Hiring workers is no longer as simple as choosing between full-time or part-time employees. Today, employers must also decide whether a worker should be treated as a W-2 employee or a 1099 independent contractor, and misclassification of either one can lead to expensive IRS penalties, back taxes, and legal issues.

This guide explains everything employers need to know about the differences between 1099 and W-2 employees, including taxes, benefits, work control, classification tests, and the forms used for each.

What’s the Difference Between W-2 vs. 1099 Employees?

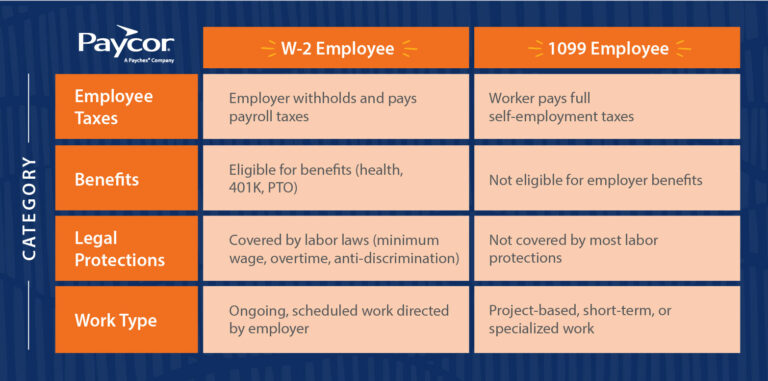

Employers and workers need to know the distinction between W-2 and 1099 staff as it affects everything from tax obligations to legal protections. The main difference is this:

W-2 employees are on payroll, receive wages, have taxes withheld by the employer, and are legally protected under employment laws, while 1099 workers are self-employed contractors who handle their own taxes and operate independently.

W-2 vs. 1099 Employees Comparison Table

What Is a W-2 Employee?

A W-2 employee is a traditional worker hired by a business. The employer controls how, when, and where they do their job. Employers are required to withhold taxes, provide legally required benefits, follow wage-and-hour rules, and issue Form W-2 at year-end.

Examples of W-2 Employees

- Hourly workers: Hourly workers are paid a wage for each hour they work and can qualify for overtime under the Fair Labor Standards Act (FLSA). Employers set schedules, track hours, and are required to ensure compliance with minimum wage and wage-and-hour laws.

- Salaried professionals: Salaried employees earn a fixed annual income regardless of hours worked. They typically hold roles requiring specialized knowledge or professional skills and may be classified as exempt from overtime depending on their duties and compensation.

- Executives and leadership roles: Executives and leaders oversee teams, departments, or entire business operations. They make strategic decisions, hold significant responsibility, and are almost always treated as exempt employees under the FLSA.

What Is a 1099 Employee?

A “1099 employee” is a misnomer since these workers are not actuallyemployees; they are independent contractors.

Contractors usually operate outside the bounds of a typical employment relationship, choosing how, when, and where work gets done—invoicing others for their services. Because they are self-employed, they pay their own taxes and provide their own tools.

Examples of 1099 Workers

- Freelancers

- Consultants

- Gig workers (rideshare, delivery, etc.)

- Project-based specialists

When to Hire 1099 vs. W-2 Employees

Choosing between a W-2 employee and a 1099 contractor shouldn’t just boil down to cost. It’s also about the nature of the work itself—how much control your business needs over how that work gets done—and the needs of the business itself.

Companies hire W-2 employees when they need long-term, ongoing work done under company control with predictable scheduling. Companies hire 1099 contractors when they need specialized skills, short-term help, seasonal support, or project-based work with minimal oversight.

Differences Between W-2 and 1099 Employees for Business

Below are the major differences employers should consider when deciding which type of worker to hire:

Employer Control

- W-2 employees work under employer instructions.

- 1099 workers control how the work gets done.

Work Responsibilities

- W-2 employees have defined roles within the organization.

- 1099 workers typically manage specific tasks or projects.

Labor Costs

- Employers cover payroll taxes and benefits for W-2 workers.

- Contractors generally cost more per hour but require no taxes or benefits.

Payroll Taxes

- W-2 workers have taxes withheld by the employer.

- Contractors pay their own federal, state, and self-employment taxes.

Workplace Culture

- Employees are part of the team.

- Contractors typically are not integrated into company culture.

Tax Forms

- W-2 employees receive Form W-2.

- Contractors receive Form 1099-NEC.

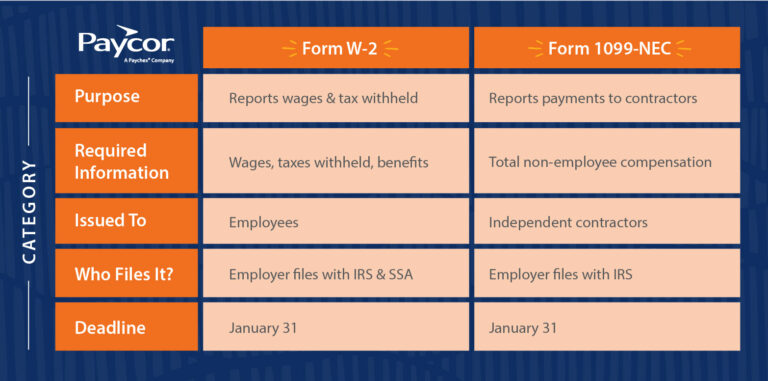

Differences Between W-2 vs. 1099 Tax Forms

What Is a Form W-2?

