Access This Checklist to Verify I-9s

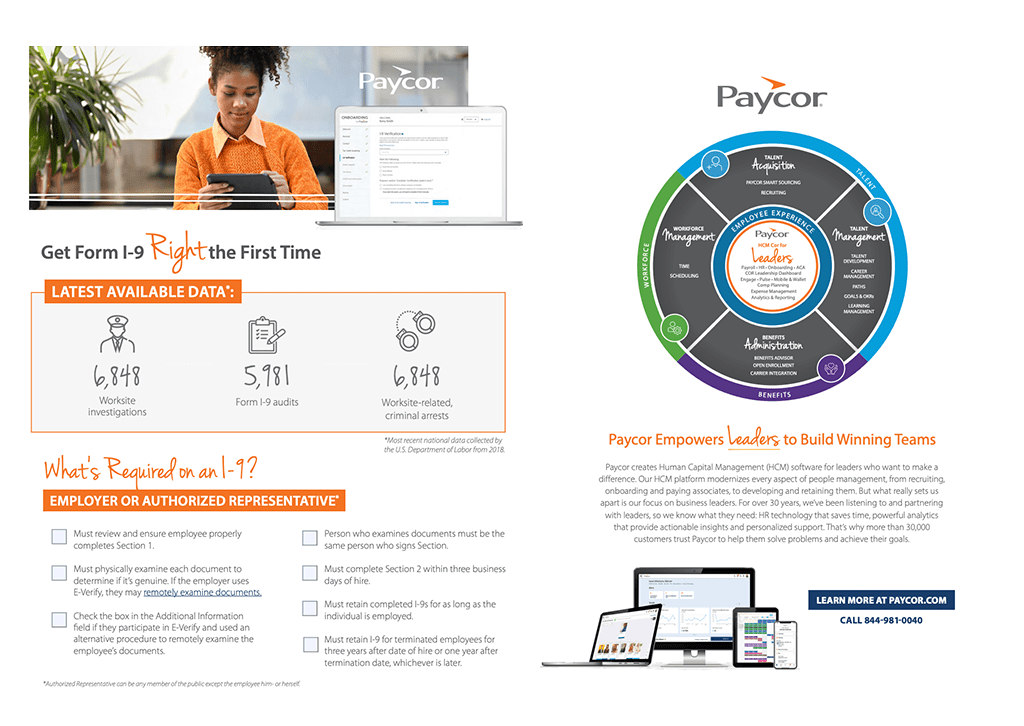

Form I-9, Employment Eligibility Verification, is one of the most well-known employment documents. It also can be one of the most intimidating forms because of the strict guidelines that must be followed to complete it correctly.

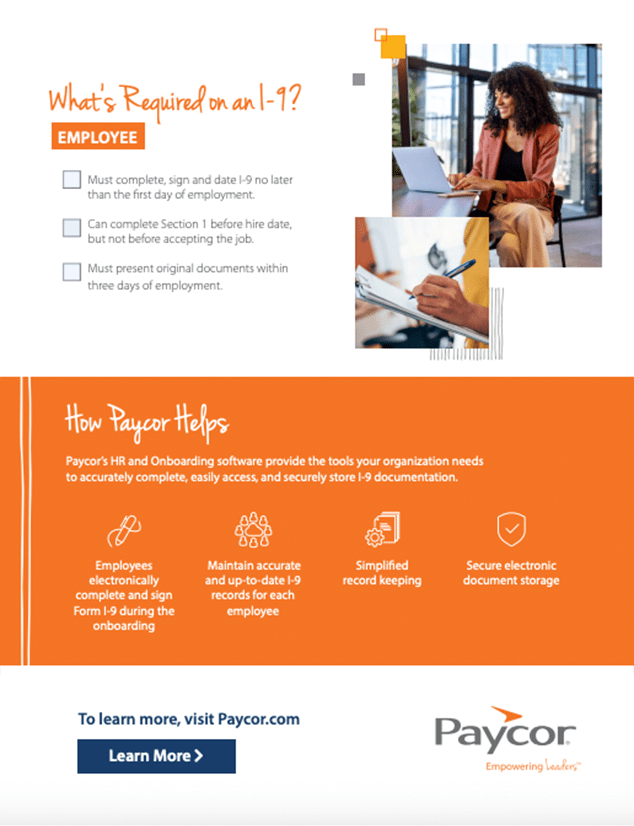

Every newly hired employee must complete section 1 of Form I-9 on their first day of employment (or before their start date, as long as they’ve accepted the job). The I-9 requires an employee to provide certain documents showing their identity and that they’re legally allowed to work in the U.S.

Employers must complete Section 2 of the form within three days of the employee’s hire date. Severe penalties are handed down to employers who don’t comply with I-9 rules. Knowingly hiring and continuing to employ unauthorized workers can warrant fines ranging from $375 to $16,000 per employee depending on the nature of the violation. It can also trigger an inspection by the Immigration and Customs Enforcement (ICE) agency.

To help keep your organization compliant and prevent penalties and fines, check out Paycor’s I-9 Guide to understand what’s required from HR leaders.