Pre-tax and post-tax deductions each serve different purposes, and smart employers understand when to use each type and how to communicate the differences to their teams. This guide breaks down everything you need to know to handle both correctly.

The Difference Between Pre- vs. Post-Tax Deductions

Pre-tax deductions are taken from an employee’s gross pay before any taxes are calculated. This lowers their taxable income, reducing federal income tax, Social Security, and Medicare withholdings. Common examples include:

- Traditional 401(k) contributions

- Health insurance premiums

- HSA contributions

Post-tax deductions come out after all taxes are withheld from gross pay. These don’t reduce current taxable income, but they may offer other advantages. For example, Roth 401(k) contributions and wage garnishments are common post-tax deductions.

The timing matters because it determines when the employee pays taxes on that income and, therefore, what their tax burden is for the current year.

Pre-Tax vs. Post-Tax Deductions: Comparing the Benefits

Pre- and post-tax deductions each have unique benefits. In most cases, employers cannot choose which ones occur pre-tax vs. post-tax; it depends on the reason for the deduction.

For example, health insurance premiums are pre-tax deductions, while union dues are typically withheld after taxes. But retirement options sometimes offer employees a choice because Roth account contributions are deducted after taxes.

Benefits of Pre-Tax Deductions

Pre-tax deductions deliver immediate tax savings for employees:

- Lower Taxable Income: Reduced federal, state, and local income tax liability

- Reduced FICA Taxes: Lower Social Security and Medicare withholdings for both employer and employee

- Immediate Savings: Employees see the tax benefit in every paycheck

- Employer Cost Savings: Lower FICA contributions on pre-tax deductions

- Enhanced Benefits Appeal: Makes benefits packages more attractive without increasing gross compensation

Benefits of Post-Tax Deductions

Post-tax deductions offer different advantages:

- Tax-Free Withdrawals: Roth contributions grow tax-free and can be withdrawn tax-free in retirement

- Flexibility: Fewer restrictions on when and how funds can be accessed

- Future Tax Protection: Hedges against higher tax rates in retirement

- Estate Planning Benefits: Certain post-tax accounts and benefits can be passed to heirs more favorably

Differences Between Pre-Tax and Post-Tax Deductions

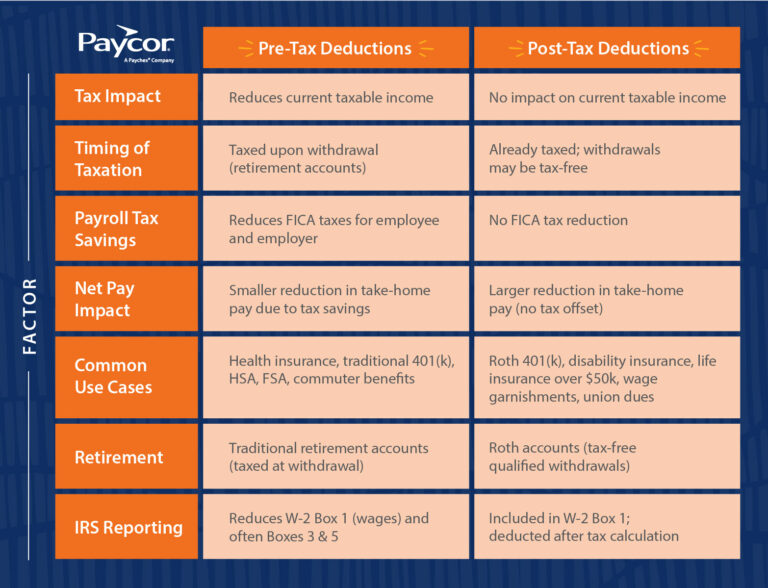

Tax Impact

Pre-tax deductions lower your current year’s tax bill by reducing taxable income. If an employee earning $60,000 contributes $5,000 to a traditional 401(k), they’re only taxed on $55,000. Post-tax deductions don’t reduce current taxes but may eliminate taxes on future withdrawals.

Timing of Taxation

With pre-tax deductions, you’re deferring taxes to a future date, typically in retirement. Post-tax deductions mean you’ve already paid taxes, so qualified withdrawals (like Roth 401(k) distributions) are tax-free.

Payroll Tax Savings

Pre-tax deductions reduce FICA taxes for both the employee and employer. An employee contributing $200 monthly to a pre-tax health plan saves about $15 in FICA taxes. The employer saves the same amount. Post-tax deductions don’t affect FICA calculations.

Net Pay Impact

Pre-tax deductions reduce take-home pay less than post-tax deductions because of the tax savings. A $200 pre-tax deduction might only reduce net pay by $140-150 after tax savings, while a $200 post-tax deduction removes the full $200 from take-home pay.

Use Cases

Pre-tax deductions work best for benefits employees need right away, like health insurance, dependent care, and commuter benefits. Post-tax deductions are generally used for long-term planning tools like Roth accounts or mandatory deductions like court-ordered garnishments.

Retirement

Traditional retirement accounts (pre-tax) give immediate tax breaks, but you’ll pay taxes on withdrawals in the future. Roth accounts (post-tax) don’t reduce current taxes but offer tax-free growth and withdrawals in retirement.

IRS Reporting

Pre-tax deductions lower the wages reported in Box 1 of Form W-2 (wages) and often reduce amounts in Boxes 3 and 5 (Social Security and Medicare wages). Post-tax deductions are taken after these amounts are calculated, so they appear in gross wages but not in the employee’s pocket.

