States and cities across the country have implemented Ban the Box or criminal background check legislation in recent years. Now, federal lawmakers are considering a law which would encourage holdout states to pass Ban the Box bills themselves.

Recently, St Louis joined the list of cities with its own law, while New York City and Illinois updated their legislation. To help employers, we’ve created a guide to criminal background check laws by state and city for 2021.

One in Three American Adults Have a Criminal History

In the past, having a criminal history prevented some potentially great job candidates from being hired, regardless of how long ago the crime took place, how minor the infraction was, or how good of a fit they might be for the role. When you consider that an estimated 70 million Americans—one in three Americans who are of working age—have some kind of criminal history, it’s not difficult to understand how requiring a squeaky-clean record could become problematic for some jobs.

Even People Without Convictions Can Be Discriminated Against

Many criminal background checks fail to distinguish between someone being arrested or charged and actually being convicted. Potential employees are routinely asked on job applications if they’ve “ever been arrested for a serious crime.” Not if they have a conviction history…simply arrested. It’s easy to see how checking “yes” on this box could be used to take some candidates out of the running for a job.

This is exactly the reason why many states and localities are passing criminal background check laws to protect job hunters who have a criminal record from being immediately disqualified during the hiring process.

What is a “Ban the Box” Law?

A “ban the box” law is a criminal background check law that prohibits employers from requesting a potential employee’s criminal history on a job application in certain states and localities. Some laws forbid a company from asking if the candidate was ever sentenced for a crime until a specific time in the hiring process, such as during an interview or after a conditional offer of employment.

Ban the Box Is Good for Children and Families

Colorado is one of the most recent states with laws requiring employers to ban the box with its Colorado Chance to Compete Act (CCCA). They, like other states that have implemented the ban, found that,

“Previous involvement with the criminal justice system often creates a significant barrier to employment in that applicants with criminal histories are less likely to be considered for an available job when that information is included on an initial job application… Children and families suffer when people with criminal histories are unable to work or work at jobs that are below their potential given their education and skills….”

Additionally, including a criminal history question on an application often results in disparate impact discrimination. Because Latino and African American men are arrested and convicted at a higher rate than Caucasian men, an employment application asking about criminal history has a disproportionate impact on them.

Credit Checks Can Also Be Considered a Discriminatory Act

Several states also have laws that prevent an employer from using a person’s credit history to make employment decisions. A credit history background check can also be lumped under “disparate impact discrimination” as it can have a negative impact on women and minorities. These two groups are more likely to experience bankruptcies or have poor credit reports. Generally, states that have credit check restrictions allow for one if the job in question is for a financial institution or where the applicant would otherwise have access to financial data.

