The Affordable Care Act (ACA) has been the law since 2010, setting important standards for employer-provided health coverage. While the rules have evolved over time, one thing hasn’t changed: Employers must meet ACA reporting requirements every year to stay compliant.

For HR leaders and business owners who want to build effective benefits packages, ACA reporting isn’t just another exercise in filling out more paperwork. It can protect your organization from costly penalties and ensures your employees have access to mandatory healthcare benefits. In this guide, we’ll cover the essentials of ACA compliance, including eligibility rules, filing deadlines, payroll considerations, and HR responsibilities.

What Is ACA Compliance?

The phrase “ACA compliance” means that employers meet the Affordable Care Act requirements for employers, including offering affordable health insurance to eligible employees and reporting that coverage to the IRS. Businesses must:

- Determine which employees qualify for health coverage (ACA eligibility).

- Offer minimum essential coverage that meets affordability standards.

- File the proper ACA forms with the IRS on time.

- Provide employees with accurate annual coverage statements.

Who Has to Comply with ACA?

Not every employer is required to file ACA reports. Compliance applies mainly to Applicable Large Employers (ALEs), which are businesses that have a certain workforce size.

What is an Applicable Large Employer?

An Applicable Large Employer (ALE) is an organization that employed, on average, 50 or more full-time employees (FTEs), including full-time equivalents, during the previous calendar year.

- A full-time employee is someone who works at least 30 hours per week.

- Part-time employees’ hours are combined to determine full-time equivalents.

If your business meets this threshold, you’re required to comply with ACA reporting and filing rules.

ACA Compliance Requirements for Employers

Employers who qualify as Applicable Large Employers must meet several ACA compliance requirements to avoid penalties. Here’s a breakdown of the most important steps:

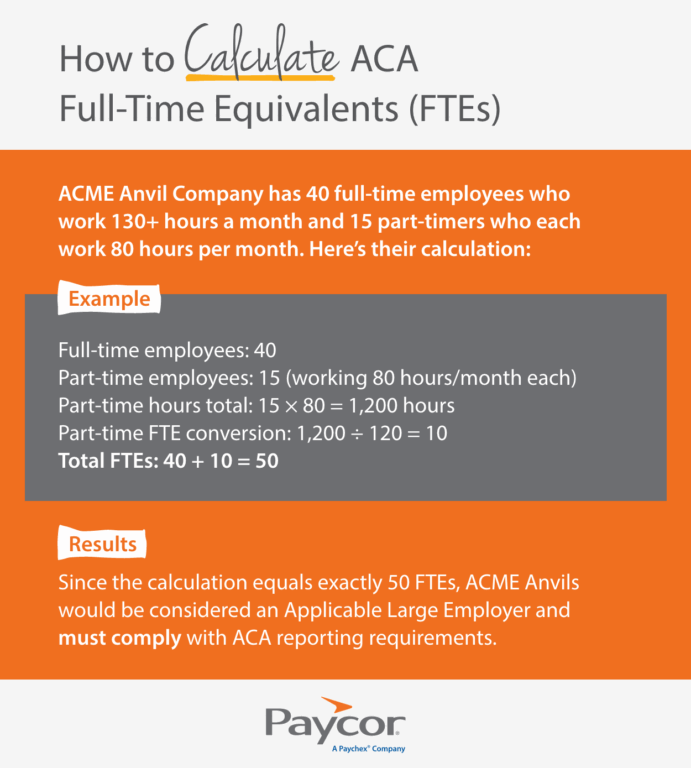

Calculating Full-Time Equivalents (FTEs) for ACA Reporting

To determine if your business is an Applicable Large Employer, you’ll need to calculate full-time equivalents (FTEs):

- A full-time employee works at least 30 hours per week or 130 hours per month.

- Add up the hours of all part-time employees for the month and divide by 120.

- Combine the number of full-time employees and the part-time conversion to find your total FTE count.

If the average is 50 or more FTEs in the prior year, your business is subject to ACA reporting.

Determing Employee Affordability

Employers must ensure their health coverage is “affordable” under ACA rules. For 2026, coverage is considered affordable if the employee’s share of the lowest-cost, employee-only plan does not exceed a set percentage of their household income (the IRS adjusts this percentage annually). Employers often use one of three IRS-approved “safe harbors”:

- W-2 wages

- Rate of pay

- Federal poverty line

Having accurate payroll data is essential for demonstrating affordability.

Determining Employee Eligibility

Not every worker qualifies for employer-provided coverage under the ACA. Eligibility typically includes:

- Full-time employees (30+ hours/week).

- Employees who meet ACA “measurement period” criteria for variable-hour positions.