7 Employer Tips for Managing Pre-Tax and Post-Tax Deductions

Use these best practices to streamline your payroll processing and ensure payroll compliance.

1. Document Deduction Policies

Create clear written policies explaining which deductions are pre-tax vs. post-tax. Include eligibility requirements, election periods, and change procedures. Documentation protects you during audits and helps employees make informed decisions.

2. Stay Current on Contribution Limits

IRS limits change annually for retirement plans, HSAs, and FSAs.

In 2026, the 401(k) contribution limit is $24,500 ($32,500 for those 50+), and HSA limits are $4,400 for individuals ($8,750 for families). Build processes to update these automatically.

3. Communicate Benefits Clearly

Employees may not know how pre-tax deductions can save them money. HR can share real examples to help them understand. A $100 pre-tax deduction might only cost an employee $75 in take-home pay, while a post-tax deduction costs the full $100.

Leaders should educate their workforce, but take care to avoid giving employees advice about their personal financial decisions.

4. Get Your Payroll System Right

Manually tracking deductions is a recipe for human error. Instead, HR should use payroll software features to automatically categorize deductions and update tax calculations in real time. The system should flag when employees exceed contribution limits or when deductions conflict with payroll taxes.

5. Monitor Compliance Requirements

Various deductions have different rules. Legally, some benefits must be offered on a pre-tax basis while others are optional. Stay informed about state and federal payroll tax regulations and adjust your processes when laws change.

6. Train Your Payroll Team

Your payroll staff needs to understand the tax implications of each deduction type. Misclassifying even one deduction affects multiple employees and creates compliance headaches. Regular training saves time, money, and complicated legal issues down the line.

7. Review Deductions Regularly

Audit your deduction setup regularly. Verify that pre-tax deductions properly reduce taxable wages and that post-tax deductions are calculated correctly. Develop a process to identify and correct errors before they turn into ongoing problems.

How Paycor Helps with Both Pre- and Post-Tax Deductions

Managing deductions manually creates an unnecessary level of risk. One typo can trigger an avalanche of tax penalties, compliance violations, and employee confusion. Paycor’s payroll software automates the process, streamlining complexity and protecting your team.

Paycor is a comprehensive, unified HCM that empowers leaders to:

- Distinguish between pre- and post-tax deductions

- Calculates taxes easily

- Track updates in real time as employees change their elections

- Stay on top of changing local and federal regulations

Our solution also improves the employee experience. Clear reporting shows employees exactly how their deductions affect take-home pay, so they can make better decisions about benefits. Their elections flow directly to payroll thanks to our unified HCM software.

Manage Pre-Tax and Post-Tax Deductions with Paycor

Paycor’s payroll and benefits platform simplifies pre- and post-tax deductions so HR can focus on strategy instead of spreadsheets. Get this right, and you’ll avoid compliance issues, boost engagement and retention, and drive business results.

Ready to streamline deductions? Schedule a guided tour to see how Paycor can help.

Pre-Tax vs Post-Tax Deductions FAQs

Get answers to HR’s most important questions about pre-tax and post-tax deductions.

Which is better, pre- or post-tax deduction?

Neither is universally better or worse.

Pre-tax deductions reduce current taxes, which makes them ideal for employees in high tax brackets who need immediate savings. Post-tax deductions, like Roth contributions, work better for younger employees in lower tax brackets who expect higher earnings (and higher taxes) later.

The right choice depends on the current tax rate, expected future tax rate, and the employee’s immediate financial needs.

Can you have both pre- and post-tax deductions?

Yes, employees can combine pre-tax and post-tax deductions. Many employees contribute to both a traditional 401(k) (pre-tax) and a Roth 401(k) (post-tax) to diversify their tax exposure. They can also have pre-tax health insurance while making post-tax contributions to a life insurance policy.

Just watch contribution limits. Combined traditional and Roth 401(k) contributions can’t exceed annual IRS limits.

Can employees switch between pre-tax and post-tax deductions?

It depends on the benefit type. Retirement plan changes typically happen during enrollment periods or after qualifying life events. Health insurance elections usually can’t change mid-year unless there’s a qualifying event like marriage, birth, or job loss.

Payroll garnishments are mandatory post-tax deductions that employees can’t elect to change. Always check your plan documents for specific rules.

Are union dues classified as pre- or post-tax deductions?

Union dues are post-tax deductions. The IRS doesn’t allow pre-tax treatment for union dues, so they come out of an employee’s net pay after all taxes are calculated. This means union dues don’t reduce taxable income or provide any immediate tax benefit to the employee.

Is health insurance pre-tax or post-tax?

Most employer-sponsored health insurance premiums are pre-tax deductions, which reduces both income tax and FICA tax. However, some supplemental insurance policies may be post-tax. Domestic partner coverage may also be post-tax if the partner doesn’t qualify as a tax dependent.

Are retirement benefits subject to pre- or post-tax deductions?

Both types exist. Traditional 401(k), 403(b), and 457 plans use pre-tax deductions, meaning you pay taxes when you withdraw in retirement. Roth versions of these plans use post-tax deductions, where you pay taxes now but withdrawals are tax-free in retirement. Many employers offer both options and let employees choose based on their tax situation.