HCM Software for Small Business

Streamline HR and Payroll Management

Your time is too valuable to master the complexities of payroll, HR and tax compliance. Paycor helps you stay ahead of the curve, manage employee info in one place, and process payroll quickly and accurately. Speak to a representative today, call 513-338-0399.

30 Years of Experience

Paycor has more than 30 years in the HCM industry.

Over 2.3 Million Users

Our HR and payroll solutions support over 2.3 million users across all 50 states.

Best-in-Class Implementation

We provide the hands-on guidance, expert support and tools needed to ensure a seamless transition.

Software for Small Business

Unlike some competitors, we don’t sell one-size-fits-all technology. Instead, we tailor technology to your business needs.

One Unified HR & Payroll Solution That Grows with You

Leave Payroll Taxes to the Experts and Focus on Your Business.

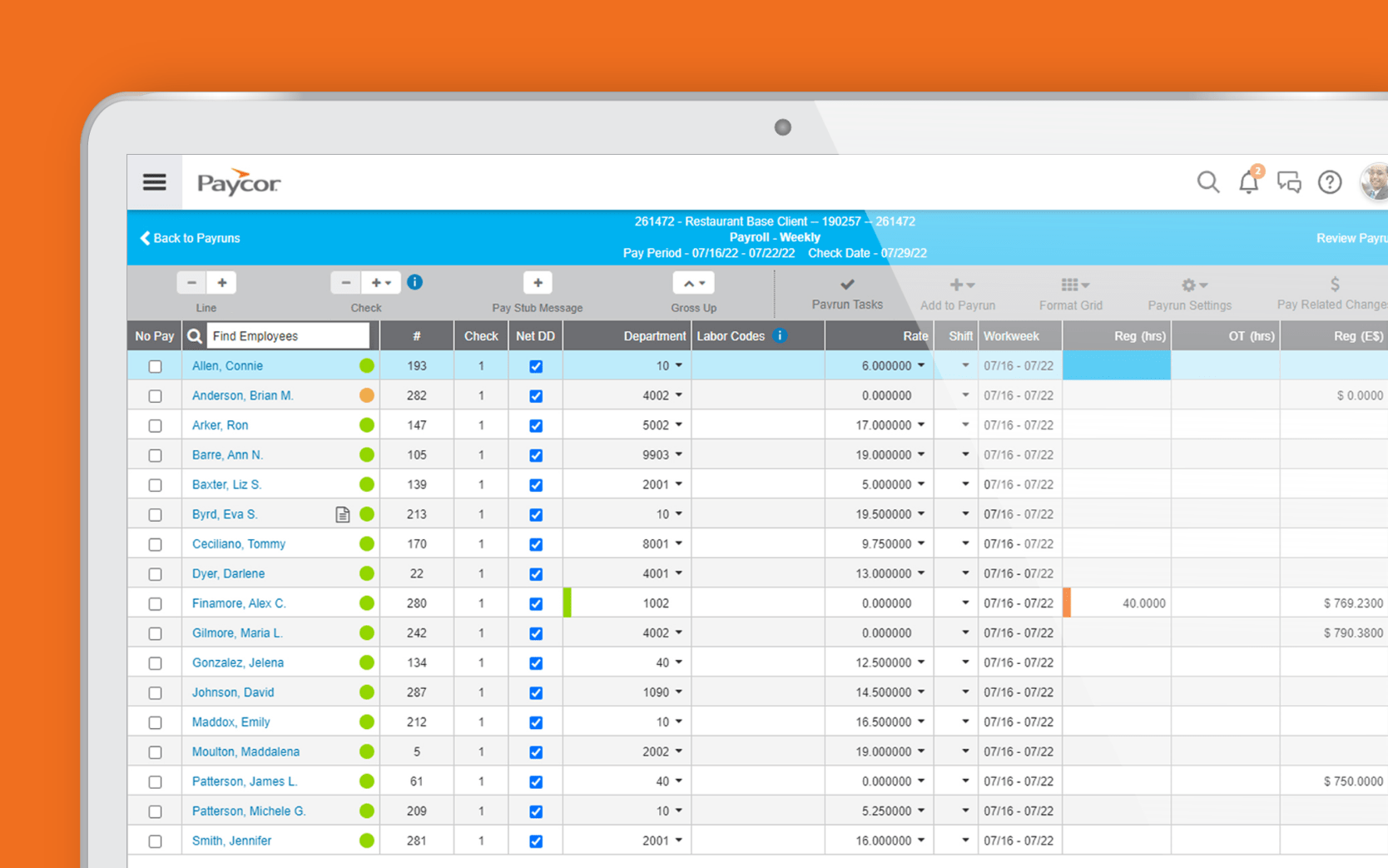

Payroll processing has never been easier. With built-in workflows and flexibility to add columns, calculate gross-to-net pay, or pre-schedule payruns to automatically process on a specific day and time, Paycor helps you eliminate hours of work and process payroll accurately.

