In any organization, the people are the strongest asset. As such, businesses must treat their workforce as a value-driver rather than a cost center. Through human capital management (HCM), companies can ensure they:

- Hire the best talent

- Onboard effectively

- Promote employee growth

- Improve productivity

- Retain employees

Read on to learn more about what HCM is in a business context, why it matters, and how HCM software simplifies and optimizes people management.

What is Human Capital Management?

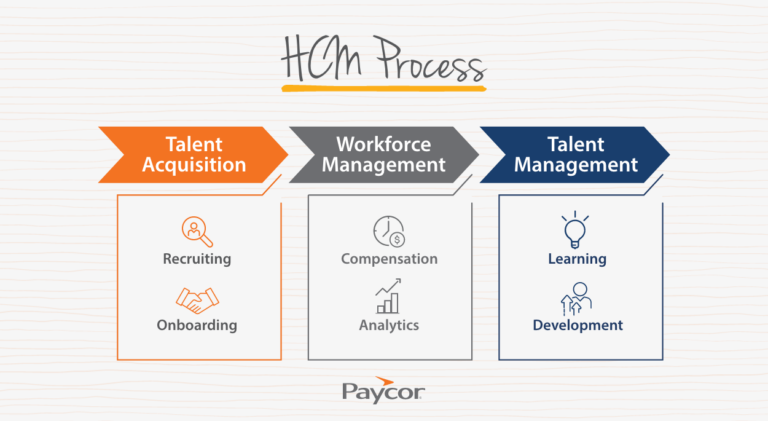

HCM refers to the set of practices an organization uses to acquire, train, manage, develop, and retain employees. HCM focuses on maximizing each step of the employee lifecycle, turning traditional HR tasks into opportunities to improve operations.

According to Schroders’ research, in partnership with Saïd Business School, the University of Oxford, and the California Public Employees’ Retirement System, effective human capital management can lead to improved outcomes.

What Are the Key Components of HCM?

HCM involves the entire employee lifecycle, from workforce acquisition to performance management. Every standard HR practice, such as payroll, scheduling, and benefits administration, is a part of HCM and presents an opportunity to invest in employees and your company.

Key functions of HCM include:

- Talent acquisition: Recruiting the right candidates and streamlining the hiring process.

- Onboarding: Ensuring smooth integration of new hires with tools for training and engagement.

- Performance management: Monitoring and evaluating employee performance to drive productivity.

- Talent management: Identifying, developing, and retaining high-potential employees while planning succession strategies and career paths.

- Learning and development: Offering continuous professional development opportunities to foster growth and skill-building.

- Compensation and benefits: Managing payroll, benefits, and rewards to retain employees and maintain satisfaction.

- Workforce planning: Using analytics to forecast workforce needs and optimize team makeup.

Why is Human Capital Management (HCM) Important?

Organizations with robust HCM practices consistently outperform their competitors by aligning workforce capabilities with business objectives. When you actually invest in your people—making sure their skills line up with what the business needs—you see real results: higher productivity, more creative ideas, and a team that’s quick to respond when the market shifts.

- Better HCM means you attract and keep top talent, instead of losing them to the competition.

- Smart people management helps keep employees engaged and motivated, which usually means less turnover.

- With strong HCM, you can spot skill gaps early and train people up before it becomes a problem.

- Good HCM practices can help you adapt faster to change—whether that’s new technology, regulations, or shifting customer needs.

- It also builds a healthier, more inclusive culture, which is the kind of thing that pays off in the long run.

Challenges of Human Capital Management

Managing people isn’t simple. Companies run into plenty of hurdles when it comes to building and supporting a strong team. Some of the most common challenges include:

- Talent Acquisition and Retention: Finding skilled candidates and convincing them to stick around is tough, especially with so much competition for top talent. Even if you hire the right people, keeping them engaged for the long haul is no small feat.

- Employee Engagement: Motivating employees and making sure everyone feels connected and invested in the company’s goals takes ongoing effort. Disengaged teams can lead to lower productivity and high turnover.

- Skills Gaps and Training: Technology and business needs move fast, but keeping employees’ skills up to date doesn’t always keep pace. Identifying what’s missing and filling those gaps quickly is a constant challenge.

- Diversity, Equity, and Inclusion (DEI): Building a workplace that’s truly inclusive means more than just good intentions. It requires actively addressing biases and making sure hiring, promotions, and everyday practices are fair for everyone.