Ban the Box Laws: By States and Cities and Counties

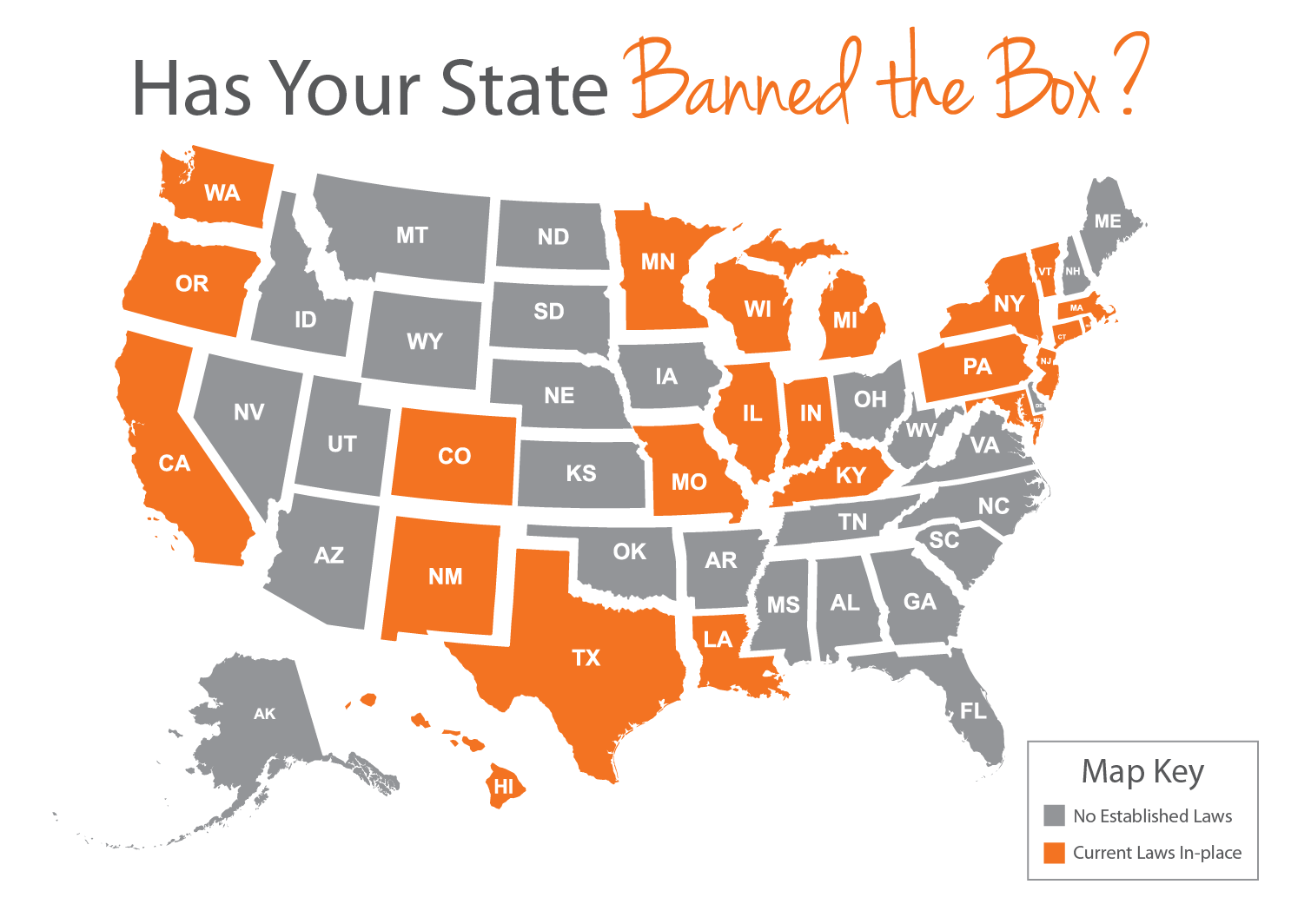

Here’s a quick snap shot of the U.S. and which states have banned the box. For a deeper dive into criminal background check laws by state, check out the chart below.

| State | Municipality | Covered Employers | Notes |

|---|---|---|---|

| Alabama | No Law | ||

| Alaska | No Law | ||

| Arizona | No Law | ||

| Arkansas | No Law | ||

| California | Employers with 5+ employees | No criminal background check until after a job offer. | |

| Compton | Contractors doing business with Compton | No criminal background check until after a job offer | |

| Los Angeles | Any employer with 10+ employees | No criminal background check until after a job offer | |

| Richmond | Private sector employers with 10+ employees that have contracts with Richmond regardless of where employer is based | ||

| San Francisco | Employers with 5+ employees | No criminal background check until after a job offer | |

| Colorado | Effective 9/1/19 for employers with 11+ employees; effective on or after 9/1/21 for all employers | ||

| Connecticut | All employers | No criminal history question on job applications with some exceptions | |

| Hartford | Contractors doing business with Hartford | No background check until after job offer | |

| New Haven | Contractors doing business with New Haven | No background check until after job offer | |

| Delaware | No Law | ||

| District of Columbia | Employers with 11+ employees | No background check until after job offer | |

| Florida | No Law | ||

| Georgia | All employers | No background check until after job offer. Then – the applicant must be provided with the opportunity to dispute the information in their history. Additionally, citizens have the right to expunge misdemeanors and non-violent felonies four years after a sentence is complete. | |

| Hawaii | All private employers | No criminal background check until after job offer. Then, employers may only inquire about felony convictions within the past seven years and five years misdemeanors, excluding periods of incarceration. | |

| Idaho | No Law | ||

| Illinois | Private employers with 15+ employees | No criminal background check before job interview, or until after job offer if no interview. Job applicants can only be disqualified if a conviction has a “substantial relationship” to the position. | |

| Chicago | Private employers with fewer than 15 employees | No criminal background check before job interview, or until after job offer if no interview | |

| Cook County | Private employers with fewer than 15 employees | No criminal background check before job interview, or until after job offer if no interview | |

| Indiana | No Law | ||

| Indianapolis | Contractors doing business with Indianapolis | Criminal history questions only after first interview | |

| Iowa | No Law | ||

| Waterloo | Employers with 15 employees or more | No criminal background check or inquiry until after a conditional offer of employment. Employers prohibited from considering criminal records including arrests and pending cases; and rejecting candidates with criminal records outside of a legitimate business reason. | |

| Kansas | No Law | ||

| Kentucky | No Law | ||

| Louisville | Contractors doing business with Louisville | City may end contracts with companies that do not ban the box | |