Stress-Free Tax Compliance

Struggling to keep up with tax and compliance changes? Trust Paycor to help you stay ahead. Our payroll product is automatically updated with tax laws and employment regulations relevant to your region and industry.

Control Labor Costs and Seamlessly Manage Expense Reports

Tired of manually enter hours worked in your payroll solution? Keep employee data accurate and avoid repetitive work with Paycor Time. Easily view and manage all time off requests and hours worked in one place. Plus, time data flows automatically to payroll with one click so you’re not entering hours in multiple locations. And with Paycor Expense Management, employees can submit expenses from anywhere using a mobile device, managers receive alerts for quick approval, and reimbursements flow seamlessly to payroll so you’re not switching to a third-party provider.

Overtime Dashboard

Paycor Time allows you to break down hours worked by department, manager, and location so you can stay on top of expenses and improve budgeting.

Compliance is a moving target. Trust Paycor to help you stay ahead of the curve.

With proactive alerts, compliance dashboards, document acknowledgment and e-signatures, Paycor helps you simplify compliance management and reduce risk.

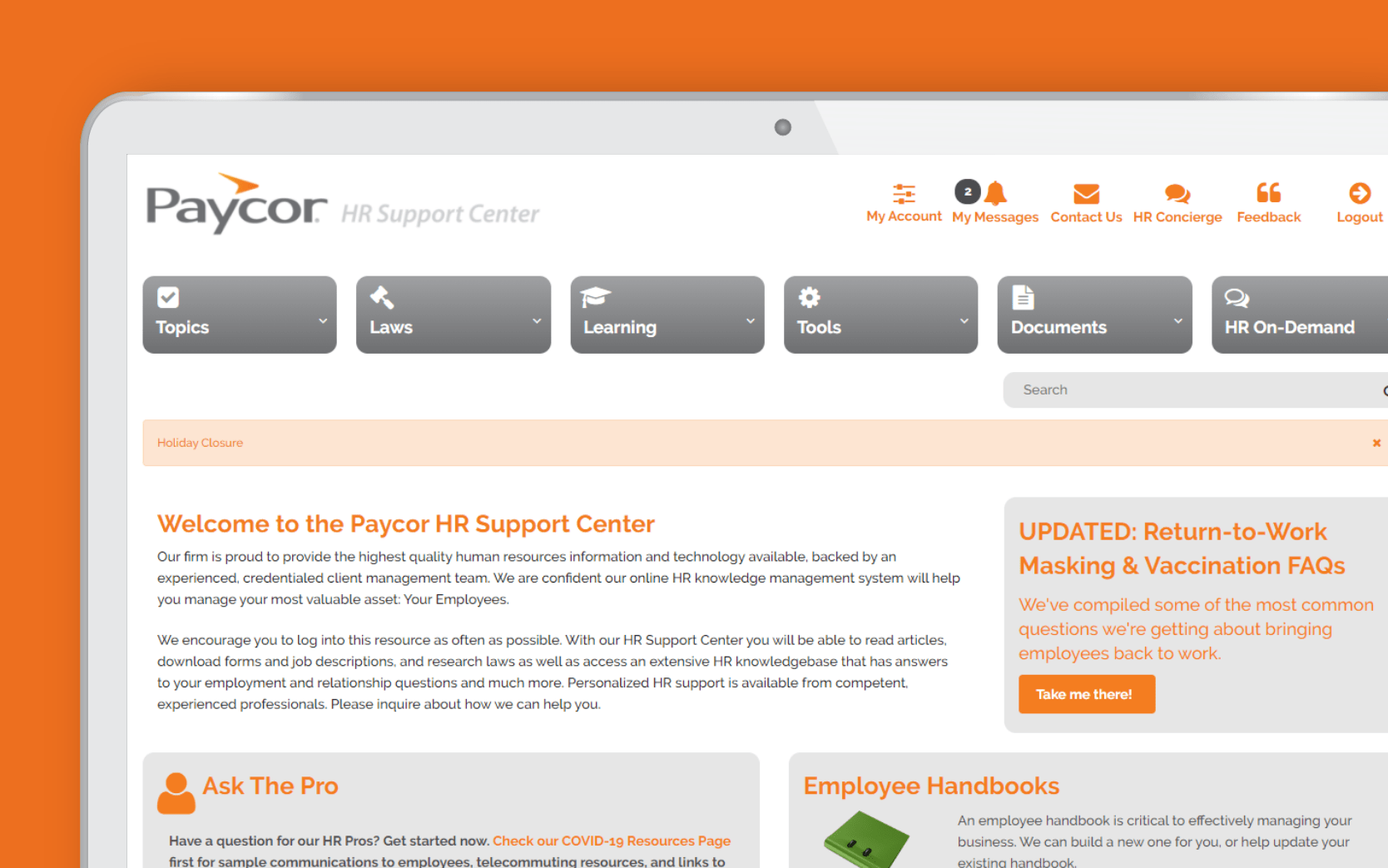

HR Support

Stop searching online for answers and templates. HR Support Center has a library of compliance resources including news alerts, FAQs, guides, letters, forms, templates, and more.

Work Opportunity Tax Credit (WOTC)

Paycor can help reduce your federal tax liability by up to $9,600 per new employee when you hire from groups who have faced barriers to employment, such as veterans, residents in areas designated as empowerment zones, and the long-term unemployed.

Remove Complexity

Paycor screens job candidates for WOTC eligibility and automates the payroll process on the backend. We also do the heavy lifting — maintaining accurate records, reporting tax credit activities, and meeting deadlines.

Employee Retention Credit (ERC)

Everyone is still trying to control costs and do more with less. The Employee Retention Credit (ERC) was created to reward businesses for keeping employees on their payroll during the pandemic, and it’s still available today.

Reduce Your Tax Bill

If your business experienced a decline in gross receipts of 20% year over year, you could claim a payroll tax credit of 70% of qualified employee wages (up to $10,000 per employee per quarter). Don’t miss out!

HR & Payroll Solutions for Small Businesses

Stress-Free Payroll —

Our solution is flexible – no waiting for changes. Make edits, view reports, run payroll, and get time back in your day.

