Of the many levers talent managers have to attract and retain workers, base pay and total compensation top the list. In fact, A Gallup poll of more than 10,000 U.S. employees identifies pay and benefits as the second most important factor in choosing a new job.

States are increasingly requiring employers to list base pay with job openings via pay transparency laws. But what exactly is base pay, and how does it compare to gross pay or total compensation? Find out in the following guide.

What is Base Pay?

Base pay, or base salary, is the fixed amount of compensation an employee receives before bonuses, overtime, or benefits are added. It serves as the foundation of an employee’s compensation package and is typically expressed as an hourly rate, weekly amount, or annual salary.

Who Receives Base Pay?

All employees receive a base pay, though it may be calculated differently. Examples include:

- Full-time employees receive base pay as a fixed annual salary or hourly rate.

- Part-time employees receive the same type of base pay as full-time counterparts, usually calculated hourly.

- Contract workers may have base pay structured as a fixed project fee, hourly rate, or retainer, depending on the agreement terms.

- Temporary workers usually receive base pay as an hourly rate without additional benefits or long-term compensation elements.

- Commissioned employees often receive a lower base pay supplemented by commission earnings tied to performance metrics.

- Tipped employees in service industries may receive a base pay that’s lower than standard minimum wage, with the expectation that tips will bring total earnings to or above minimum wage requirements

Base Pay vs Gross Pay

If base pay is the foundation of an employee’s compensation package, gross pay is the full structure built on top. For example, a base salary is what the employee earns for their work before additional compensation is included. Gross salary, on the other hand, adds overtime, bonuses, commissions, and any other earnings.

Base pay sets expectations for regular earnings, while gross pay shows the full amount an employee has earned before taxes, insurance, and other deductions are taken out. For instance, an employee with a $50,000 base salary who earns $5,000 in bonuses would have a gross salary of $55,000.

In other words:

- Base pay = regulary earnings only

- Gross pay = base pay + additional earnings (bonuses, overtime, commissions)

Net pay, on the other hand, is the amount an employee actually takes home after taxes, insurance, and other deductions are subtracted from gross pay.

For instance, an employee with a $50,000 base salary who earns $5,000 in bonuses would have a gross salary of $55,000, but their net pay would be lower once withholdings and deductions are applied.

How to Calculate Base Pay

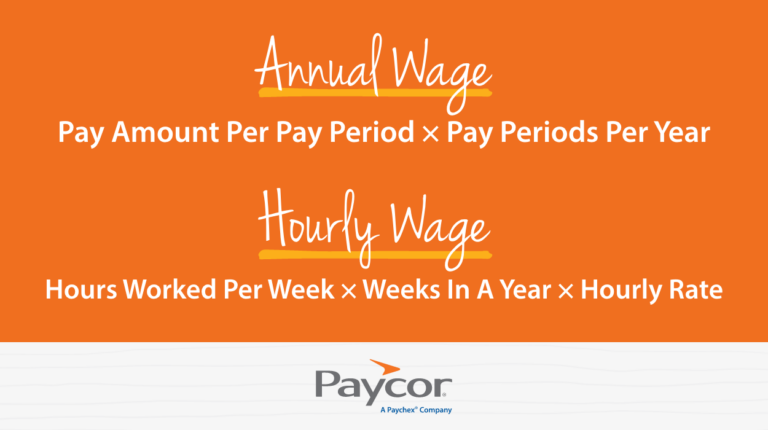

Base pay can be calculated a couple different way depending on whether an employee earns an hourly or annual wage:

- Annual wage: Pay amount per pay period × Pay periods per year

- Hourly wage: Hours worked per week × Weeks in a year × Hourly rate

For practical applications, base pay can be converted between different time periods using standard formulas. To convert hourly wages to annual salary, multiply the hourly rate by weekly hours and then by 52 weeks. For example, $25/hour × 40 hours × 52 weeks = $52,000 annual base pay.

Annual salaries can be divided by 12 for monthly pay or by 26 for bi-weekly amounts. These calculations provide consistency in how organizations communicate compensation across various pay schedules and employee classifications.