- Workforce Planning: Predicting what kind of talent your company will need down the line is complicated, especially when the market is unpredictable and business priorities keep shifting.

- Compliance and Regulation: Labor laws, benefits regulations, and industry rules are always evolving. Staying compliant, especially across multiple locations, takes vigilance and a solid system for tracking changes.

How HCM Software Can Help

The right Human Capital Management (HCM) software can make these challenges a lot more manageable. Here’s how:

- Streamlined Talent Acquisition and Retention: AI-powered recruiting tools help pinpoint great candidates faster, while applicant tracking systems simplify hiring from start to finish. Onboarding modules help new hires feel welcome and ready to contribute, and performance tracking tools support career growth to boost retention.

- Boosting Employee Engagement: Modern HCM platforms come with feedback and recognition features, so managers can check in regularly and celebrate wins. Real-time dashboards highlight engagement trends, making it easier to spot issues early. Built-in communication tools help keep everyone connected, even across remote teams.

- Closing Skills Gaps with Training: HCM systems use HR analytics and people analytics to identify where skill gaps exist and deliver targeted training right where it’s needed. Learning management features help you offer soft skills training, track participation, and measure progress so employees—and their skills—don’t fall behind.

- Advancing Diversity, Equity, and Inclusion: Advanced reporting tracks diversity data across hiring, promotions, and pay. Bias-reduction tools help make evaluations fair, and policy management features ensure DEI initiatives are actually put into practice.

- Simplifying Workforce Planning: Predictive analytics in HCM software can forecast future hiring needs based on business objectives, HR goals, and turnover trends. Succession planning tools help identify future leaders and support their development for critical roles.

- Ensuring Compliance and Regulation: Automated compliance tracking monitors changing regulations and notifies HR when action is needed. Audit trails document every HR decision, and standardized workflows help make sure company policies are applied the same way everywhere.

What Is HCM Software?

The main vehicle for human capital management that transforms HR functions into strategic advantages is an HCM platform. HCM technology integrates and automates all HR processes into a single platform, eliminating the time spent logging into various point solutions that create data silos.

From recruiting and onboarding to payroll, performance management, and employee development, HCM software streamlines the entire employee lifecycle. An all-in-one HCM platform enables HR teams to manage people-related tasks more efficiently, reducing manual workload and administrative errors.

According to HG Insights, nearly 2 million companies in the United States spend $13.3 billion on HCM software, and this is only expanding. The market report, released in May 2024, predicts 362,000 companies will spend $34.3 billion globally on HCM solutions in the next 12 months.

With the rise of remote and hybrid work creating distributed teams, the need for improved compliance management for rapidly changing regulations, and a growing focus on professional development, HCM software is a necessity for businesses of all sizes. Its ability to centralize data, improve decision-making, and enhance employee experience makes it a must-have tool for organizations looking to stay competitive in today’s fast-paced business environment.

What Are the Benefits of HCM Software?

HCM software offers a wide array of benefits that help businesses streamline HR processes and elevate their workforce management strategies. Key advantages include:

Efficiency and Automation

HCM software automates repetitive administrative tasks, reducing manual errors and freeing up time for human resource professionals to focus on employee development and other strategic initiatives.

Improved Employee Experience

With self-service capabilities, employees can easily manage their personal information, request time off, and enroll in benefits, leading to increased satisfaction and engagement.

Enhanced Talent Management

HCM platforms bring together recruitment, onboarding, performance management, and employee development in one place. This enables organizations to hire the right people and provide them with the tools to grow, improving retention and overall performance.

Data-driven Insights

HCM software collects and analyzes data in real-time, giving businesses the ability to make informed decisions about workforce planning, budgeting, and more.

Scalability and Adaptability

As businesses grow, HCM software scales with them, allowing companies to adapt quickly to changing workforce needs without overhauling their HR systems.

Compliance Management

HCM solutions help organizations stay compliant with evolving labor laws and regulations, minimizing the risk of non-compliance penalties.

How to Choose Human Capital Management Software

The right HCM software depends on your budget, company size, and desired features. When evaluating vendors, look for a platform that offers all the core tools your HR team relies on, such as payroll, time tracking, benefits administration, and performance management. The system should be intuitive enough for both HR professionals and employees to use with minimal training.

