Recruiting Software

Find and Hire Top Talent Faster

Designed by recruiters, for recruiters, Paycor’s modern platform helps you identify and hire the right talent. Speak to a representative today, call 513-338-0399.

More than 50,000 businesses nationwide trust Paycor*

Recruiting Software to Attract and Hire Top Talent

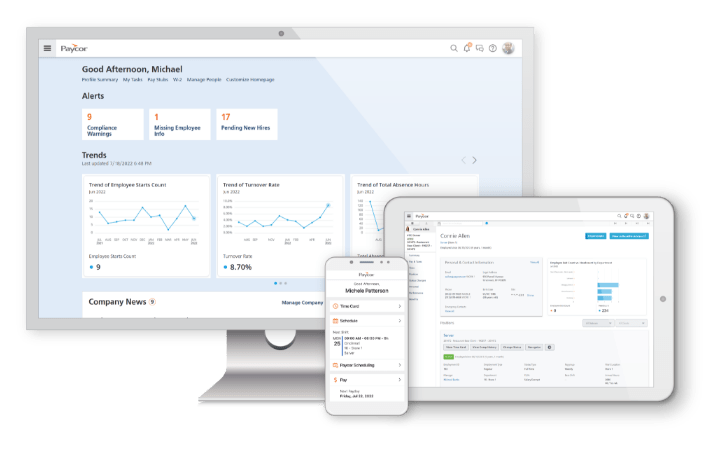

Streamline Your Hiring Process

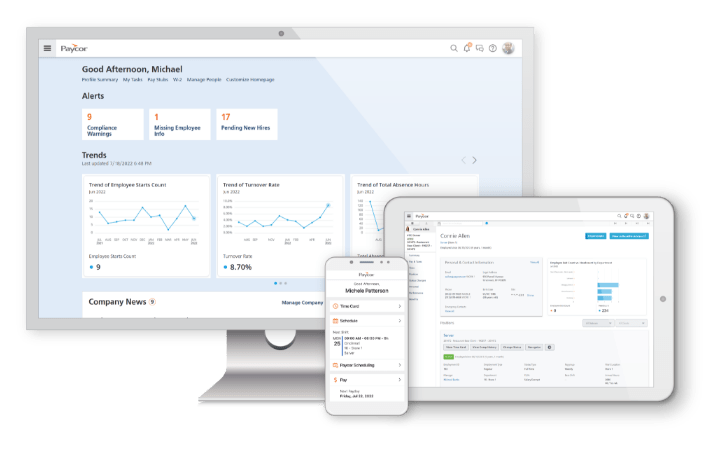

From helping you attract and engage high-quality candidates in a deep talent pool, to building trust with them throughout the hiring process, Paycor Recruiting removes everyday, manual processes —and provides real-time data so you never miss out on a dream candidate.

Candidate Dashboard

Get better visibility into the hiring process. View job candidates, recruiting status, and high-priority job listings in one place.

Interview Scorecards

Evaluate candidates consistently, track their performance, and compare their qualifications to find the best fit for your team.

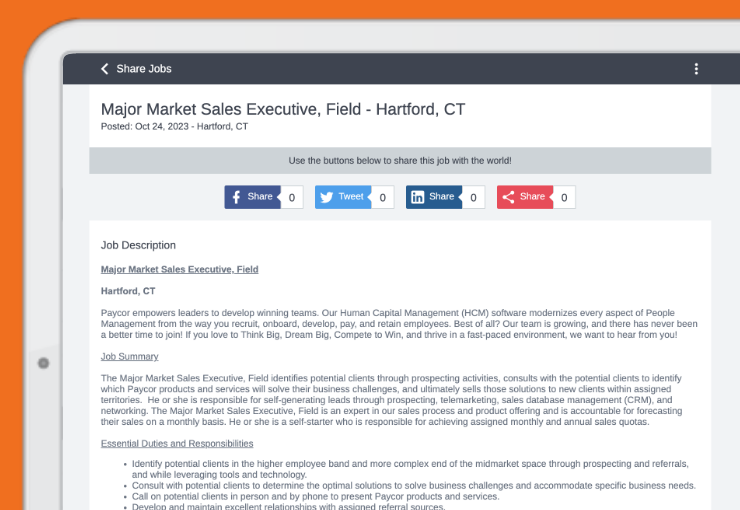

AI-Powered Job Descriptions

Create compelling job descriptions faster than ever before using AI to automatically populate required skills, qualifications, and role details.

Improve Your Candidate Experience with All-in-One Recruitment Software

How candidates apply for jobs is changing. They don’t want to spend 45 minutes filling out an application, and they’re using mobile devices and tablets (not just computers) to apply. To keep pace with the changing recruiting landscape, Paycor reduces barriers, makes it easy to connect with candidates, and helps your brand shine during the hiring process.

