When managing payroll or designing compensation packages, employers sometimes use the terms “salary” and “stipend” interchangeably, but the two words have very different meanings. And confusing the two can lead to tax errors, compliance issues, or employee misclassification.

Knowing the difference between a salary vs stipend helps HR teams determine the right payment structure for each role—and help ensure employees are fairly compensated and correctly taxed.

What Is a Salary?

A salary is a fixed, recurring payment employers provide to full-time or part-time employees in exchange for ongoing work. Salaried employees typically receive the same amount of money each pay period, regardless of hours worked, and they are most often classified as exempt under the Fair Labor Standards Act (FLSA).

How Does Salary Work?

Employers calculate salaries as an annual total, divided across regular pay periods—biweekly, semimonthly, or monthly. Salaries include standard tax withholdings, such as federal and state income tax, Social Security, and Medicare. Employers may also deduct benefits, 401(k) contributions, or insurance premiums before issuing net pay.

Salaried employees’ compensation is typically processed through payroll software, to help employers make sure taxes, benefits, and time tracking are handled automatically.

Why Are Salaries Used?

Offering a salary provides several business advantages:

- Creates predictable payroll expenses and steady employee income

- Encourages loyalty and retention among long-term staff

- Simplifies compliance and recordkeeping

- Reflects job stability and professional advancement

What Is a Stipend?

A stipend is a fixed, predetermined payment provided for specific purposes—such as training, education, or expense reimbursement—rather than as direct compensation for work performed. Stipends are often offered to interns, fellows, apprentices, or volunteers who may not be classified as employees under labor law.

How Does a Stipend Work?

Stipends are not wages and are typically not tied to hourly work. Instead, they cover costs associated with professional development or participation in a program such as housing, meals, travel, or technology.

Depending on how the stipend is structured, it may be considered taxable income under IRS guidelines. Employers must track stipends separately using expense management software or report them via Form 1099 if they’re paid to independent contractors.

Why Are Stipends Used?

Employers offer stipends to:

- Support employee development or certification costs

- Offset expenses for interns or trainees

- Encourage participation in wellness, transportation, or remote work programs

- Increase benefits flexibility without adjusting base pay

Stipend vs. Salary: Key Differences

At first glance, salaries and stipends may seem similar; after all, they’re both fixed payments that don’t fluctuate from week to week. But when you look closer, they are very different. Knowing the distinctions helps employers stay compliant, manage payroll, and design compensation programs.

Purpose

Salaries pay for ongoing job performance; stipends support learning, living, or work-related costs.

Payment Structure

Salaries recur at set intervals (biweekly or monthly). Stipends, however, may be one-time or periodic lump-sum payments.

Eligibility

Salaries only apply to employees, whereas stipends can be paid to employees, contractors, or trainees.

Tax

Salaries are subject to payroll tax withholding, and stipends may be taxable but typically have no withholdings deducted.

Employment

Salaried workers are usually full employees under labor law, while stipend recipients don’t have to be.

Usage

Salaries compensate for labor, whereas stipends help offset costs tied to participation or development.

Flexibility

Salaries are fixed. Stipends are customizable by purpose, amount, or duration.

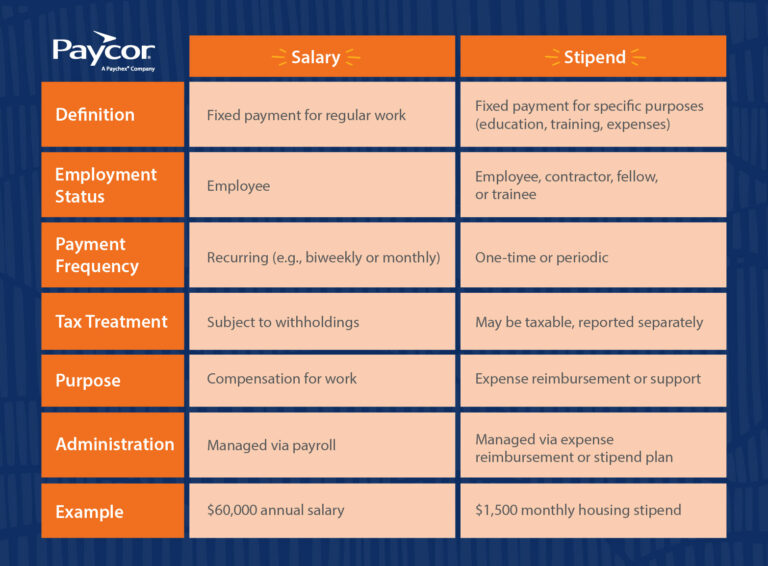

Stipend vs. Salary Comparison Chart

By understanding how salaries and stipends differ in purpose, structure, and taxation, employers can choose the option that best fits their workforce strategy. This chart highlights the most important distinctions at a glance.

