Career development is one of the top three important factors when considering a new job, according to Paycor survey data. If you aren’t offering employees growth in their current roles, they’ll often find it elsewhere. That’s why individual development plans (IDPs) prove crucial to employee retention and talent development. Read on to learn more about IDPS, their benefits, and how to create one.

What is an Individual Development Plan?

An individual development plan serves as a roadmap to an employee’s career journey with the company. It outlines their strengths and career goals, as well as showing areas for growth and what needs to be accomplished to advance in the company. Often built in conjunction with a manager, an IDP is an employee’s guide to professional development.

Purpose of an Individual Development Plan

The purpose of IDPs are to align individual career aspirations with organizational objectives, creating mutual benefits for both employees and employers. Companies utilize IDPs to support employee growth, improve retention, and create a pipeline of talented leaders for company growth, expansion, or succession planning.

When implemented thoughtfully, IDPs foster a culture of development that enhances organizational capability while giving employees clear pathways to achieve their professional ambitions.

Benefits of Using Individual Development Plans

When used correctly, an individual development plan offer advantages to both the business and the employee, including the following.

Benefits for the Business

Benefits for the organization include:

- Improved employee performance and productivity through targeted skill development

- Enhanced employee engagement and retention by demonstrating investment in career growth

- Creation of a skilled talent pipeline for succession planning and leadership roles

- Better alignment between employee development and organizational goals

- Increased adaptability to changing business conditions through strategic upskilling

- More effective resource allocation for training and development initiatives

- Strengthened organizational knowledge and capabilities

- Development of a positive learning culture that attracts top talent

Benefits for the Employee

Benefits for the employees include:

- Clear roadmap for professional growth and career advancement

- Personalized development tailored to individual career aspirations

- Improved job satisfaction through skill mastery and new challenges

- Greater visibility of potential career paths within the organization

- Increased marketability through expanded skills and competencies

- Stronger relationship with managers through collaborative development planning

- Sense of ownership over career progression

- Access to targeted resources, training, and development opportunities

What Goes in an Individual Development Plan?

An IDP consists of the following components:

Strengths

Highlight the unique talents, skills, and capabilities the employee brings to the role. This includes technical expertise, soft skills, and natural abilities that have been recognized in performance reviews or by colleagues.

Document specific examples where these strengths have created positive outcomes or results for the team or organization. Consider including quantifiable achievements that demonstrate these strengths in action, as well as feedback received that validates these areas of excellence.

Opportunities for growth

Identify areas where developing new skills or enhancing existing ones would benefit both the employee’s current performance and future aspirations. Rather than framing these as weaknesses, approach them as strategic development priorities that align with organizational needs and individual career trajectory.

Include specific competencies needed for career advancement, technical knowledge gaps, or leadership capabilities that would improve effectiveness.

Career aspirations

Now, let the employee dream big. Outline paths they could take in the organization, and note what their career aspirations are. Consider both vertical advancement (promotion through leadership) and horizontal growth (deepening expertise in their field).

This section of an IDP helps ensure development activities support meaningful long-term goals rather than just addressing immediate needs, and allows managers to identify potential career paths within the organization.

Action items

Finally, include a list of action items broken out by what the employee should do immediately to succeed in their role and future tasks to grow into the professional they want to be.

Each item should specify what development activity the employee will undertake, how success will be measured, what resources they’ll need, and when they plan to complete it. Establish checkpoints to review progress and adjust as needed.

What Makes an IDP Effective?

Individual development plans are most effective when:

- They have SMART goals. SMART stands for Sepcific, Measurable, Attainable, Relevant, and Time-Bound. This makes it easier to talk about the IDP’s goals, because everyone understands what the employee is working toward. It’s easier to succeed when you know what success looks like.

- They’re tailored to the individual employee. Everyone’s needs are different. While you can use a standard template to create IDPs, their content will be unique. For example, different people have different learning styles. An employee who loves to read could put together a list of books to learn about your industry. Someone who learns by listening might do better with a podcast.

- They align with company values. IDPs are part of your employee engagement strategy. If all goes well, you’ll have a relationship with this worker for a long time. Use this process as a way to reinforce your company’s overarching values. If your organization’s No. 1 value is innovation, for instance, IDPs shouldn’t squash an employee’s creativity.

- You communicate clearly and often. Employee growth doesn’t happen overnight. Schedule regular check-ins where you can review progress and offer support if needed.

4 Individual Development Plan Examples

Learn from the following IDP examples for different career stages and development needs:

New Employee IDP Example

Strengths:

Strong technical background in data analysis with proficiency in Excel. Demonstrates excellent attention to detail and follow-through on assigned tasks. Quick learner who has already mastered the company’s CRM system within the first month. Brings fresh perspective from previous industry experience helps identify process improvements.