Custom Hiring Workflows

Tailor your recruitment strategy to fit your needs, streamline candidate evaluation, and build a seamless hiring experience from start to finish.

Career Pages

Easily create a fully branded careers page that matches your website, without IT support.

Candidate Texting

Stay connected, send timely updates, and build strong relationships with candidates through convenient and personalized text messages.

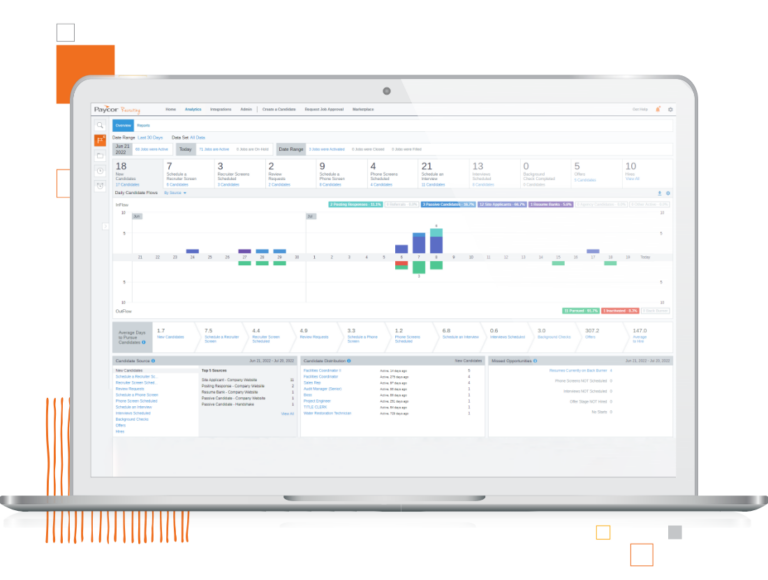

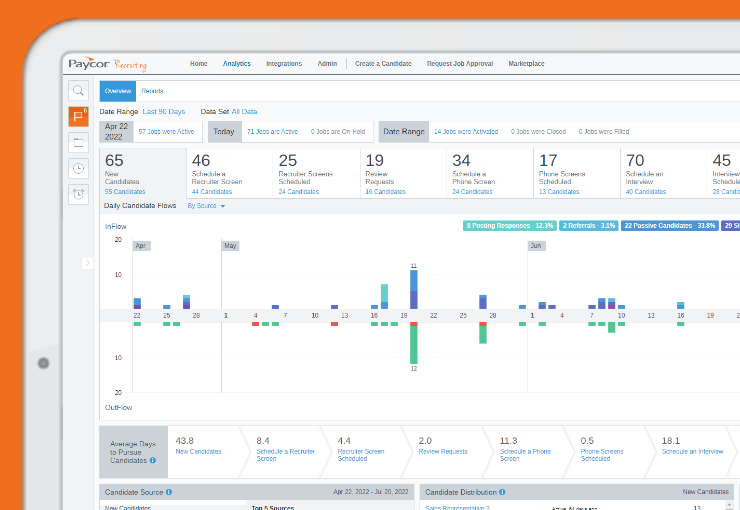

Recruitment Analytics Software that Thinks Like You

Recruiting Analytics

Gain valuable insights into your hiring process and track important metrics like time-to-hire and lead sources.

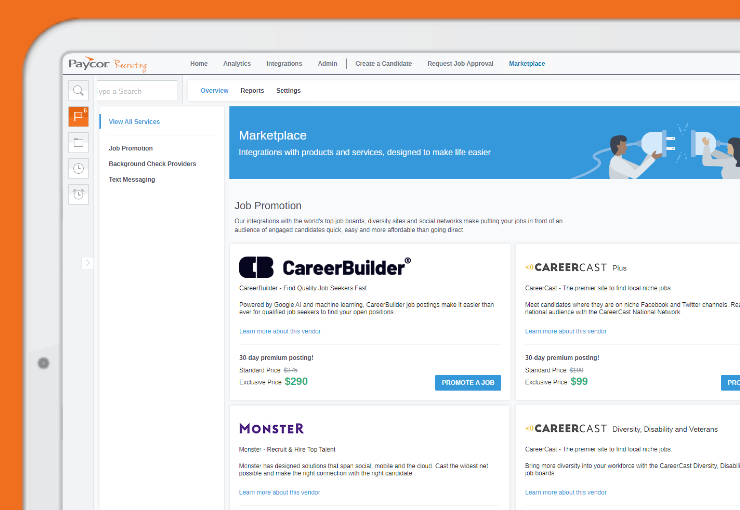

Job Board Integrations

Paycor Recruiting’s vast network of integration partners offers background checks, pre-hire assessments, seamless job postings to 20,000+ online job boards, and more.

