Understanding the difference between Form W-2 and Form W-9 is an important distinction for employers, contractors, and payroll teams. While both forms deal with tax reporting, they apply to very different worker classifications. Mixing them up can result in IRS penalties and reporting errors.

This guide breaks down what each form is for, who uses it, and how to stay compliant.

What’s the Difference Between W-2 and W-9?

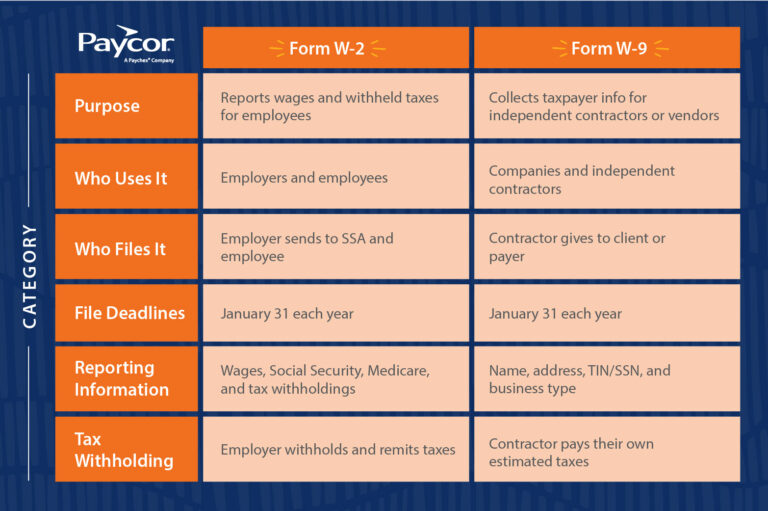

Here are the differences between Forms W-2 and W-9 at a glance:

- Form W-2 is used for employees: it reports wages and taxes withheld.

- Form W-9 is used for independent contractors: it provides taxpayer information so clients can issue a 1099 form.

Form W-2 Basics

Form W-2 is the document employers provide to employees and the Social Security Administration (SSA) each year. It summarizes an employee’s total wages and tax withholdings.

What’s Included

- Employee and employer identification info

- Total wages, tips, and compensation

- Federal, state, and local taxes withheld

- Social Security and Medicare earnings

- Benefit contributions (e.g., retirement, health coverage)

When It’s Used

Employers must send W-2s to employees and file them with the SSA by January 31 each year. Employees then use their W-2s to file annual income tax returns.

Form W-9 Basics

Form W-9 is provided by an independent contractor, freelancer, or vendor to a company that pays them (i.e., the payer). This form gives the payer the necessary tax information to complete Form 1099-NEC at year-end.

What’s Included

- Contractor’s name or business name

- Address

- Taxpayer Identification Number (TIN or SSN)

- Business entity type (individual, LLC, S Corp, etc.)

- Signature certifying accuracy

When It’s Used

Businesses collect W-9s at the beginning of a contractor relationship, typically before any payments are made. The payer keeps the form on file and later uses it to issue Form 1099-NEC if the contractor earns $600 or more during the year.

Do I Need a W-2 or a W-9 Form?

You may only need one or the other, or, depending on how you do business, you might use both forms. Here’s how to know:

- Use a W-2 if you have employees on payroll with taxes withheld.

- Use a W-9 if you pay independent contractors or vendors for services.

The rule of thumb: If you control how, when, and where the person works, they’re likely a W-2 employee. If they control the work independently, they’re a W-9 contractor.

How to Transition an Independent Contractor from a W-9 to W-2

Sometimes a contractor becomes a full-time employee. Here’s how to make that transition smoothly:

1. Review the Classification

Confirm the contractor meets employee criteria under IRS Common Law Rules (behavioral, financial, and relationship control).

2. End the Contractor Agreement

Close out any existing 1099 contracts and collect a final invoice for work completed.

3. Add the Worker to Payroll

Gather new-hire documents (W-4, I-9, direct deposit, etc.) and set up payroll in your HR system.

4.Provide Onboarding and Benefits

Offer any applicable benefits, assign an employee ID, and integrate the new hire into company systems.

To Summarize: Are W-2 and W-9 the Same?

No, the two forms are not the same. A W-2 reports employee wages and withholdings to the IRS, while a W-9 provides taxpayer information for independent contractors so a 1099 can be issued later. They serve different worker types, are filed by different parties, and are never interchangeable.

How Paycor Helps with W-2 and W-9 Forms

Paycor automates tax form management for both employees and contractors, reducing manual work and compliance risk.

Paycor’s solutions include:

- Payroll Software: Automatically generates and files W-2s.

- Onboarding Software: Collects and stores W-9 and I-9 forms digitally.

- HR Software: Maintains accurate employee classifications and records.

Streamline W-2 and W-9 Tax Form Compliance with Paycor

From onboarding to year-end reporting, Paycor helps ensure every worker—employee or contractor—is managed correctly.

Take a Guided Tour to see how Paycor automates compliance and simplifies tax form filing.

W-2 vs W-9 FAQs

Still have questions about W-2 and W-9 forms? Read on!

Is a W-9 for a 1099 or W-2?

A W-9 is for contractors who will later receive a 1099-NEC, not for W-2 employees.

What’s the difference between W-2 vs. W-9 vs. 1099?

Form W-9 collects contractor tax info, Form 1099 reports contractor payments, and Form W-2 reports employee wages and taxes withheld.

Why would an employee fill out a W-9 instead of a W-2?

They shouldn’t. Employees complete a W-4 instead. A W-9 is for non-employees providing services.

Can you have both a W-2 and W-9?

Only if you work for a company as an employee and provide separate, unrelated contract work as an independent contractor.

Are you taxed on a W-9 and W-2?

Yes, but W-2 taxes are withheld automatically by the employer, while W-9 contractors pay their own quarterly estimated taxes.

Does a W-9 mean I have to pay taxes?

Yes. A W-9 signals to the IRS that the income reported on Form 1099 is taxable.