As pay transparency continues to gain support, employers must keep up to ensure they’re payroll is compliant. While there’s currently no federal law for pay transparency, 16 states have enacted pay transparency laws. Learn what wage transparency laws are and which states have such laws on the books.

What Are Pay Transparency Laws?

Pay transparency laws are regulations that require employers to disclose salary information at various points in the employment process and allow employees to discuss salaries freely. These laws aim to level the playing field and address wage gaps based on gender, race, and other protected characteristics.

State pay transparency laws vary, but examples include:

- Requiring employers to post salary ranges in job advertisements

- Requiring employers to disclose pay scales to job candidates or current employees upon request

- Prohibiting employers from asking applicants about their salary history during the interview and hiring process

What is the Salary Transparency Act?

A Salary Transparency Act was introduced in the House in 2023. If enacted, the federal law would require employers to disclose the wage or wage range in the public or internal posting of an employment opportunity. This bill is still pending.

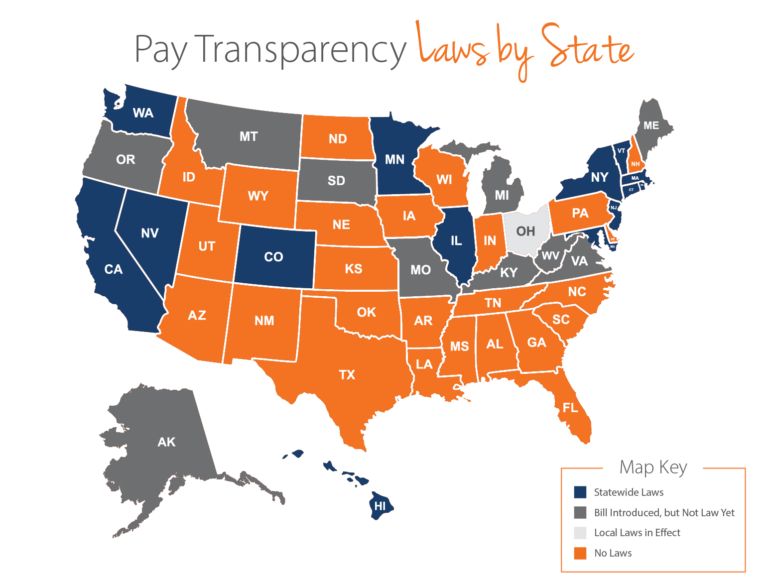

Pay Transparency Laws By State: Which States Have Salary Transparency Laws?

The following states have pay transparency laws, including:

- California

- Colorado

- Connecticut

- Delaware

- Hawaii

- Illinois

- Maryland

- Massachusetts

- Minnesota

- Nevada

- New Jersey

- New York

- Oregon

- Rhode Island

- Vermont

- Washington

U.S. Pay Transparency Laws By State 2026

| State | Is There a Pay Transparency Law? | Effective Date | Law Details |

| California | Yes — SB 1162: California’s Pay Transparency Act Yes — SB 642 (Amendment to Pay Transparency Rules) | Jan. 1, 2023 January 1, 2026 | Employers with 15 or more employees must include a pay scale in all job postings, whether internal or external, and provide current employees with their position’s pay scale upon request. Employers with 100 or more employees are required to submit an annual pay data report to the California Civil Rights Department. Expands definition of wages to include bonuses, stock options, and other compensation. |

| Colorado | Yes — Equal Pay for Equal Work Act | Jan. 1, 2021 | Employers are prohibited from asking applicants for their wage history or retaliating against employees for discussing their pay. In addition, employers are required to disclose compensation in all job postings and notices, both internal and public. |

| Connecticut | Yes — Public Act No. 21-30 | Oct. 1, 2021 | Prohibits employers from retaliating against employees for discussing their pay. Requires employers to provide applicants with pay ranges for positions upon request. |

| Delaware | Yes — House Bill 105 | Sep. 26, 2027 | Employers with more than 25 employees must include the hourly or salary compensation range, along with benefits, in all job postings, both internal and external. |

| District of Columbia | Yes — Wage Transparency Omnibus Amendment Act of 2023 | June 30, 2024 | Employers are required to include salary range or hourly pay rate on job postings and provide healthcare benefits information before a first interview. Prohibits employees from asking prospective employees for wage history. |

| Hawaii | Yes — Act 203 | Jan. 1, 2024 | Requires employers with 50+ employees to include pay scales with job postings. |

| Illinois | Yes — Illinois House Bill 3129 | Jan. 1, 2025 | Requires employers with 15+ workers to provide a wage scale and benefits description with job postings. |

| Maryland | Yes — Equal Pay for Equal Work Act | Oct. 1, 2020 | Employer must post wage ranges in internal and public job postings, and provide ranges to applicants upon request. |

| Massachusetts | Yes — Frances Perkins Workplace Equity Act | July 31, 2025 | Employers with 25+ employees must disclose the pay range for all job postings. |

| Minnesota | Yes — Statute 181.173 | Jan. 1, 2025 | Employers with 30+ employees must include a pay range in job postings along with a general description of benefits and other compensation offered. |

| Nevada | Yes — Bill 293 | Oct. 1, 2021 | Requires employers to share salary information with internal and external applicants. Prohibits employers from asking job applicants for their salary history. |

| New Jersey | Yes — Bill 2310 | Jan. 1, 2024 | Requires employers with 10+ employees to post salary range and a description of benefits and other compensation with all job postings. |

| New York | Yes — Labor Law Section 194-B | Sep. 17, 2023 | Employers with 4+ employees must disclose salary ranges for all positions and state if role is commission-based. |

