Minimum Wages by State: A Complete Guide for 2026

Minimum wage laws are complicated, and they’re constantly changing. If your company has employees in multiple states, keeping up with these updates can be daunting. While some states are on a schedule for annual increases to eventually reach $15 an hour, others still adhere to the federal minimum.

Here’s what you need to know about the federal minimum wages—and the minimum wage rates by state—in 2026.

What is the Federal minimum wage?

The federal minimum wage in the United States is $7.25 per hour.

This wage is mandated by the Fair Labor Standards Act (FLSA), which sets standards for wages and overtime pay for most private and public sector employees. These employees are referred to as “covered nonexempt workers.” Provisions of the FLSA apply in states that have not enacted their own minimum wage laws (e.g., Alabama, Louisiana, Mississippi, South Carolina, and Tennessee) or in states where the local law sets a minimum wage below the federal rate (Georgia and Wyoming).

How Often Does the Federal Minimum Wage Increase?

Unlike the minimum wage in many states, the federal minimum wage is not indexed to inflation. This means it doesn’t automatically adjust each year to account for changes in the cost of living. For the federal minimum wage to increase, Congress must act to send legislation to the president to sign into law.

Since the minimum wage floor was introduced at 25¢ an hour in 1938, lawmakers have approved 22 increases, typically spaced anywhere from one to ten years apart. The most recent adjustment took effect on July 24, 2009, raising the rate to $7.25 per hour. As of 2026, this marks the longest stretch in the law’s history without an update. Until Congress acts again, the federal minimum wage will remain frozen at its current level.

To help your business follow the latest minimum wage requirements for full-time and part-time workers, Paycor has created a breakdown. See below for a list of minimum wages by state.

2026 Minimum Wages By State

The below minimum wages reflects the most current information from official state and federal labor departments, including the U.S. Department of Labor and the National Conference of State Legislatures.

| State | 2026 Minimum Wage (effective 1/1/26 except as noted) | 2025 Minimum Wage |

| Alabama*** | $7.25 | $7.25 |

| Alaska | $14.00 (effective July 1, 2026) | $13.00 |

| Arizona | $15.15 | $14.70 |

| Arkansas* | $11.00 | $11.00 |

| California** | $16.90 (Wage by city in California) | $16.50 |

| Colorado** | $15.16 | $14.81 |

| Connecticut | $16.94 | $16.35 |

| Delaware* | $15.00 | $15.00 |

| Florida | $15.00 (effective Sept. 30, 2026) | $14.00 |

| Georgia† | $7.25 | $7.25 |

| Hawaii | $16.00 | $14.00 |

| Idaho* | $7.25 | $7.25 |

| Illinois | $15.00 | $15.00 |

| Indiana* | $7.25 | $7.25 |

| Iowa* | $7.25 | $7.25 |

| Kansas* | $7.25 | $7.25 |

| Kentucky* | $7.25 | $7.25 |

| Louisiana*** | $7.25 | $7.25 |

| Maine | $15.10 | $14.65 |

| Maryland** | $15.00 | $15.00 |

| Massachusetts* | $15.00 | $15.00 |

| Michigan | $13.73 | $10.56 |

| Minnesota | $11.41 | $11.13 |

| Mississippi*** | $7.25 | $7.25 |

| Missouri | $15.00 | $13.75 |

| Montana | $10.85 | $10.55 |

| Nebraska | $15.00 | $13.50 |

| Nevada* | $12.00 | $12.00 |

| New Hampshire* | $7.25 | $7.25 |

| New Jersey | $15.92 for businesses with 6 or more employees $14.23 – businesses with fewer than 6 and seasonal employees | $15.49 for businesses with 6 or more employees $13.73 for businesses with fewer than 6 and seasonal employees |

| New Mexico* | $12.00 | $12.00 |

| New York** | $17.00 (New York City, Long Island and Westchester) $16.00 (Rest of the state) | $16.50 per hour (New York City, Long Island and Westchester County) $15.50 per hour (rest of the state) |

