HCM Software

HCM Software

Built for Leaders

Transform your people management with the HCM solution that drives growth and helps ensure compliance.

(532 Reviews)

(2,065 Reviews)

Turn HR Chaos into Strategic Success

Stop juggling multiple systems and spreadsheets. Paycor’s HCM software gives you a unified platform that automates routine tasks, delivers personalized experiences, and offers actionable insights. With built-in compliance protection across all 50 states, you’ll save time while staying ahead of ever-changing regulations.

HR and Payroll

Simplify payroll processing and HR management with our award-winning mobile-friendly solutions.

Flexible payroll with

real-time compliance.

Unified HR platform with unlimited workflows.

One location to easily review, reimburse, and report.

AI-powered workforce insights and predictions.

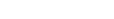

Talent Acquisition

Dominate the talent war with AI-powered recruiting that finds, engages, and onboards top performers.

Find and hire high-quality talent faster & smarter.

Find active, passive & diverse candidates with AI.

Set employees up for success from day one.

Lower Sourcing Costs

Reduce time and cost-per-hire with technology that automates sourcing.

Talent Management

Coach, develop, and retain your best people with tools that inspire growth and drive performance.

Increase engagement & build a culture where people thrive.

Transform employee feedback into actionable insights.

Turn career conversations into career transformations.

Plan comp strategies that attract and retain talent.

Deliver self-paced training that fits busy schedules.

Transform frontline managers into confident leaders.

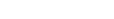

Workforce Managment

Control labor costs and maximize productivity with intelligent scheduling and time tracking.

Reduce labor expenses with one powerful platform.

Create customized schedules that work for everyone.

Smart Scheduler

Automatically generate schedules based on your predefined criteria.

