Raises, promotions, and shift differentials don’t always align perfectly with payroll cycles. In addition (and unfortunately), payroll errors sometimes occur. That’s where retroactive pay comes in. Retro pay provides a way for employees to receive the correct pay for changes or corrections that apply to a previous pay period.

In this guide, we’ll break down what retro pay is, when it’s necessary, how to calculate it, and how to issue it properly.

What is Retro Pay?

Retro pay, short for retroactive payment, is when additional compensation is added to an employee’s paycheck to compensate for a payment the employee didn’t receive the previous pay period. It’s important to note that retro pay is not the same as back pay, the latter of which refers to wages owed due to legal or contractual disputes.

Retroactive Pay vs. Back Pay

Although the terms are sometimes used interchangeably, retroactive pay and back pay apply to different payroll situations.

Retroactive pay corrects an underpayment, when an employee was paid less than they earned for work already performed. This usually happens after a raise, promotion, or payroll error wasn’t reflected in time.

Back pay, on the other hand, compensates employees for work that was never paid at all, often due to wage disputes, misclassification issues, or legal rulings.

When is Retro Pay Necessary

Retro pay ensures employees receive the full amount they earned, even if it’s after the original payday. Common reasons to apply retro pay include:

- Missed or late pay increases: If an employee’s raise is approved but not processed in time for their paycheck.

- Payroll errors: Mistakes in hours worked, incorrect rates for shift differentials, or missed overtime payments.

- Contractual or union changes: When collective bargaining agreements update compensation retroactively.

- Promotions or job changes: If changes in role or responsibilities affect pay mid-pay period but weren’t reflected right away.

How To Calculate Retro Pay

Learn how to calculate retro pay for hourly and salary workers with the formulas offered below.

Payment Errors

For retro pay due to payment errors, follow this process:

- Determine the underpayment by finding the difference between what should have been paid and what was paid. For example: Owed payment – Actual payment = Underpayment.

- If this was just a one-time error, just add the underpayment to the next normal paycheck.

- If the underpayment affected more than one pay cycle, multiply the underpayment by the number of affected pay periods. For example, Underpayment x 4 Pay periods = Retro pay.

- Apply the retroactive payment to the next paycheck.

Pay Changes

To account for pay rate changes, use these steps:

Identify the start and end dates for which the new pay rate is effective. This period represents the time for which the employee was paid at the old rate but should have been paid at the new, higher rate.

- Calculate the difference in pay:

- For hourly employees, subtract the old hourly rate from the new hourly rate to find the hourly pay difference

- For salaried employees, find the difference in pay per pay period by subtracting the old pay per pay period from the new pay per pay period.

- Determine the number of hours worked or pay periods in the retroactive period:

- For hourly workers, calculate the total number of hours the employee worked during the retroactive period. This will require reviewing timesheets or payroll records for the relevant dates.

- For salaried employees, count the number of pay periods that fall entirely or partially within the retroactive period.

- Calculate the retro pay amount:

- For hourly employees, multiply the hourly pay difference (from Step 3) by the total number of hours worked during the retroactive period (from Step 4).

- For salaried staff, multiply the pay period difference (from Step 3) by the number of pay periods in the retroactive period (from Step 4).

How is Retro Pay Taxed?

Unlike with supplemental wages, retro pay is subject to standard payroll taxes and deductions. In other words, it’s taxed the same way as regular wages. This includes:

- Federal income tax

- Social Security

- Medicare

- Any applicable state or local taxes

Whether employers include retro pay in the employee’s regular paycheck or issue it as a separate check, it must be taxed using the same rates and methods applied to regular earnings.

Retro Pay Examples

Let’s see how retro pay works using a couple examples.

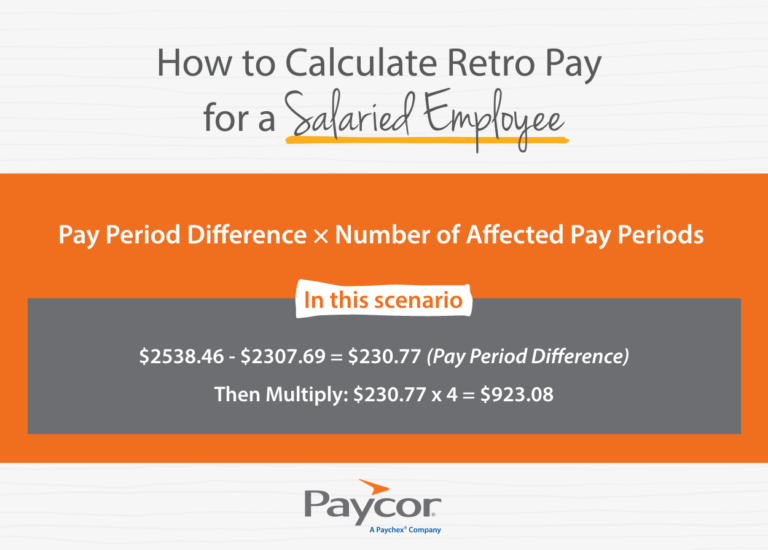

Retro Pay Example 1 (Salary Employee)