| North Carolina* | $7.25 | $7.25 |

| North Dakota* | $7.25 | $7.25 |

| Ohio | $11.00 | $10.70 |

| Oklahoma* | $7.25 | $7.25 |

| Oregon** | $16.30 (Portland metro); $15.05 (standard); $14.05 (non-urban) | $14.70 |

| Pennsylvania* | $7.25 | $7.25 |

| Rhode Island | $16.00 | $15.00 |

| South Carolina*** | $7.25 | $7.25 |

| South Dakota | $11.85 | $11.50 |

| Tennessee*** | $7.25 | $7.25 |

| Texas* | $7.25 | $7.25 |

| Utah* | $7.25 | $7.25 |

| Vermont | $14.42 | $14.01 |

| Virginia | $12.77 | $12.41 |

| Washington | $17.13 | $16.66 |

| Washington, D.C. | $17.95 | $17.50 |

| West Virginia* | $8.75 | $8.75 |

| Wisconsin* | $7.25 | $7.25 |

| Wyoming† | d | $7.25 |

* No change from 2024 has been announced.

** Varies by geographical location within the state.

*** State does not have local minimum wage regulations, and instead adheres to federal minimum wage laws.

† State minimum wage is lower than the federal minimum wage. Most – but not all – employees are paid according to federal regulations.

Analysis of Minimum Wages by State

Over the past decade, there’s been clear movement toward a higher minimum wage across the country. According to the Economic Policy Institute’s Minimum Wage Tracker, 28 states and Washington D.C. have changed their minimum wage law since January 2014. Thirty states and Washington D.C. have adopted a minimum wage higher than the federal minimum wage. In addition, 63 localities have adopted minimum wages above their state minimum wage.

This steady increase reflects a growing recognition that the federal minimum wage of $7.25, set in 2009, is no longer sufficient to provide an adequate standard of living for many workers. The minimum wage is indexed for inflation in 19 states and Washington D.C., meaning it automatically adjusts each year for increases in prices. As state legislatures respond to pressure from labor advocates and their constituents, we’re likely to continue seeing an upward trend in minimum wage rates.

U.S. States with the Highest Minimum Wage

Washington, D.C. leads the nation with $17.95 per hour (effective July 1, 2025).

The top 5 other states with the highest minimum wage include:

- New York: $17.00 (in NYC, Long Island, & Westchester), $16.00 (rest of state)

- Connecticut: $16.94

- California: $16.90

- Hawaii: $16.00

- Rhode Island: $16.00

What’s the Highest Minimum Wage in the United States?

As of 2026, the single highest locally mandated minimum wage in the United States is in Tukwila, Wash., where all covered employers must pay at least $21.65 per hour. Close behind are Burien, Wash., at $21.63 for large employers and Renton, Wash., at $21.57 for large employers (with midsize employers reaching the same rate mid-year).

Seattle now requires $21.30 for all employers, continuing its annual inflation-based adjustment. Among statewide or district-wide rates, the leader remains the District of Columbia at $17.95 per hour, effective July 1, 2025, which still exceeds every state but falls below Washington’s top local ordinances.

U.S. States with the Lowest Minimum Wages

The states with the lowest minimum wages are Georgia, Wyoming, and Oklahoma. Georgia and Wyoming both list $5.15 per hour as a minimum wage, but this only applies to employers not covered by the Fair Labor Standards Act (FLSA).

Similarly, Oklahoma’s state minimum wage is $2.00 for very small employers, though most businesses are also covered by the FLSA.

This means even though Georgia, Wyoming, and Oklahoma are the states with the lowest listed minimum wages, the federal minimum wage of $7.25 takes precedence for most workers.

Beyond these three states with the lowest listed minimum wages, there are others that either don’t set a statewide minimum wage at all or have set theirs at the federal level of $7.25 per hour.