Base Pay Calculation Examples

Many terms are used when discussing base pay, including base salary, base income, and base rate. Here’s a breakdown on a few:

Weekly Base Pay Example

Base pay is more the commonly used term for hourly workers. The formula is: Hourly rate × Hours worked per week. For instance, an employee earning $25 per hour working 40 hours per week would have a weekly base pay of $1,000 ($25 x 40 = $1,000).

Monthly Base Pay Example

Monthly base income is simply the employee’s base pay divided across months. With a $60,000 salary, the monthly base income would be $5,000 ($60,000 ÷ 12).

Base Salary Example

Base salary is the term typically used for full-time workers who are paid salary versus on an hourly basis. It’s the fixed amount an employee earns in a year before any extra earnings or deductions.

An employee who is paid bi-weekly could calculate their salary by multiplying their pay rate by the amount of paychecks they receive in a year. For example: $2,500 per pay period × 26 = $65,000 base salary.

How is Base Pay Determined

Organizations determine base pay through systematic approaches that consider both external market factors and internal equity considerations. Factors evaluated include:

Geographic Location

Salary ranges vary significantly by region, with adjustments for cost of living differences across metropolitan areas, suburbs, and rural locations. Companies often use cost-of-living calculators to calculate appropriate adjustments between different markets. Major metropolitan areas like New York or San Francisco typically command premium compensation compared to smaller cities or rural areas.

Industry Standards

Most companies begin by analyzing salary survey data from industry reports to establish competitive ranges for similar positions. These ranges typically include minimum, midpoint, and maximum values based on market percentiles, with new hires often starting between the minimum and midpoint.

Required Qualifications

Educational credentials, certifications, and specialized skills directly impact base pay levels, with advanced degrees or technical certifications typically warranting higher compensation. Employers quantify the value of specific credentials based on market demand and organizational needs. Skills that are scarce or in high demand can significantly elevate base pay expectations.

Years of Experience

Professional tenure provides valuable context for compensation decisions, with experienced professionals commanding higher salaries reflecting their accumulated expertise. Most organizations establish defined progression bands that correlate experience with expected compensation ranges.

Budget

Organizational financial constraints establish practical boundaries for compensation decisions, requiring balance between competitive offers and fiscal responsibility. Department or division-specific budget allocations often dictate available compensation resources. Companies frequently establish annual merit increase budgets as percentages of overall payroll expenses to maintain financial predictability.

How Paycor Helps with Base Pay

Ensure competitive base pay with Paycor HR & Payroll software. Pay Benchmarking allows you to optimize compensation strategies and pay decisions based on industry standards and market data. Once base pay is set, the software automates pay runs, ensuring proper deductions for taxes and benefits.

Base Pay Frequently Asked Questions

Still have questions about Base Pay? Read on.

Can base salary change?

Yes, base salary can change based on promotions, performance reviews, cost-of-living adjustments, or company policy updates.

How often should base pay be adjusted?

Base pay is typically reviewed annually but may be adjusted more often for promotions or exceptional performance.

Does base income include taxes?

No, base pay is the employee’s earnings before taxes and other deductions are taken out.

Is base salary monthly or yearly?

Base salary is usually quoted as a yearly amount but can be broken down into weekly, monthly, or biweekly pay periods.

Are base salary and annual salary the same?

Yes, base salary and annual salary often mean the same thing — the fixed yearly amount an employee earns before bonuses or overtime.

How do I determine a fair base pay for a new role?

To set a fair base pay, you should benchmark compensation against industry standards, geographic location, and required experience using reliable salary data or market surveys.

How do you communicate base pay to employees or job candidates?

Be transparent about how base pay is determined and clearly explain what’s included (and not included) in total compensation to build trust and avoid confusion.

What compliance laws affect setting employee base pay?

Base pay must comply with federal, state, and local wage laws, including the Fair Labor Standards Act (FLSA) and Equal Pay Act, which govern minimum wage, overtime, and pay equity.

See the solutions in action with a guided product tour.