As a trusted HR and payroll provider, Paycor gets hundreds of questions about tax forms, including Form W-3 each year. To help HR professionals mitigate risk, our compliance experts answered the most frequently asked questions around Form W-3.

The form usually doesn’t change much from year to year, but you’ll want to double-check for potential discrepancies. Remember, if you’re ever confused by payroll terminology, you can consult our payroll glossary.

What is a W-3 Form?

Technical answer: Form W-3 is used to total up all parts of Form W-2. Both forms are filed together and sent to the Social Security Administration (SSA) every year. Form W-3 is also known as “Transmittal of Wage and Tax Statements.”

What employers really need to know: As an employer, your responsibility is to review all W-2s for your workforce, summarize employee wages and tax information, and then combine that data into one W-3 form.

What’s the Difference Between Form W-2 and Form W-3?

Employees use the information provided by their employer on the Form W-2 to complete and file their personal income tax returns. Employers use Form W-3 to report employee income to the IRS and Social Security Administration.

Employers must file both W-2 and W-3 forms with the Social Security Administration by January 31 of every year.

Who Must File Form W-3?

Any employer required to file Form W-2 must also file Form W-3. Be sure to use the correct version. For example, use the 2024 version for reporting 2024 taxes, even though you may be working on the form in 2025.

When Do You Need to File W-3 and W-2 Forms?

To remain compliant, you’ll need to mail or electronically file W-2 forms and Form W-3 with the SSA by January 31 of every year.To remain compliant, you’ll need to mail or electronically file W-2 forms and Form W-3 with the SSA by January 31 of every year.

How to Complete Form W-3

Take a deep breath. Completing Form W-3 may not be as challenging as you think. Because this form asks for the same information as Form W-2, it’s more of a time suck than anything else.

However, since many employers still have questions about the individual sections of Form W-3, we’ve broken down everything you need to know here.

What is a W-3 Control Number?

The W-3 control number is a tracking number employers can assign to Form W-3 for internal recordkeeping purposes. This section is optional.

Box b: Kind of Payer

Check the box that applies. If you have more than one type of Form W-2, you must send each type with a separate Form W-3. Most private businesses will check 941, which means they file Form 941, the quarterly federal tax return.

The other options are:

- Military: For military employers

- 943: For agricultural employers

- 944: For very small employers, whose annual liability for Social Security, Medicare, and withheld federal income taxes is $1,000 or less

- CT-1: For railroad employers

- Household employee: For household employers

- Medicare government employee: For U.S., state, or local agency filing Forms W-2 for employees subject only to Medicare tax

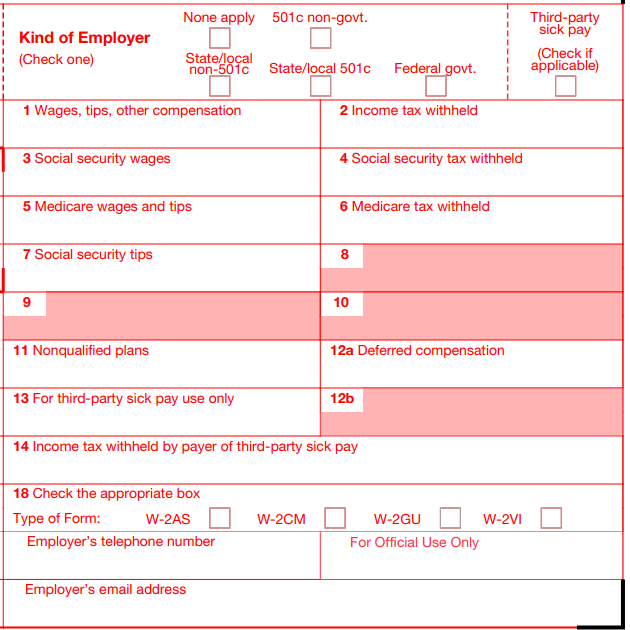

Box b: Kind of Employer

Unless you’re a non-profit or government entity, select “None apply.”

The other options are:

- 501c non-government: For tax-exempt organizations

- State/local non-501c: For state or local government agencies

- State/local 501c: For state or local government organizations that are also 501c organizations

- Federal government: For federal government agencies

- Third-party sick pay: For third-party sick pay payers filing Form W-2 for sick pay recipients

Boxes 1-18

Enter the combined income and tax information from all the W-2s you’re including in this W-3 filing. These totals must match exactly with the sum of the amounts reported on all Forms W-2 being transmitted. Double check these numbers carefully, as discrepancies could trigger IRS notices.

How to File a W-3

W-2s and W-3s can be filed by mail or electronically. However, if you have 250 or more W-2 forms, you must electronically file both forms.

To file W-2s electronically, you’ll need to register for the Social Security Administration’s Business Services Online (BSO).

When you complete that step, you have two options:

- Upload wage files from your payroll or tax software.

- You can use a fill-in W-3 form to submit up to 50 W-2 forms at a time.

If you decide to mail the forms, send them to the following address:

Social Security Administration

Direct Operations Center

Wilkes-Barre, PA 18769-0001

If you use “Certified Mail” to file, change the ZIP code to “18769-0002.” If you use an IRS-approved private delivery service, add “Attn: W-2 Process, 1150 E. Mountain Dr.” to the address and change the ZIP code to “18702-7997.” Go to IRS.gov/PDS for a list of IRS-approved private delivery services.

Where Can You Get W-3 Forms?

If you’re filing on paper, you can’t just print off a W-3 form from the IRS website and file it with the SSA. The form is printed with special red ink, so you’ll need to buy the official form from the same place you buy your W-2 forms. You can also file electronically through the SSA’s BSO system, which eliminates the need for paper forms. If you partner with an HR and payroll provider, they’ll typically handle the filing process for you.

If you’re a Paycor customer and still have unanswered questions, please contact your payroll specialist for more support.

How Paycor Helps

Paycor’s human capital management (HCM) platform modernizes every aspect of people management, from recruiting, onboarding, and payroll to career development and retention. Our online payroll software is backed by tax and compliance expertise. Paycor customers benefit from stress-free tax compliance, which includes:

- Compliance dashboard: Proactive alerts and compliance warnings, alerting you to issues like missing or invalid tax IDs, unverified or invalid addresses, and discrepancies in employees’ direct deposit information.

- Tax recommendations: Tax setup guidance based on each employee’s work and home address.

- Tax processing: We handle the details, so you don’t have to, including tax filing, W-2s, and 1099 processing.

Learn why more than 30,000 customers trust Paycor to help them solve problems and achieve their goals. Take a guided product tour today.