Paycor Builds HR Software for Leaders

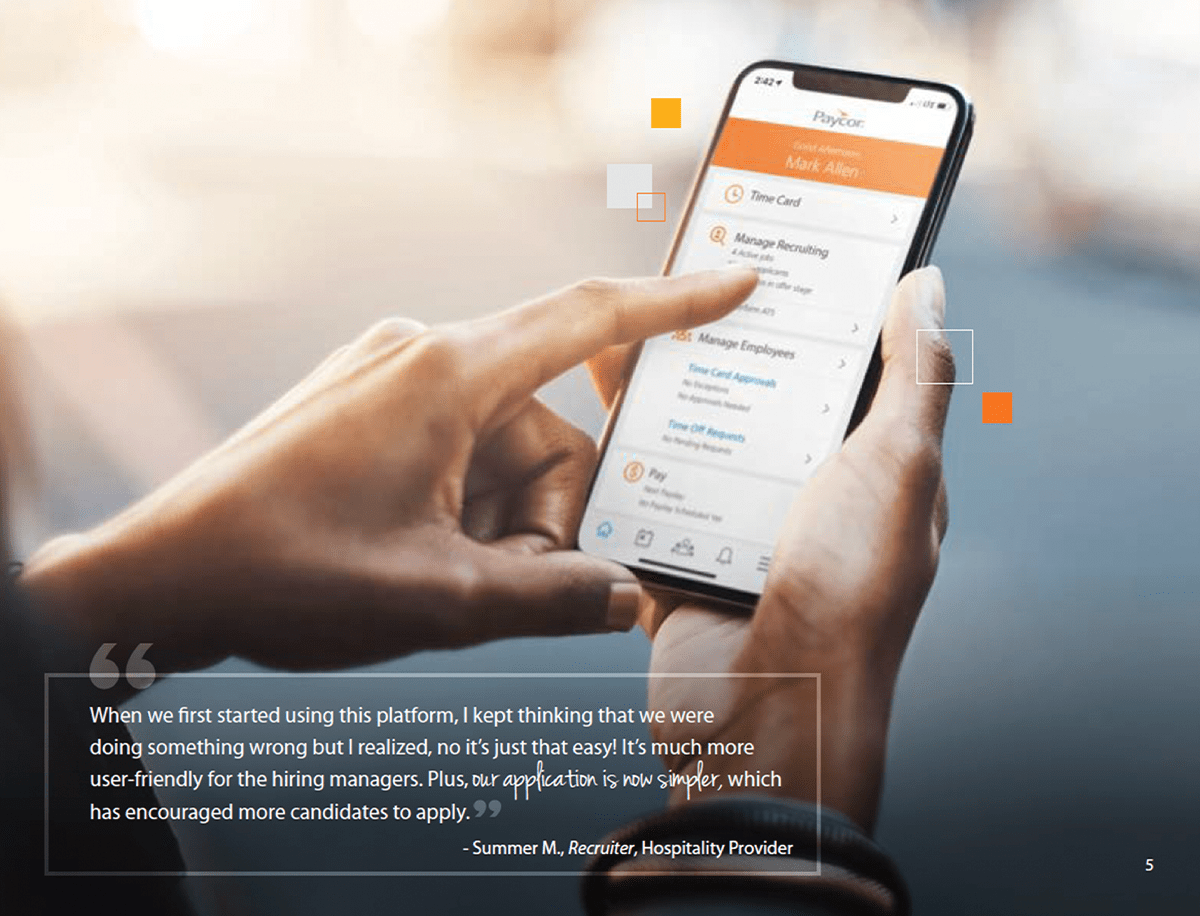

Paycor empowers leaders by giving them the HR software, personalized support, and expert advice they need to modernize every aspect of people management.

Learn How Paycor Can Help You:

- Streamline recruiting, hiring, and onboarding

- Solve the complexities of employee benefits and open enrollment

- Train, develop, motivate, and promote talent