Every job comes with “a hard part.” For HR, letting someone go ranks among the most difficult. Making matters more challenging are the additional responsibilities, including understanding and adhering to state-specific separation notice requirements. A single misstep could result in penalties while leaving a departing employee with a negative experience.

It’s also beneficial for employers to have documentation that might help answer questions about unemployment claims and even possibly prevent a lawsuit.

Separation notices are not only used for terminations. They are an integral part when employees are laid off and even when a worker leaves voluntarily. Knowing what to do in the offboarding process requires precision because, in the case of multi-state businesses, each state that requires separation notices has specific forms and policies. This article explains what a separation notice is, contains details specific to each state, and most importantly, how HR departments can ensure they stay compliant.

What Is a Separation Notice?

A separation notice, also known as a termination letter or separation form, provides important information related to the ending of an individual’s employment. The document presented to the employee when they leave the company often includes details about their final paycheck, benefits continuation (such as COBRA), and, most importantly, instructions on how to file for unemployment benefits.

Pro tip: Use our termination checklist to keep track of important steps during the separation process.

What Are State Separation Notice Requirements?

With no federal mandate on separation notices for all departing employees, many states stepped in to protect the rights of workers. The laws, which included specific requirements, are designed to ensure that separating employees are provided with information about their eligibility for unemployment insurance. These requirements might vary from state to state (e.g., from format of the notice and the timeframe of delivery to the specific information that must be included).

Here’s an example: Some states require employers to provide a notice with specific unemployment benefits, while other states only require a notice that includes a general statement about the availability of unemployment compensation.

State Requirements for Separation Notices

No two states have the same law about separation notices, which presents a significant challenge for businesses that operate in multiple states.

The requirements vary widely and might include details such as:

- Why a separation occurred (quit, layoff, discharge, etc.)

- The effective date of separation

- Name, address, and state unemployment insurance account number for the employer

- Instructions on how to file an unemployment claim

Here is a state-by-state breakdown of the requirements and necessary documents.

| State | State Requirements | Required Documents |

|---|---|---|

| Alabama | Employers are required to notify employees about the availability of unemployment benefits upon separation. | Notice of availability of unemployment compensation (e.g., letter, text, email, or flyer) |

| Alaska | Employers must provide notice about unemployment benefits availability within seven days of the employee’s last day. | Notice to employees |

| Arizona | A printed statement explaining how to file for unemployment benefits must be provided. | UIB-1241A |

| Arkansas | Employers must provide a notice on the availability of unemployment benefits. | State site with forms |

| California | Immediate written notice and specific pamphlets must be provided to employees who are discharged, laid off, or take a leave of absence. | Form DE 2320 – For Your Benefit, Form DE 2515, Form DE 2511 |

| Colorado | Employers must provide a completed form employees can use to apply for unemployment insurance benefits. | Form 22-234 |

| Connecticut | An unemployment insurance separation packet must be given to the separating employee or mailed to their last known address. | UC-21-0924 – Unemployment insurance separation packet |

| Georgia | A separation notice must be given to the employee on their last day of work or mailed within three days. | Form DOL-800 |

| Illinois | Employers must provide a specific form to all employees separated for seven or more days. The form must be delivered on the last day or sent within five calendar days. | Form CLI111L – What Every Worker Should Know About Unemployment Insurance |

| Iowa | When an employee leaves and the employer believes they are not qualified for unemployment benefits, the employer must complete a Notice of Separation form. | Form 60-0154 (Notice of Separation) |

| Louisiana | Employers must provide a specific form within three days after the separation. | Form LWC-77 |

| Maryland | Employers are required to notify separated employees that unemployment benefits may be available. | Employee notification form (document form not specified) |

| Massachusetts | A brochure must be provided to the employee as soon as possible and within 30 days of separation. | Form 0590-A (How to File a Claim for Unemployment Insurance Benefits) |

| Michigan | Employers must provide a specific form to the employee. | Form UIA 1711 (Unemployment Compensation Notice to Employee) |

| Missouri | Employers are required to provide a copy of a specific form to departing employees. | Form M-INF-288-5-AI |

| Nevada | A specific notice must be provided to all departing employees at the time of separation. | Notice DETR-ESD (Employer Notification to Employees of the Availability of Unemployment Compensation) |

