) to help you avoid common payroll pitfalls. Here are just a few guides that can help you keep in tip-top shape – whether you’re processing payroll in-house or ensuring your provider is your partner in compliance.

Get refreshed on your responsibilities for Payroll Wage Garnishments.

Discover Payroll Garnishments 101

Understand payroll frequency and set up reminders for payroll processing dates.

2025 Payroll Calendar Templates

Know your payroll tax responsibilities as an employer.

Payroll Taxes Vs. Income Taxes

Payroll Options: Who is Responsible for Running Payroll?

When it comes to managing payroll, you’re not alone. For starters, you have us as a great resource for reference. But, HR professionals also have at least three options to consider for help. Payroll can be managed by a PEO (Professional Employer Organization); manually in-house, which is only recommended for organizations with a handful of employees or fewer; or a payroll provider.

Choosing the right option is critical, because the wrong choice has big ramifications — a poor employee experience; compliance risks or unintended expenses. Weigh the pros and cons and make an informed decision that aligns with your organization’s needs and budget.

PEO vs. Payroll Provider

Pros of a Payroll Provider

- Specialized Expertise

A dedicated HR and payroll provider often has a deep understanding of the intricacies of human resources and payroll laws, regulations, and best practices. - Scalability

Such providers usually offer scalable solutions that can grow with your business, enabling you to add or subtract services as needed. - Data Security

Reputable HR and payroll providers often employ sophisticated data security measures to help protect sensitive employee information. - Time Savings

Outsourcing these tasks frees up time for you and your team to focus on other core areas of your business. - Cost-Effective

Over time, outsourcing can save money by eliminating the need to hire, train, and retain in-house HR and payroll staff. - Compliance

They help ensure that your business stays compliant with ever-changing labor laws and tax regulations.

Cons of a PEO

- Loss of Control

Working with a PEO often means giving up some control over your employees, as the PEO typically becomes a co-employer. - High Costs

PEOs often charge a percentage of your total payroll, which can become expensive as your business grows. - Employee Disconnect

Employees may feel disconnected from your company if they are officially employed by the PEO. - Service Limitations

PEOs may not offer as wide a range of HR services as dedicated HR providers. - Dependence

Over time, it may become difficult to disengage from a PEO as they become more integrated with your employees and processes. - Standardized Policies

PEOs often apply their own policies and procedures, which may not align perfectly with your company’s unique needs.

Curious about which is the best for your organization? Let’s take a closer look at each of these options.

Professional Employer Organizations (PEOs):

Outsourcing your payroll to a PEO can provide a hands-off approach to payroll processing and management. However, there are important considerations to keep in mind. For starters, PEOs are the most expensive option available. Additionally, partnering with a PEO means entering a co-employment relationship, often requiring a long-term contract. Departing from a PEO can also be a challenging process.

Managing Payroll In-House:

Many small and medium-sized businesses believe that handling payroll internally saves costs. However, this notion is far from the truth. Apart from the time-consuming nature of managing payroll yourself, there are additional costs and risks that often go unnoticed. There are direct deposit and setup fees ranging from $50 to $150, transaction fees of $31.50 per pay period, and paper checks and printer fees starting at around $60 per pay period.

Partnering with an HR & Payroll Service Provider:

By teaming up with an HR & payroll software provider, HR professionals can enjoy immediate benefits. These providers offer streamlined payroll processes, accurate tax calculations, record maintenance, and access to a dedicated team of payroll experts. This option strikes a balance between fully outsourcing payroll to a PEO and managing it in-house.

Unlike PEOs, partnering with a payroll service provider does not require a long-term commitment. Furthermore, as your organization grows, the cost per employee decreases, offering scalability and cost-effectiveness.

Estimated Cost for Payroll Services*

HR & Payroll

Providers

Up to 40 times less

expensive than a PEO

PEO

20 Employees: $42,000

50 Employees: $105,000

200 Employees: $420,000

*Estimated annual costs based on example in article. Not official quote.

Who gets the best grade when it comes to payroll service options? That’s for you to decide.

Payroll Providers 101

What Are the Advantages of Working with a Payroll Provider?

Many organizations have found success with outsourcing payroll and using online payroll software for a number of reasons. By entrusting tax and compliance to experts, HR professionals and business owners can save valuable time that would otherwise be spent on manual calculations and meticulous attention to detail. Why struggle knowing all of the answers when you could have a partner? The right payroll provider can also lead to potential cost savings when compared with the time and effort required for in-house payroll management.