States with no statewide minimum-wage law

- Alabama ($7.25)

- Louisiana ($7.25)

- Mississippi ($7.25)

- South Carolina ($7.25)

- Tennessee ($7.25)

States whose minimum wage equals the federal Minimum wage

- Idaho ($7.25)

- Indiana ($7.25)

- Iowa ($7.25)

- Kansas ($7.25)

- Kentucky ($7.25)

- New Hampshire ($7.25)

- North Carolina ($7.25)

- North Dakota ($7.25)

- Pennsylvania ($7.25)

- Texas ($7.25)

- Utah ($7.25)

- Wisconsin ($7.25)

Which State Has the Lowest Minimum Wage in the United States?

Technically, the answer is Oklahoma. The state allows very small employers (fewer than 10 full-time workers or less than $100,000 in annual sales) that aren’t covered by the Fair Labor Standards Act (FLSA) to pay as little as $2.00 an hour—the lowest statutory minimum wage in the nation. In practice, however, most Oklahoma employees are covered by the FLSA and therefore must still receive at least the federal $7.25 an hour.

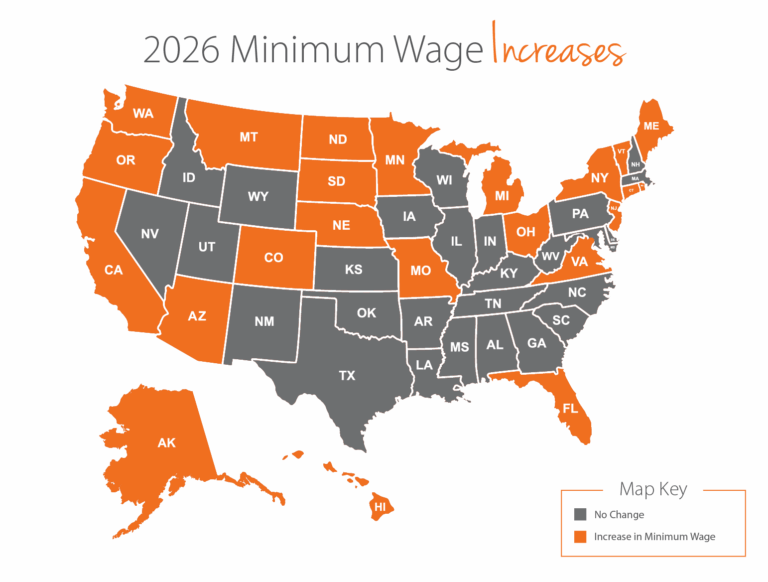

Which States Are Increasing the Minimum Wage in 2026?

More than 23 states have announced minimum wage increases for 2026, as shown in the minimum wage by state map. These states are:

- Alaska

- Arizona

- California

- Colorado

- Connecticut

- Florida

- Hawaii

- Maine

- Michigan

- Minnesota

- Missouri

- Montana

- Nebraska

- New Jersey

- New York

- Ohio

- Oregon

- Rhode Island

- South Dakota

- Vermont

- Virginia

- Washington

- Washington, D.C.

In most of these states, the minimum wage is scheduled to increase on January 1, 2026.

Fast Food Minimum Wage in California

As of April 1, 2024, under Assembly Bill 1228, every “fast food restaurant employee” who works for a limited-service chain with ≥60 locations nationwide must be paid at least $20.00/hour statewide. That rate remains in force with no plans for an increase in 2026.

The law also created a Fast Food Council that can adjust the rate each January 1, but any hike is capped at the lower of 3.5% or the annual CPI change. Discussions about a $0.70 cost-of-living adjustment (to $20.70) occurred in 2025, yet the council did not finalize that change. Employers must continue paying at least $20.00 per hour to covered fast-food employees statewide.

