ACA Reporting Software

ACA Reporting Software & Compliance Tool

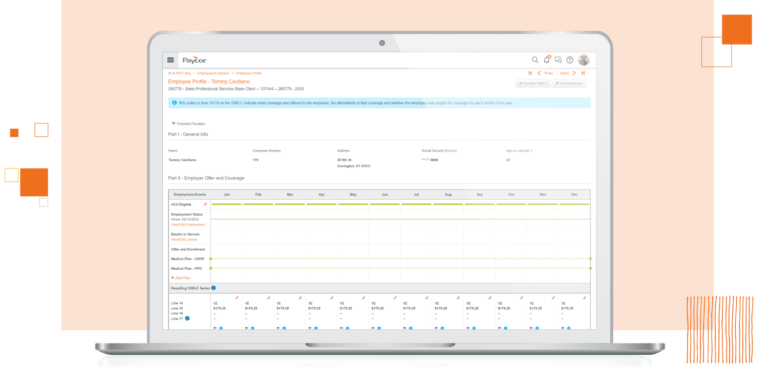

Paycor’s ACA software provides comprehensive reports and IRS Filing Service that will give you confidence you’re compliant even with all the complexities of ACA reporting.

More than 50,000 businesses nationwide trust Paycor*

Eliminate the Stress of ACA Filing

Paycor’s ACA management tool is an award-winning solution that helps organizations manage Affordable Care Act reporting and ensures your benefits and ACA processes are streamlined and compliant.

Filing Success —

Paycor’s ACA Software helps you confidently prepare, file, and review 1094-C and 1095-C forms.

Proactive Notifications —

We ensure your filing is complete and without errors or discrepancies.

