Hiring from underrepresented talent pools can strengthen your workforce while reducing your tax burden. The Work Opportunity Tax Credit (WOTC) helps businesses do both by rewarding employers who give opportunities to job seekers who face significant employment barriers.

What Is WOTC?

The Work Opportunity Tax Credit (WOTC) is a federal business tax incentive that rewards employers for hiring individuals who have historically faced significant barriers to employment. By participating, companies can lower their federal income tax liability while helping people move from public assistance into meaningful, long-term jobs.

What Is the WOTC Program?

The Work Opportunity Tax Credit program is a joint initiative of the U.S. Department of Labor (DOL) and the Internal Revenue Service (IRS). It encourages employers to hire and keep individuals from specific target groups who often have a difficult time finding work.

These groups include veterans, individuals receiving government aid, and people living in designated communities. The WOTC program promotes workforce diversity, community reinvestment, and corporate social responsibility while offering businesses a tangible tax benefit.

When Did WOTC Start?

The WOTC was first introduced in 1996 as part of the Small Business Job Protection Act and has been extended multiple times since. The credit has received bipartisan support in Congress and remains a cornerstone of federal employment policy.

The credit is currently authorized through December 31, 2025, under the Consolidated Appropriations Act, with discussions underway in Congress to extend or expand the program beyond 2026. Employers should continue to monitor IRS and DOL updates for renewal legislation.

Work Opportunity Tax Credit Changes: 2026

As of late 2025, no fundamental changes have been made to the WOTC eligibility structure or tax credit rates. However, the DOL and IRS have proposed modernizing digital WOTC certification processes to streamline electronic submissions through state workforce agencies by 2026. This modernization aims to reduce paperwork, accelerate certifications, and improve audit accuracy.

How Does the WOTC Work?

The WOTC is a business tax incentive that allows companies to receive tax credits for hiring individuals who are part of specific groups that have consistently faced significant barriers to employment.

WOTC was created to help these individuals move from economic dependency on various types of government assistance into self-support, helping them earn a steady income and become contributing taxpayers. At the same time, the program helps participating employers reduce their income tax liability.

Here are the top five WOTC-issuing states*:

1. California: 184,741

2. Texas: 192,950

3. Florida: 183,992

4. New York: 179,446

5.Ohio: 143,768

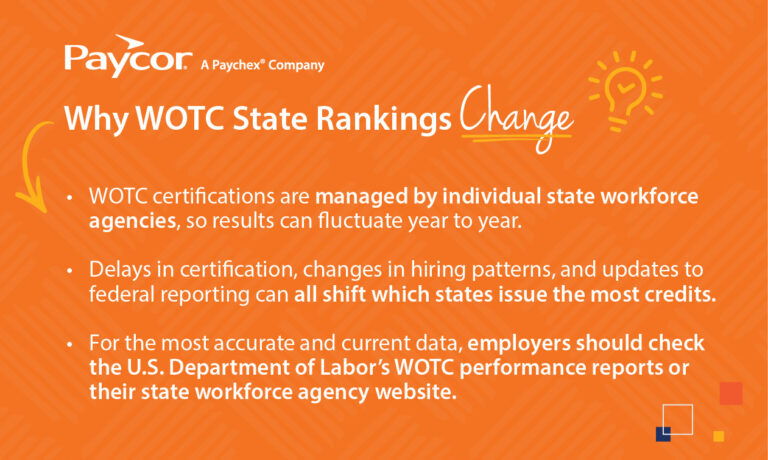

Note that as of 2024, the DOL national report aggregates certifications nationally so state-level rankings may have shifted. This data is based on the most recently published 2022–2023 reports.

What Is WOTC Screening?

WOTC screening is the process employers use to determine whether a new hire qualifies the business for the tax credit. Screening typically happens during onboarding and includes two forms:

- IRS Form 8850 (Pre-Screening Notice)

- ETA Form 9061 (Individual Characteristics Form)

Employers must submit these forms to their state workforce agency within 28 days of the employee’s start date.

Employer Benefits of WOTC

Employers who use the WOTC program can:

- Reduce federal income tax liability

- Improve hiring diversity and inclusion

- Offset onboarding and training costs

- Strengthen community relationships by creating equitable employment opportunities

- Access potential multi-year tax savings

WOTC Requirements: Who Qualifies for the Work Opportunity Tax Credit?

Eligibility for a WOTC is based on an employer’s hiring from specific groups that often face significant obstacles to employment. The amount of credit an employer can claim varies and depends on:

- Which target groups are hired

- The wages paid to those individuals in the first year of employment

- The number of hours the employees worked

WOTC Targeted Groups

- Veterans who had a period of unemployment for at least 6 months (can be non-consecutive) in any one year.

- Temporary Assistance for Needy Families (TANF) recipients who have received support for 9 months in an 18-month period.

- Ex-felons.

- SNAP (Food Stamp) recipients who have received assistance for 6 consecutive months (or 3 months in a 5-month timeframe).

- Designated community residents who are between 18 and 40 years old and live in federal and/or renewal communities.

- Long-term unemployed individuals who have been unemployed for 27+ consecutive weeks.

- Vocational rehabilitation referrals.

- Supplemental Security Income (SSI) recipients who have received support for 1 month within a 3-month period.

- Summer youth employees living in empowerment zones who are employed between May 1 and September 15.

- Individuals with a service-connected disability.

How Is the Work Opportunity Tax Credit Calculated?

