Paycor Compliance Solutions

Staying current on the ever-changing compliance landscape is a full-time job but it’s a position most organizations don’t have. That’s why more than 29,000 customers trust Paycor’s HR and payroll products to help them save time and reduce risk. Download this guide to see how.

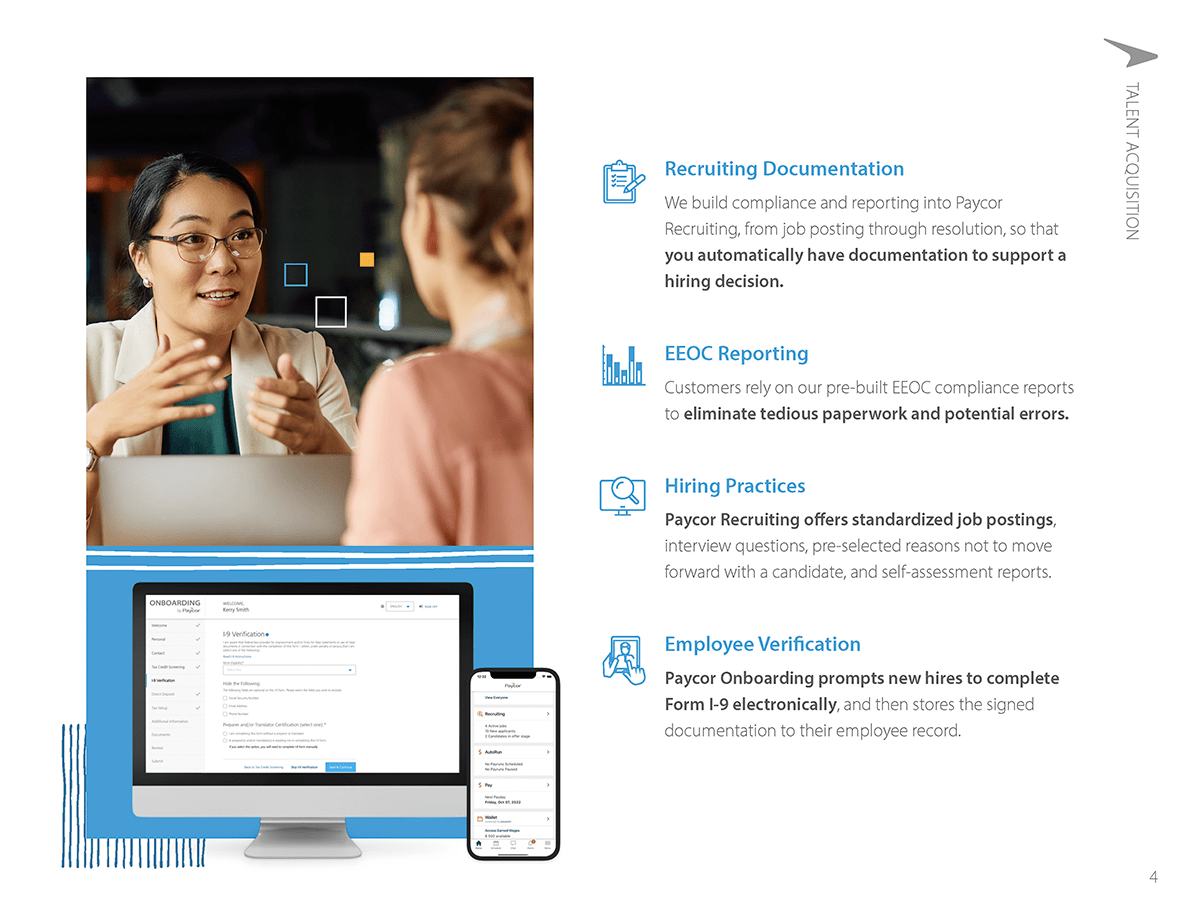

- Hiring compliance, including recruiting documentation and EEOC reporting

- Employment verification, including e-signature and timestamps

- Tax compliance dashboards and proactive alerts