It’s also important to choose software that can grow with your business. Whether you’re planning to expand your team or need more advanced functionality in the future, scalability ensures you won’t outgrow the human capital management system.

In addition, consider:

- Reporting and analytics capabilities

- Platform compliance and security

- Integrations

- Onboarding and customer support

Best Practices for Implementing HCM Software

Successfully implementing HCM software requires careful planning and execution to maximize its benefits. Implementation best practices include:

Define clear objectives

Before selecting an HCM platform, identify your organization’s key HR challenges and set clear goals for how the software will address them. Whether you aim to streamline recruitment, enhance compliance, or improve employee engagement, aligning the software’s capabilities with business objectives is critical.

Involve key stakeholders

Engage the HR and IT departments, as well as other department leaders, in the selection and implementation process. Their insights help ensure the software meets the needs of various teams.

Ensure data accuracy

Give yourself a fresh, error-free start by cleaning and validating employee data before transferring it to the HCM platform.

Prioritize training

Ensure all HR professionals and employees receive adequate training on how to use the new system. A well-informed team will adopt the software faster, leading to higher efficiency and user satisfaction.

Customize for your business

Many HCM platforms offer customizable options. Tailor the system to match your organization’s specific workflows and processes for a more seamless experience.

Monitor and evaluate

After implementation, continuously monitor system performance and collect feedback from users. Regularly review metrics such as employee engagement, operational efficiency, and compliance to assess the system’s effectiveness and make necessary adjustments.

How Paycor’s Software Helps You with Human Capital Management

Paycor’s HCM software helps modernize people management for 30,000+ organizations. The unified platform streamlines and optimizes every aspect of the employee lifecycle, from talent acquisition and training to payroll and benefits administration.

Among its robust features are:

- HR + Payroll: Drive efficiencies with software that streamlines payroll, reduces tax compliance risk, and enables employees to self-service time off requests, contact information changes, and more.

- Talent Acquisition: Discover new candidates, quickly fill open positions, and provide engaging onboarding with software that leverages AI to automate sourcing and increase candidate diversity.

- Talent Management: Create an exceptional workplace where employees thrive, contribute, and succeed together with talent management solutions that include a learning management system, talent development, and compensation management for pay increases and bonuses.

- Workforce Management: Integrated time and advanced scheduling features enable companies to manage labor costs, automate scheduling tasks, minimize compliance risks, and ensure optimal coverage at all times.

- Benefits Administration: Build a comprehensive benefits plan that attracts and retains top talent while simultaneously simplifying benefits administration.

- Compliance Solutions: Reduce risk, save time, and simplify compliance management. Paycor’s compliance experts help customers stay ahead of changing regulations.

With Paycor, companies not only improve operational efficiency, but also foster a more engaged, productive, and satisfied workforce. Ready to see how an all-in-one HCM platform can benefit your business? Take a guided tour today.

Human Capital Management FAQs

Still have questions regarding human capital management? Here are some answers to frequently asked questions.

How Do You Build Human Capital?

Human capital refers to the people in your organization. Human capital is built through recruiting and onboarding, then nurtured by investing in employee development, offering training and upskilling opportunities, promoting internal mobility, and creating a supportive work environment.

What is the Goal of Human Capital Management?

The goal of human capital management is to maximize the value of employees by aligning workforce capabilities with business goals.

Is Human Capital Management the Same as HR?

While closely related, HCM and HR have different approaches. Traditional HR focuses on administrative roles and responsibilies ike payroll, benefits, and compliance. HCM takes a strategic approach, viewing employees as valuable assets and using data-driven insights to optimize workforce performance, engagement, and development. HCM encompasses HR functions, but expands them into strategic business advantages that drive competitive positioning and measurable outcomes.

What’s the Difference Between HCM and HRMS?

HCM is a comprehensive strategy for managing people, while HRMS (Human Resource Management System) is the technology that supports HR functions like payroll, benefits, and records.

Note: Both of these systmes are also different from an HRIS.

Does Human Capital Management Include Payroll?

Yes, HCM includes payroll as part of its core functionality.

Can Human Capital Management Reduce Turnover Rate?

Yes, HCM can help lower turnover rates by improving employee engagement, development, and satisfaction.

How Do You Measure the Success of a Human Capital Management Strategy?

Track metrics like employee retention, engagement scores, time-to-fill positions, training completion rates, and overall workforce productivity.