Employee Referrals

Reward your employees for referrals with a fast, mobile, easy-to-use tool for sharing job openings on their personal networks.

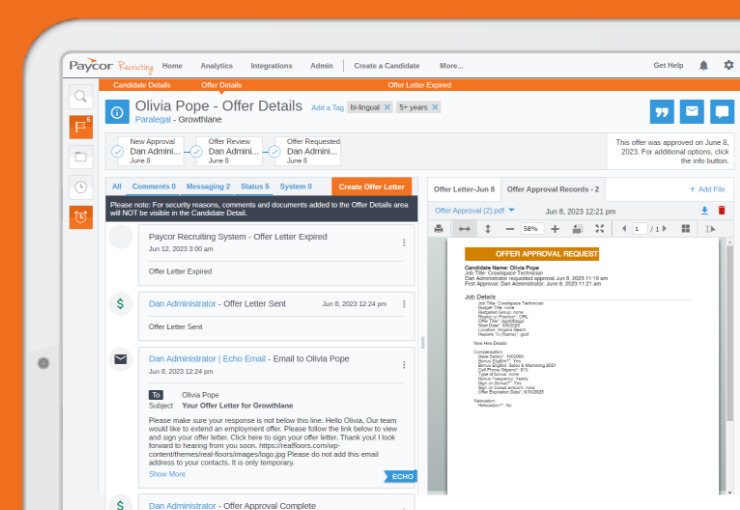

Automated Offer Letters

Get quick, easy candidate responses to improve your offer acceptance rates.

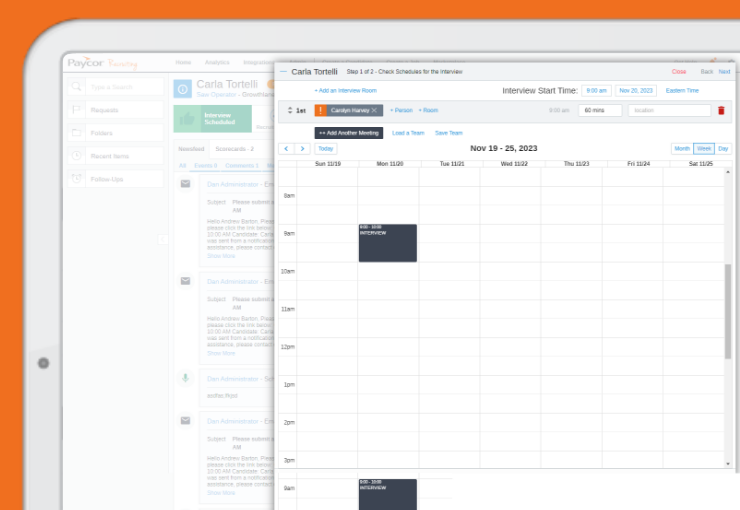

Virtual Recruiting

Video interviewing with Spark Hire and Zoom meetings integration creates a seamless user experience for candidates and saves you time.

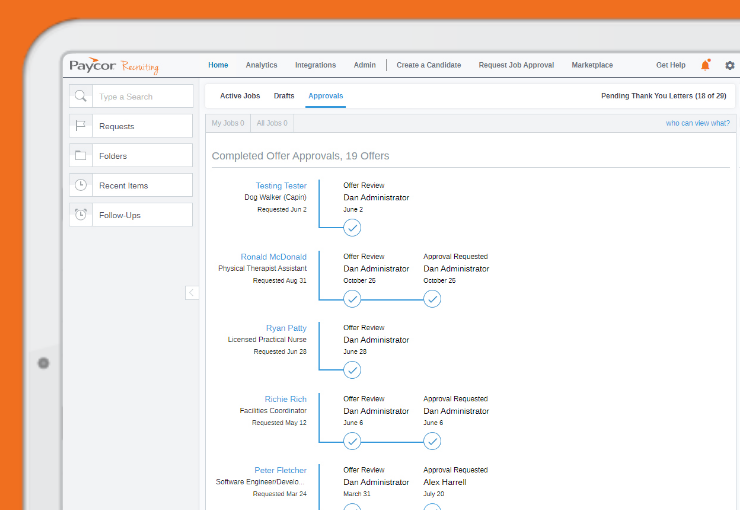

Streamlined Approvals

Automated workflows mean no more manually tracking down everyone when your business requires multiple levels of approvals for job postings and offers.

Why 50,000+ Businesses* Trust Paycor

Ready to Learn More?

Hundreds of Apps & Tech Partners

We love to partner with the third-party apps your business currently uses. Explore our Marketplace to find the right fit.

Pay Solutions

Point of Sale

Benefits

Global Payroll

Advanced Scheduling

Background Screening

Tailored to Your Industry

The Paycor Difference

“The partnership with Paycor has been tremendous. They have allowed us to take control of our business and shift our focus from a heavy administrative burden to what we do best, keeping children safe.”

