Understanding the difference between Form W-2 and Form W-4 is important for both employers and employees, yet these two IRS documents are often confused.

Employers must distribute and file W-2s correctly, while employees must complete W-4s accurately to ensure proper tax withholding. Mixing them up can lead to payroll errors, incorrect tax filings, and avoidable IRS issues.

If you’ve ever wondered “Do I need a W-2 or a W-4?” or “Is a W-4 the same as a W-2?” this guide explains everything you need to know.

What’s the Difference Between a W-2 vs W-4?

The simplest explanation for the differences is this:

A W-4 is completed by the employee at the start of employment (or when tax preferences change). The W-4 determines how much tax is withheld from each paycheck.

A W-2 is completed by the employer at the end of the year, reporting actual wages and withholdings. The W-2 shows what was actually withheld during the year.

Below are the basics of each form.

W-2 Form Basics

A W-2 is an annual tax document prepared by the employer. It shows how much an employee earned and how much in taxes were taken out of an employee’s total pay throughout the year. Employees use this form when filing their federal and state tax returns.

The information required to complete a W-2 includes:

- Employee’s legal name

- Employee’s Social Security number

- Employer name, address, and EIN

- Total wages, tips, and compensation

- Federal income tax withheld

- Social Security wages and tax

- Medicare wages and tax

- State/local wages and tax (if applicable)

For more detail on W-2s, see W-2 vs 1099.

W-4 Form Basics

A W-4 is completed by the employee, so employers know how much federal income tax to withhold from each paycheck. Employees submit a W-4 when they start a job or when their financial situation changes.

The information needed to complete a W-4 includes:

- Employee filing status

- Number of dependents

- Additional withholding requests

- Multiple jobs or spouse income adjustments

- Tax credits or deductions

More guidance on the form is available in the W-4 Form Guide.

The Differences Between W-2 vs W-4

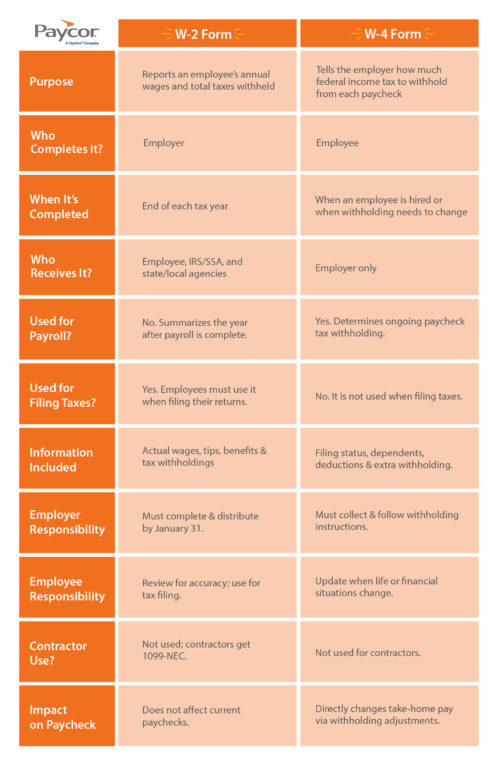

While both IRS forms affect tax reporting, they serve completely different purposes. The following table highlights their core differences.

Here are more detailed explanations:

Purpose of W-2 and W-4

The W-2’s purpose is to report wages and withholdings to the IRS so employees can file their taxes. The W-4’s purpose is to give employers the correct withholding instructions for each employee’s paycheck.

Completion of W-2 vs W-4

Employers complete and issue the W-2 to employees by January 31. Employees complete the W-4 with no specific date requirement.

Use of W-2 and W-4 Forms

W-2s are used after the year ends for tax filing. W-4s are used before and during employment to guide payroll withholding.

W-2 and W-4 Form Filing Process

Employers are required to file W-2s with the SSA and give copies to employees and state departments (if necessary). W-4s are not filed with the IRS, but employers keep them on file for the business’s internal use.

How W-2 and W-4 Forms Affect Employee Paychecks

W-4s determine how much tax is withheld each pay period, which affects an employee’s net pay. W-2s do not affect paychecks; they only summarize annual earnings.

Taxes and W-2 vs W-4

The W-4 gives withholding instructions. The W-2 reports total annual tax withheld.

How to Determine If You Need a W-2 or W-4 Form

Determining whether you need a W-2 vs a W-4 depends on your role within the business. For instance:

- If you are an employee starting a job, you need a W-4.

- If you are an employer processing payroll, you need a W-4.

- If you an employee filing taxes, you need a W-2.

- If you an employer reporting wages, you must file a W-2.

- If you’re an employer onboarding a new hire, you need a W-4.

- If you’re an employee preparing for year-end taxes, you need a W-2.

To Summarize: Is a W-4 the Same as a W-2?

No, W-4 and W-2 forms serve completely different purposes. Employees fill out the W-4 so employers know how much tax to withhold each pay period, and employers prepare the W-2 to report wages and withholdings for tax filing.

Both forms work together, but they are absolutely not interchangeable.

How Paycor Helps with W-2 and W-4 Forms

Paycor automates payroll and tax processes, making it easier for employers to manage W-2 and W-4 forms accurately. Tools that simplify W-2s and W-4s include:

- Payroll Software: Automates payroll tax calculations and withholding.

- HR & Payroll Platform: Stores employee W-4 updates and generates W-2s at year-end.

- Compliance Tools: Helps employers stay aligned with federal and state tax regulations.

- Employee Self-Service: Allows employees to submit updated W-4s digitally.

Streamline Your W-2 and W-4 Forms with Paycor

Managing tax forms doesn’t have to be stressful! Paycor helps automate calculations, simplify reporting, and ensure accuracy throughout the year.

Take a Guided Tour today!

W-2 vs. W-4 FAQs

Still have questions about the differences between W-2 and W-4s? Keep reading1

Do you need both a W-2 and W-4?

Yes. Employees complete a W-4 at hire, and employers issue a W-2 at year-end.

Do you need a W-2 or W-4 to file taxes?

Employees file taxes using a W-2, not a W-4.

How do W-2 and W-4 forms work together during tax season?

The W-4 determines withholding all year; the W-2 reports what was withheld.

Is there a difference between W-2 and W-4 for independent contractors?

Contractors do not receive either form. They receive a 1099-NEC instead.

Can I update my W-4 after receiving a W-2?

Yes. Employees can file a new W-4 any time their tax situation changes.