Opportunities for growth:

Develop deeper understanding of company products and internal processes. Build relationships across departments to increase collaboration effectiveness. Enhance presentation skills for communicating analysis findings to non-technical stakeholders. Learn company-specific reporting standards and compliance requirements.

Career aspirations:

Become a senior analyst within 2-3 years. Develop expertise in business intelligence tools and advanced data visualization. Eventually transition into a data team leadership role that combines technical expertise with mentoring junior team members.

Action items:

- Complete company product knowledge training program by end of Q2

- Shadow two cross-functional meetings monthly for the next 3 months

- Enroll in the company’s presentation skills workshop in Q3

- Meet with compliance officer by month-end to review reporting requirements

- Schedule monthly check-ins with assigned mentor to review progress

Manager Development IDP Example

Strengths:

Exceptional technical expertise in department operations. Effectively leads team to meet and exceed goals. Respected by team for fairness and accessibility. Maintains high standards for work quality and leads by example through personal work ethic.

Opportunities for growth:

Develop project management and resource allocation skills. Enhance strategic thinking to align department goals with broader organizational objectives. Improve delegation practices to develop team capabilities while managing personal workload. Build conflict resolution skills for addressing team dynamics.

Career aspirations:

Progress to senior management overseeing multiple teams within 3-4 years. Develop expertise in change management to lead future organizational initiatives. Eventually transition to a director-level position with responsibility for departmental strategy and resource planning.

Action items:

- Complete leadership coaching certification program within 6 months

- Meet with executive team member quarterly to better understand organizational strategy

- Identify two responsibilities to delegate to team members this month, with appropriate support

- Attend conflict resolution workshop in Q2

- Lead a cross-functional project within the next year to build strategic perspective

Leadership Development IDP Example

Strengths:

Strong strategic vision with ability to anticipate market changes. Exceptional communication skills. Effective at building high-performing teams. Track record of successful profit and loss management and resource optimization. Respected for ethical decision-making and transparency.

Opportunities for growth:

Enhance understanding of emerging technologies affecting the industry. Develop more effective approaches for leading through uncertainty and organizational change. Build stronger relationships with board members and external stakeholders. Improve work-life balance to ensure sustainable leadership effectiveness.

Career aspirations:

Position themself for C-suite consideration within 2-3 years. Develop expertise in international business operations. Eventually seek board positions to contribute to governance and strategic direction in related industries.

Action items:

- Attend executive technology forum this quarter to deepen digital transformation knowledge

- Complete advanced change management certification within 6 months

- Schedule quarterly meetings with board members to strengthen relationships

- Work with executive coach on sustainable leadership practices and boundaries

- Lead major organizational change initiative within the next year

Soft Skills Development IDP Example

Strengths:

Detail-oriented and thorough in work product. Reliable for meeting deadlines and commitments. Knowledgeable resource for team members on procedural questions. Produces consistently high-quality deliverables.

Opportunities for growth:

Enhance communication effectiveness in group settings and presentations. Develop emotional intelligence for better understanding of team dynamics. Build conflict resolution and negotiation skills. Improve adaptability when faced with changing priorities or approaches.

Career aspirations:

Transition from individual contributor to team lead within 1-2 years. Develop the interpersonal effectiveness needed for client-facing roles. Eventually move into a position that combines technical expertise with team collaboration leadership.

Action items:

- Join Toastmasters or similar public speaking group within one month

- Complete emotional intelligence assessment and debrief with HR by end of quarter

- Take on a role in an upcoming change initiative to practice adaptability

- Request to facilitate team meetings once monthly to practice group communication

- Read one book on interpersonal effectiveness per quarter and apply key learnings

Note: Each of these examples can be customized to the specific needs of your organization and employees. The key is ensuring individual career professional development plans are specific, measurable, aligned with both individual and organizational goals, and include concrete action steps with clear timelines.