Washington D.C. Minimum Wage

| Period | Standard (non-tipped) wage | Tipped-employee* base wage | Authority |

| Through June 30, 2025 | $17.50/hr | $10.00/hr | Fair Shot Minimum Wage Amendment Act of 2016 |

| Starting July 1, 2025 | $17.95/hr | $10.00/hr | D.C. Department of Employment Services notice |

The District sets its own wage floor and adjusts it every July 1 based on changes in the Consumer Price Index (CPI). The 2025 CPI produced a 45-cent increase, bringing the general minimum wage to $17.95 per hour. Employers must pay at least this amount to all non-exempt workers for every hour worked in the District.

*Under Initiative 82’s tip-credit phase-out, the tipped base wage rises each July 1 until it matches the regular minimum wage in 2027; employers must always top up tipped employees’ pay so that tips + base wage ≥ the full minimum wage.

How Paycor Helps You Monitor Minimum Wages by State

Paycor’s human capital management software provides a centralized, automated system to help with wage compliance. Key features include:

- Compliance Dashboard: Provides timely notifications about regulatory changes that could impact your workforce, including minimum wage shifts.

- Multi-Jurisdiction Support: Handles complex calculations for numerous state and local jurisdictions, flagging potential compliance issues before they become problems.

By automating these critical functions, Paycor helps businesses stay ahead of evolving regulations and reduce administrative burden.

Use Paycor to Supply Minimum Wages Correctly

Ready to take the guesswork out of minimum wage compliance? Stay ahead of minimum-wage hikes by letting Paycor do the heavy lifting. See how Paycor’s compliance solution and payroll software keep paychecks in line with federal, state, and local laws—automatically.

Take a quick product tour today.

Paycor is not a legal, tax, benefit, accounting, or investment advisor. All communication from Paycor should be confirmed by your company’s legal, tax, benefit, accounting, or investment advisor before making any decisions.

Federal and State Minimum Wage FAQs

Get quick answers to your additional minimum wage questions.

Is the Federal Minimum Wage Rising in 2026?

No. The federal minimum wage remains at $7.25 per hour in 2026. This rate has been static since 2009.

Who does minimum wage apply to?

Minimum-wage laws cover almost every non-exempt employee working for an employer subject to the Fair Labor Standards Act—which includes most businesses engaged in interstate commerce or with at least $500K in annual sales—plus their state or local counterparts. Exempt groups (e.g., bona-fide executives, many salaried professionals, outside salespeople, certain seasonal/recreational workers, and independent contractors) are not entitled to the minimum wage.

Which States Have an Upcoming Increase to $15 Minimum Wage?

The following states have passed legislation to reach a $15 minimum wage in 2026.

- Arizona

- Colorado

- Florida

- Hawaii

- Maine

- Missouri

- Nebraska

- New Jersey

- Oregon

Which States Have a Minimum Wage Higher than $15 an Hour?

| State | 2026 rate | Effective date |

| Arizona | $15.15/hr | Jan 1, 2026 |

| California | $16.90/hr | Jan 1, 2026 |

| Colorado | $15.16/hr | Jan 1, 2026 |

| Connecticut | $16.94/hr | Jan 1, 2026 |

| Delaware | $15.00/hr | Already in effect |

| Florida | $15.00/hr | Sept 30, 2026 |

| Hawaii | $16.00/hr | Jan 1, 2026 |

| Illinois | $15.00/hr | Already in effect |

| Maine | $15.10/hr | Jan 1, 2026 |

| Maryland | $15.00/hr | Already in effect |

| Massachusetts | $15.00/hr | Already in effect |

| Missouri | $15.00/hr | Jan 1, 2026 |

| Nebraska | $15.00/hr | Jan 1, 2026 |

| New Jersey | $15.92/hr (large employers), $15.23/hr (seasonal and small business employees), $14.20/hr (agricultural workers) | Jan 1, 2026 |

| New York | $17.00/hr in NYC/Long Island/Westchester and $16.00/hr in the rest of the state | Jan 1, 2026 |

| Oregon | $15.05/hr (standard state rate) | Already in effect |

| Rhode Island | $16.00/hr | Jan 1, 2026 |

| Washington | $17.13/hr | Jan 1, 2026 |

| Washington, D.C. | $17.95/hr | Already in effect |

Which States Are Moving to $15+ Minimum Wage?