A W-2 is issued to employees to report annual wages and payroll taxes. Employers must file copies with the SSA and state agencies.

When to Issue a Form W-2

Issue a W-2 to any employee who earned $600 or more in wages during the year or if you withheld any amount of income, social security, or Medicare tax.

When Form W-2s Need to Be Sent

All W-2s must be sent to employees and the SSA by January 31.

What Is a Form 1099?

Form 1099-NEC reports compensation paid to non-employees such as contractors, freelancers, and gig workers.

When to Issue a 1099 Tax Form

Issue a 1099-NEC if a contractor earned $600 or more during the tax year.

When 1099s Need to Be Sent

Employers must send 1099s to contractors and the IRS by January 31.

W-2 vs. 1099 Form Filing

Both worker types require annual tax reporting, but the forms and filing processes differ. Here’s what employers need to know about each:

Filing W-2s

Employers must prepare W-2s, provide copies to employees, and file them with the SSA. Many states also require copies.

Filing 1099s

Employers must prepare 1099-NEC forms, send them to contractors, and file them with the IRS.

W-2 and 1099 Employee Classification Tests

Misclassifying workers can result in IRS penalties, back taxes, and legal consequences. To avoid errors, employers must understand the following classification tests.

IRS Common Law Test

The IRS uses a multi-factor common law test that evaluates three main categories of control:

- Behavioral control (whether the company directs how work is done)

- Financial control (whether the worker has unreimbursed expenses, investment in tools, or opportunity for profit or loss)

- The type of relationship (whether there are written contracts, benefits, or an expectation of ongoing work).

Note: No single factor is decisive, and the IRS examines the entire working relationship to determine the degree of control and independence.

Learn more at the IRS Independent Contractor Guidelines.

DOL Economic Reality Test

The U.S. Department of Labor applies an economic reality test under the Fair Labor Standards Act to determine whether a worker is economically dependent on the employer (employee) or in business for themselves (independent contractor).

This test considers factors including the worker’s opportunity for profit or loss, investment in facilities or equipment, permanence of the relationship, degree of control by the employer, whether the work is integral to the business, and the worker’s skill and initiative.

For detailed guidance, visit the DOL’s Worker Classification page.

Equal Employment Opportunity Rules

Federal anti-discrimination laws—including Title VII of the Civil Rights Act, the Americans with Disabilities Act, and the Age Discrimination in Employment Act—apply only to employees, not independent contractors.

This means W-2 employees are protected from workplace discrimination and harassment based on race, color, religion, sex, national origin, age, disability, and genetic information, while 1099 contractors generally are not covered by these protections. The distinction becomes legally significant in discrimination claims.

More information is available through the Equal Employment Opportunity Commission.

State Employee Classification Tests

Many states also have their own worker classification rules that may be stricter than federal standards. California’s ABC Test, for example, presumes all workers are employees unless the hiring entity can prove:

- The worker is free from control and direction,

- The work performed is outside the usual course of the hiring entity’s business, and

- The worker is customarily engaged in an independently established trade or occupation.

Other states like Massachusetts, New Jersey, and Illinois have adopted similar ABC tests for certain purposes as well. So, it’s important that employers operating in multiple states consult each state’s labor department for their specific requirements.

How Paycor Helps with W-2 and 1099 Employee Classification

Paycor is an HCM technology provider that helps HR leaders create, manage, and maintain compliance across the entire employee lifecycle. Paycor’s HR & Payroll Solutions centralize employee data, automate pay calculations, and track record-keeping requirements. And our compliance solutions help employers reduce compliance risk through automated workflows, guided onboarding, built-in tax calculations, and tools that support proper worker classification.

Streamline W-2 and 1099 Tax Form Completion with Paycor

From onboarding to year-end tax forms, Paycor makes it easy to classify workers correctly, calculate taxes, and file accurate W-2s and 1099s.

Take a guided tour!

W2 vs 1099: FAQs

Want to learn more about the differences between W-2 and 1099 workers? Keep reading!

Can someone be both a 1099 worker and W-2 employee in the same year?

Yes, but only if the work performed is significantly different in nature.

Does 1099 or W-2 offer more job flexibility?

Contractors (1099) typically have greater flexibility; employees (W-2) have more stability.

Which is best for employees: W-2 or 1099?

It’s important to remember the distinction that 1099 workers are not employees. W-2 roles offer benefits and legal protections; 1099 roles offer independence and potential tax deductions.

Which classification affects unemployment eligibility?

Only W-2 employees qualify for unemployment benefits.

How do deductions work for 1099 vs W-2 employees?

1099 workers may deduct business expenses; W-2 employees generally cannot unless eligible under IRS rules.