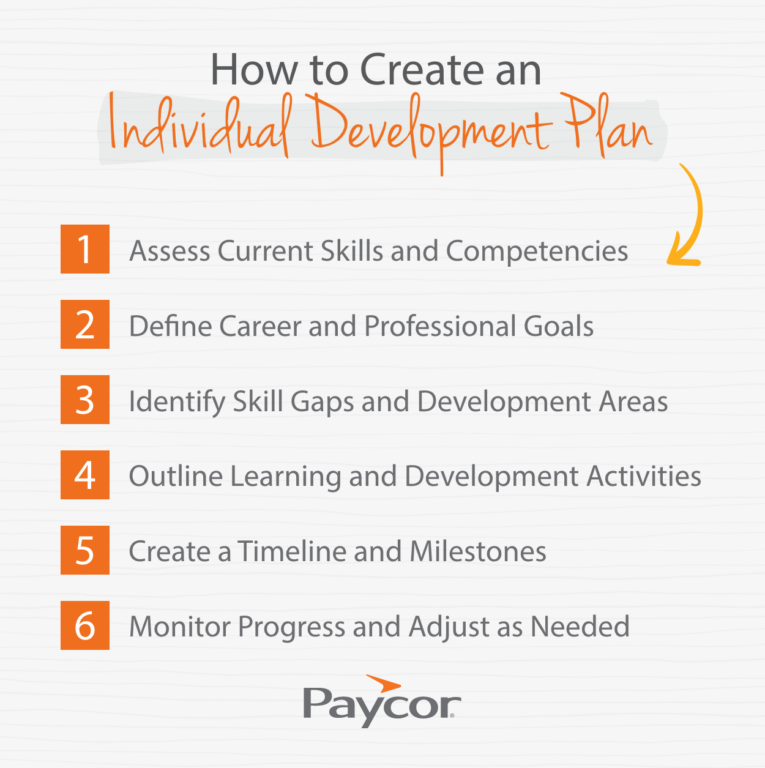

How to Create an Individual Development Plan Step by Step

Follow these steps for creating an individual development plan:

1. Assess Current Skills and Competencies

Start by evaluating the employee’s existing skills and strengths. Use information from self-evaluations, peer feedback, and performance reviews. Knowing an employee’s strengths helps guide opportunities for improvement as well as their next steps in the organization.

2. Define Career and Professional Goals

Work with the employee to identify their short-term and long-term career objectives. These goals should be specific, measurable, and aligned with both their personal aspirations and organizational needs.

3. Identify Skill Gaps and Development Areas

Once goals are established, determine which skills, certifications, or experiences the employee needs to acquire to achieve them. This will likely include a mix of technical skills and soft skills. Reviewing job descriptions and competency models helps clarify expectations, while considering industry trends ensures employees remain competitive in their field.

4. Outline Learning and Development Activities

Make a plan for how the employee will build the skills needed. For preparation for a promotion, this might include job shadowing senior employees or obtaining a mentor within the organization. To gain industry knowledge, the employee may pursue a certification or attend industry events.

5. Create a Timeline and Milestones

Break down development activities into actionable steps with deadlines. Define key milestones to track progress and make adjustments if needed. A structured timeline helps maintain accountability and keeps employees engaged in their development journey.

6. Monitor Progress and Adjust as Needed

Regularly review the IDP to assess progress and address any challenges. Employees and managers should meet periodically to discuss achievements, roadblocks, and potential modifications to the plan. Flexibility ensures the IDP remains relevant and effective as circumstances change.

How to Measure the Success of an IDP

Businesses and employers can measure the success of an IDP by meeting with recipients to evaluate progress toward career goals and assess skill development. Support employees to meet deadlines and milestones, adjusting when needed.

Employers should also consider employee engagement and retention rates. Successful IDPs should contribute to job satisfaction and career advancement, reducing turnover. Additionally, measuring how well an employee applies newly acquired skills in their role helps demonstrate the plan’s effectiveness. If employees show increased confidence, take on new responsibilities, or advance within the company, it’s a strong indicator that IDPs are driving meaningful growth.

Individual Development Plan FAQS

Still have IDP questions? Read on.

Who Needs an IDP?

An IDP can benefit an employee at any level. Even if an employee wishes to remain in their current position, they should still be developing technical and soft skills that enable them to be more successful in their roles.

Do Individual Development Plans Work?

Yes, when properly structured and followed, IDPs help employees grow by providing clear goals, skill-building opportunities, and accountability. Regular check-ins and adjustments ensure ongoing progress.

Which Industries Benefit from IDPs?

Individual professional development plans for employees are valuable across industries, including healthcare, technology, finance, manufacturing, and education. Any field that values skill development, career progression, and employee engagement can benefit from structured development plans.

How Paycor Can Help You Create IDPs

Paycor creates HR software for leaders who want to make a difference. Our Human Capital Management (HCM) platform modernizes every aspect of people management. That includes the way you track employee performance. Our tools let you analyze key metrics, publicly recognize employees, and set up regular performance reviews.

Career development software and educational tools like Paycor Paths empower everyone at your company to learn and grow. Whether you want to develop your own leadership skills or empower an employee to practice key competencies, Paycor can help you move forward. Take a guided tour to learn more.