A recent survey of more than 1,000 small business owners found that processing payroll requires up to five hours per pay period or 21 days each year. — Intuit

Another advantage of outsourcing payroll is enhanced data security. In-house payroll processing poses a few risks, including data breaches and identity theft. Partnering with a reputable online payroll service ensures that your data is stored securely on cloud-based servers with advanced encryption and redundant backups. Payroll providers also have teams that stay up to date with government regulations and compliance requirements, alleviating the burden on business owners and HR professionals.

Need more reasons? Check out this article: Why Your Business Needs a Payroll Service

However, it’s important to note here that not all payroll providers are made equal.

There’s a chance you may already be working with a payroll provider who may not be a good fit for your business. Are you still responsible for pulling all the weight? Do you still have to complete spreadsheets, reports and answer all the questions? It may be time to choose a new partner.

As mentioned before, it’s important to consider how the payroll service impacts the employee experience. Productive employees are often those who are engaged and satisfied with their employee experience. When employees feel valued and supported, they are more likely to work harder. On the other hand, disengaged employees are often on the verge of leaving.

But, if your payroll provider is not meeting yours or your employees’ needs, is not prepared to scale with your business, offers limited services while raising prices and does not prioritize your needs, it may be time to consider switching.

| Experiences |

|---|

| Implementation Issues |

| Not Configurable to Needs |

| Poor Customer Service |

| System Failures |

| Lack of Integrations |

| Errors |

| No New Features + Rising Costs |

Are you stuck with a payroll provider relationship but not sure how to break it off? Use our helpful guide when it’s time to switch

How to Choose a Payroll Provider

The benefits of using a payroll provider are clear, but it’s also important to understand how you can decide which one is best for your company.

Ask these 5 questions

Will it save me time & money?

Is the payroll solution better than what I’m using now?

Will it keep my business compliant?

Will it help me attract & retain workers?

Will it make me a better leader?

Some providers sell off-the-shelf solutions without understanding the needs of your organization. A payroll system should be able work the way you need it to—and have the features you need. And, your payroll provider should be by your side from the initial pre-purchase discussions through implementation and beyond, communicating expectations, offering training, and answering your questions every step of the way. If you’re just beginning your search for a new payroll software program, here’s a great place to start:

- Smooth Implementation Process: Choose a provider that offers a detailed implementation process and ask for references to assess their track record with similar businesses.

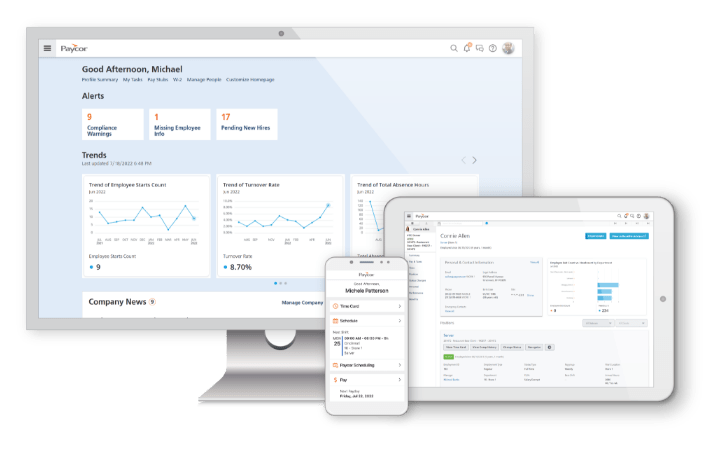

- User Experience: The payroll solution should be easy to navigate, intuitive, and accessible 24/7 on multiple devices, without unnecessary complexities.

- Integration: Look for a provider that offers integration between payroll, HR, and time systems to avoid duplicate data entry and ensure smooth data management.

- Employee Self-Service: Consider the needs of your employees and choose a payroll solution that allows them to easily access information such as pay stubs and schedules independently, saving time and improving efficiency.

- Tax-Filing Services: Select a payroll provider that offers streamlined tax filing and reporting services to ensure compliance with federal, state, and local tax regulations, reducing the risk of fines and penalties.

These considerations will help you identify the ideal solution that meets your business needs, provides a positive user experience, ensures compliance, and offers ongoing support.

Leveraging Payroll Options for the Best Employee Experience

Feeling confident? We’ve covered payroll basics, payroll watchouts, payroll options and most importantly, the reason why you can’t afford to neglect payroll accuracy. It’s more important than ever to provide the best employee experience to keep your top performers; and, the best news is that you don’t have to do it alone.

Paycor is here to help you with your payroll and HR needs.

Why Paycor?

Paycor has more than 30 years of experience and more than 30,000 customers who trust us to pay their employees. With Paycor, HR leaders benefit from offloading administrative payroll tasks, while employees benefit from a seamless experience and payroll options. And, Paycor’s payroll system can transform the way you process payroll with general ledger integration, OnDemand Pay, AutoRun functionality, employee self-service and powerful reporting tools.