Providing benefits to employees’ domestic partners operates differently than providing benefits to legal spouses and dependents. Employers have to calculate the domestic partners ‘imputed income’. If you don’t know how to do that, don’t worry—we’ve prepared this guide explaining everything you need to know.

What is a domestic partner?

Before the Supreme Court’s ruling in the landmark case of Obergefell v. Hodges in 2015, domestic partnership was a more popular option for same-sex couples seeking the benefits associated with heterosexual marriage. Domestic partnership provided certain advantages, including hospital visitation rights, the ability to include a partner in a health insurance plan, and family medical leave. However, compared to marriage, domestic partners had to provide additional evidence of their committed relationship to access these benefits. This evidence could include shared financial accounts or a Domestic Partnership Agreement that outlined the shared medical, financial, and property aspects of their relationship. In contrast, married couples often only needed to present a marriage certificate.

Civil unions are a type of legally recognized relationship status at the state level that offer certain benefits similar to marriage. However, it’s important to note that civil unions do not grant federal protections or benefits, unlike marriage. In some states and regions where both civil unions and domestic partnerships are legally recognized, domestic partnerships may be classified as a form of civil union.

When is a domestic partner treated like a spouse?

If one of your employees gets married, their spouse is entitled to some tax-free benefits offered by your company; health insurance is the primary one. If, however, that same employee is in a domestic partnership, no such luck… with one exception. If the domestic partner can also be claimed as a tax dependent on the employee’s income taxes, they’re treated like a spouse. To qualify as a dependent, the domestic partner must live with the employee full-time, have gross income of $4,700 or less (for 2023), and receive more than half of their total financial support from the employee.

What is imputed income?

If you determine that domestic partners don’t qualify as a dependent and they receive health benefits, the contribution you make toward any premium is counted as a type of employee income called imputed income. That can come as quite a shock to employees who might incorrectly believe that a legal domestic partner’s coverage is the same as a married couples.

It’s important to highlight this detail in your open enrollment materials to eliminate any unwelcome surprises around domestic partner coverage when payday or year-end rolls around.

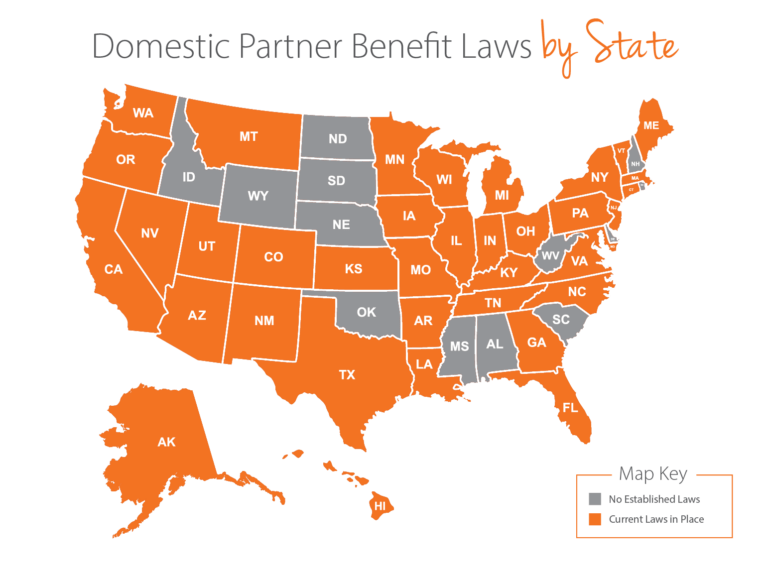

Which states recognize domestic partnerships and offer benefits?

Here’s a quick snapshot of the U.S. detailing which states have laws around domestic partner benefits and domestic partnership registration. For a deeper dive into a specific state, check out the chart below.

To help organizations stay informed—and compliant—we’ll keep these resources updated in line with any new legislation at federal, state, or local level.

Benefits of Domestic Partnership by State

| State | Benefits of Domestic Partnership |

|---|---|

| Alabama | None |

| Alaska | Juneau extends protections to domestic partners. |

| Arizona | Phoenix, Tempe, Scottsdale, Bisbee, Cottonwood, Flagstaff, Sedona, and Tucson extend benefits. So does Pima County. |

| Arkansas | The City of Eureka Springs extends benefits to city employees. |

| California | Berkeley, Beverly Hills, Cathedral City, Davis, Healdsburg, Laguna Beach, Long Beach, Oakland, Palm Springs, Palo Alto, Petaluma, Sacramento, San Bruno, San Diego, San Francisco, Santa Barbara, San Luis Obispo, Santa Monica, Santa Rosa, and West Hollywood extend protections to domestic partners. The following counties extend similar protections: Alameda, Marin, San Francisco, Santa Barbara, Santa Clara, San Mateo, Santa Cruz, Sonoma, and Ventura. |

| Colorado | Aspen, Boulder, Denver, and Eagle County extend benefits and have a partner registry. |

| Connecticut | State extends benefits. Hartford extends benefits and provides a registry. Following the federal legalization of same-sex marriages, all civil unions were converted into marriages. |

| Delaware | Following the federal legalization of same-sex marriages, all civil unions were converted into marriages. |

| Florida | The cities of Bay Harbor Islands, Cape Coral, Clearwater, Gainesville, Hialeah, Key West, Kissimmee, Lake Worth, Miami, Miramar, North Miami, Pembroke Pines, Punta Gorda, Sarasota, South Miami, St. Petersburg, Tavares, West Palm Beach, and Wilton Manors extends benefits. Broward, Hillsborough, Leon, Miami-Dade, Orange,Palm Beach, Pinellas, and Sarasota Counties offer similar protections. |