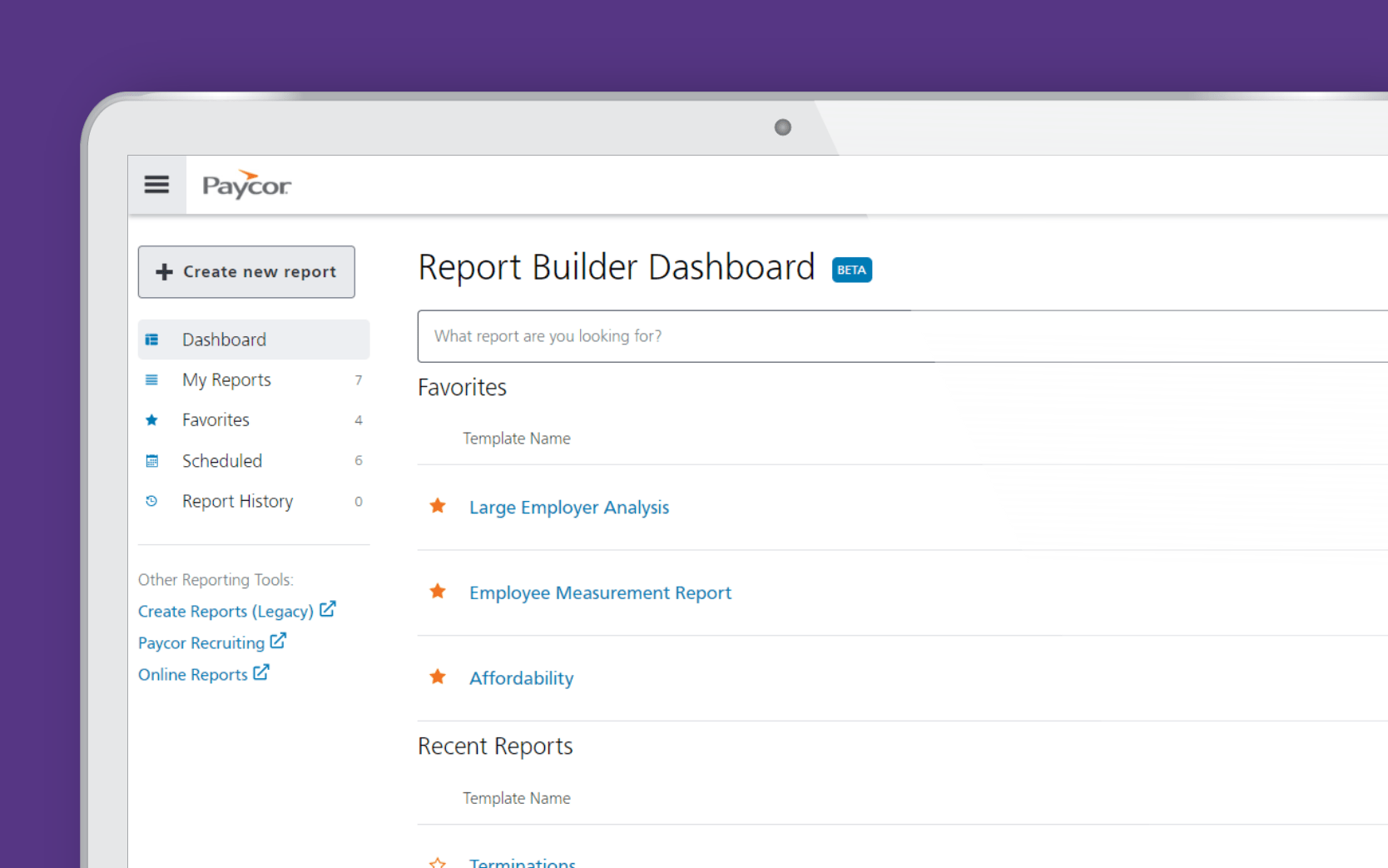

Reporting Engine —

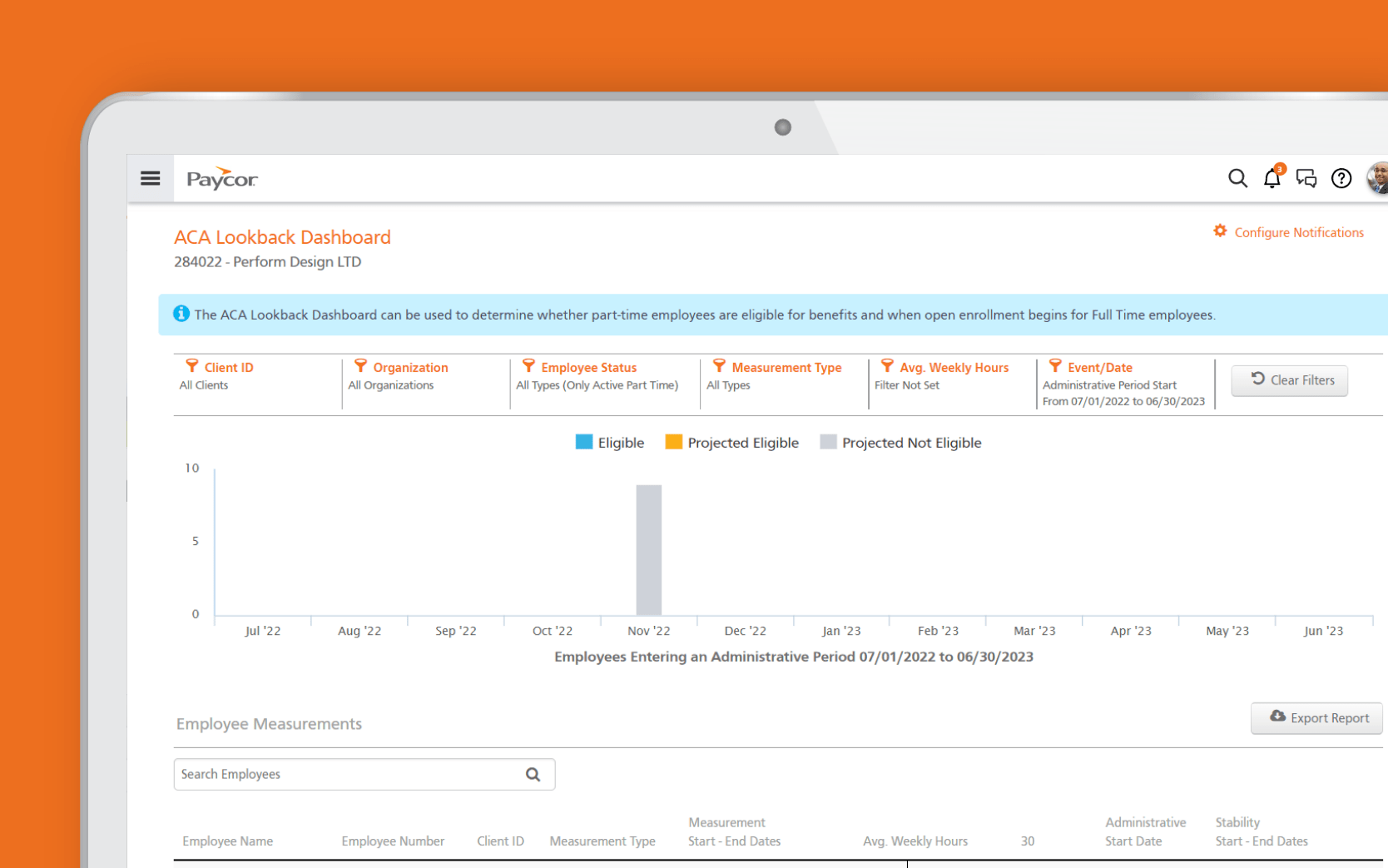

Access critical ACA reports and dashboards.

Streamline Open Enrollment —

Utilize interactive dashboards to identify eligibility across administrative periods, compare past and current measurement periods and view remaining hours before an employee becomes eligible.

*Section highlights key pain points and differentiators of Paycor’s software.

The ACA Compliance Solution HR Leaders Trust

Paycor allows you to quickly, easily and confidently pay employees from wherever you are. Get started to see how.

Configured for Your Industry

Recruit and hire skilled nurses, dynamically schedule staff, and boost engagement and retention with Paycor’s configurable software.

Recruit skilled labor, optimize coverage, and track and analyze labor costs with Paycor’s configurable software.

Speed up the recruiting process with same day hire, streamline with custom hiring workflows, offer workers OnDemand Pay and self-service on an award-winning mobile app.

Save time with a unified, mobile-first experience intuitively designed for leaders and gain deeper insights about your business with powerful analytics.

Maintain compliance, pay adjuncts and staff accurately and on time, schedule staff at multiple campuses, recruit qualified talents, and get up to speed faster with our industry-skilled implementation.

Recruit, onboard, pay, and schedule workers in a mobile-first environment. The last thing retailers need is a generic solution. That’s why leading retailers partner with Paycor.

Pay employees accurately and on-time in a heavily regulated tax environment. Overcome staff shortages, maintain tax compliance, and help tie operations to grant funding.