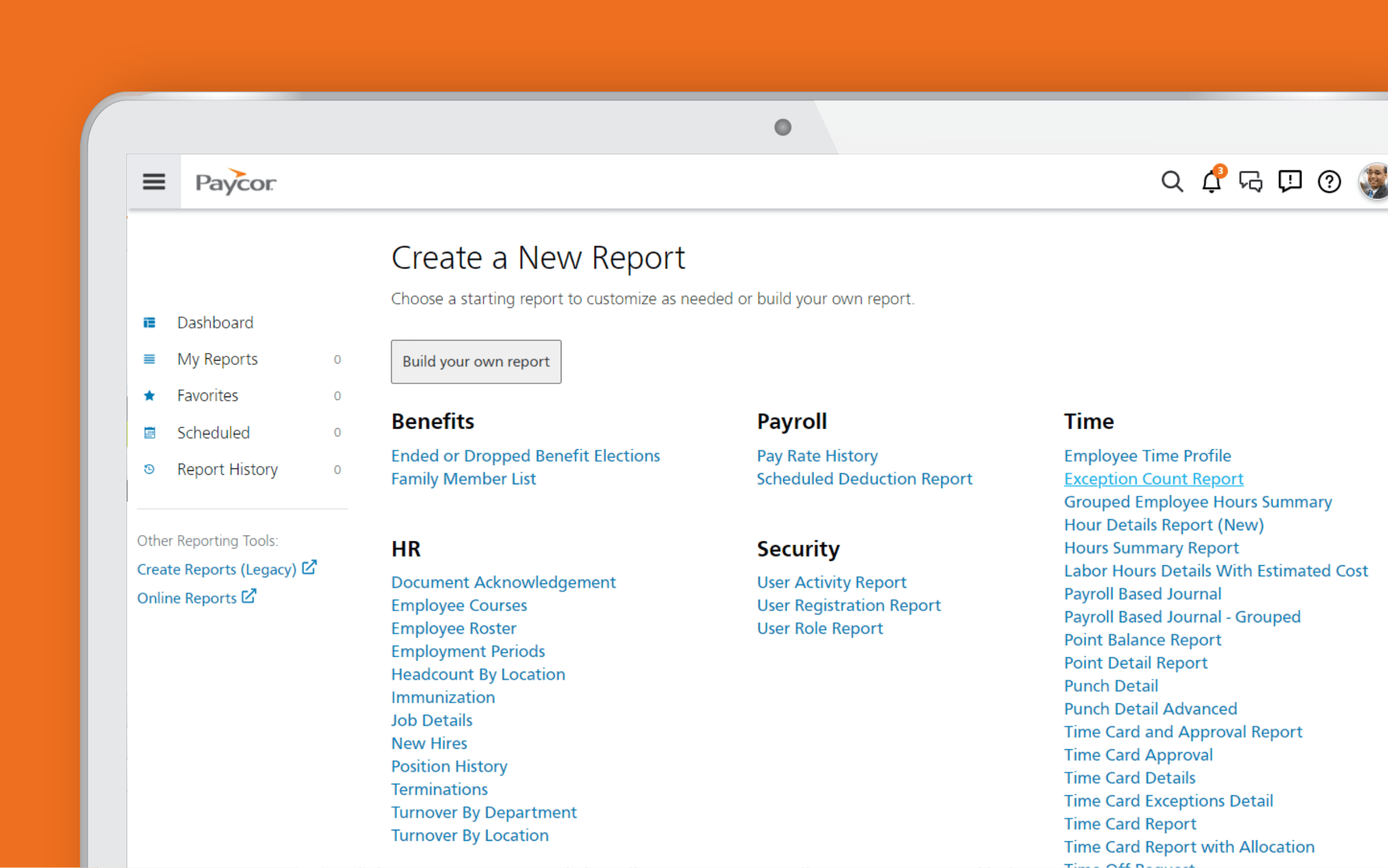

Powerful Reporting —

Easily create, schedule, and share custom reports with just one click and access pre-built templates to make reporting more efficient.

HR Resources —

Our HR Support Center features a library of must-have resources including toolkits, forms, law alerts, articles, templates, and more.

