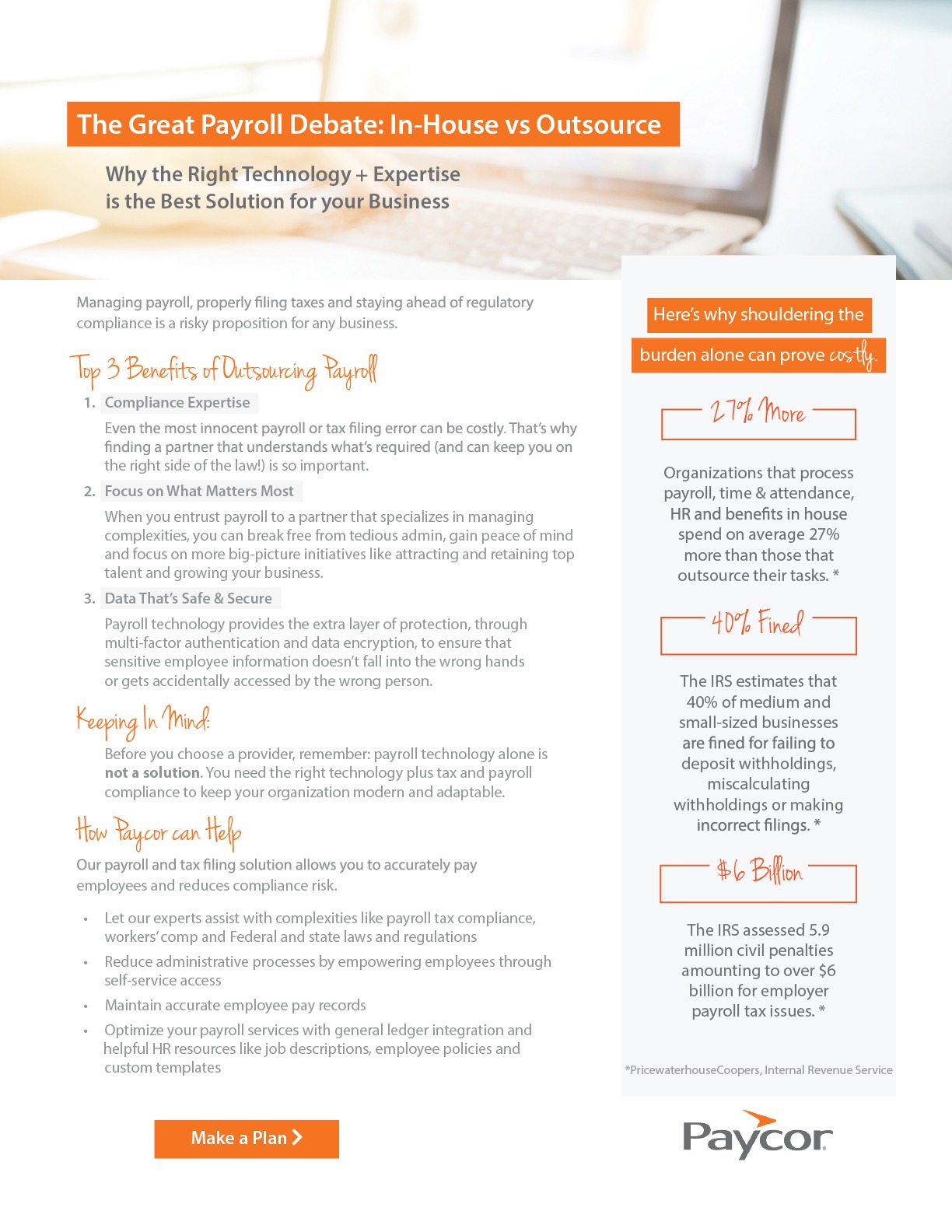

Ensuring your team gets paid accurately and on-time is critical to business success and likely one your top priorities as a leader. For payroll processing, you have two options: outsourced or in-house. With in-house, the burden of payroll falls on you. It’s never been harder to hire (and retain) employees, and so for some organizations, hiring even one payroll expert isn’t in the cards. There’s also the drawback of just how much time it takes to do payroll right, especially since the payroll process is complex and easy to mess up. It’s no surprise then that organizations outsourcing payroll and HR functions spend on average 27% less than those that take on the work in-house.

Check out this short overview to learn how the right HR and payroll partner can free up your time so you can focus on your customers and protect your business from costly mistakes.