Proven Results with ACA Reporting Software

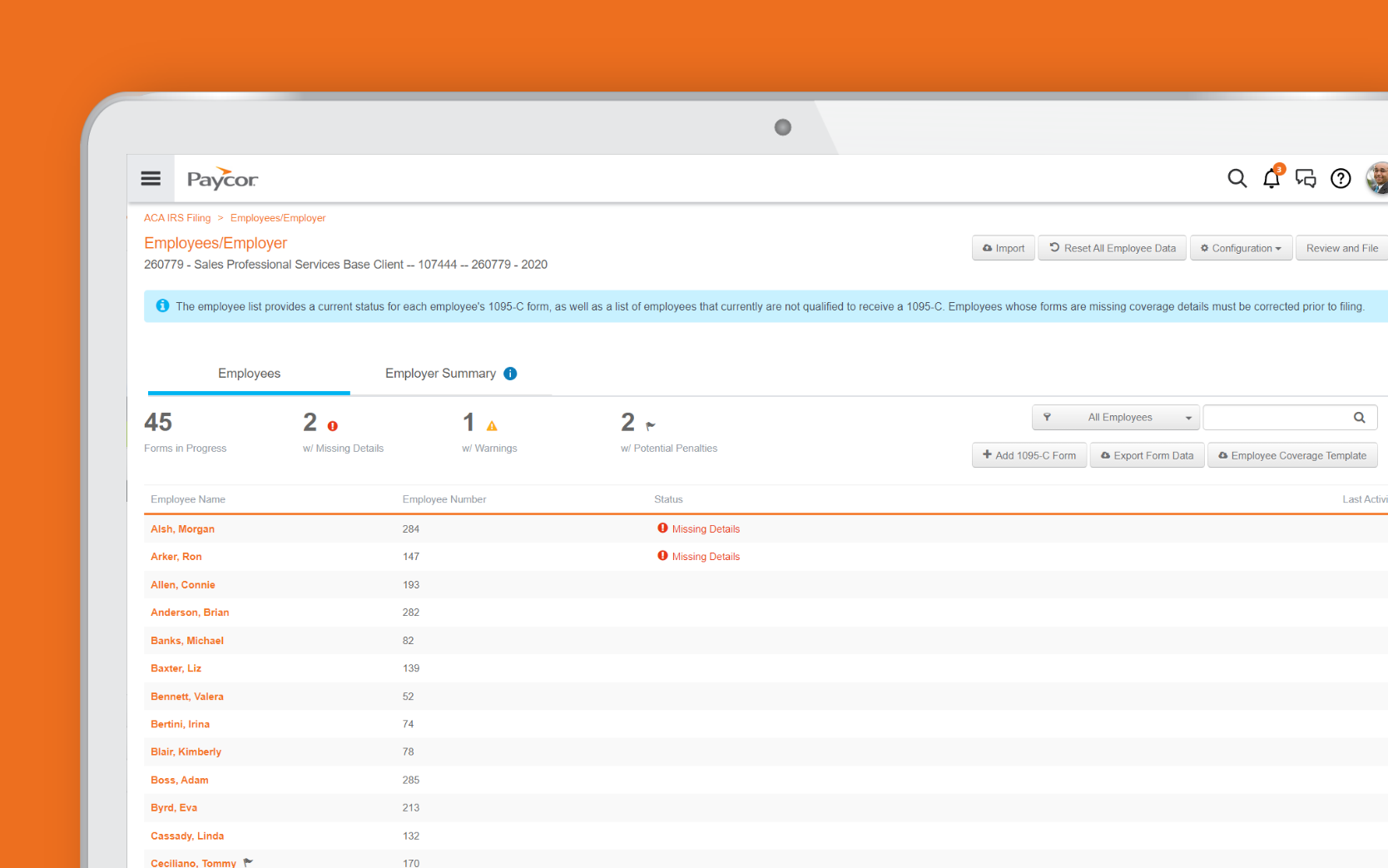

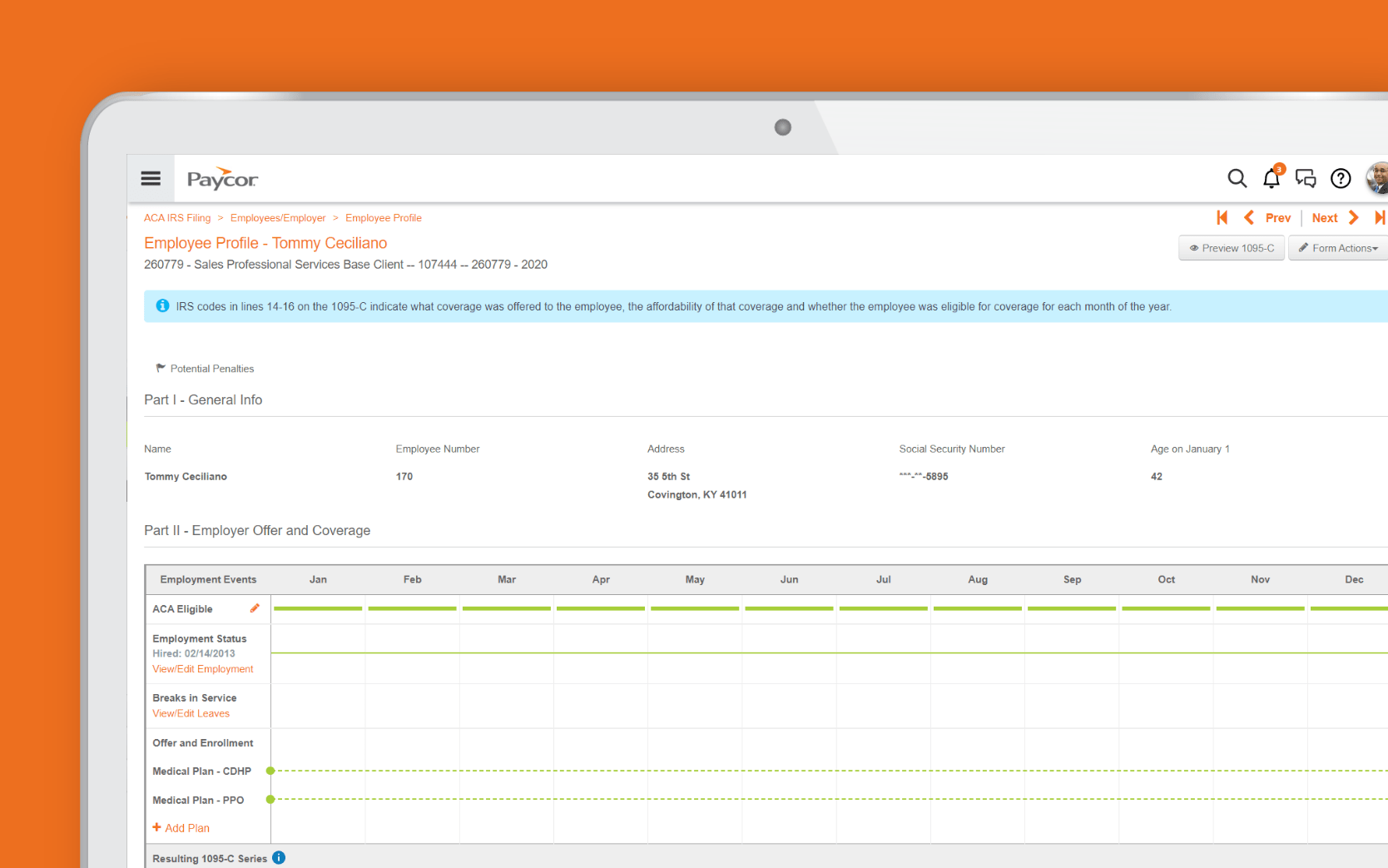

How does Paycor ensure ACA filing success? Our product teams created an unparalleled ACA reporting and filing solution, with an error management system, real-time alerts and in-app training for clients. Our ACA Care team, built from the ground up, was comprised of ACA and product experts. With our product expertise and amazing service combined, we were able to guide our clients successfully through the complexities of ACA IRS filing and reporting.

Ensure Compliance

Never worry about penalties or fines again. Our full-service ACA reporting solution offers proactive alerts to help you stay ahead of the latest regulations. And you can access our online ACA resource center for guides, checklists, calculators and more.

Eliminate Complexities

Need a better way to manage ACA filing? Paycor’s ACA reporting service helps you prepare, generate and file 1094-C and 1095-C forms and sends them directly to you or your employees.

