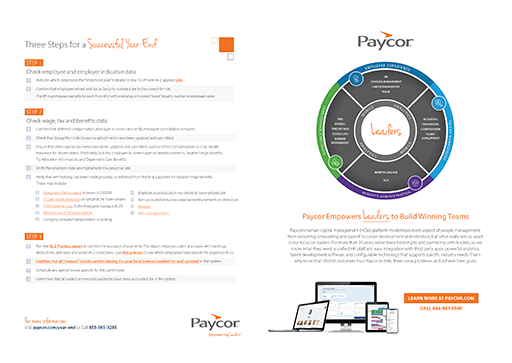

3 Steps for Successful & Strategic Year-End HR Planning

The end of one year and the beginning of another is a busy time for HR professionals. There are endless amounts of paperwork and employee questions. And, without some form of organization, the feeling of overwhelm could consume you. A checklist is the easiest way to get employees on board for year-end. Don’t rely on your memory. Start with our free downloadable checklist.

How Can HR Professionals Prepare for Year-end?

Start early! The end of the year requires HR professionals to gather data, ensure employee information is accurate, and double-check those special situations to mitigate compliance risks.

What’s In A Year-End HR Checklist?

A Method to Check Employee Data

If you are not already tracking, checking and purging employee data regularly, now is the time to start. Doing so can save you a lot of time and headaches down the road. The complexities of record-keeping can be overwhelming for employers, which is why it is important to have a method to check employee data against what is required by the law.

The requirements vary from state to state and even within some federal systems, but some examples include:

– W-2s; including name and social security numbers

– 941 forms

– 1099s for independent contractors

Our Year-End HR Checklist provides step-by-step support for you to improve your practices and check your data to stay compliant with the law.

A Method to Check Wage, Tax, and Benefits Data

Employers of all sizes must keep up to date with wages, tax, and benefits data because it will help you stay compliant with employment laws and keep your business running smoothly. Having a method to keep track of this is essential to the success of your organization.

Are your employee’s contractors, subcontractors, remote, or hybrid? With so many employees being remote, you may need to know how the tax laws work for their State, and how to pay remote employees and prevent double taxation.

There are many benefits to keeping accurate and up-to-date records of your employee’s wages, taxes, and benefits. Doing so can help you stay compliant with employment laws, and avoid penalties or fines. Additionally, having accurate records can help you identify what is working well and what may need to be changed. Ultimately, it is crucial to the success of your business.

A Method to Check for Special Situations

HR managers should know that there are always some special situations to consider when doing their year-end planning. Here are some examples:

- An employee works part of the year in one state and part of the year in another state.

- An employee is paid biweekly but their last paycheck of the year falls on the first week of January.

- An employee has been with the company for less than a year.

- An employee makes a change to their benefits or adds a dependent.

- An employee takes a loan from their 401k or makes a withdrawal.

- Some benefits, such as health insurance, may be taxed differently than others.

- There may be special tax implications for employees who are paid in stock options.

As you can see, there are a lot of things to consider when it comes to year-end planning for your employees, and this is just the tip of the iceberg.

The best way to ensure that everything is done correctly and efficiently is to first download our free customizable template.

What Are the Main Watch outs for Year-End HR Prep?

Human Resources serves as the backbone of any company. Without the Human Resources department, a company would not be able to function properly. It is responsible for a variety of tasks, including hiring and firing employees and managing payroll.

But there is much more to an HR department that you must watch out for when you are doing your year-end prep.

The main watch outs for Year-end HR Prep include:

- Employer-employee relations

- Safety and compliance regulations

- Recruiting and training

- Disciplinary actions

- Training and development

- Uphold the organization’s mission

- Employee performance reviews

- W-2 and 1099 forms

- Benefits enrollment

- Employee satisfaction surveys

Benefits of Creating Checklists in HR

You need more than you can remember or keep track of in your head. By following a checklist, you can be confident that no steps have been missed and that your preparations are as thorough as possible.

When you know what needs to be done and when it needs to be done, there is less chance of confusion or last-minute panic, and it is easy to get everyone on board.

How Do You Process the Year-End?

With all the changes that have come with 2022, you want to make sure your processes are up-to-date and compliant. Processing the end of the year for HR is much easier with Paycor’s HR software system. Each year, we create a year-end website and guide for our customers. But, even if you don’t have an HR technology system, by utilizing our free checklist, you are on your way to a stress-free and organized year-end!

How Paycor Helps

The last thing you need is for year-end to be a stressful time for you and your team. We’ve put together the resources and information you need to close out the year with confidence on our special Year-end Resource Center page. This is your one-stop shop for all the information you need to make sure your year-end is a breeze!