| Georgia | Atlanta, Clarkston, Decatur, Doraville, East Point, and Savannah extends benefits and provides a registry. Athens-Clarke, DeKalb, and Fulton Counties provide similar protections. |

| Hawaii | State extends benefits and provides a registry. |

| Idaho | None |

| Illinois | Chicago and Cook, Urbana, and Champaign Counties extend benefits. Oak Park extends benefits and provides a registry. |

| Indiana | Bloomington and Indianapolis extends benefits. |

| Iowa | Iowa City extends benefits and provides a registry. |

| Kansas | Lawrence and Topeka provide a registry. |

| Kentucky | Berea, Covington, and Louisville extends benefits. |

| Louisiana | New Orleans extends benefits. |

| Maine | Portland extends benefits and provides a registry. |

| Maryland | Baltimore, College Park, Hyattsville, Mount Rainier, and Takoma Park extend benefits. |

| Massachusetts | Boston, Brewster, Brookline, Nantucket, Provincetown, and Springfield extend benefits. Boston, Brewster, Brookline, Cambridge, Nantucket, and Northampton provide a registry. |

| Michigan | Ann Arbor, East Lansing, Kalamazoo, Washtenaw County and Wayne County extend benefits. Ann Arbor and East Lansing provide a registry. |

| Minnesota | Crystal, Duluth, Eagan, Eden Prairie, Golden Valley, Maplewood, Minneapolis, Northfield, Richfield, Robbinsdale, Rochester, Saint Paul, Shorewood, and St. Louis Park offer protections. |

| Mississippi | None |

| Missouri | Clayton, Columbia, Kansas City, Olivette, St. Louis, and University City offer protections. |

| Montana | Missoula and Missoula County extend benefits. |

| Nebraska | None |

| Nevada | State extends benefits. |

| New Hampshire | Following the federal legalization of same-sex marriages, all civil unions were converted into marriages. |

| New Jersey | The state extends benefits. |

| New Mexico | Albuquerque and Santa Fe extend benefits. |

| New York | Babylon, East Hampton, Great Neck, Greenburgh, Huntington, North Hills, Southampton, Southold, Brighton, Eastchester, Ithaca, New York City, Rochester, and Westchester County extend benefits. Albany, Ithaca, New York City, and Rochester provide a registry. |

| North Carolina | Chapel Hill extends benefits and provides a registry. Carrboro provides a registry. Buncombe, Mecklenburg, and Orange Counties provide similar protections. |

| North Dakota | None |

| Ohio | Athens, Cincinnati, Cleveland, Cleveland Heights, Columbus, Dayton, Cuyahoga County, Franklin County, Lakewood, Oberlin, Toledo, and Yellow Springs provide a registry. |

| Oklahoma | None |

| Oregon | The state extends benefits. Portland, Benton County, and Multnomah County extend benefits. Ashland provides a registry. |

| Pennsylvania | Allentown, Pittsburgh, Philadelphia, and the borough of State College extends benefits. |

| Rhode Island | Burlington City extends benefits. Following the federal legalization of same-sex marriages, all civil unions were converted into marriages. |

| South Carolina | None |

| Tennessee | Chattanooga, Knoxville, and Nashville-Davidson County extend protections to city employees. |

| Texas | The cities of Austin, Dallas, Fort Worth, San Antonio, and Travis County extend benefits |

| Utah | Salt Lake City offers a mutual commitment registry by which businesses can determine eligibility for benefits. |

| Vermont | The state extends benefits to state employees only Burlington and Middlebury extend benefits. Following the federal legalization of same-sex marriages, all civil unions were converted into marriages. |

| Virginia | Alexandria extends benefits. |

| Washington | The state extends benefits. Olympia, Tumwater, and King County extend benefits. Lacey provides a registry. Seattle extends benefits and provides a registry. |

| West Virginia | None |

| Wisconsin | Madison, Sherwood Hills Village and Dane County extend benefits. Madison and Milwaukee also provide a registry. |

| Wyoming | None |

Can domestic partners receive Social Security benefits?

Some states permit domestic partnerships to help seniors in retaining their social security benefits. In certain states, seniors who have been divorced or widowed may forfeit their entitlement to their former spouse’s social security benefits upon remarriage. Domestic partnerships provide a means for seniors to experience certain advantages of remarriage while still maintaining their social security benefits.

How to calculate imputed tax

Just like their regular pay, this imputed income is taxable income for the employee. You are responsible for calculating the estimated fair market value (FMV) of those health benefits so you can report the additional employee income to the IRS, pay your business’s share of FICA taxes and deduct that expense from your business income.

Note: It’s not required that you withhold federal tax or state income tax. Most companies calculate this amount at the end of the year and report the value of the benefit as income on the employee’s W-2 for that tax year.

So, how do you determine what “fair market value” is?

Unfortunately, the IRS doesn’t offer clear guidance on this subject, so it’s left up to you to figure out. But don’t worry, we’ll give you a head start.

One simple way to do the calculation is to determine the difference between your company’s cost of an employee-only monthly premium and the cost of an employee-plus-one monthly premium. Multiply that number by 12 and you will get your total.

For example:

Employee-only premium

Employee-only premium = $600

Employer pays = $450

Employee pays = $150

Employee-plus-one premium

Employee-plus-one premium = $1250

Employer pays = $937.50

Employee pays = $312.50

Calculation

$937.50 – $450 = $487.50/month

$487.50 x 12 months = $5,850

Paycor can help

If all these calculations are making your head spin, we totally get it. When you partner with a provider who can manage payroll complexities like imputed income, wage garnishment and child support, you can offload the headaches, so you can focus on impacting your bottom line. Talk to Paycor and discover how we can help you remain compliant while giving you back time in your day.