Stipend vs. Salary: Which One Should You Offer?

Choosing between providing a salary or a stipend depends on work structure and employee classification. For instance, you should:

- Offer a salary when the worker is an employee performing ongoing duties for the business.

- Offer a stipend when the payment supports costs unrelated to hourly or exempt work, such as continuing education or wellness benefits.

Note: Employers should also consider compliance and reporting implications under IRS and DOL regulations.

Types of Stipends to Consider

Not all stipends serve the same purpose. Depending on your workforce and business goals, stipends can help cover everything from education to remote work expenses.

But offering the right types of stipends can boost employee satisfaction, strengthen retention, and position your organization as an employer that invests in its people. Here are some types to consider:

Education or Training Stipends

These stipends cover tuition, certification fees, or professional development courses.

Wellness Stipends

Encourage healthy lifestyles by reimbursing gym memberships, fitness classes, or ergonomic equipment.

Technology or Remote Work Stipends

Offset internet, phone, or home office setup costs for hybrid and remote teams.

Transportation Stipends

Help employees with commuting costs such as public transit passes, parking, or fuel allowances.

Meal or Living Stipends

Provide support for employees temporarily relocating or attending off-site training.

When to Offer Stipends

Knowing when to offer stipends is just as important as knowing what kind to offer. Stipends can be a powerful way to support employees during key moments, whether they’re onboarding, pursuing development opportunities, or adapting to new work environments.

The right timing ensures your investment delivers maximum value for both your team and your organization. You should consider offering stipends when you are:

- Expanding Employee Benefits: Use stipends to personalize perks without adjusting payroll.

- Managing Remote Teams: Support remote or hybrid workers with technology or home office stipends.

- Recruiting Interns or Apprentices: Provide stipends instead of wages to help cover living or education costs during training programs.

- Encouraging Professional Growth: Offer stipends for certifications or skill-building courses that benefit both the employee and organization.

- Offsetting Company Travel or Relocation Costs: Stipends simplify reimbursement for lodging, meals, or temporary housing.

How Paycor Helps with Stipends and Salaries

Paycor gives HR leaders visibility and control over all types of compensation through:

- Payroll Software: Automate salary payments, deductions, and tax withholdings.

- Expense Management Software: Track, approve, and report stipends and reimbursements accurately.

- Compensation Planning: Design fair, data-driven pay strategies across salaried and stipend-based roles.

Offer Salaries and Stipends with Paycor

Whether you manage salaried professionals or stipend recipients, Paycor simplifies payroll and compliance.Take a Guided Tour to see how Paycor’s HCM software streamlines every part of compensation management.

Salary vs. Stipend FAQs

Have more questions about salaries and stipends? Read on!

Is a stipend considered a salary?

No. A stipend is a fixed payment that is not tied to wages or hours worked.

Is a stipend a bonus?

No. Bonuses reward work performance stipends cover specific expenses or participation.

Can a stipend be paid in addition to a salary?

Yes. Employers often give stipends alongside salaries for education, wellness, or technology expenses.

Are employee stipends taxable?

In many cases, yes. Stipends may be taxable income if not directly reimbursing business expenses.

Which offers better benefits, a stipend or salary?

One isn’t necessarily better than the other. A salary provides stability and benefits; stipends add flexibility and customization.

Do salary and stipend payments follow the same schedule?

No. Salaries follow a set payroll cycle; stipends may be one-time or periodic.

Is a stipend suitable for remote workers or freelancers?

Yes. Many companies offer technology or home office stipends to remote and contract workers.

How is a stipend amount determined?

Employers set stipend amounts based on budget, purpose, and desired employee support level.