| Louisiana | No Law | ||

| New Orleans | Contractors doing business with New Orleans | No criminal history questions on job applications | |

| Maine | All employers | No criminal history inquiries on applications or advertisements that a person with a criminal history may not apply. | |

| Maryland | No Law | ||

| Baltimore | Employers with 10+ employees | No background check until after job offer | |

| Montgomery County | Employers with 15+ employees | No criminal history questions or checks until after first interview | |

| Prince George’s County | Employers with 25+ full-time employees | No criminal history questions or checks until after first interview | |

| Massachusetts | All private employers | No criminal history questions on application. Also bans questions about certain types of crimes later in the hiring process. | |

| Boston | Contractors/vendors doing business with Boston | ||

| Cambridge | Contractors/vendors doing business with Cambridge | ||

| Worcester | Contractors/vendors doing business with Worcester | ||

| Michigan | Employers with 15+ employees | ||

| Detroit | Contractors doing business with Detroit when contract is $25,000+ | No questions about criminal convictions until interview or qualification | |

| Kalamazoo | Contractors doing business with Kalamazoo when contract is $25,000+ or those seeking tax abatement | Must commit to not use criminal history to discriminate | |

| Minnesota | All private employers | No criminal history inquiries on job application with limited exceptions | |

| Mississippi | No Law | ||

| Missouri | No Law | ||

| Columbia | All employers in Columbia | No criminal history check until after conditional job offer | |

| Kansas City | Private employers with six+ employees | No criminal history check until after job interview | |

| St. Louis | Private employers with 10+ employees | No criminal history check until after job interview. When making hiring and promotion decisions based on criminal record, employers must demonstrate that decision is based on all available information. Hiring forms and job advertisements mustn’t exclude applicants based on criminal history. | |

| Montana | No Law | ||

| Nebraska | No Law | ||

| Nevada | No Law | ||

| New Hampshire | No Law | ||

| New Jersey | Employers with 15+ employees over 20 calendar weeks | Preempts local laws | |

| New Mexico | All private employers | Can consider a conviction after reviewing an application and discussing employment with the applicant | |

| New York | No Law | ||

| Buffalo | Private employers with 15+ employees/contractors doing business with Buffalo | No criminal history questions on job applications | |

| New York City | All employers with 4+ employees | No criminal background check prior to conditional job offer. On July 29, 2021, Fair Chance legislation will be extended to current employees. | |

| Rochester | All employers with 4+ employees and contractors doing business with Rochester | Criminal background check only after initial job interview or conditional job offer | |

| Syracuse | City contractors | No background checks until after conditional job offer | |

| North Carolina | No Law | ||

| North Dakota | No Law | ||

| Ohio | No Law | ||

| Oklahoma | No Law | ||

| Oregon | All private employers | Illegal to exclude applicant from an interview solely due to past criminal conviction | |

| Portland | Employers with 6+ employees | No criminal background check prior to conditional job offer | |

| Pennsylvania | No Law | ||

| Philadelphia | All employers with at least one employee in Philadelphia | No criminal background check prior to conditional job offer. (As of April 1, 2021, protections are extended to gig workers and independent contractors.) | |

| Pittsburgh | Contractors/vendors doing business with Pittsburgh | No criminal history check before applicant is deemed otherwise qualified | |

| Rhode Island | Employers with 4+ employees | No criminal background check on job applications | |

| South Carolina | No Law | ||

| South Dakota | No Law | ||

| Tennessee | No Law | ||

| Texas | No Law | ||

| Austin | Employers with 15+ employees | No criminal background check prior to conditional job offer | |

| Utah | No Law | ||

| Vermont | All private employers | No criminal history questions on job application | |

| Virginia | No Law | ||

| Washington | All private employers | No criminal history check before applicant is deemed otherwise qualified | |

| Seattle | All employers with 1+ employees | Must have a legitimate business reason to automatically exclude applicants with arrest or conviction records | |

| Spokane | All private employers | No criminal history questions before a job interview | |

| West Virginia | No Law | ||

| Wisconsin | No Law | ||

| Madison | Contractors doing business with Madison on contracts worth $25,000+ | No criminal history questions or background checks until after conditional job offer | |

| Wyoming | No Law |

How Paycor Helps

We’re proud to keep more than 30,000 organizations informed about and compliant with federal and state laws and regulations. Want to see how Paycor can help you mitigate risk? Check out our article on hiring compliance, or talk to a Paycor representative.

The information provided in our chart is for educational purposes only; it is not legal advice. Always check regulations to help ensure compliance.