The DOL’s Overtime Rule

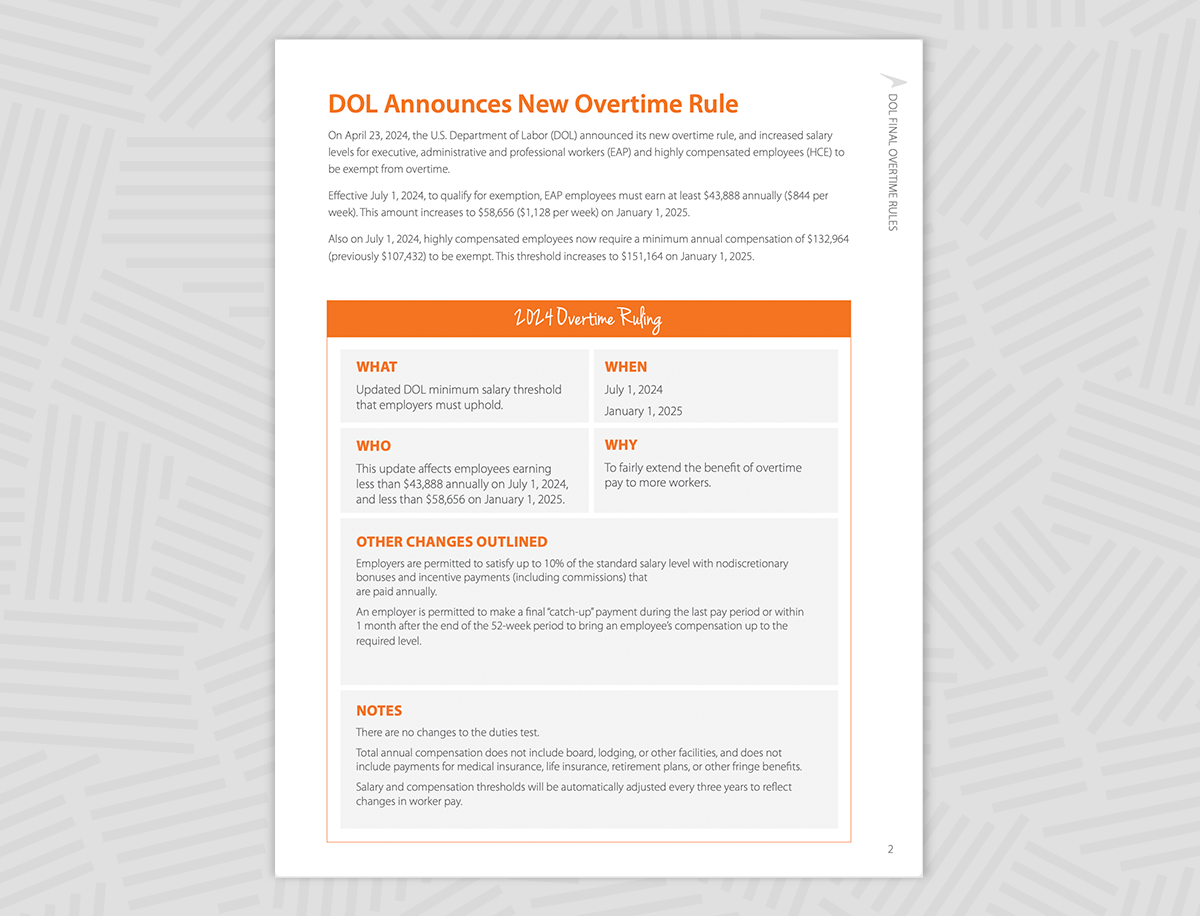

The Department of Labor’s Fair Labor Standards Act (FLSA) requires employers to pay employees overtime if they work more than 40 hours in a workweek. The overtime rate is 1.5 times the employee’s regular pay rate. While this is a federal standard, there are exceptions and different types of overtime requirements that can vary by city and state.

