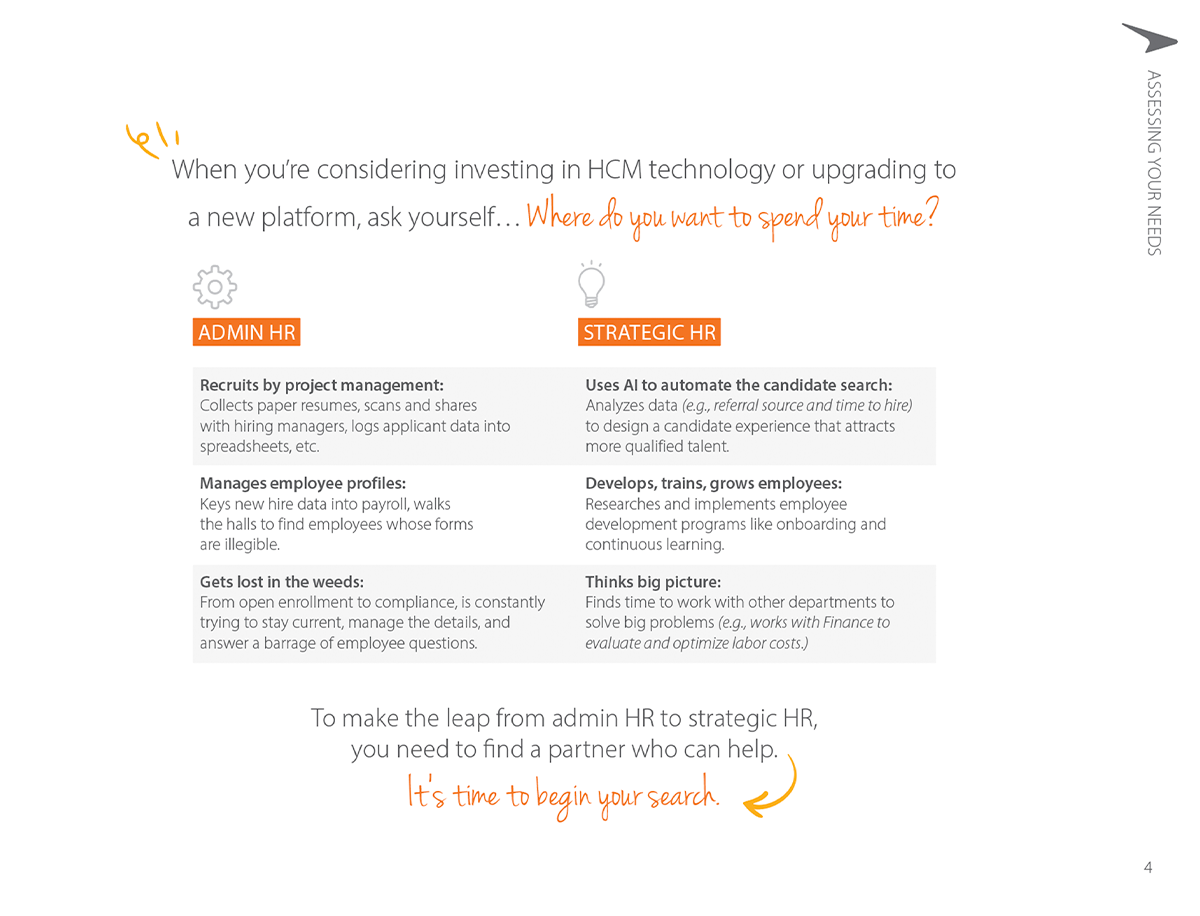

Move from Administrative to Strategic HR

The typical HR department spends nearly 60% of their time on transactional HR (Deloitte). But having the right HCM technology can save HR leaders time, labor costs, and frustration. With the number of options available, it’s not always easy to choose which solution will work best for your business. This buyer’s guide is designed to help.

Identify the key features to evaluate and tough questions to ask about potential HCM systems:

- Right Technology & Expertise

- Compliance Capabilities

- Ease of Use