For 2026, the new states scheduled to have a $15 minimum are Missouri, Nebraska, and Florida

What are some state-by-state minimum wage exemptions?

| State | Key exemption (or special rate) | How it works |

| Oklahoma | $2.00 /hr “micro-employer” rate | Businesses with fewer than 10 full-time workers or under $100K in annual sales that are not covered by the FLSA may pay as little as $2.00. |

| Montana | $4.00 /hr small-business rate | Non-FLSA employers whose gross sales are ≤$110,000 a year can use this sub-minimum instead of the regular state wage. |

| Minnesota | Training wages | Youth under 20 can earn $9.31/hr for their first 90 days. |

| Delaware | 90% youth/training wage & occupational exemptions | New hires under 18—or any new employee’s first 90 days—may be paid at 90 % of the state minimum. Agriculture, domestic service, outside sales, fishing crews, etc., are fully exempt. |

| California | No tip credit; $20 fast-food wage | Statewide law bans sub-minimum tip credits, and chains with ≥ 60 U.S. locations must pay at least $20.00/hr (airports & stadiums are exempt). |

| Georgia & Wyoming | $5.15 /hr state minimum | This rate applies only to employers not covered by the FLSA; nearly everyone else defaults to the federal $7.25. |

What are some exemptions of minimum wage for certain types of workers?

Common worker-type exemptions written into federal and (often) state wage laws:

- Tipped employees: May be paid a cash wage as low as $2.13/hour if tips raise total pay to at least the full minimum.

- Youth under 20: Can receive a training wage of $4.25/hour for their first 90 calendar days with an employer.

- Full-time students: Employers holding a DOL certificate may pay up to 85% of the regular minimum for students in retail, service, ag, or higher-ed jobs.

- Student-learners/apprentices: Those enrolled in accredited vocational programs may earn 75% of the minimum under a special certificate.

- Workers with disabilities: Workers with Section 14(c) certificates are permitted “commensurate wages” based on measured productivity.

- Certain job categories fully exempt from the minimum wage: Workers such as small-farm agricultural hands, seasonal amusement-park employees, outside salespeople, and newspaper deliverers.

What Is the New Minimum Wage for Federal Contractors?

The minimum wage for federal contractors in 2025 is $13.30 an hour ($9.30 for tipped workers).

- On March 14, 2025, Executive Order 14236 revoked EO 14026, the Biden-era order that had pushed the federal-contractor wage to $17.75. The U.S. Department of Labor has stopped enforcing EO 14026.

- With EO 14026 gone, the older EO 13658 rate governs covered service- and construction-contract work. DOL’s September 30, 2024, notice set that rate at $13.30 per hour (and $9.30 for tipped employees) effective January 1, 2025.

Unless a contract or a higher state/local law specifies otherwise, federal contractors must now pay at least $13.30 per hour to workers performing on or in connection with EO 13658-covered agreements.

What Are Compliance Requirements for Businesses Operating in Multiple States?

An employer must pay the highest minimum wage rate that applies to an employee based on their work location. This requires tracking federal, state, and local wage laws across all jurisdictions where you have employees.

What Is the Difference between Federal and State Minimum Wage?

The federal minimum wage is the nationwide pay floor established by the Fair Labor Standards Act. State (and sometimes city or county) minimum wages are separate laws that can set a higher—or occasionally lower—rate and may include their own indexing formulas, exemptions, and enforcement rules. Employers must always pay the highest applicable rate in the location where the employee performs the work.