Processing payroll is one of the most important jobs an HR department is tasked with. Employees rely on their paychecks to be accurate and on time. For the 57% of Americans who live paycheck to paycheck, late payroll could be catastrophic. There’s little room for human error, which is why many companies rely on payroll automation.

But what exactly is automated payroll? And what are the benefits and challenges to using it? Read on.

What is Payroll Automation?

Automation in payroll is the use of software to manage and process employee payments automatically. It eliminates manual tasks like calculating wages, withholding taxes, and distributing paychecks by handling these functions through a digital system. This ensures greater accuracy, consistency, and efficiency in payroll management.

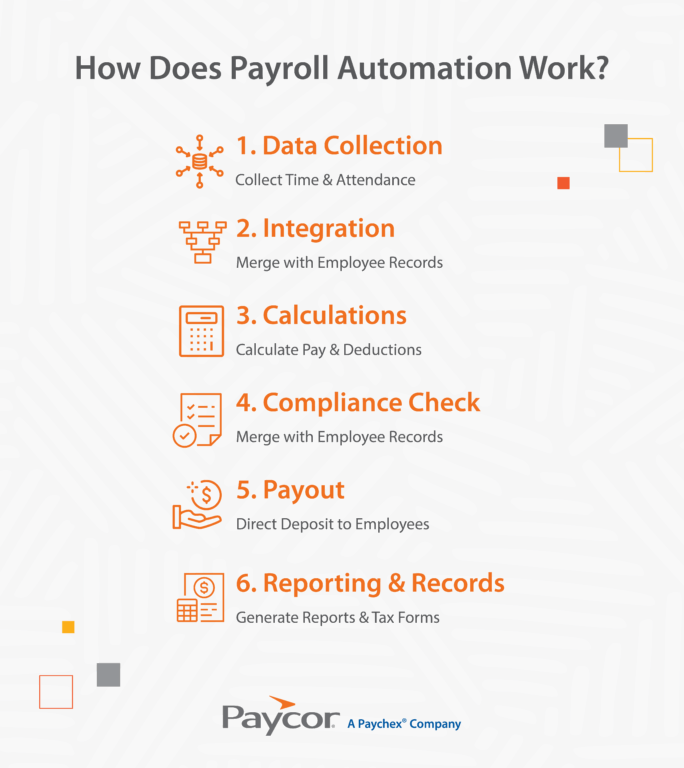

How Does Payroll Automation Work?

Payroll automation works by using specialized software to handle the entire employee payment process with minimal human intervention. The system begins by automatically collecting time and attendance data from various sources like time clocks, mobile apps, or manual entries, then integrates this information with employee records containing pay rates, tax withholding information, and benefit elections.

Pay Calculation and Deductions

Once the data is gathered, the software performs complex calculations to determine gross pay based on hours worked, overtime rules, bonuses, and commissions, while simultaneously computing all necessary deductions, including federal, state, and local taxes, Social Security, Medicare, health insurance premiums, retirement contributions, and other voluntary deductions.

Tax Compliance and Regulatory Updates

An automated payroll system maintains up-to-date tax tables and compliance rules, ensuring accurate withholdings and adherence to labor laws across different jurisdictions.

Payment Processing

After calculating net pay, the software generates electronic pay stubs and creates direct deposit files that are transmitted securely to banking networks, depositing wages directly into employee accounts on the designated pay date.

Recordkeeping and Reporting

Throughout this process, the system maintains detailed records for payroll auditing purposes, generates required tax reports and forms like W-2s, and can automatically remit tax payments to appropriate government agencies.

Manual vs. Automated Payroll

Manual payroll requires HR or finance staff to enter and calculate data for each pay period, often using spreadsheets. It’s time-consuming and prone to errors. In contrast, automated systems streamline these processes with minimal human input, reducing mistakes and saving time.

Benefits of Payroll Automation

Benefits of payroll automation include the following:

Time and Cost Savings

Automated payroll systems dramatically reduce the time required to process payroll from hours or days to just minutes. This efficiency translates directly into cost savings by enabling HR staff to focus on strategic initiatives rather than manual calculations and data entry.

Improved Accuracy

Manual payroll processing is prone to human error, from miscalculations to data entry mistakes that can result in incorrect paychecks and compliance issues. Automated systems perform consistent calculations based on programmed rules and current tax tables, virtually eliminating mathematical errors and ensuring employees receive accurate pay every time. This accuracy extends to tax calculations, benefit deductions, and overtime computations.

Enhanced Compliance

Staying compliant with tax regulations, labor laws, and reporting requirements is complex and constantly changing. Automated payroll systems are regularly updated with the latest tax rates, wage and hour laws, and regulatory changes, ensuring your company remains compliant without manual intervention. The systems also generate required reports automatically and can file taxes electronically, reducing the risk of penalties and fines.

Better Security and Data Protection

Paper-based payroll systems and manual processes create security vulnerabilities through physical document handling and multiple access points. Automated systems provide robust security features including encrypted data storage, role-based access controls, audit trails, and secure data transmission. This protects sensitive employee information and financial data while maintaining detailed records of who accessed what information and when.

Employee Self-Service Capabilities

Modern automated payroll systems include employee portals where staff can access pay stubs, tax documents, update personal information, and view their payment history without contacting HR. This self-service functionality reduces administrative burden on HR teams while providing employees with 24/7 access to their payroll information.

