How COVID-19 Is Impacting the Labor Market

As the demand for labor shifts and the unemployment rate rises, workers and employers adjust.

During the last few years we’ve experienced a labor market with record low unemployment rates, giving job seekers an unprecedented advantage and forcing employers to put their best foot forward in order to attract the talent and skilled workers.

With such economic growth, it was a good time to look for a job

Pre-Coronavirus Labor Market Statistics

And then COVID-19 appeared and everything came to a screeching halt. In the blink of an eye, the way we work changed. Some businesses had to shutter their doors while others scrambled to design operational plans that would keep employees safe and healthy. The novel coronavirus pandemic touched every business and organization in the world.

So, what does this mean for employers? Many are still reverberating from the initial impact, and unfortunately no one knows for sure what the future will bring. However, we’ve pulled together some of the latest labor market statistics and reflections of industry experts and financial minds to get an idea of what might happen in the workforce and when we could see economic growth again.

The novel coronavirus pandemic touched every business and organization in the world.

Coronavirus Labor Market Statistics

Unemployment Insurance Claims Nationwide

Depression-Era Unemployment Rates

Unemployment rates skyrocketed as workers were required to shelter in place and demand for labor ceased.

The Congressional Budget Office predicts unemployment will reach at least 16% by the third quarter of 2020 if not sooner, but “real” unemployment (people who are not looking for work or are underemployed) has arguably already surpassed the high of the Great Depression (24.9%).

To compare, unemployment hovered just under 10% during the Great Recession in the late 2000s.

“The reported numbers are probably going to get worse before they get better,” said U.S. Treasury Secretary Steven Mnuchin, May 10, 2020. Mnuchin went on to acknowledge the “real” unemployment rate may have already reached 25%.

While many workers will be able to rejoin the workforce once the coronavirus restrictions are lifted, some will discover they no longer have a job position to return to.

Overall, the U.S. economy shrank at an annualized rate of 4.8% in the first quarter of 2020 and many analysts project it will shrink at a rate of 25% or more in the second quarter.

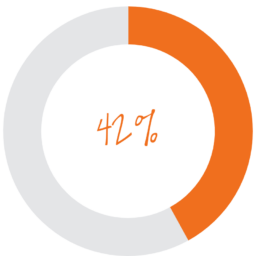

of recent layoffs will result in permanent job position loss*

*Source: The University of Chicago’s Becker Friedman Institute for Economics

Which Industries are Losing Jobs?

The nature of a global shut down and local stay-at-home orders has different consequences for different industries.

Some of the hardest hit industries were leisure and hospitality (which includes jobs such as waiters, chefs, bartenders, bellhops and casino employees), retailers, and professional and business services.

“Today’s [May 8, 2020] report reflects the massive impact that measures to contain the coronavirus have had on the American workforce,” said U.S. Secretary of Labor Eugene Scalia. “This employment situation is exceptionally fluid. By re-opening safely, we have the capacity to avoid permanent job loss for the overwhelming percent of Americans.”

Which Industries are Growing and Adding Jobs

Not every type of business is scrambling to stay afloat during COVID-19.

As reported recently in The Wall Street Journal, we’re witnessing a historic shift in the labor market. “The coronavirus pandemic is forcing the fastest reallocation of labor since World War II, with companies and governments mobilizing an army of idled workers into new activities that are urgently needed.”

Some companies are still hiring thousands of new employees to keep up with changing consumer demands and spending habits. From grocery stores, delivery services, healthcare manufacturing companies, hospitals and more, many employers have plenty of roles to fill.

Job Growth Across Industries

There’s no question the labor market has changed in the past few months. What that means for employers depends a lot on their type of business. Some industries are witnessing an increase in available talent while others are having a hard time filling open positions with skilled workers. However, in the long run, the Department of Labor projects certain occupations will have more job growth than others.

Top Jobs for Growth by 2028

| 1. | Home health aides | 36.6% |

| 2. | Personal care aides | 36.4% |

| 3. | Software developers | 25.6% |

| 4. | Medical assistants | 22.6% |

| 5. | Cooks, restaurant | 21.9% |

When Will Demand for Labor Rebound?

The truth is, it’s anybody’s guess.

Bank of America predicts unemployment rates:

CNN reports that even relatively optimistic economists say the labor market won’t fully recover by end of 2021 and there’s just been too much damage to rebound that quickly.

The chief economist at PNC Bank sees a slower recovery where we don’t return to healthy level of 4% or 5% unemployment for three or four years. And JPMorgan Asset Management says it will take 10+ years to get back to 3.5% unemployment.

According to one recent study, the most realistic path forward involves a strategy of slowing the spread of new cases of coronavirus and then slowly relaxing those restrictions and letting the economy return to normal as immunity grows throughout the country. But during this time, we’ll probably remain in a recession.

The study goes on to say the worst of the health crisis is yet to come, with peak infection period in the U.S. occurring between October 2020 and May 2021. By the time this pandemic is over, simulations suggest two-thirds of the U.S. population will have contracted COVID-19. Which means, a large portion of labor forces will continue to be quarantined or recovering for weeks on end as the virus spreads.

The good news is, research shows that once a pandemic is over, the economy usually snaps back quickly.

Paycor is here to support you through all the coronavirus regulatory changes and help you return to work when it’s safe. And if you’re a business leader looking for ways to cut costs during this health crisis and while keeping an eye on a return to profitability in the future, check out our recent report for actionable insights and the framework of a plan.