But the law doesn’t require overtime pay for everyone. Some workers, especially those in executive, administrative, and professional roles (EAP), often called “white-collar” workers, can be exempt. Download our quickstart guide to learn:

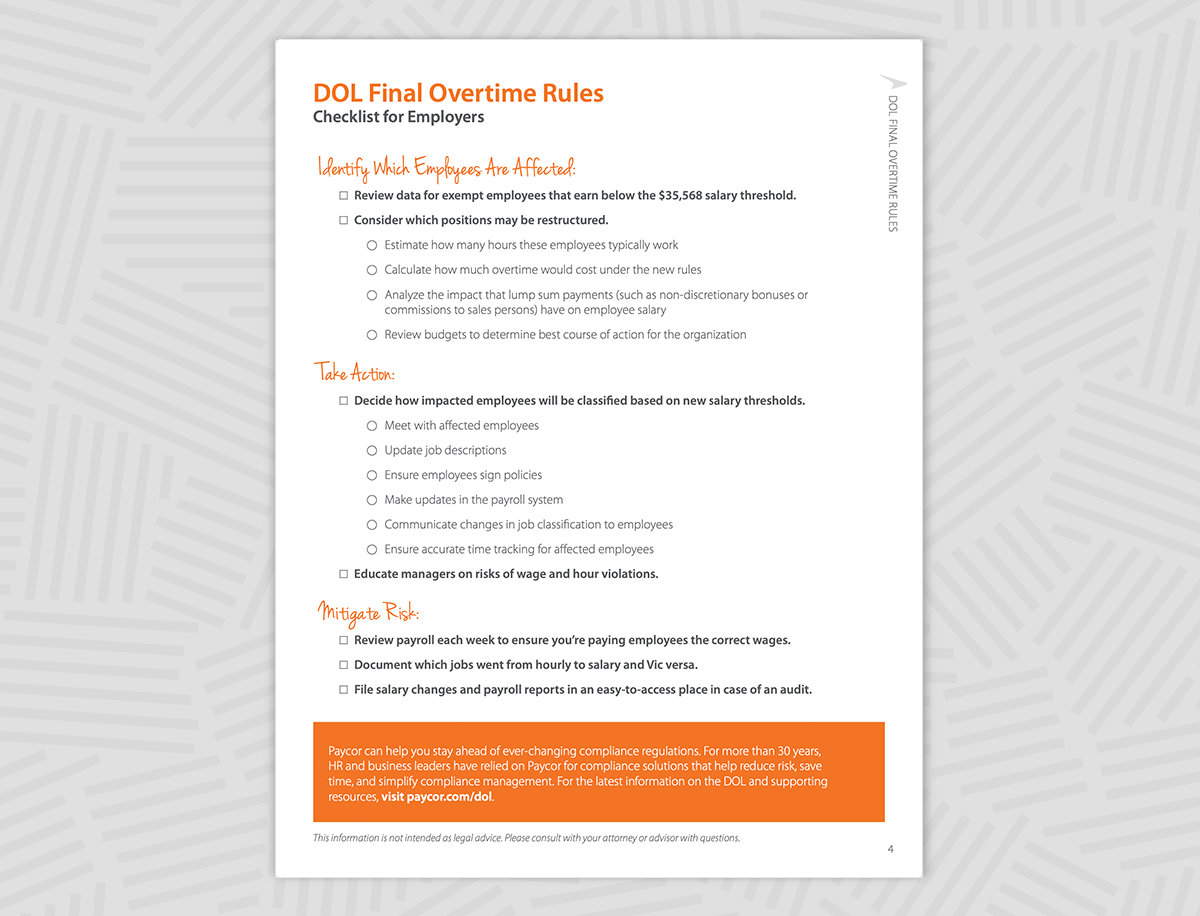

Download our guide for help to:

- The three requirements to be exempt

- What is the “duties” test

- How you can mitigate risk