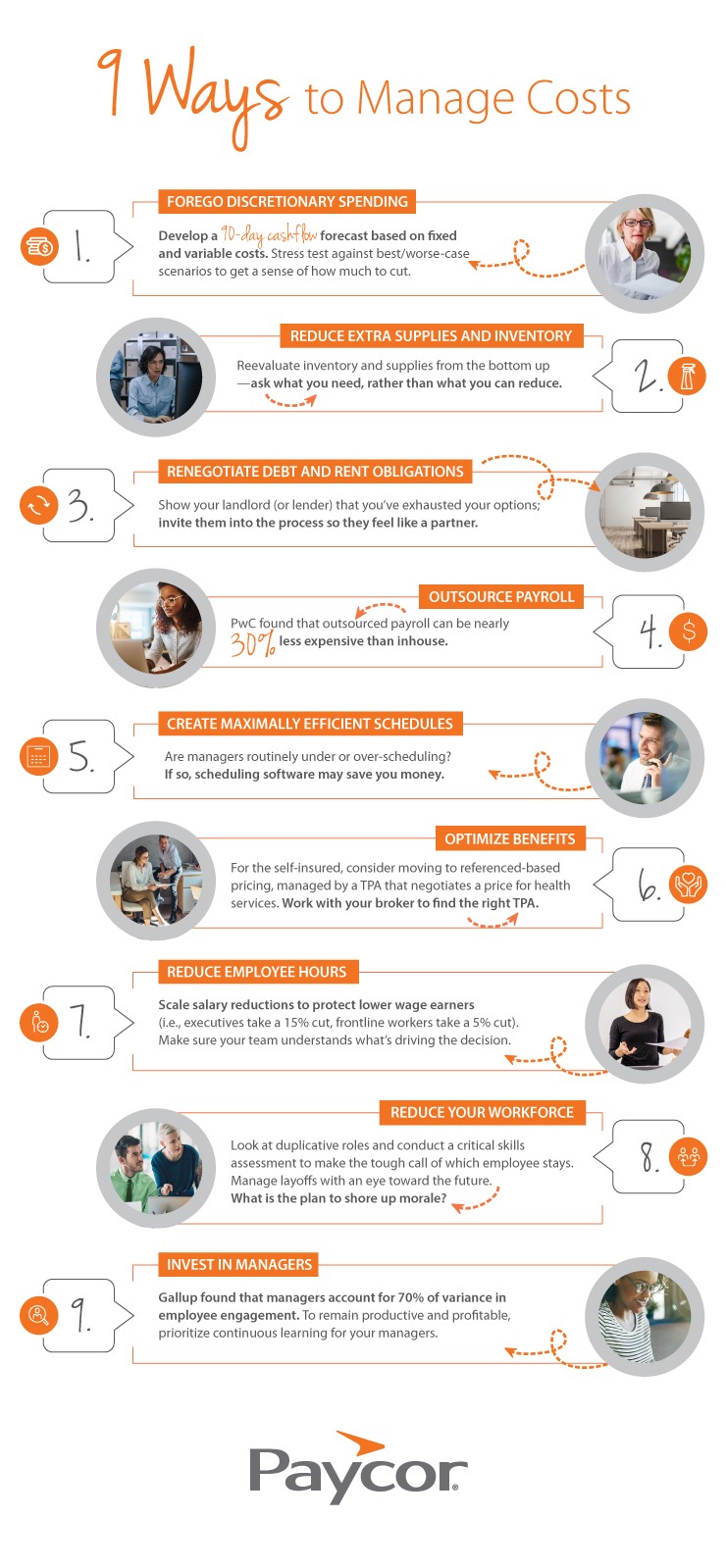

HR and business leaders are looking to cut costs—but cut too deep, or in the wrong places—and you’ll pay for it down the road. Check out this infographic to learn the 9 ways business leaders can manage costs and return to profitability in the future.

1. Forego Discretionary Spending

Develop a 90-day cashflow forecast based on your fixed and variable costs. Then, stress test the forecast against best/worse-case scenarios. You want to get a sense of how much (and where) you need to cut.

2. Reduce Extra Supplies & Inventory

Reevaluate inventory and supplies from the bottom up—ask what you need, rather than what you can reduce. Consider both best-case and worse-case scenarios: running down stocks might leave you unable to meet the demand of a quick return to growth, but you’ll be less exposed to an extended slump.

3. Renegotiate Debt and Rent Obligations

Show your landlord (or lender) that you’ve exhausted your options; invite them into the process so they feel like a partner. Propose a temporary deferment or a rent reduction, spread out over the remainder of the lease. At minimum, ask for forgiveness on late fees and an agreement not to report late payments to the credit bureaus.

4. Outsource Payroll

Compare the costs of inhouse vs outsourced payroll, but don’t stop there. Remember that whoever is in charge of your payroll has a legal obligation to stay on top of emergency legislation and rapidly integrate changes into the system. That’s a daunting (and risky) task even in normal circumstances.

5. Create Maximally Efficient Schedules

Take a closer look at your workforce management and scheduling practices. Are managers routinely under or over-scheduling? Are you making payroll mistakes due to inaccurate timesheets? Are you consistently surprised by unplanned overtime? If so, scheduling software may actually save you money.

6. Optimize Benefits

Work with a trusted broker to evaluate all the ways you could optimize your benefits spend.

7.Reduce Employee Hours

No one wants to reduce the hours or salaries of the team you worked so hard to recruit, train and develop. If you make this move, scale salary reductions to protect lower wage earners (i.e. executives take a 15% cut, frontline workers take a 5% cut). Make sure your team understands what’s driving the decision and go above and beyond to do the right thing. When the economy recovers, you’ll want to be able to hire back your top talent and to do that, your company’s reputation must be intact.

8. Reduce Your Workforce

Look at duplicative roles across the organization and then conduct a critical skills assessment to make the tough call of which employees stay. As much as possible, transparency in decision-making is key; now is the time to over-communicate and to show that your decision-making was pragmatic and fair. You should also manage layoffs with an eye toward the future. What is the plan to shore up team morale post-layoff? The answer to this question will be unique and personal to your company, but one thing’s for sure: managers will play a key role (see our last suggestion for details).

9. Invest in Managers

Prioritize continuous education and learning for your managers. Your HCM provider should be able to provide both ready-made courses and the technology you need to easily design your own training. Core managerial skills to train for include balancing demands from multiple constituencies, interpersonal skills and emotional intelligence, delegation and the giving and reviving of feedback.

Share this Infographic On Your Site

Previous:

Social Distancing at Work