| Ohio | Yes | Local law(s) in effect. | |

| Oregon | Yes — Wage Deduction Transparency Law (SB 906) | Jan. 1, 2026 | Employers must provide employees with detailed explanations of payroll codes, itemized deductions, and pay rates at the time of hire. Employers must also provide a description of how and why each deduction may occur, including allowances claimed as part of minimum wage and employer-provided benefits. |

| Rhode Island | Yes — Pay Equity Act | Jan. 1, 2023 | Employer can’t ask applicants for wage history and must supply pay range for positions upon request. Prohibits employers from retaliating against employees for discussing their pay. |

| Vermont | Yes — Act 155 | July 1, 2023 | Employers with 5+ employees must disclose salary range or hourly wage in all job postings. For commissioned or tipped jobs, posting should state they are commission or tip-based. |

| Washington | Yes — Equal Pay and Opportunities Act | Jan 1. 2023 | Requires employers with 15+ employees to include salary ranges on all job postings and disclose pay for internal transfers and promotions upon employee request. |

States Without Pay Transparency Laws

While pay transparency legislation continues to gain momentum across the United States, the majority of states have yet to enact comprehensive pay transparency requirements. Currently, 34 states do not have statewide pay transparency laws mandating salary range disclosure in job postings or during the hiring process.

The states without pay transparency laws include: Alabama, Arizona, Arkansas, Florida, Georgia, Idaho, Indiana, Iowa, Kansas, Louisiana, Maine, Michigan, Mississippi, Missouri, Montana, Nebraska, New Hampshire, New Mexico, North Carolina, North Dakota, Oklahoma, Pennsylvania, South Carolina, South Dakota, Tennessee, Texas, Utah, West Virginia, Wisconsin, and Wyoming.

Note: Some states, like Ohio, have local ordinances in specific cities (Cincinnati, Cleveland, Columbus, and Toledo) and they lack statewide legislation.

Employers operating in these states should still monitor local developments and consider voluntary pay transparency practices, as the trend toward wage transparency continues to grow.

States Considering Pay Transparency Laws

As pay transparency gains steam nationwide, more states are proposing related legislation. 10 states that have introduced bills regarding pay transparency but haven’t passed a law yet. They include:

How to Stay Compliant with Salary Transparency Laws

Staying compliant with pay transparency laws across different states requires understanding both where your employees work and where potential candidates might apply from.

With requirements varying by jurisdiction and non-compliance resulting in penalties, you should use wage transparency as a strategic advantage. Here’s how:

Step 1: Determine Which Laws Apply to Your Business

Identify which pay transparency laws affect your business based on employee locations and recruiting activities. Review employee count thresholds for each applicable state.

Note: Cities like New York City or Jersey City that may have additional requirements beyond state law.

Step 2: Audit Your Current Practices

Review all job postings—external and internal—to identify gaps in salary disclosure. Examine whether postings include required elements such as salary ranges, benefits information, or job descriptions, and make sure your recruitment process doesn’t ask about salary history where prohibited.

Step 3: Develop Standardized Salary Ranges

Create defensible salary ranges for all positions based on market data and internal equity. The ranges should be “good faith estimates” that accurately reflect what you’re willing to pay, and you should document your methodology to explain decisions to candidates, employees, and auditors.

Step 4: Update Templates and Train Your Team

Revise job posting templates to include compensation information and establish approval workflows before listings go live.

Providing training to hiring managers and HR staff on requirements, can help them know what can and cannot be asked during interviews, and how to respond to salary questions.

Step 5: Stay Updated

Pay transparency laws are changing rapidly. Subscribe to legal updates, join HR organizations, and consider working with employment law counsel to stay ahead of changes.

How Paycor Helps

From recruitment to onboarding and compensation, employers need to be organized and compliant. Paycor’s HCM software is backed by compliance expertise to help ensure your HR and payroll practices evolve with changing regulation. With compliance solutions for every aspect of HR, we empower 30,000+ organizations to remain informed and compliant. Take a guided tour to learn more.

Salary Transparency Law FAQs

Still have questions about pay transparency laws?

How many states have pay transparency laws?

As of 2026, 16 states and Washington D.C. have enacted statewide wage transparency laws requiring employers to disclose salary information at various points in the employment process.

Is there a federal salary transparency law in the United States?

There is currently no federal pay transparency law in the United States. A Salary Transparency Act was introduced in the House in 2023, which would require employers to disclose wage or wage ranges in public or internal job postings, but this bill remains pending. Until federal legislation passes, pay transparency requirements vary by state and local jurisdiction.

Can job postings include broad salary ranges under Salary Transparency laws?

Most states with pay transparency laws require employers to provide a “good faith estimate” of the salary range, meaning the range should reflect what the employer reasonably expects to pay.

While laws don’t always specify exactly how narrow the range must be, overly broad ranges (such as $50,000-$200,000) may not comply with wage transparency legislation.

Do Pay Transparency laws apply to remote jobs?

Yes, pay transparency laws typically apply to remote positions if the job could be performed by someone in a state requiring pay transparency or if the employer does business in that state.

For example, California’s and Washington’s laws explicitly cover jobs that can be done remotely from those states, regardless of where the employer is located. This means companies posting remote positions may need to comply with multiple states’ salary transparency requirements depending on where candidates could potentially work from.

Do Salary Transparency laws only apply to large companies?

No, states with salary transparency laws have varying employer size thresholds. Some states like Rhode Island have laws that apply to employers with just one employee in the state, while others have higher minimums. For instance, California requires 15+ employees, Illinois requires 15+, Minnesota requires 30+, and New Jersey requires 10+ employees.

Even small businesses may be subject to compensation transparency requirements depending on their location and headcount.