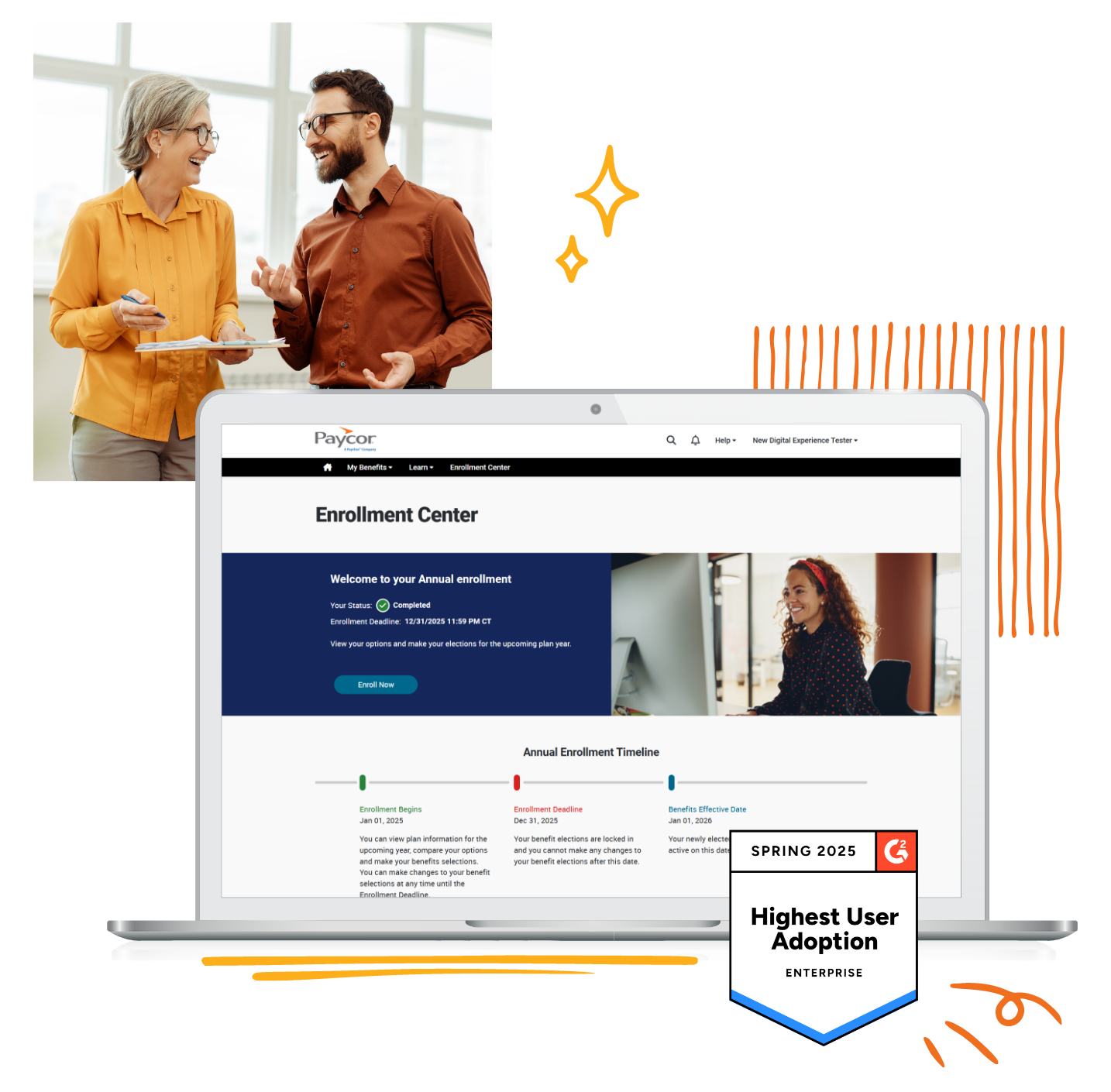

Benefits Administration

Reduce benefits headaches with automated enrollment and hassle-free compliance management.

Empower employees while cutting down admin work.

Sleep soundly knowing ACA compliance is handled.

Improve budgeting with pay-as-you-go workers’ comp.

Ask Emma

Real-time AI-powered support and personalized recommendations.

Compliance

Stay ahead of changing regulations with compliance solutions that see around corners.

Our expert teams keep you updated and informed.

Document Management

Organize critical compliance documentation effortlessly.

Set employees up for success from day one.

Lower Sourcing Costs

Reduce time and cost-per-hire with technology that automates sourcing.

HR Services

Your HR team works tirelessly to support your growing organization. But who supports them when complex challenges arise?

The Paycor Signature HR Solutions Bundle pairs Paycor’s powerful technology with expert HR guidance, compliance and safety support, employee benefits, and wellness programs powered by Paychex—all designed to simplify HR and fuel your business growth.

Paycor Integration Platform

Seamlessly connect Paycor with your existing tools and systems through our comprehensive integration solutions.

Paycor Marketplace

Our dynamic network of best-in-breed third-party apps and trusted technology partners.

Paycor Developer Services

Experts who can scope, design, and build integrations for resource-constrained businesses.

Paycor Developer Tools

The Developer Portal empowers you to create your own integrations quickly and efficiently.

Trusted By Users & Third Party Evaluators

The Paycor Difference

We’re helping businesses succeed and empowering leaders with the most comprehensive, flexible, and innovative HCM solutions in the market.

“With Paycor, there’s just so many features, all in one place. Other companies might have the solutions we need, but it’s not integrated like Paycor.”

– Karyn R., Controller, CertaSite

Time + Attendance

With mobile punching, admins can verify location and record missed punches.

Learning Management

Paycor LMS offers training and certification programs for technicians.

HCM Software FAQs

What is HCM software (human capital management software)?

HCM software is a people-focused approach to HR that unites a variety of human resource processes to work as one—from recruiting and onboarding, to payroll and benefits, to workforce and performance management.

How does an HCM software benefits an organization?

HCM software allows leaders to evaluate employee effectiveness, engagement and development.

How do you select the best HCM software?

When selecting HCM software, do these 6 things:

1. Ensure it is a user-friendly system

2. Review the core features (products and services)

3. Determine if the software is able to scale with company growth

4. Discover if it assists in mitigating compliance litigation

5. Check for robust security to ensure data integrity

6. Ask about available integrations with critical business systems

What is the best HR software for a small business?

The best HR software for a small business is one that improves productivity, retention and employee engagement.

What are the differences between HRIS, HRMS, and HCM software?

An HRMS or human resource management system includes everything in an HRIS and HCM, plus a payroll system and tools for more efficient labor management. HRIS, or a human resource information system is HR software focusing on people, procedures, and policies. HCM, or human capital management, refers to the management of employees in an organization.

HR Software for Leaders

See how Paycor’s HR solutions optimize nearly every aspect of people management.