Automate ACA Filing and Reporting

Say goodbye to manual reports and uploads. With Paycor, you can manage employee benefits through an online platform that integrates with payroll, time and our ACA IRS filing service while also tracking hours to determine which employees are eligible for benefits.

ACA Reporting Trusted By Users & Third-Party Evaluators

“Our goal is to be a great employer that treats our inmate employees the same as our non-inmate population by giving them a traditional employment experience from the interview to their release.”

– Josh Pearce, Chief People Officer, Capital III

Pulse Surveys

Paycor Pulse provides continuity from building surveys to analytics. Insights give the team the information needed to make informed decisions.

Work Opportunity Tax Credit (WOTC)

Paycor’s integrated solution helps Capital III identify Work Opportunity Tax Credits for eligible employees.

ACA Reporting Software FAQs

What is ACA reporting?

Affordable Care Act or ACA reporting refers to the information and forms employers must collect concerning their employees’ health care coverage during the calendar year.

Is ACA reporting still required?

Yes, ACA reporting is still required. Reporting requirements depend on employer size and the type of insurance you maintain, whether insured or self-insured. In general, the reporting requirements apply if you’re an employer with 50 or more full-time employees or equivalents; a self-insured employer, regardless of size; or a health insurance provider.

How do I prepare for ACA reporting?

This can be achieved by verifying your ACA data is valid, reviewing ACA compliance requirements, sending 1095-Cs to employees, and filing with the IRS.

What states have ACA reporting requirements?

The following states have ACA reporting requirements: California, the District of Columbia, Massachusetts, New Jersey, Rhode Island, and Vermont. These states require employers to report their ACA information at the state level.

What states have additional ACA reporting requirements beyond federal laws?

Several states – including California, Massachusetts, Rhode Island, and New Jersey – have additional ACA reporting requirements beyond the federal regulations. HR leaders in other states should stay informed of local policies in case they change over time.

What happens if you don’t file ACA?

Failing to comply with Affordable Care Act (ACA) regulations can cause serious compliance problems. Your business could be fined per employee and/or per day, and you might be denied potential tax credits.

How does Paycor’s ACA software simplify ACA compliance?

Paycor’s ACA software simplifies compliance by automating the filing process. We identify and flag discrepancies so you can correct errors before you submit. Leaders can easily access and view critical reports to streamline the process.

Can Paycor’s ACA software integrate with my existing payroll and HR systems?

Yes, Paycor’s ACA software can integrate with over 320 other tech partners. Our integrations streamline data flow, reduce manual data entry, and ensure accurate and timely reporting. Visit the Marketplace to learn more.

Resources

From stressful open enrollment periods to endless employee questions, benefits administration is challenging. Finding the right technology to streamline processes and educate employees is crucial. Read this article for more.

Article

Read Time: 1 min

2025 Open Enrollment Checklist [Free + Downloadable]

Use our open enrollment checklist to help you simplify the process, cover your bases, and deliver a better experience for you employees.

Article

Read Time: 15 min

ACA Reporting for 2026: Requirements, Forms, & Deadlines

ACA compliance reporting can protect your organization from penalties. Here’s the ACA reporting requirements, forms, and deadlines you need to know.

Article

Read Time: 18 min

Open Enrollment: A Complete Guide for Employers

Open enrollment doesn’t have to be stressful or complicated. Read our guide on employee open enrollment to stay compliant.

On-Demand Webinar

Partner Series: How Paycor Can Help with Open Enrollment

As you approach open enrollment season, Paycor is going to do more than just wish you the best.

Guides + White Papers

Read Time: 1 min

Affordable Care Act (ACA) IRS Filing Guide

With Paycor, you’ll get an unparalleled ACA IRS filing solution, with an error management system, real-time alerts and in-app training for clients.

Article

Read Time: 5 min

How Benefits Management Software Helps Businesses

Administering employee benefits at scale, isn’t easy. See how benefits management software can help you get it right.