Fatima is a salaried employee who was earning $60,000 per year. Effective March 1, her annual salary was increased to $66,000. However, the payroll system wasn’t updated until the end of April, and she continued to receive her old pay for March and April. Fatima is paid biweekly (26 pay periods per year). We need to calculate her retro pay.

Start by determining the retroactive period. In Fatima’s case, this would be the two months in which she received her old pay. If Fatima receives biweekly pay, this amounts to four pay periods.

Then, calculate the difference in pay per pay period by subtracting the old pay amount from what the new pay amount should be.

In this scenario, it looks like this: $2538.46 – $2307.69 = $230.77

Once you have that number, multiply it by four for four pay periods. $230.77 x 4 = $923.08. The figure, $923.08, will be Fatima’s retro pay amount before taxes and deductions.

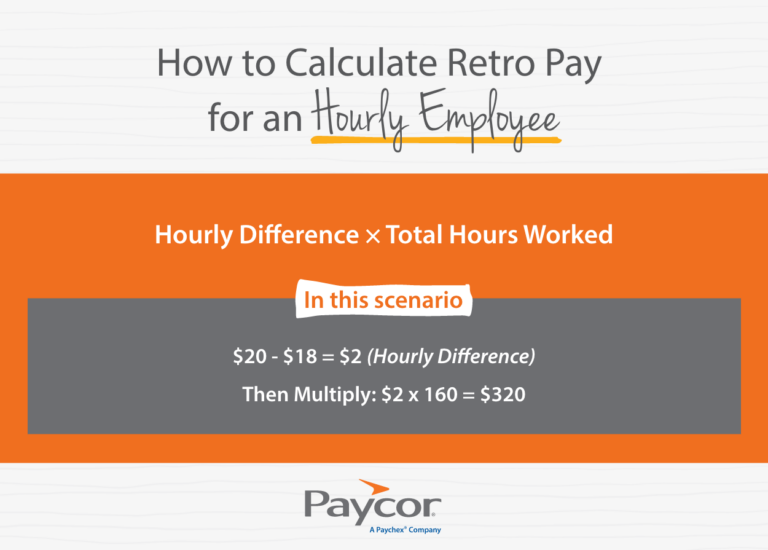

Retro Pay Example 2 (Hourly Employee)

For this scenario, John is an hourly employee earning $18 per hour. Effective June 15, his hourly rate increased to $20 per hour. The payroll change wasn’t implemented until his first paycheck in August. From June 15th to the last pay period in July, John worked a total of 160 hours. We need to calculate his retro pay.

The hourly difference (new rate minus old rate) is $2 per hour. Since we know John worked 160 hours during his retroactive period of June 15 through the last pay period in July, we can multiply 160 by $2.

This results to $320 of retroactive pay before taxes and deductions.

How to Issue Retroactive Payments to Employees

Retro pay can be included in the next regular paycheck or issued as a separate off-cycle payment, depending on company policy and payroll software capabilities. Let the employee know an adjustment has been made and when to expect the payment. Once the payment is issued, update payroll records and maintain documentation for compliance and auditing purposes.

Make Retro Payments Easier with Paycor

Paycor Payroll automates the payroll process, applies accurate tax withholdings, and informs users of any compliance updates. It also reduces the chance for errors that require retro pay by enabling employees to view their paystub up to three days before payday.

Learn why 30,000+ businesses trust Paycor with their payroll needs. Take a guided product tour today.

Retro Pay Frequently Asked Questions

Still have questions regarding retro pay? Read on.

Is Retro Pay Mandatory?

Yes, if an employee was underpaid or owed wages due to payroll errors, raises, or contract changes, retro pay is required by labor laws.

Is Retro Pay Taxed Higher?

No, retro pay is taxed at the same rate as regular wages. It may appear higher if paid in a lump sum, but the tax rate remains the same.

How Long Does Retro Pay Take?

Timing varies by employer, but retro pay is often issued in the next payroll cycle after the error is identified and calculated.