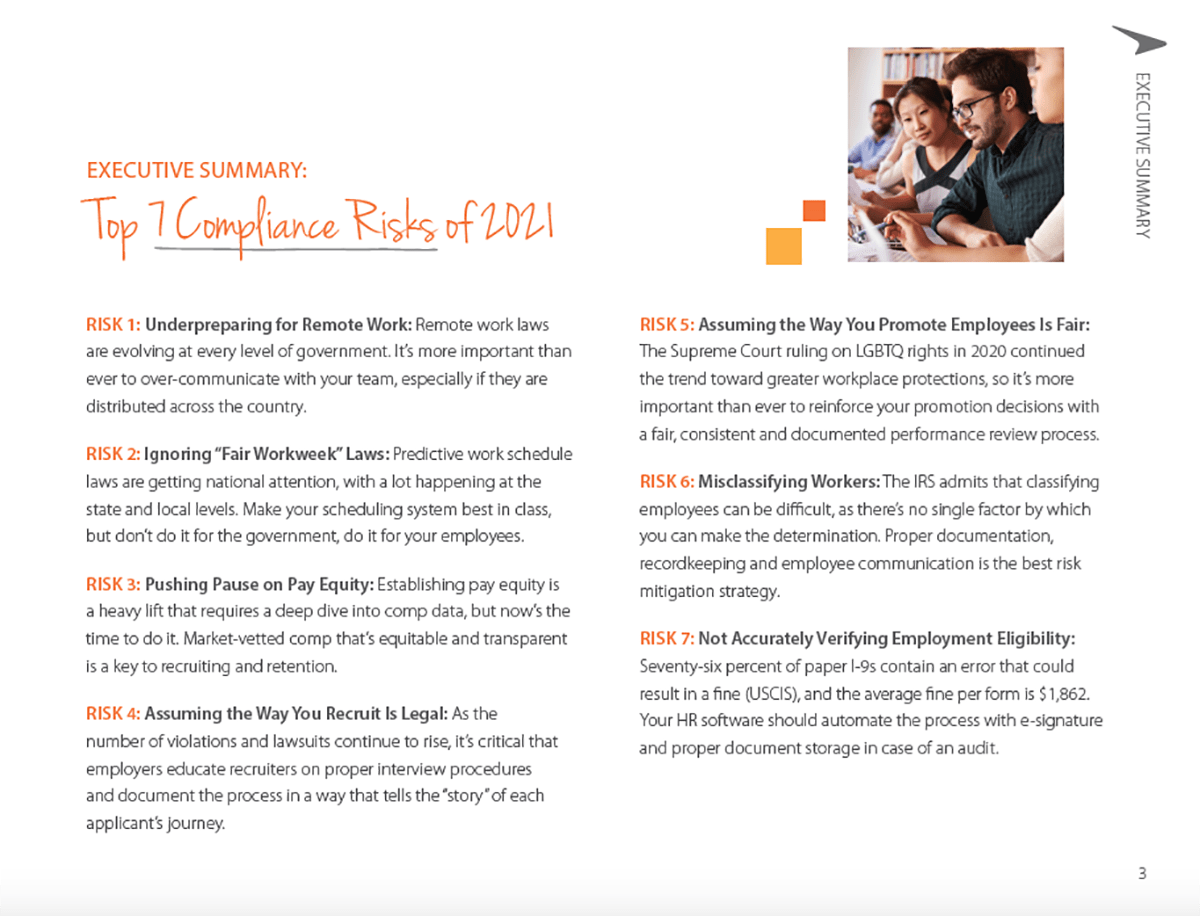

How to Avoid the Top 7 Compliance Risks

When it comes to compliance you can never have too much information. Especially now that more workers are remote and laws are changing to accommodate them. In this guide, we break down the top compliance risks and provide tips to steer clear.

Download our guide to learn:

- Tips on taxes and remote workers

- Recruiting dos and don’ts

- The latest info on worker’s comp