Learning Management System for Employees

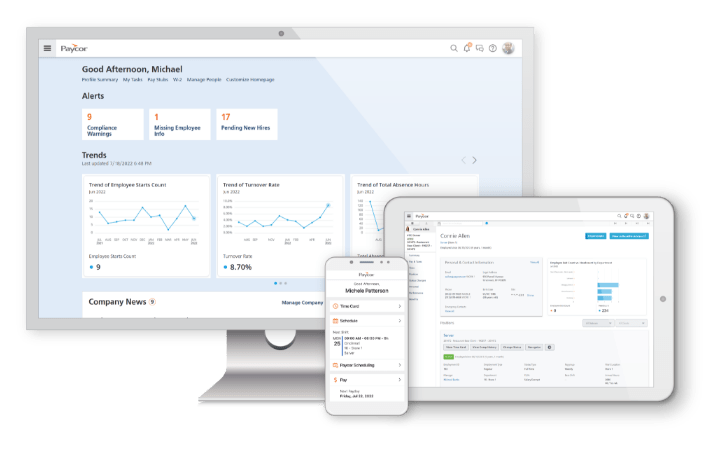

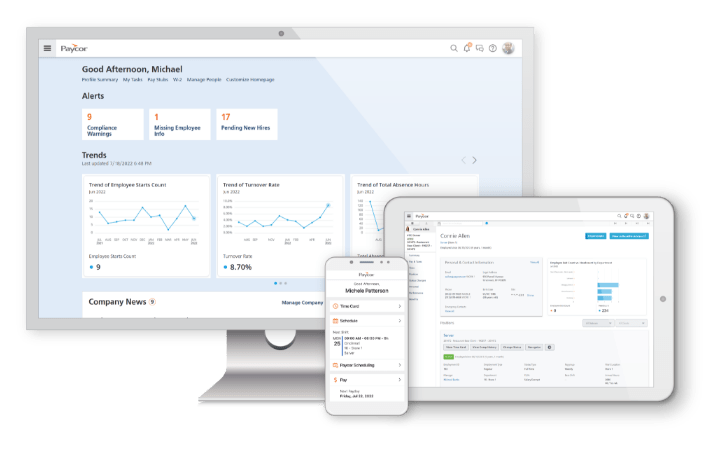

Learning for Anyone, Anywhere

With the right Learning Management System (LMS), you can deliver development and compliance training simultaneously. Compliance, skills, and healthcare training help protect your business and build your people. Speak to a representative today, call 866-966-8317.

More than 50,000 businesses nationwide trust Paycor*

Maximize Training + Development Opportunities

Robust Features for Any Size Business

To create a learning culture in your organization, it’s imperative to make learning opportunities readily accessible and empower employees to view learning material when it’s most convenient. More than ever, employees want to take control of and personalize their learning and career paths.

Empower Employees

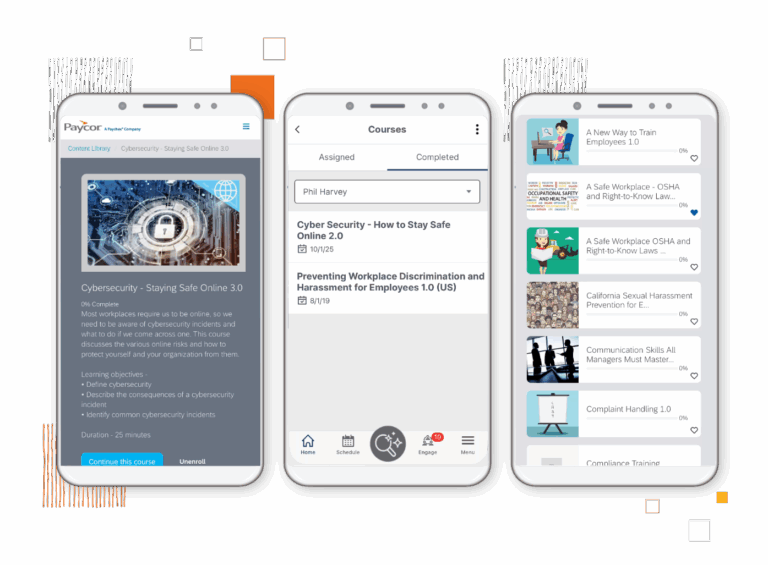

Make learning easy with modular, self‑paced training from a desktop or mobile device.

Unique Courses

Organize training programs and personalize content by groups, teams, departments or individuals.

Compliance Training

Access a library of pre-built compliance courses ready to assign, track completions automatically, and provide detailed audit reports.

High-quality Content

Create and publish professional courses easily through an advanced course builder with a simple user interface.

Learning Opportunities Drive Retention

Nothing sends the message “we’re investing in you” more than career paths augmented by specialized learning, designed to give individuals the skills they need to make an attractive lateral move or to get to the next level.

Improve Visibility

Evaluate your training success using precise feedback, real-time reporting, and automated alerts for milestones or course completions.

More Flexibility

Rather than being stuck in a classroom all day, learners want the ultimate flexibility to complete training when and where it’s convenient —from a desktop or mobile device.

Gamification

Use leaderboards and badges within the platform to engage and reward employees for course completions.

Everything You Need,

All in One Place

Skills Training

Help employees build business and personal development skills with 1,500+ courses covering Leadership & People Management, Sales & Marketing, Technology & Productivity, and Personal Development & Wellbeing.

Compliance Training

More than 500 courses covering current, important regulatory topics such as Data Privacy & Security, Business Ethics & Operations, Human Ethics, and Health & Safety, plus audit-ready reports.

