Determining salary ranges plays a big part in compensation planning, and taking your time to get it right will pay off long-term. The job market has been extremely volatile but after record unemployment, we’re now seeing record job postings and a true battle for talent. You shouldn’t miss out on hiring a great employee because you aren’t paying enough for a position. When you start to establish compensation ranges, it’s important that HR leaders and CFOs work together with the realization that salary pay scale is one of the key drivers of recruiting and retention.

What Is a Salary Range?

A salary range is the calculated difference between a minimum and maximum base salary that a company is willing to pay for a specific job or job family.

How Does a Salary Range Work?

Salary ranges are used to help companies set and stick to workforce budgets and enable job candidates or current employees to understand the payscale of a job posting.

How to Determine Salary for a Position

Properly defined pay ranges not only help ensure you’re paying employees fairly but can also be used during salary negotiation, budget planning and to control labor costs. Check out these 8 steps for developing a formal salary structure:

- Do You Want to Lead, Lag or Match?

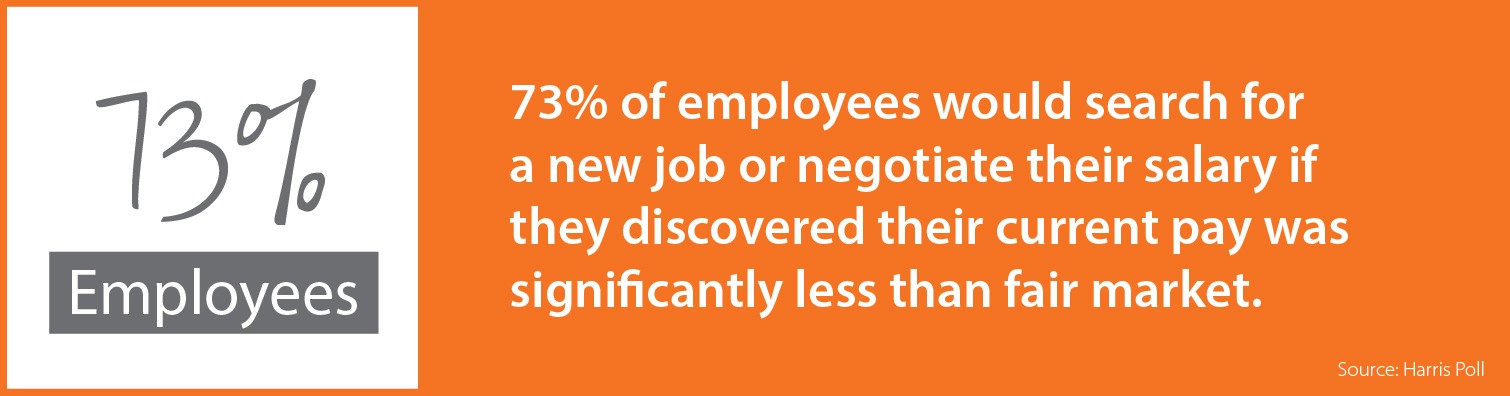

When you’re a market leader, top talent will view your company as a popular one. If you decide you just want to match the market, you’ll simply pay the same as your competitors. If you’re lagging, it’s probably not intentional—at least it shouldn’t be. Oftentimes you discover you’re behind the curve when you conduct a salary survey or wage analysis by taking time to review your current pay scale as compared to your competitors and the local market.

- Review Job Descriptions

This can be a tedious process but it’s important for HR leaders to work with managers and employees to find out what they really do on a day-to-day basis. Conducting an online survey is an efficient way to ask your workforce to define all aspects of their jobs. Then you can build official job descriptions and determine salary by job based on the feedback.

- Rank the Job Positions

Once you have the updated job descriptions, evaluate each one by type of job and organize them by relative worth and responsibility. Some of the more common ways to classify are:

- Ranking — The ranking method categorizes job roles based on the overall value and complexity within your organization.

- Points — The points method is more complex and uses a predetermined scale (e.g., 1-10) for the importance of key job elements. Jobs are scored based on the total number of points, and minimum pay rates are assigned accordingly.

- Classification — This system categorizes comparable job content and value (such as executive, managerial, skilled and semi-skilled labor). This method works well for larger organizations and puts jobs of the same class into similar compensation packages.

- Conduct Market Research

Use a compa-ratio to determine which employees are being paid below or above average for their pay range. The U.S. Bureau of Labor Statistics is a great place to start your research, but don’t ignore salary calculators or popular salary information websites/apps such as Glassdoor and Indeed. You can be sure that anyone applying for a job at your company is checking the salary intel that others post online. It’s important to make sure that you’re comparing apples to apples when you’re in this phase. The tasks, functions and level of responsibility should closely match.

- Create Pay Grades

Use either your job evaluation data or market data to group job positions by similar salary survey data. Note the starting salary, highs and lows to more easily determine how you want to position your company in the market. Each group of job positions with similar market salaries makes up a salary grade. A small business may only have three or four pay grades while a large company could have dozens.

- Create Salary Ranges within Pay Grades

For each pay grade you will need to create a minimum, midpoint and maximum pay range. You won’t find hard and fast rules for these ranges, so it’s up to your company to determine. A traditional salary range spans about 30%. So, if you use a midpoint salary as your base (ex. $50,000), you’d then multiply it by 1.15 to get the maximum range ($57,500) and .85 for the minimum ($42,500).

- Make Adjustments for Existing Employees

When it comes time to compare the salaries of your current employees to the salary ranges you’ve just established, it’s inevitable that you’ll discover some are paid more or less than the new ranges dictate. If some of your employees’ salaries fall below the new salary threshold, you have the option to increase their pay.

If you’re paying an employee a salary that’s above a pay grade, you have a few options. One is to forgo the next scheduled raise and instead give that employee a bonus. That way you’re not raising the base salary even higher. Or you could consider promoting the employee to the next pay grade. Of course, you always have the option to reduce their base pay or make them ineligible for future increases, but that’s not going to be viewed as a popular decision and would clearly have a negative impact on morale and engagement.

- Monitor and Update

Salaries always fluctuate, so it’s important to ensure you continue to monitor the market. This doesn’t mean you have to conduct salary surveys every year, but if there are significant economic changes, it likely will be worth an evaluation.

What Goals Can Salary Ranges Help You Achieve?

Having salary ranges in place can help build a desirable work culture when you pay employees commensurate with their skill levels.

Additional Benefits and Perks

While sticking to your established salary range is important to help ensure you stay on budget, you may want to consider adding additional perks in order to attract the right candidate. Offering benefits such as tuition reimbursement, mentoring, professional development courses, childcare, wellness credits and flexible schedules can be more attractive than a higher salary to some people. This is even more important when you have a remote-first workforce.

About Paycor

Paycor builds HR solutions for leaders. With Paycor, you can modernize every aspect of people management, from the way you recruit, onboard and develop your team, to the way you pay and retain them. See how Paycor can help the leaders of your organization solve the problems of today and tomorrow.