– Brian Brooks, COO

Recruiting & Hiring

Paycor offers one solution to manage all aspects of the recruiting process from job postings to interviews and hiring.

Onboarding

Prior to Paycor, onboarding was tedious and time-consuming for new hires and administrators. Paycor has helped streamline the process with one location to manage all documentation.

Recruiting Software FAQs

What is recruiting software, and how can it improve the hiring process?

Recruiting software is a comprehensive digital tool that streamlines every aspect of hiring, from posting job listings to tracking candidates and managing offers. The software enhances efficiency through automated workflows and powerful search capabilities, while also reducing compliance risks and providing real-time analytics to optimize hiring practices.

How does recruitment software with an applicant tracking system (ATS) work?

An ATS works by automatically scanning incoming resumes and storing them in a searchable database, where it can rank candidates based on how well their qualifications match the job requirements. The system then helps employers manage the entire hiring process by automating tasks like posting job openings, communicating with candidates, and tracking applicants through each stage, while providing hiring managers the ability to search the candidate database using specific keywords and skills.

What key features to look for in recruitment management software?

Modern recruitment management software should include an applicant tracking system (ATS) with AI-powered candidate matching, seamless job board integration, and automated screening tools to filter candidates effectively.

Is recruiting software the same as an ATS?

Not exactly. An applicant tracking system (ATS) is a key part of recruiting software, focused on managing candidates through the hiring process. Recruiting software goes beyond tracking. It can include tools for sourcing, job posting, interview scheduling, analytics, and candidate relationship management.

How can a recruiting tool help save time and money?

Recruiting software is a time-saving tool that assists recruiting professionals with all aspects of the hiring process by improving efficiency and data management. It provides a single location where everything related to candidate tracking — from interview to job offer — can be maintained and easily accessed.

The right recruiting technology gives HR managers and recruiters the freedom to focus on finding the ideal candidate instead of wasting hours struggling with poorly designed technology. Using recruiting software can provide solutions to many of the challenges recruiters regularly encounter, including finding more candidates through powerful search capabilities, creating a better candidate experience, optimizing recruiting practices with real-time analytics, managing the entire process in one place, and reducing compliance risk.

See How Much Time & Money You Can Save With Paycor Recruiting

How does HR recruitment software enhance the candidate experience?

Modern recruitment software enhances the candidate experience by providing a seamless, mobile-friendly application process and maintaining consistent communication through automated updates and personalized messages at every stage of their journey. The software also enables quick feedback, simplified scheduling for interviews, and a professional employer brand presence across all touchpoints, making candidates feel valued and informed throughout the entire hiring process.

What are the best-recruiting methods?

There are many methods for recruiting; but lately, virtual recruiting has increased in popularity. Paycor Recruiting has a suite of virtual features to streamline the process.

What is Artificial Intelligence (AI) recruiting?

AI recruiting is the use of artificial intelligence in the talent acquisition process. Paycor Smart Sourcing automates the candidate search making it 25% faster at 28% lower cost and it helps you increase the diversity of your talent pipeline by capturing 67% of the talent other solutions miss.

How can AI help me with recruiting?

Paycor Smart Sourcing empowers your HR team to search multiple platforms for passive candidates (candidates that other recruiting software can’t even see) from a database of more than 1.5 billion profiles. And the AI tool can communicate across platforms, so not only can we find more candidates, but we can also reach out to them, establish a relationship, and get them into your pipeline.

Can Paycor’s recruiting software integrate with job boards and other tools?

Paycor’s recruiting software seamlessly integrates with major job boards, social media platforms, and career sites, allowing employers to post jobs once and distribute them automatically across multiple channels. The platform also connects with email systems, calendars, and other HR tools, creating a unified system that streamlines the entire recruitment workflow from posting to hiring.

Featured Resources

The HR COE is an action plan based on Paycor’s proprietary data and research. Think of it as your roadmap to achieving HR excellence in talent management, workforce management, benefits and the employee experience.

Live Webinar

Evolving Workforce: The Power of Upskilling, Reskilling, and Skills-Based Hiring

HRCI & SHRM credit available

As the workforce adapts to changes in business, technology, and the economy, organizations must ensure employees have the skills to keep up.

2:00pm ET, January 20th, 2026

Article

Read Time: 19 min

The 5 Steps of a Successful Hiring Process

Want to know how a hiring process works? Learn about and use these 5 hiring process steps to design your recruiting and hiring procedures.

Article

Read Time: 1 min

Free Onboarding Email Template for New Hires

Using an onboarding email template makes onboarding more efficient. Download our free onboarding email templates to streamline your onboarding.

Article

Read Time: 15 min

What is Talent Acquisition? The Complete Guide

Here’s what you need to know about talent acquisition, including what it is, how it works, and the best practices to follow.