The world of HR is changing rapidly, and nobody knows this more than the leaders of medium and small businesses. We asked them about the increasing importance of learning & development and compensation management, the compliance issues that keep them up at night and how data and automation will change human resources forever.

This infographic is based on The Future of HR survey, conducted by Harris poll on behalf of Paycor. These results were based on conversations with more than 500 C-Suite executives and HR managers/directors at companies ranging from 2 to 999 employees.

The results show how HR is developing, with automation allowing for a greater focus on the bigger picture and learning & development playing a bigger role than ever before.

Compliance remains a big priority, while the C-suite are undecided on the effectiveness of big data.

People Management Areas of Investment

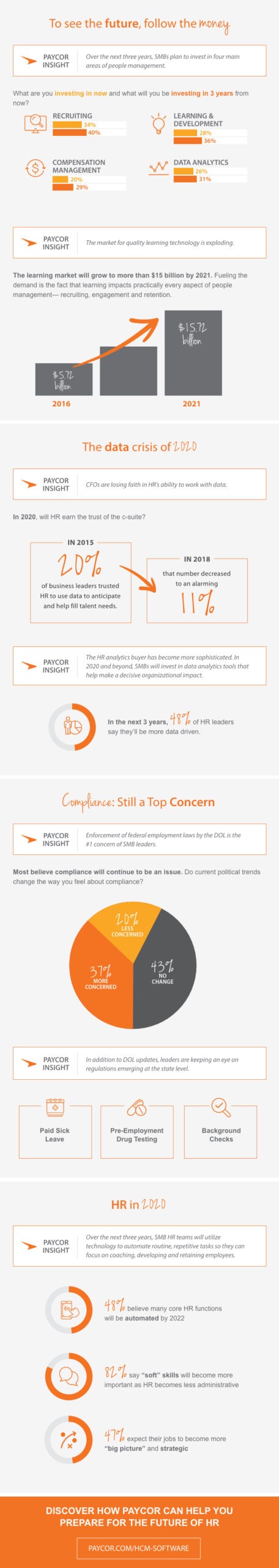

Where are SMBs investing now and where will they invest in 3 years?

Recruiting (34% to 40%)

- Learning & Development (28% to 36%)

- Compensation Management (20% to 29%)

- Data Analytics (26% to 31%)

The Growth of Learning & Development

The learning management market is exploding from $5.72 billion in 2016 to a projected $15.72 billion in 2021. Why? Because it’s central to almost every aspect of people management—recruiting, engagement and retention.

The Decline of Data Confidence

CFOs who trust HR to use to recruit fell from 20% in 2015 to 11% in 2018.

However, 48% of HR leaders still believe that they will be more data driven over the next 3 years.

The Importance of Compliance

The #1 concern for SMB leaders is DOL enforcement of federal employment laws, while 37% of SMB leaders feel more concerned about compliance due to current political trends.

Going into 2020, other potential compliance headaches are:

Automation Will Change Everything

Over the next three years, the human resources leaders at medium and small businesses will use technology to reduce administration, allowing them to focus on coaching, developing and retaining employees.

- 48% believe many core HR functions will be automated by 2022

- 82% think “soft skills” will increase in importance as HR becomes less administrative

- 47% expect their jobs to become more “big picture” and strategic