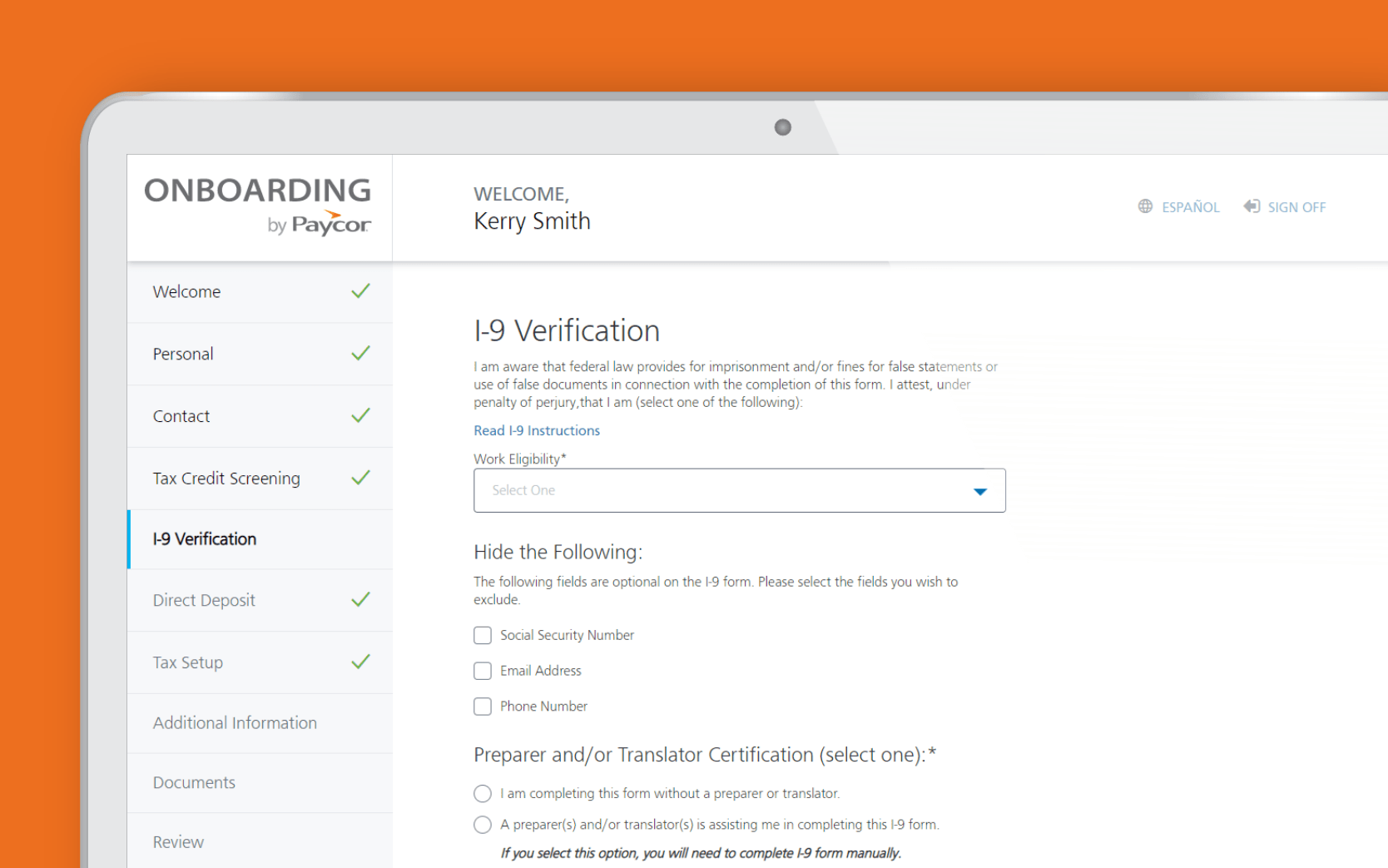

Employee Onboarding —

Empower new hires to fill out information and acknowledge documents from a computer or mobile device prior to their first day.

Explore Everything Paycor Offers

Paycor’s human capital management (HCM) platform modernizes every aspect of people

management, from payroll and recruiting to onboarding and career development. Tour our product today to see how we can help your business.

Best-In-Class Partnerships

Modern, flexible integrations that complement any product suite. Seamlessly connect your

people and business needs with Paycor

Retirement

Labor Law Posters

Tax Credits

Background Screening

OnDemand Pay

Job Boards

Paycards

“Our staff loves using Paycor Scheduling. They can set notifications, pick up or trade shifts. I’m no longer the middle man.”

– Shanna B., Manager, Red Bluff Pet Resort

Talk to Our Experts

Our team is ready to learn more about your business and your current challenges. Contact us today.

FAQs

How can HCM software help small businesses?

HCM software streamlines HR tasks, freeing owners to focus on growth. It enhances the employee experience, from onboarding to performance management, leading to increased engagement and retention. Real-time insights enable data-driven decisions.

How does HCM software simplify payroll for small businesses?

HCM software simplifies payroll for small businesses by automating calculations, tax withholdings, and filings. It ensures compliance with changing tax laws and employment regulations, saving time and reducing errors. With features like pre-scheduled payruns and integration of time tracking data, small business owners can process payroll quickly and accurately. Learn how Paycor’s payroll software makes payroll stress-free.

Can HCM software help small businesses manage employee benefits?