| New Jersey | Employers must provide a specific form to employees at the time of separation. | Form BC-10 |

| Pennsylvania | Employers must notify separating employees of the availability of unemployment compensation with a specific form. | Form UC-1609 |

| Rhode Island | Employers must provide notice to separating employees that unemployment benefits are available at the time of separation. | Rhode Island Sample Notice (flyer, text, email, letter, or other communication) |

| South Carolina | A standardized notice detailing UI availability must be provided to all separating employees. | Notice of the Availability of Unemployment Insurance Benefits |

| Tennessee | A specific form must be given to the employee within 24 hours of separation. | Form LB-0489 (Separation Notice) |

| Wisconsin | A printed informational leaflet must be provided to all separated employees. | There is no official form available |

This article is intended for informational purposes only and does not constitute legal information or advice. This information and all HR Support Center materials are provided in consultation with federal and state statutes and do not encompass other regulations that may exist, such as local ordinances. Transmission of documents or information through the HR Support Center does not create an attorney-client relationship. If you are seeking legal advice, you are encouraged to consult an attorney.

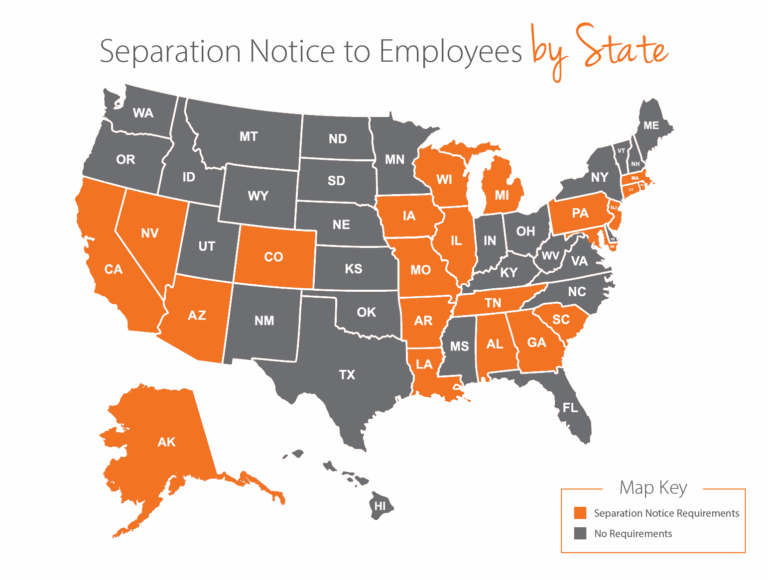

How Many States Have Separation Notice Requirements

As of mid-2025, about 20 states mandate that employers give departing workers a separation notice, often to help with unemployment claims. The remaining states either have no such requirement or require some other form of separation documentation only in specific circumstances. Employers should always check their state’s current rules, since penalties for non-compliance can include fines or delays in unemployment processing for former employees.

Importance of Following State Termination Notice Requirements

Business owners have many challenges; top among those is retention. As of November 2024, more than half of U.S. employees (51%) were either actively searching for or open to new job opportunities (Gallup). With a majority of employees looking elsewhere, it’s important to have a smooth offboarding process, which includes proper separation notices.

Consider the financial risks your business might face, and it becomes very clear why understanding your compliance obligations with state separation notice laws is so important. Failing to manage the offboarding process properly can compound the costs. There are also legal ramifications, including some states that classify non-compliance as a misdemeanor.

To prepare for any situation, it’s a good idea to have an effective employee termination checklist and a termination letter template on hand.

How Paycor Helps You Stay Compliant

Staying up to date with state and federal laws is a full-time job. Paycor’s compliance solutions are designed to automate and simplify these complex processes. Our solutions help you manage the entire employee lifecycle, from hiring to offboarding, by providing the tools that you might need to ensure compliance at every step. This also includes generating required forms and documents, so you can focus on your people rather than on paperwork.

Follow State-by-State Separation Requirements with Ease

Don’t let the complexities of employment law put your business at risk. By leveraging powerful, all-in-one HR software, you can streamline your offboarding process, maintain compliance with state separation notice laws, and protect your company’s bottom line.

Take a guided tour to learn how Paycor can simplify your HR operations and help you stay ahead of compliance challenges.