Seasonal employees may require special consideration depending on hours worked. Correctly determining ACA status for each employee is an important part of compliance.

Tip: Make sure to keep accurate payroll records. This will help simplify this process later on.

Potential Penalties for ACA Non-Compliance

Failing to meet Affordable Care Act compliance reporting requirements can result in steep IRS penalties including:

- Failure to Offer Coverage (4980H(a)): If an ALE fails to offer minimum essential coverage to at least 95% of its full-time employees and their dependents, a $3,340 penalty is assessed per employee.

- Failure to Provide Affordable Coverage (4980H(b)): If coverage is determined to be unaffordable or does not provide minimum value, employers may be penalized $5,010 for each full-time employee who receives a premium tax credit.

- Failure to File ACA Reports: Late or incorrect ACA filings (Forms 1094-C and 1095-C) also carry per-form penalties from $60–340 per form depending on the date. Willful disregard of filing will result in a fine of $680 per form.

Staying current with ACA compliance requirements reduces the risk of these costly fines.

ACA Reporting & Filing Deadlines

ACA filings are due annually, with two key deadlines:

- Employee Copies (Form 1095-C): Must be furnished to employees by March 2, 2026.

- IRS Filings (Forms 1094-C and 1095-C): Must be submitted electronically by March 31, 2026, or February 28, 2026, if filed by paper.

Missing these deadlines can result in penalties, so it’s important to prepare early.

Reporting for ACA Compliance

ACA compliance reporting requires three main steps.

1. Collect Required ACA Forms

Employers must complete:

- Form 1094-C: A transmittal form summarizing ACA data.

- Form 1095-C: Individual employee forms detailing coverage offers.

These forms are the foundation of Affordable Care Act reporting.

2. Prepare ACA Report

To prepare ACA reports, employers need:

- Employee names, Social Security Numbers, and ACA status.

- Coverage offered, cost of lowest-premium plans, and qualifying offer dates.

- Payroll data to confirm ACA eligibility.

3. Submit ACA Forms to IRS

Employers must electronically file ACA reports with the IRS through the Affordable Care Act information returns (AIR) system. For many organizations, payroll or HR software simplifies this process.

ACA Compliance & Human Resources

HR teams play a critical role in ACA compliance. They manage ACA HR compliance tasks such as:

- Tracking employee eligibility.

- Coordinating with payroll to ensure ACA payroll data is accurate.

- Communicating coverage options to employees.

- Overseeing ACA compliance reporting and filing.

Without HR oversight, ACA compliance for employers can quickly become overwhelming.

How Paycor Helps with ACA Reporting

ACA compliance requires accurate payroll records, benefits tracking, and on-time filing. Paycor simplifies ACA reporting by:

- Automating ACA eligibility tracking and payroll data integration.

- Generating accurate IRS Forms 1094-C and 1095-C.

- Offering guided workflows to help HR teams meet ACA filing deadlines.

- Providing compliance dashboards to reduce errors and penalties.

Stay ACA Compliant with Paycor

The Affordable Care Act continues to create challenges for employers, but with the right tools, ACA reporting doesn’t have to be stressful. Staying compliant protects your organization from penalties while supporting employees with reliable healthcare coverage.

Download Paycor’s free ACA checklist to simplify your reporting process. You can also contact us to learn more about how our ACA reporting solution can help your team master ACA compliance.

ACA Reporting Compliance FAQs

Have more questions about ACA reporting and ACA compliance? Read on.

What does ACA stand for?

ACA stands for the Affordable Care Act, a federal law passed in 2010 to expand access to health insurance and set coverage standards for employers.

Is ACA required for 2025?

Yes. Employers that qualify as Applicable Large Employers (ALEs) must comply with ACA requirements for 2025 and file reports in early 2026.

What is an ACA penalty notice?

An ACA penalty notice is an IRS letter (often Letter 226J) sent to employers who failed to file accurate forms or otherwise did not meet ACA compliance requirements.

What size of an employer must report for ACA?

Employers with 50 or more full-time employees or full-time equivalents (Applicable Large Employers) must complete ACA filings.

What is the deadline for ACA reporting in 2026?

Employee copies (1095-C): Due March 2, 2026

IRS filing (1094-C & 1095-C): Due March 31, 2026

What is an ACA Report?

An ACA report is the data employers submit to the IRS on Forms 1094-C and 1095-C showing whether they offered eligible health coverage.

How does ACA affect payroll?

ACA payroll reporting requirements link hours worked, wages, and eligibility. Payroll data helps determine who qualifies for coverage and whether coverage is affordable.

What is ACA benefit status?

ACA benefit status refers to whether an employee qualifies as full-time under the ACA (30+ hours per week) and is eligible for employer-sponsored health coverage.