The Federal Unemployment Tax Act (FUTA) requires most employers to pay federal unemployment tax. Paying FUTA tax requires filling out a Form 940 annually to maintain compliance. Whether you’re a new business owner navigating payroll taxes for the first time or an established employer looking to ensure proper compliance, understanding your FUTA obligations is essential.

Read on to learn more about the purpose of FUTA taxes, including who is required to pay them and how they are calculated.

What is the Federal Unemployment Tax Act (FUTA)?

The Federal Unemployment Tax Act (FUTA) is a federal law that establishes a tax on employers to fund the federal government’s oversight of state unemployment insurance programs. The FUTA system operates as a federal-state partnership, with the federal portion supporting administrative costs and providing a backstop for state unemployment funds during periods of high unemployment or economic distress.

Purpose of FUTA Taxes

FUTA taxes help fund unemployment benefits for workers who lose their jobs through no fault of their own. Specifically, they fund:

- State workforce agencies that administer unemployment programs

- The federal government’s share of extended unemployment benefits

- Federal loans to states with depleted unemployment funds

Who Pays Futa Taxes?

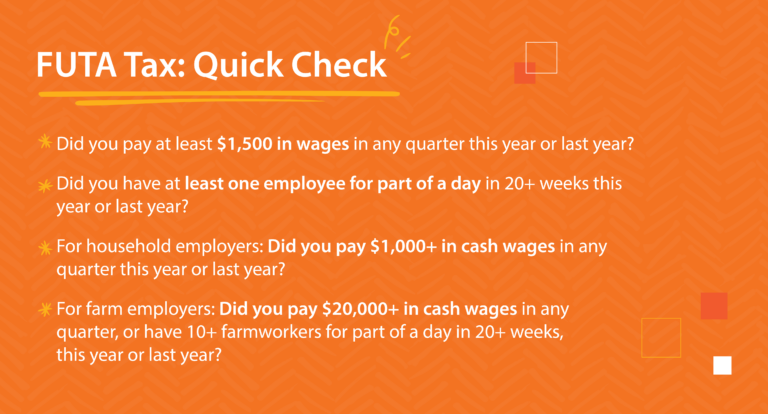

Employers must pay FUTA taxes if they paid wages of $1,500 or more in any calendar quarter or had at least one employee working for any part of a day in 20 or more different weeks during the current or previous year. FUTA taxes are reported annually on IRS Form 940.

FUTA Tax Requirements

If you paid cash wages to household employees (housecleaner, nanny, etc.) in excess of $1,000 in any quarter during the calendar year or the prior year, you must pay FUTA tax on the first $7,000 of cash wages.

Who is Exempt from Paying FUTA Tax?

According to the IRS, an organization that is exempt from income tax under section 501(c)(3) of the Internal Revenue Code is also exempt from paying FUTA tax. In addition, a household employee is exempt if they are a spouse, parent, or child under the age of 21.

Exemptions for farmworkers apply if:

- You paid less than $20,000 in cash wages to agricultural workers during any calendar quarter in the current or preceding calendar year, or

- You employed fewer than 10 agricultural workers during at least some part of a day in each of 20 different weeks (the weeks don’t need to be consecutive) in either the current or preceding calendar year.

How FUTA Taxes Are Calculated

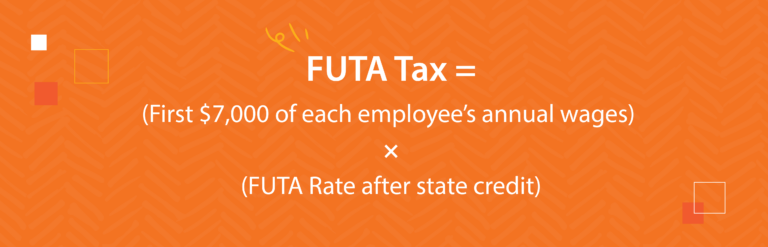

The standard FUTA tax rate is 6% on the first $7,000 of wages paid to each employee during the calendar year. This creates a maximum FUTA tax of $420 per employee annually ($7,000 × .06).

However, employers can take a credit of up to 5.4% of taxable income if they pay state unemployment taxes under the State Unemployment Tax Act (SUTA). This amount is lower in states that have not repaid money they borrowed from the federal government to pay unemployment benefits.

Employers who receive a credit of 5.4% end up paying a FUTA tax of just 0.6%. In that case, the formula to calculate FUTA tax liability is: Number of employees × $7,000 × 0.006.

For example, if a company has 20 employees, the FUTA tax liability would be: 20 × $7,000 × 0.006 = $840.

How Does an Employer File FUTA Taxes?

Employers must file FUTA taxes annually using IRS Form 940, “Employer’s Annual Federal Unemployment (FUTA) Tax Return.” The process involves calculating the total FUTA liability for the year, taking into account any state unemployment tax credits, and submitting the completed form by the IRS deadline, which is typically January 31 of the following year. Employers can file electronically using the IRS e-file system or mail a paper return.

When is FUTA Paid?

Although Form 940 is filed annually, FUTA taxes must be deposited quarterly if the tax due exceeds $500 in a quarter. Payment deadlines are the last day of the month following each quarter:

- Q1 (Jan–Mar): April 30

- Q2 (Apr–Jun): July 31

- Q3 (Jul–Sep): October 31

- Q4 (Oct–Dec): January 31

How The FUTA Tax Impacts Employers

Understanding and complying with FUTA tax requirements is essential for every business with employees. Beyond the direct tax expense, employers must allocate administrative resources to calculate taxable wages, monitor state unemployment tax payments to ensure credit eligibility, and file accurate returns by federal deadlines.

Noncompliance can result in financial penalties, interest charges, and potential audits. Staying current with FUTA helps ensure employees can access unemployment benefits if needed, ultimately supporting workplace stability and demonstrating employer responsibility in the broader labor ecosystem.

Additional FUTA Tax FAQS

Still have questions regarding FUTA tax? Read on.

What’s the Difference Between FICA and FUTA?

FICA covers Social Security and Medicare taxes shared by employers and employees. FUTA is an employer-only tax that funds federal unemployment benefits.

What is FUTA Withholding?

FUTA is not withheld from employee wages. It is an employer-paid tax used to fund unemployment benefits.

When Does the FUTA Tax Rate Change?

The FUTA tax rate may change if adjusted by the IRS or if a state is subject to a credit reduction. Employers should check annually for updates.

Are Nonprofits Exempt from Paying FUTA Tax?

Some 501(c)(3) nonprofits are exempt from FUTA tax if they meet specific IRS criteria and do not reimburse the state for unemployment claims.

Do Employees Pay FUTA Tax?

No, employees do not pay FUTA tax. It is solely the employer’s responsibility.

Is FUTA Tax Deductible?

Yes, FUTA tax is a deductible business expense for employers.

Is There a Base Wage for FUTA?

Yes, FUTA applies only to the first $7,000 of each employee’s annual wages, known as the wage base.

Can Businesses File FUTA Tax Online?

Yes, businesses can file Form 940 and pay FUTA tax online through the IRS e-file system.

How Paycor Helps

Stay on top of payroll taxes with Paycor HR and Payroll software, which provides tax compliance alerts, helps ensure accurate withholdings, and automates tax filings. Backed by solid compliance and tax expertise, Paycor solutions serve more than 30,000 businesses nationwide.

See Paycor’s solutions in action with a guided product tour.