Yes, HCM software simplifies employee benefits administration by streamlining enrollment, tracking eligibility, and managing open enrollment periods. It helps ensure small businesses are compliant with benefits regulations, like COBRA and ACA, with proactive alerts and notifications to prevent costly mistakes.

Can HCM software integrate with other tools small businesses use?

Yes, HCM software integrates seamlessly with tools that small businesses rely on, such as accounting software, time-tracking systems, and expense management platforms. Many HCM software platforms offer APls and open architecture, allowing small businesses to create custom integrations tailored to their specific tech stacks and needs.

Resources

Get the expert advice and thought leadership you need to help your clients solve their toughest business challenges.

Article

Read Time: 26 min

5 Best Performance Management Software Systems

Trying to find your next best employee evaluation tool? Here’s our list of the best performance management software for employers, owners, and HR professionals.

Article

Read Time: 1 min

Employee Letter of Recommendation Template [Free + Downloadable]

Need to write an employee recommendation letter? Download and use our customizable, free letter of recommendation template for employees.

Article

Read Time: 15 min

What Is Inclusive Leadership? Style, Steps, & Importance

Inclusive leaders impact companies every day. Learn the definition of inclusive leadership and how to become an inclusive leader.

Live Webinar

Company Culture – Addressing Current and Future Trends

HRCI & SHRM credit available

The workplace is evolving faster than ever, and organizational culture sits at the heart of how businesses navigate change. Staying ahead of workplace culture trends is critical for engagement, retention, and performance.

11:00am ET, February 19th, 2026