Real-Time Reporting and Analytics

Automated systems provide instant access to payroll data through comprehensive reporting and analytics dashboards. Managers can track labor costs, overtime trends, department expenses, and budget variances in real-time, enabling better decision-making and financial planning. These insights help identify cost-saving opportunities and ensure proper budget allocation across departments.

Scalability and Flexibility

As businesses grow, automated payroll systems can easily accommodate additional employees, new locations, and complex pay structures without requiring proportional increases in administrative staff. The systems can handle various pay frequencies, multiple pay rates, different employee classifications, and complex benefit structures, making them suitable for companies of all sizes and industries.

How to Automate Payroll Processing

Automating payroll requires upfront planning but pays off quickly in time savings and accuracy. Follow these essential steps to set up a streamlined, automated payroll process:

1. Choose the Right Payroll Software

Start by selecting a payroll platform that fits your business size, industry, and needs. Look for features like tax filing, direct deposit, employee self-service, integrations with your HR and accounting systems, and compliance support.

2. Collect and Input Employee Information

Gather complete employee data, including Social Security numbers, tax withholdings, payment preferences, and benefits deductions. Enter this information accurately into the payroll system to ensure proper calculations and compliance.

3. Integrate Time-Tracking and Attendance

Sync your time-tracking software with your payroll system, or use a solution that offers both. This ensures that work hours, overtime, and time off are calculated automatically and accurately each pay period.

4. Set Up Payroll Schedules

Define how often employees will be paid (weekly, bi-weekly, semi-monthly, etc.) and set deadlines for timecard submissions and approvals. The software will run payroll automatically on the defined schedule once configured.

5. Configure Tax Settings and Deductions

Input federal, state, and local tax information, as well as deductions for benefits, retirement contributions, and wage garnishments. Most systems update tax tables automatically and calculate withholdings for you.

6. Run a Test Payroll

Before going live, run a sample payroll cycle to confirm calculations, deductions, and pay distributions are accurate. Double-check employee pay stubs to ensure everything aligns with expectations.

7. Go Live and Monitor

Once testing is complete, launch your automated payroll process. Continue to monitor the system regularly to ensure accuracy and make updates when there are changes in tax laws, employee data, or benefits.

Challenges of Payroll Automation

While payroll automation offers significant benefits, transitioning to an automated system can present some hurdles. Common challenges include:

- Data migration: Moving employee and payroll data from manual records or old systems can be time-consuming and error-prone.

- System complexity: Some payroll software has a steep learning curve, especially for small businesses without a dedicated HR team.

- Integration issues: Incompatibility with existing HR or accounting systems can cause workflow disruptions.

- Compliance confidence: Employers may worry about staying current with tax and labor law changes.

However, modern payroll platforms like Paycor are designed to address these challenges. With user-friendly interfaces, expert support, real-time compliance updates, and seamless integrations, payroll automation becomes much more approachable and effective.

How To Choose a Payroll Automation System

When selecting a payroll automation system, business owners should consider:

- Ease of use: The platform should be intuitive and simple to set up and manage.

- Compliance support: Look for automatic updates to tax laws and built-in reporting for regulatory requirements.

- Integration capabilities: Ensure the software integrates with your existing systems, such as HR, timekeeping, and accounting tools.

- Scalability: Choose a solution that can grow with your business.

- Customer support: A responsive support team makes all the difference during set-up and when questions arise.

- Employee self-service: Features like online paystubs, tax forms, and personal info updates improve the employee experience.

How Paycor Helps Automate Payroll Processing

Paycor Payroll software automates routine tasks, mitigates payroll compliance risks, and drives efficiencies across your organization. Features include:

- AutoRun allows administrators to schedule payroll to process at a specific day and time.

- Paycor Mobile Wallet empowers employees with access to earned wages, pay card info, and financial wellness resources.

- Compliance dashboard provides proactive alerts and compliance warnings, including for missing or invalid tax IDs, tax recommendations, and discrepancies in employees’ direct deposit information.

- Payroll reports provide full transparency into cash requirements and tax liability.

Use Paycor: The Best Payroll Automation Software

Ready to streamline your payroll process? Paycor offers best-in-class implementation, including hands-on guidance and the tools required to ensure a seamless transition. We pay 1 out of 11 private sector workers in the U.S., and nearly 800,000 customers trust Paycor + Paychex as their HCM provider. Learn more with a guided product tour.

Additional Payroll Automation FAQs

Still have questions regarding payroll automation? Read on.

Is Payroll Automation Software Worth It?

Yes! Payroll automation saves time, reduces errors, ensures payroll compliance, and improves the overall efficiency of your payroll process.

How Secure Is Automated Payroll?

Most payroll systems use encryption, access controls, and secure cloud storage to protect sensitive employee and financial data.

Is Automated Payroll Accurate?

Yes, automated payroll reduces manual errors by using built-in formulas and up-to-date tax rates for accurate calculations.

Can Automatic Payroll Be Integrated with other Technology?

Absolutely! Many payroll systems integrate with time-tracking, HR, accounting, and benefits platforms for seamless workflows.

How Does Payroll Automation Handle Tax Compliance?

Automated systems calculate and withhold the correct taxes, generate reports, and often file taxes automatically to stay compliant with laws.

Is Paycor a Payroll Automation System?

Yes, Paycor is a payroll automation platform that streamlines payroll processing, tax compliance, reporting, and employee self-service.