Simplify the Process with a Free SOX Compliance Checklist

The Sarbanes-Oxley Act (SOX) requires public companies to follow strict financial and data control standards, but managing compliance doesn’t have to be overwhelming. Our free SOX Compliance Checklist helps finance and HR leaders identify, document, and maintain key internal controls that support accurate reporting and reduce audit risk.

What is SOX Compliance?

SOX compliance refers to the policies, procedures, and internal controls organizations must follow under the Sarbanes-Oxley Act of 2002. The law was passed to protect investors and employees from corporate fraud by enforcing transparency and accountability in financial reporting.

Any publicly traded company in the U.S. as well as private companies preparing for IPO must comply with SOX regulations to ensure the accuracy, security, and integrity of their financial data.

What is a SOX Compliance Checklist?

A SOX compliance checklist is a step-by-step tool that helps businesses confirm they’ve met all legal and internal control requirements for Sarbanes-Oxley compliance. It’s used by CFOs, controllers, internal auditors, and IT teams to track and test compliance controls across financial systems, HR, and payroll processes.

Using a checklist streamlines audits, reduces risk, and ensures nothing slips through the cracks.

Requirements and Sections Covered in the SOX Compliance Checklist

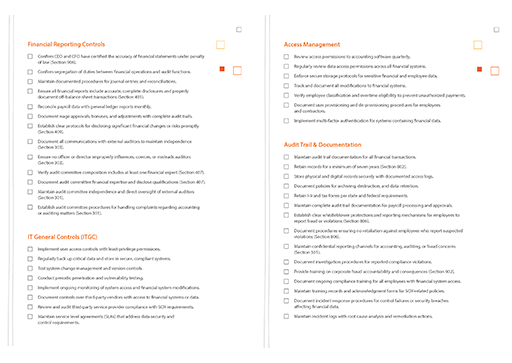

The SOX Compliance Checklist helps organizations meet all major requirements under the law, including:

- Section 302 – Corporate responsibility for financial reports

- Section 401 – Disclosures in financial reports

- Section 404 – Management assessment of internal controls

- Section 409 – Real-time issuer disclosures

- Section 802 – Criminal penalties for altering or destroying records

- Data access, storage, and retention rules

- Payroll reporting accuracy and audit trail documentation

- IT system monitoring and risk controls

These requirements are covered in detail in the downloadable checklist.

SOX Compliance Checklist: Who Should Use It?

This checklist is designed for professionals responsible for financial accuracy, internal controls, or data security, including:

- CFOs and Controllers

- Finance and Accounting Teams

- Internal Auditors

- HR and Payroll Managers

- IT and Security Leaders

Whether you’re preparing for an external audit or conducting an internal review, this checklist can help keep your organization compliant.

Benefits of Using a Checklist for SOX Compliance

Using a structured SOX checklist helps teams:

- Simplify audit preparation by organizing key documents and evidence.

- Reduce compliance risk by proactively identifying control gaps.

- Increase collaboration between finance, HR, and IT.

- Save time by using repeatable steps for quarterly and annual reviews.

- Demonstrate accountability to investors, leadership, and regulators.

Download Your SOX Compliance Checklist

Stay ahead of audits and maintain compliance confidence with Paycor’s free SOX Compliance Checklist.

Use it to map out control owners, review timelines, and documentation requirements—all in one easy-to-follow tool.

SOX Compliance Checklist FAQs

Have more questions about the SOX compliance checklist? Read below.

How often should a SOX compliance checklist be used for auditing?

Most organizations review their SOX checklist quarterly to verify ongoing control performance and update documentation ahead of annual audits.

How do I use the SOX compliance requirements checklist?

Use the checklist as a roadmap for confirming internal controls, documenting testing procedures, and assigning ownership across departments.

What are some mistakes the SOX Compliance checklist can help me avoid?

The checklist helps teams prevent common missteps like incomplete audit trails, missing documentation, or failing to test IT security and payroll systems consistently.