Paycor Wallet & OnDemand Pay

Pay Employees Faster with the Paycor Mobile Wallet

According to Nucleus Research, 70% of workers would prefer to work for an employer with earned wage access. Increase your chances of retaining employees with key benefits like earned wage access, flexible pay options, and financial wellness resources.

Mobile Wallet Features

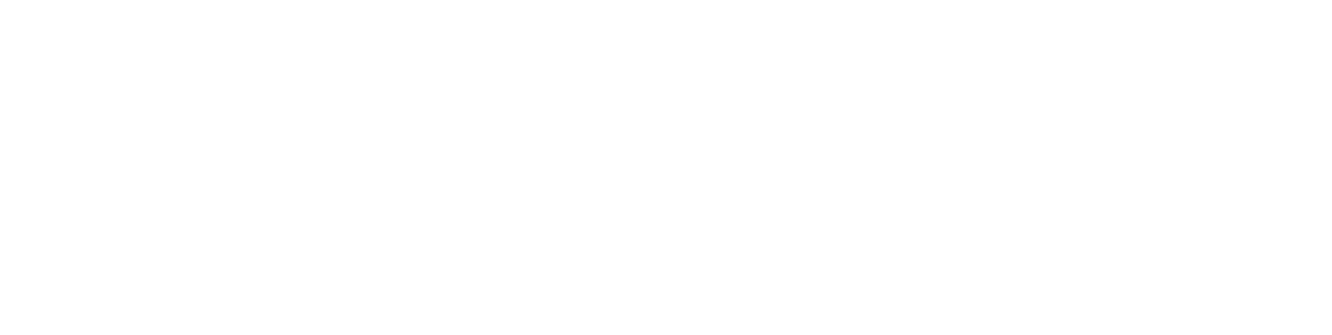

OnDemand Pay (Earned Wage Access)

Give employees up to 50% of money they’ve earned prior to payday.

Employees can transfer1 earned wages to the Paycor Visa® Card and access money via their mobile device.

OnDemand Pay is free2 for employers and employees pay little to nothing – much lower than the cost of a pay day loan service.

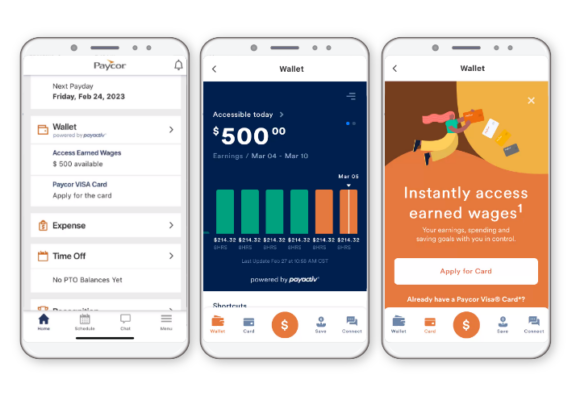

Paycor Visa® Card

Modernize the way you pay employees. Use the reloadable Paycor Visa® Card3 to pay employees up to 2 days faster with direct deposit linked to the card.

Employees can access money from ATMs, receive money electronically with just a tap, or use funds for online purchases.

And best of all it’s free! Offer the Paycor Visa® Card to employees at no cost: no activation, monthly, or annual fees.

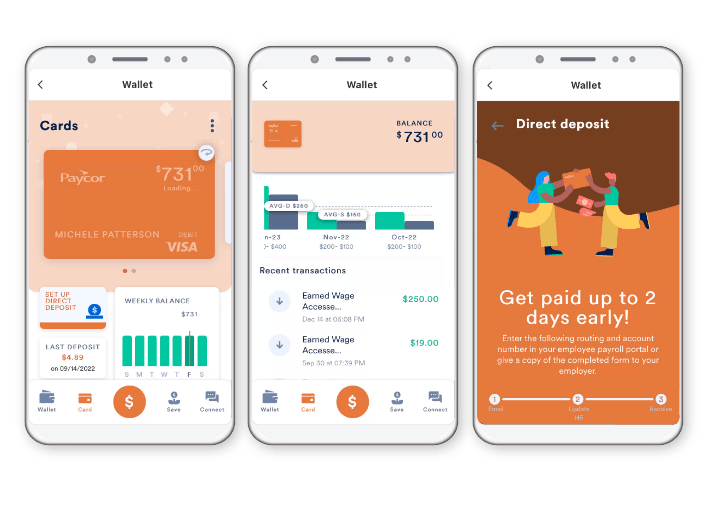

Financial Wellness Resources

Give employees peace of mind over their finances with financial wellness tools, including budgeting help and goal-based savings.

Employees can also track earnings, bills and spending in one place.

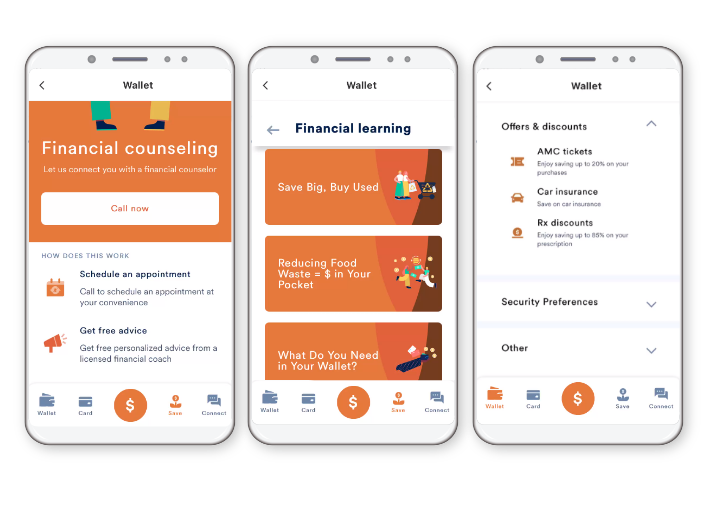

Financial Learning & Counseling

Help employees plan for the future with free financial coaching and self-paced courses.

And, provide access to discounts for movie tickets, prescriptions, insurance and more all within the Mobile Wallet app.

See Paycor in Action

1. Many (but not all) employers, government benefits providers, and other originators send direct deposits early with an effective date of 1-2 days later. Beginning with your second direct deposit of at least $5 from the same source, Central Bank of Kansas City (CBKC) will post the funds to your Payactiv Visa Card when we receive it, rather than on the effective date. This may result in your having access to the funds sooner. The date CBKC receives your direct deposit, and the effective date are controlled by the originator.

2. To qualify, you must have at least 1 successful direct deposit of $200 or more to the Paycor Visa® Card per pay period.

3. The Paycor Visa Prepaid Card is issued by Central Bank of Kansas City, Member FDIC, pursuant to a license from Visa U.S.A. Inc. Certain fees, terms, and conditions are associated with the approval, maintenance, and use of the Card. You should consult your Cardholder Agreement and the Fee Schedule at payactiv.com/card411. If you have questions regarding the Card or such fees, terms, and conditions, you can contact us toll free at 1 (877) 747-5862, 24 hours a day, 7 days a week.

Central Bank of Kansas City does not administer nor is liable for the Paycor Mobile App.