Industry

Retail

# Employees

32

Solution

Payroll

Midwest Security Services needed an HCM company who could provide accurate payroll and tax withholdings. They chose Paycor.

“The experience of using Paycor’s payroll is clean and easy—and that’s something I need. There’s a lot more follow-up and communication. If I have a request for a new garnishment or there’s a change, I get emails at every step of the way from Paycor. I don’t have to wonder if something was taken care of because I receive confirmation notices. It’s great.”

Shelly Mize, head of HR, Midwest Security Services

Prior to Paycor

Based in Kettering, Ohio, Midwest Security Services develops security solutions for schools, hospitals and corporations including video surveillance, access control systems, fire alarm and intercom systems. As a small business, they relied heavily on their previous payroll provider to withhold the correct amount of federal, state and local taxes as well as keep up to date on paycheck garnishments. When that failed to happen and caused a six-month correction period (“nightmare”), they switched to Paycor.

Challenges

- Local taxes not accounted for during payroll

- Lack of employee self service

- Poor customer service

- Took too long to get payroll reporting

With Paycor

Paycor’s streamlined payroll process including automated wage garnishments (and admin notifications) give Shelly peace of mind. As an HR department of one, she uses Paycor’s ongoing webinar series and online classes available in the Training Hub as a way to stay current on product updates and new compliance regulations, especially during COVID-19. Employees say the app is user-friendly and easy to view their overtime hours and paystubs.

Solutions & Key Features

- Seamless, streamlined payroll

- On-demand learning modules for products

- Automated notifications for payroll changes

- Consistent communication and support

- Visibility into payroll reporting

Midwest Security Services partners with Paycor to pay their workforce accurately and on time.

- Payroll

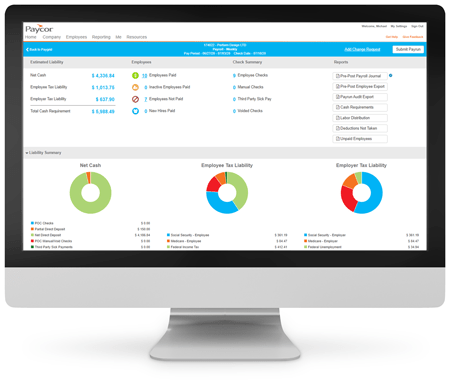

Payroll

With one system to access data and process payroll, Midwest Security Services never has to worry about compiling information from multiple sources, tax errors or data integrity. The mobile app gives employees self-service to view their paystubs and overtime hours, reducing the amount of inquiries to HR.

Customer Community

Paycor’s exclusive community for customers, the CORner, allows Shelly to network with other HR leaders, share best practices and be one of the first to learn about new Paycor product offerings. She’s also notified of any compliance changes or updates.

COVID-19 Response

Paycor’s COVID-19 Command Center delivered instant insights for crisis management. Shelly used the tool to help process PPP forgiveness applications and code wages appropriately for the CARES Act.

“Those reports [for COVID-19] were a godsend. It was awesome to just plug in some key dates and get a straightforward, easy-to-read report—such a useful tool. And using the different webinars on the CORner to learn about updates has been great. I watched one on I-9 changes and how to stay compliant.”

Shelly Mize, head of HR, Midwest Security Services