When it comes to paying out banked PTO, there is no federal law in place that mandates employers to do so upon separation of employment. Instead, it depends on state laws, which vary significantly. Some states mandate the payout of unused PTO upon separation, while others leave the decision up to the employer to dictate in a PTO policy or employee contract.

Managing PTO during the separation of employment is one of the most difficult tasks an HR professional has to do. The laws are different in every state, and they are constantly changing. As an HR professional, it is your responsibility to keep up with these changes and make sure your organization’s policies are compliant. This becomes more complicated for employers who operate in multiple states.

To help manage this complexity, we’ve compiled helpful information to guide you through the process.

What Exactly is PTO?

PTO, or paid time off, is a policy that allows employees to take time away from work while still receiving their regular pay. While employers aren’t required to offer PTO, many do so as a way to attract and retain employees, or simply because they believe it’s the right thing to do.

Paid Time Off (PTO) can be used for a variety of purposes, such as:

- Vacation Days

- Holiday

- Sick time

- Bereavement

- Personal time

- Maternity/paternity leave

When designing PTO policies, employers should consider the benefits of time off, such as increased employee satisfaction, enhanced productivity, and improved recruitment and retention rates.

Some companies distinguish between sick pay and vacation pay, while others consolidate all time off under the umbrella of a paid time off policy. The manner in which your company policy dictates that employees build up their banked paid time off is called accrual.

You can give out all of an employee’s PTO in a lump sum at the beginning of the calendar year, or you can have vacation accrue throughout the year, with employees earning a set number of PTO hours per pay period. It depends on your vacation policy.

You can also require new employees to work a certain number of days (most commonly 90) before they start acquiring PTO, or you can offer PTO immediately as an attractive recruitment incentive.

What is a PTO Payout?

A PTO payout refers to the payment an employee receives for any unused PTO they have accrued upon leaving the company. Whether an employer provides a PTO payout depends on the organization’s policies and the regulations of the state where the employee worked.

Why Do You Need a Clearly Defined PTO Policy?

A clearly defined PTO policy is essential for ensuring consistency, transparency, and fairness within an organization. It helps employees understand how they can earn and use paid time off, prevents misunderstandings or disputes, and ensures compliance with state labor laws.

Not having a straightforward PTO policy in place can be costly. For example, in California, where there is no “use-it or lose-it” policy, this case challenged an employer’s initial decision: McPherson v. EF Intercultural Foundation, Inc.

The employer was sued for unpaid PTO by three employees who worked a combined 40 years for the organization. Instead of receiving the same PTO benefits as salaried employees from the organization, they were given what was called an unlimited amount of PTO. However, they were given times that they could not take off work, so it was not actually unlimited. Due to the nature of their jobs, they only took around two weeks per year.

The employer felt the PTO agreement was a verbal or written agreement through email, but the court found it as an undefined arrangement and ruled in favor of the plaintiffs. They were awarded 20 days of unused vacation time per year of working, which was the maximum amount that the employees who were able to accrue vacation could receive.

PTO Accrual Policy Example

Not sure where to begin with creating a PTO policy? Get started with this accrual policy example.During the first 90 days of employment, a new employee doesn’t accrue PTO. When they complete their 90-day probationary period, they begin to accrue PTO on a pro rata basis per pay period according to the following schedule.

| Time in Service | Annual PTO Accrued |

| 0 – 5 years | 18 days |

| 6 – 11 years | 23 days |

| 12+ years | 28 days |

When building your PTO policy, it’s important to also decide and communicate in advance whether your company will allow PTO to be carried over to the following year, cashed out, or establish a use-it-or-lose-it policy.lace regarding their PTO. If they are part of a union, this will be outlined in their collective bargaining agreement.

What Happens When an Employee Leaves the Company?

If an employee has unused vacation time accrued when they quit, are fired, or otherwise separate from the company, they may be entitled to be paid for that time. Around half of the 50 states have statutes that require companies to pay out employees’ unused PTO time when the employment relationship ends.

These rules differ depending on the state. California, for example, requires all unused PTO, regardless of when it was earned, to be paid out at the employee’s current rate of pay. Several states required earned PTO to be paid to the employee as part of the final wages they receive upon termination of employment. However, states such as North Dakota allow employers to withhold payment of unused accrued PTO if an employee who quits has been employed for less than a year or gave fewer than five days’ notice.

