To comply with the Affordable Care Act (ACA), self-insured or fully-insured Applicable Large Employers (ALE) that have 50 or more full-time employees (including full-time equivalent employees), must prepare and submit the IRS Employer-Provided Health Insurance Offer and Coverage Form 1095-C by the end of the first quarter. We want to help fellow HR leaders make the compliance process less stressful by providing instructions, guidance, and information about regulation changes and potential pitfalls.

State & Federal Deadlines & Filing Information

It is important to remember the deadlines established by the IRS in the ACA.

Paper filing to IRS February 28, 2022

- Print in landscape format

- Use First-Class Mail

- Do not fold, paper clip, or staple forms

- Use conveniently sized packaging. On each package, write your name and number the packages consecutively. Place Form 1094-C in package number one.

1095 form distributed to employees March 2, 2022

- Note: Date change (Previous due date: January 31)

- Consider sending a note that encourages the employee to keep the document for their records.

Electronic filing with IRS March 31, 2022

- Required for employers with 250+ full-time equivalent (FTE)[1]

- Easier to use and more secure

- To receive a waiver, submit Form 8508 at least 45 days before the due date of the returns but no later than the due date of the return

- Recommended by the IRS

- Using payroll companies, standalone vendors, and benefits administrators

If needed, companies can file for an automatic 30-day extension using the Application for Extension of Time to File Information Returns Form 8809, on paper or online through the FIRE system on or before the due date of the returns. Under certain hardship conditions, the IRS may grant an additional 30-day extension. (See Instructions for Form 8809 for more information.) IRS penalties for companies that file late range from $50-$530 for each form, depending on the length of the delay; late fees increase by the day.

In addition to sending 1095-C Forms to the IRS, there are some states that mandate submitting sending Forms to their state agencies. These states include:

| California | March 31, 2022 |

| District of Columbia | April 30, 2022 |

| Massachusetts | March 31, 2022 |

| Massachusetts | March 31, 2022 |

| New Jersey | March 31, 2022 |

| Rhode Island | March 31, 2022 |

Instructions for Completing Form 1095-C

HR leaders must submit a 1095-C Form for every FTE. The following instructions and tips will help you complete the filing process. The IRS defines FTE as anyone who works more than 30 hours per week or 130+ hours per month

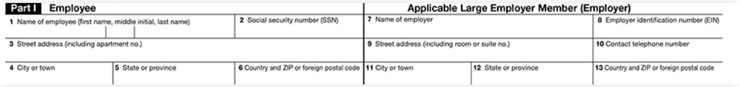

Part I: Employee & ALE Member

Provide primary company and employee information in Lines 1-13.

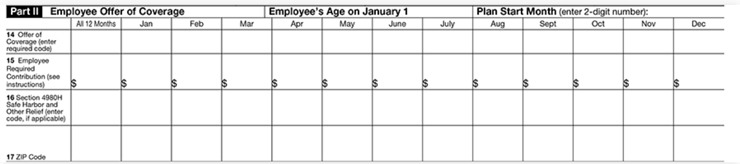

Part II: Employee Offer of Coverage [Note: The IRS recently made changes on the Form related to the individual coverage health reimbursement arrangement (ICHRA) plan.]

In this section, document the employee’s:

- Age (New Requirement): Enter the employee’s age as of January 1, 2021.

- Plan Start Month: Enter the two-digit number (01 through 12) representing the calendar month the company offered health plan coverage to the employee (or would have offered if the employee was eligible to participate in the plan). DO NOT LEAVE THIS FIELD BLANK.

- Offer of Coverage (Line 14): Document the employee’s coverage status for each month of the year, even if the employee was not full-time for one or more calendar months or did not accept coverage. Enter IRS codes that represent the different types of coverage your company offered to the employee, their spouse, and dependents. If no offer of coverage was made, enter code 1H. (Note: The IRS added several new codes to describe how companies determined the affordability of ICHRA Coverage.)

- Required Contribution (Line 15): Document monthly premium that the employee was required to pay each month of the calendar year. If the employee did not receive coverage, leave blank.

- Safe Harbor & Other Relief (Line 16): Enter codes related to the employee’s eligibility for enrollment in health coverage and the coverage status for each month of the calendar year. Only use a code if the employee was enrolled for every day of that month. If the employee was not offered coverage, enter code 2A.

- Zip Code (New Requirement): List the employee’s zip code by month. DO NOT LEAVE BLANKS ON THIS LINE.

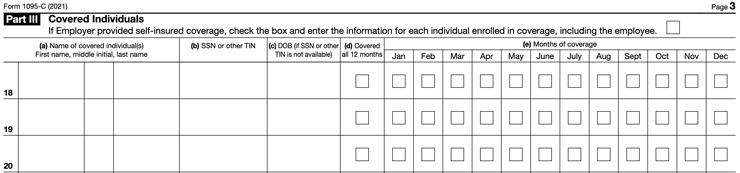

Part III: Covered Individuals

If the company offered minimum essential coverage, including an individual coverage HRA, to at least 95% of its FTEs and their dependents for the entire calendar year, enter “X” in the “Yes” checkbox in “All 12 Months” or for each of the 12 calendar months or each applicable month.

For months, if any, where the company did not offer minimum essential coverage, including an individual coverage HRA, enter “X” in the “No” checkbox in “All 12 Months” or for each of the 12 calendar months or each applicable month.

How the IRS Uses the Information

Filing the 1095-C Form with the IRS verifies that employers offered qualified health insurance coverage to eligible FTEs and certifies coverage meets minimum essential coverage requirements. The 1095-C Form also helps the IRS determine:

- Whether an employer is potentially liable for payment under the employer shared responsibility provisions of section 4980H of the ACA, and payment amount, if any.

- Eligibility of employees to purchase premium tax credit.

How Paycor Helps

Navigating the complexities of ACA IRS filing has never been easier than with the support of Paycor and our award-winning ACA Connect solution. Our system, services, and ACA Care team of professional experts can help you navigate benefits administration challenges, stressful open enrollment periods, and endless employee questions. With help from Paycor, you can prepare, generate, and file required forms like 1095-C and receive real-time alerts and feedback on submission status. ACA Connect can ensure your benefits and ACA processes are streamlined and compliant.