Healthcare Training

More than 190 courses focused on Healthcare Compliance, Ethics & Legal Standards, Patient Care, Safety & Clinical Competency, Revenue Cycle, Billing & Insurance, and Communication, Professional Development & Workplace Culture.

Why 50,000+ Businesses* Trust Paycor

Ready to Learn More?

Hundreds of Apps & Tech Partners

We love to partner with the third-party apps your business currently uses. Explore our Marketplace to find the right fit.

Pay Solutions

Point of Sale

Benefits

Global Payroll

Advanced Scheduling

Background Screening

Tailored to Your Industry

The Paycor Difference

“The time savings and process improvements we’ve experienced have been very noticeable. Paycor has helped us eliminate so much tedious, manual work.”

– Ursula L., HR Manager, Gerber Poultry

Mobile Learning

Employees can now complete training courses via Paycor Mobile.

Bilingual Content

Bilingual courses have eliminated the need to translate content.

LMS FAQs

What are learning management systems?

A learning management system is a software application for the administration, documentation, tracking, reporting, automation, and delivery of educational courses, training programs, or learning and development programs. The learning management system concept emerged directly from e-learning.

An LMS is your gateway to delivering personalized content that educates and engages your people and keeps you compliant. It’s a powerful tool that allows stakeholders throughout an organization to create, manage, share, and track training programs and learning materials with the end goal of improving engagement, which increases retention and boosts business performance across the organization.

Who needs an LMS system?

Leaders and the employees both benefit from learning management systems. Having an LMS takes the burden off leaders to manually keep up with employee learning and allows them to automate and prioritize tasks. Employee learning is key for development, motivation, and productivity.

What are the key features to look for in an employee training software?

Essential features of employee training software should include an intuitive user interface with mobile accessibility, customizable learning paths, and content management capabilities that support various media formats and assessment tools. The platform should also offer comprehensive analytics and reporting functions, progress and performance dashboards, automated compliance tracking, integration capabilities with existing HR systems, and social learning features like peer-to-peer collaboration and knowledge sharing.

How does an LMS transform employee training?

Employers recognize the value of development and are taking a more sophisticated approach to learning, which requires a one-stop solution to deliver content in a meaningful way. Gone are the days of rigid, time-consuming offsite training sessions. Employers are investing in solutions that are accessible, easy to navigate, and can provide instant insights into course effectiveness.

How does employee training benefits the entire business?

Employee training benefits the entire business by:

1. Making learning accessible to everyone

2. Improving training ROI

3. Maintaining compliance

What to look for in an LMS?

When evaluating an LMS, look for:

1. Tailored learning paths

2. Unlimited access

3. One source of truth

4. Progress and performance dashboards

Does Paycor’s LMS track and report training completion for compliance audits?

Yes. Quick Reports can provide a high-level summary of the total number of employees assigned vs. completed for a specific course. The Reporting Engine enables admins to build a customized, detailed report showing course completion dates for each employee.

Can Paycor’s LMS support industry-specific compliance training (e.g. HIPAA, OSHA, GDPR)?

Yes, Pacyor’s LMS libraries contain several courses regarding HIPAA, OSHA, and GDPR compliance.

Is Paycor’s LMS SCORM or xAPI compliant?

Yes, Paycor’s LMS supports SCORM and mobile-first learning. It includes certification tracking, microlearning, and seamless integrations.

Does Paycor’s LMS support multi-language compliance training?

Yes. Courses are available in English, French, German, Japanese, Korean, Portuguese, and Spanish.

How often is compliance content updated in Paycor’s LMS?

Courses are reviewed and updated on a quarterly basis to continuously improve engagement and help ensure alignment with current business needs.

How can an LMS for employee training improve retention?

An LMS significantly improves employee retention by providing personalized learning paths and continuous development opportunities. The system’s ability to deliver engaging, accessible training content while tracking progress helps employees feel valued and invested in their growth.

How does LMS training help reduce administrative work?

A Learning Management System reduces administrative work by automating routine tasks like course enrollment, progress tracking, certificate generation, and compliance monitoring that would otherwise require manual oversight.

How can Paycor’s LMS address skill gaps within my workforce?

Paycor’s LMS helps identify and address workforce skill gaps by providing customizable learning paths and targeted training programs that align with specific job roles and organizational needs. The platform enables managers to track employee progress, assign relevant courses, and measure learning outcomes through detailed analytics, ensuring that training initiatives directly address competency gaps and support professional development goals.

Featured Resources

The HR COE is an action plan based on Paycor’s proprietary data and research. Think of it as your roadmap to achieving HR excellence in talent management, workforce management, benefits and the employee experience.

Article

Read Time: 7 min

Why Using a Learning Management System (LMS) is More Important Than Ever

With hiring freezes in place across many companies, organizations need to cross train employees. See how an LMS can help.

Guides + White Papers

Read Time: 0 min

LMS Buyer’s Guide

An LMS delivers personalized content to educate and engage your team, ensuring compliance. It lets stakeholders create, manage, and track training to boost engagement and performance.

Live Webinar

From Good to Grateful – How HR Can Cultivate a Thriving Culture

HRCI & SHRM credit available

Gratitude is more than a soft skill. Done right, it’s a key component of your business strategy. When employees feel genuinely appreciated, they’re more engaged, more productive, and more likely to stay.

2:00pm ET, February 5th, 2026

Live Webinar

Tough Love: Feedback is a Gift – Confronting Difficult Conversations With Respect

HRCI & SHRM credit available

Too often, leaders hesitate to address performance concerns or disruptive behaviors because they don’t want to hurt feelings or create tension. But that silence has a cost. When tough conversations don’t happen, small issues turn into big ones and toxic behaviors quietly take root.

2:00pm ET, February 17th, 2026