The states that require PTO payout are:

- California

- Colorado

- Illinois

- Indiana

- Louisiana

- Maine

- Maryland

- Massachusetts

- Minnesota

- Montana

- Nebraska

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Rhode Island

- Wyoming

Even if you don’t have a state law on the books requiring it, many people still expect payouts for unused vacation days when they leave a job. If you have a policy, employment contract, or a practice of doing so, you’re required to pay accrued PTO to every employee who leaves the company in their form of wage. That means you can’t arbitrarily pay banked PTO to salaried employees and not to hourly employees; the practice and policy must equally apply to all employees.

At separation, most employers pay out PTO at the employee’s current pay rate, while others use the pay rate the employee was making at the time the paid time off was earned. There may be rules that the employee has to give advanced notice to receive payout for their unused PTO. This is up to the employer, as it is not mandated by law to give notice.

No matter your policy, it’s best to make sure your employees are aware of the laws in place regarding their PTO. If they are part of a union, this will be outlined in their collective bargaining agreement.

Frequently Asked Questions

Whether employees get a PTO payout when quitting depends on a number of factors. See below for quick answers.

Are Companies Required to Pay Out PTO?

This varies by state and the company’s policies. There is no federal law in place requiring PTO to be paid out.

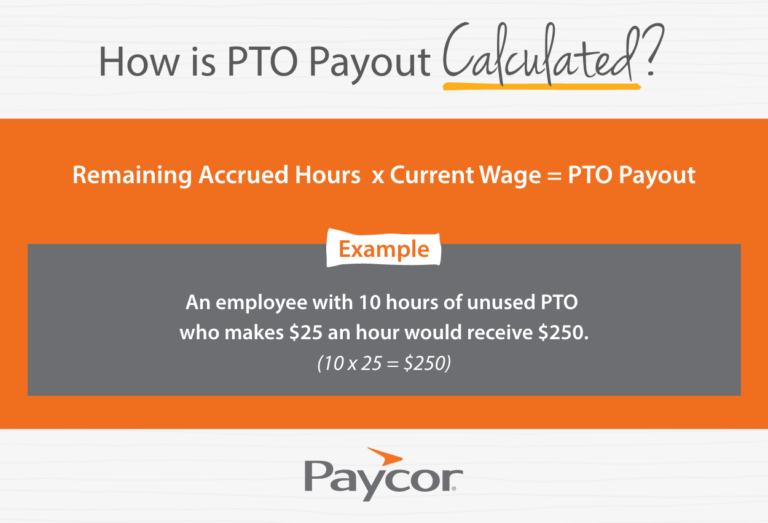

How is PTO Payout Calculated?

PTO payout is calculated by multiplying the remaining accrued hours an employee has by their current wage. For example, an employee with 10 hours of unused PTO who make $25 an hour would receive $250.

Is PTO Payout Taxed at a Higher Rate?

Yes, and this is because the IRS considers it to be supplemental wages since it is a lump sum payment. The supplemental income flat rate tax of 22% applies.

How Can Companies Ensure Compliance with PTO Regulations?

Companies can ensure compliance by regularly reviewing and updating their PTO policies to align with state laws. This may require consulting with legal experts and HR professionals or conducting regular audits.

What Are the Potential Consequences for a Company Not Paying Out Banked PTO?

Failing to pay out banked PTO can result in legal disputes, fines, penalties, and damage to the company’s reputation. Employees may file complaints with labor boards or pursue legal action, leading to costly settlements or judgments.

Can Employers Cap the Amount of PTO that Can Be Paid Out?

Yes, in some states, employers can set a cap on the amount of PTO that can be paid out upon termination, but this must be clearly stated in the PTO policy and comply with state laws.

Are there Exceptions or Special Circumstances where PTO Payout is Not Required?

Yes, exceptions may exist based on state laws or specific employment agreements. For example, some states allow employers to enforce “use-it-or-lose-it” policies, or PTO payout may not be required if the employee was terminated for cause.

How Should PTO Payout Be Handled in Multi-State Companies?

Multi-state companies must comply with the PTO laws of each state where they have employees. This often means having different PTO payout policies based on the state-specific regulations.

Paycor Can Help

Paycor Time helps makes labor management both efficient and cost effective for employers. The system automatically calculates employees’ time off based on unique accumulation rules.

With our flexible mobile application, Paycor Mobile employees can request time off, see how much PTO they’ve accrued, and easily access employer PTO policies. Employees can also review schedules, clock in and out with ease, and view pay stubs all from one place.

The best part is Paycor stays on top of compliance, so you don’t have to worry about it. Whether it’s applying local, state, and federal tax rate updates or maintaining benefits administration compliance, Paycor protects your company from risk, enabling leaders to focus more on growing the business and building a high-performing culture. Take a product tour today.