If an employer hires an eligible employee from a target group, a federal tax credit will be available at the end of the year.

The credit amount is based on the number of hours the employee works and the total wages earned during their first year of employment.

- Worked 120–399 hours: 25% of first-year wages up to the maximum credit

- Worked 400+ hours: 40% of first-year wages up to the maximum credit

- The credit applies only to the first year of employment (except for the TANF group – see below)

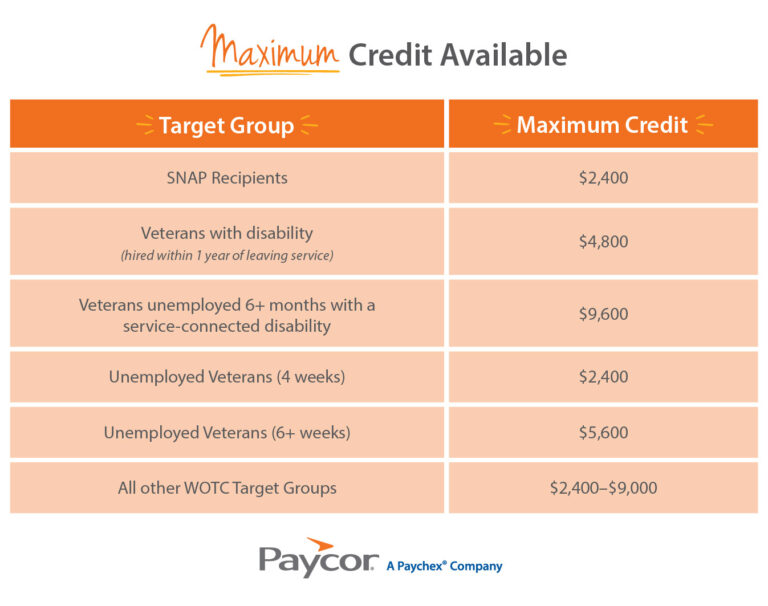

Maximum Credit Available

To claim a WOTC for an employee in the Temporary Assistance for Needy Families (TANF) target group, a different set of metrics is used. For these employees, the employer must have a member of this group working for up to 24 consecutive months.

If the employee works a minimum of 400 hours in their first year, an employer is eligible to receive a tax credit equal to 40% of the first-year wages, up to the maximum tax credit.

If the employee works a minimum of 400 hours in their second year of employment, an employer is eligible to receive a tax credit equal to 50% of the second-year wages, up to the maximum tax credit.

Want to know your WOTC claim amount?

Use our WOTC calculator to get an estimate of your calim.

How Do Employers Claim WOTC

The WOTC is a federal tax credit and is limited by a company’s income tax liability (or the amount of Social Security tax owed for certain organizations).

Before claiming the credit, employers must:

- Obtain a Pre-Screening Notice (Form 8850) within 28 days of hiring.

- Receive certification from their state workforce agency verifying eligibility.

- File for the credit using the IRS forms listed below.

What forms are Needed to Claim WOTC?

The following forms are needed to claim federal tax credit for WOTC:

Form 8850: Pre-Screening Notice

This form is used to confirm that a new hire belongs to one of the WOTC-targeted groups before employment begins.

Form 5884: Work Opportunity Credit

The 5884 form is used to calculate and claim the WOTC amount for each qualified employee.

Form 3800General Business Credit

Form 3380 is used to report the total amount of business credits (including WOTC) a company is claiming on their tax return.

How Paycor Helps Employers with the Work Opportunity Tax Credit

Paycor simplifies WOTC management through automation and partnership with HIREtech, which integrates directly with Paycor’s payroll system. Together, the tools:

- Streamline WOTC screening and form collection

- Automatically send payroll and employee data for tax credit calculation

- Integrate with state systems for faster certification

- Maximize available credits through accurate data tracking

Let Paycor Help You with WOTC

The WOTC program can be a powerful advantage for your business but managing forms, eligibility, and deadlines can be overwhelming.

Paycor and HIREtech have established an automated payroll feed that makes implementing a tax credit solution simple. Paycor can send all the information necessary to start claiming credits directly to HIREtech and the HIREtech software platform can easily integrate into most state tax programs in conjunction with your WOTC screening to maximize your tax credits.

Get in touch today to see how we can help you manage WOTC for your workplace.

Take a Guided Tour to see how Paycor makes claiming WOTC simple and compliant.

Work Opportunity Tax Credit FAQs

Still have questions about WOTC? Read on for more information.

What does WOTC stand for?

WOTC stands for Work Opportunity Tax Credit, a federal program incentivizing employers to hire individuals facing barriers to employment.

Is WOTC a good thing?

Yes. The WOTC reduces a business’s tax liability and promotes inclusive hiring practices.

Who is in the WOTC targeted group?

Groups such as veterans, ex-felons, long-term unemployed, TANF recipients, and SNAP recipients are all included in WOTC.

How does WOTC affect employers?

WOTC helps employers lower their federal tax bills while diversifying their workforces.

Is the WOTC program worth it?

Yes. The average credit ranges from $2,400–9,600 per qualified employee, depending on the category.

What are some common WOTC claim mistakes?

Some of the most common WOTC mistakes include:

1. Late form submission (beyond 28 days)

2. Missing certifications

3. Incomplete screening documentation

How do I file a Work Opportunity Tax Credit certification request?

Submit Form 8850 and ETA Form 9061 to your state workforce agency within 28 days of the hire date