EEO-1 Reporting & Compliance Updates

Update: The EEOC announced that it will extend the deadline for Component 2 data filing indefinitely until the desired participating level is reached. Stay tuned to Paycor.com for more details. Eligible employers are required to collect 2017 & 2018 employee pay data by race, ethnicity and gender and submit it to the Equal Employment Opportunity Commission (EEOC) by September 30, 2019.

UPDATE: On April 25, 2019 a federal judge announced a ruling that will require employers to collect 2018 employee pay data by race, ethnicity and gender and submit it to the Equal Employment Opportunity Commission (EEOC) by September 30, 2019. On May 1, the EEOC announced their decision to collect 2017 pay data in addition to the 2018 pay data.

What is the EEO-1 Form?

The EEO-1 form is a compliance survey that requires employers to categorize employment data by race/ethnicity, gender and job category.

Who is Required to File the Updated EEO-1 Report?

Private employers, including federal contractors with 100 or more employees, are required to submit pay data (also known as Component 2 data).

What are the New EEOC Compliance Requirements?

The current EEO-1 Report requires employers to categorize company employment data by race, ethnicity, gender and job category. With the new ruling, employers are required to report wage information from Box 1 of the W-2 form and total hours worked for all employees by race, gender and ethnicity within 12 proposed pay bands.

What Does This Mean for Your Organization?

The amount of additional data employers will be required to provide is very significant. If employers are unable to generate compensation, hours worked and pay bands into one report, it will create additional administrative work and could result in costly reporting errors.

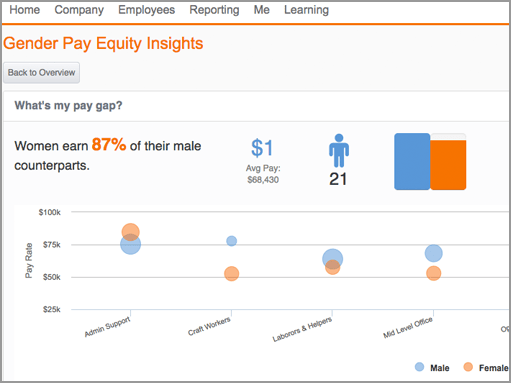

Simplify Your EEO-1 Reporting with Paycor

Paycor’s HCM platform offers a unified experience with HR, time and payroll data easily accessible in one location. Our solution will not only help create the EEO-1 Report with just a few clicks, but it will help you prevent audits by proactively identifying issues in your current practices.

EEOC Compliance Resources

The Essential EEOC Guide to New EEO-1 Reporting

Download Now

EEO-1 Report Checklist

View Now

Unconscious Bias in the Workplace

Read more

EEO-1 Reporting FAQs, On Demand Webinar

Watch Now

Support

Helping our clients get the most out of our service and keeping them ahead of the curve is key to their success and ours. From helpful training to frequent webinars, Paycor provides answers every step of the way.