Employee Voting Rights

The United States was built on the principle of self-governance or autonomy, and the primary method most people use to exercise that right is by casting a vote for the people or the laws that most closely represent their personal values.

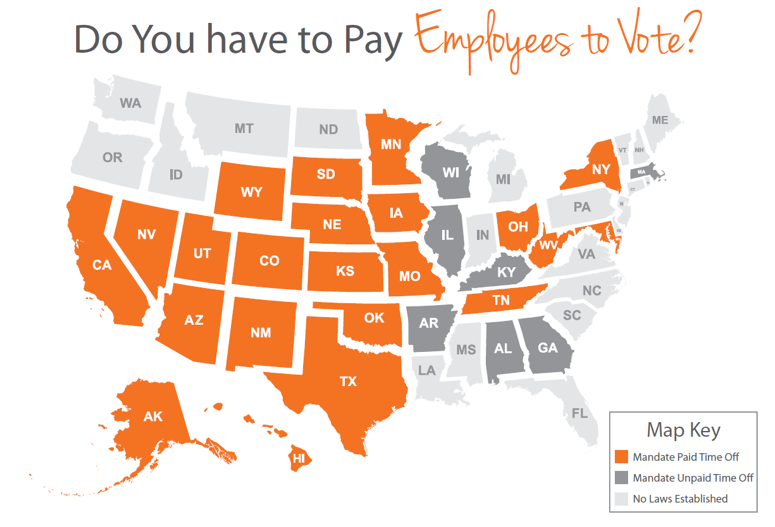

While this right is a very important one, today there’s no federal law that requires employers to provide time off from work for voters and Election Day isn’t considered a holiday the way it is in many other countries. On a positive note, though, many states require businesses to provide paid or unpaid time off so their employees can vote.

The 2020 election is coming soon, so now is the time for businesses to get familiar with employee voting rights in their state. But it’s also worth going beyond what’s required, and offering employees all the time they need to carry out their civic duty.

Which states require employers to offer time off to vote?

Providing paid time off (PTO) to vote is required in 22 states; unpaid time off is required in seven more.

How much time off do they get?

Most states that require paid time off allow the employee to take two to three hours to vote, which is typically a reasonable amount of time for tackling long lines. Some states’ laws say that an employee can take time off for “as long as it reasonably takes to vote.” Additionally, other states require proof of voting in order for an employee to receive time off with pay.

The states that mandate PAID time off to vote are:

- Alaska

- Arizona

- California

- Colorado

- Hawaii

- Iowa

- Kansas

- Maryland

- Minnesota

- Missouri

- Nebraska

- Nevada

- New Mexico

- New York

- Ohio

- Oklahoma

- South Dakota

- Tennessee

- Texas

- Utah

- West Virginia

- Wyoming

(The state of Mississippi mandates time off for employees to vote but it doesn’t specify if it’s paid or unpaid time.)

The states that mandate UNPAID time off to vote are:

- Alabama

- Arkansas

- Georgia

- Illinois

- Kentucky

- Massachusetts

- Wisconsin

Oregon and Washington don’t mandate paid or unpaid time off for voting; however, those are the only two states that allow their citizens to cast their ballots by mail so an employee shouldn’t have the need to take time off.

Establishing a Voting Policy

This year, many large companies (including Starbucks and Microsoft) aren’t just offering time for employees to vote, they are encouraging them to play an even more important role in the democratic process by training as poll workers. Others businesses are going one step further and offering Election Day as a paid, business-wide holiday, independent of state laws.

If that’s not something in the cards for a company, though, the employer may specify the hours an employee can be away from work in order to cast their vote. By providing sufficient time for employees to vote, a business can help ensure that their civic duties are met, even if it isn’t mandated by state law. It’s the right move for your employees—and the country.

Need help creating a PTO policy?

Check out our sample PTO policy for small and medium sized businesses. If your hands or full, Paycor can help. Our HR technology, benefits administration software, and expertise can guide you through the complexities of compliance and mitigate risk.