Year End 2025

Get Ready for Year-End 2025.

Year-end shouldn’t be a stressful time for you and your team. We’ve prepared the resources and information you need to close out the year with confidence.

Reminder: W-2 information will process immediately after your last scheduled check date in 2025.

Act Early!

- Run W2 Preview Report

- Submit Hold Books Open Request

We’ve got the tools that make year-end easy!

Use our training information and helpful resources to close out the year and set up your organization for success in 2025.

October Year End Action Items –

Check out our year-end knowledge guide for an overview of tasks at year end!

Familiarize yourself with our end-of-year tax checklist.

Make sure your contacts are updated!

Request to hold books open by December 6th.

Check out self-paced training on the training hub.

November Year End Action Items –

Verify your W-2 delivery address is up to date!

Keep in mind that W-2s mailed to a PO Box will be shipped via USPS instead of UPS.

When available, the tracking number will be sent to the e-mail address associated with the W-2 delivery address.

Check out the compliance one-stop shop.

Encourage your employees to opt into paperless forms! The deadline to opt in is 12/1.

Run your W-2 preview report and check for any incorrect employee information.

December Year End Action Items –

Check out a step by step guide to ACA filing.

Familiarize yourself with W-2 boxes.

Coming Soon! Our “What’s New In 2025” Infographic.

Run your last payroll of the year by 12/27/24!

Learn about what goes on “behind the scenes” after you submit your last payroll.

January Year End Action Items –

If you have California employees, your ACA filing deadline is 1/10.

Check the status of your tax packets on the W-2 tracking tool.

Begin filing 1099 FIRE process.

Check out our infographic for the most recent payroll and tax compliance updates.

February – April Year End Action Items –

If you have no California employees, your deadline is 2/14 for ACA filing.

2025-26 Key Dates and Resources

October:

If you haven’t done so already, run your W-2 Preview report.

November 27 – 28:

Paycor is closed for Thanksgiving Holiday. See processing schedule.

December 1:

Deadline to opt-in to paperless Form W-2

December 5:

Deadline to alert Paycor to hold books open until 12/31/25

December 22:

ACA Review and File Button available

December 25:

Paycor is closed for Christmas. See processing schedule.

December 29:

Deadline to process final payroll check of the year

January 1:

Paycor is closed for New Year’s Day. See processing schedule.

January 12:

Status tracker for Tax Packets, 1099s, and W2s open

January 14:

Deadline to submit California ACA/1095C forms

February 27:

Deadline to submit non-California ACA/1095C forms

CPA Resources

Get Reporting Access for Mutual Clients

Request access to client reports by filling out this form.

We’re Here to Help

For any questions, please contact our Support team at 855-565-3285. Should you need additional assistance or reporting access for a specific client, you can reach us at [email protected].

Have Questions about Year-End?

Download our CPA Year-End Kit to learn about important dates and deadlines as well as detailed instructions to help you out with year-end.

Year-End Readiness

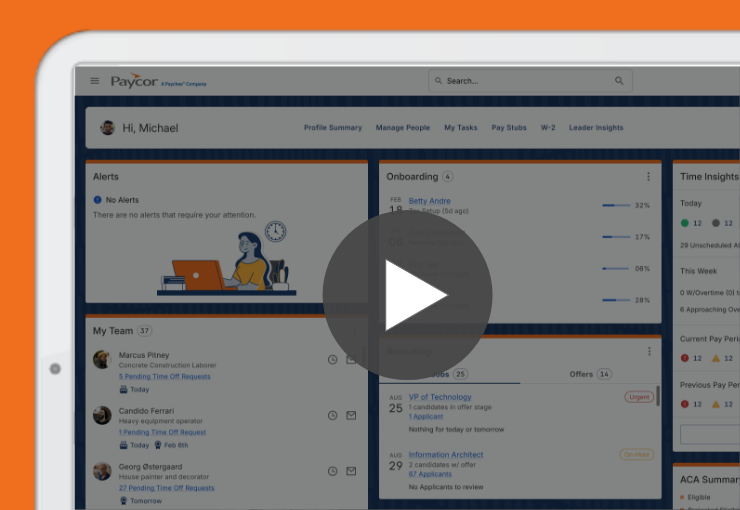

Run W2 Preview Report

Run this report as early as possible to catch errors and prevent W2Cs.

Review Tax Checklist

Complete this End-of-Year Tax Checklist to make sure you haven’t missed anything.

ACA Filing 101

Everything you need to know about ACA and reporting.

Technical Account Manager Consulting Services

Looking for additional guidance? Our Technical Account Managers offer a variety of consulting opportunities to help you achieve your business needs.

Year-End Training

Check out helpful videos in Paycor Knowledge for all things year end!

Stay Up-to-Date on Miscellaneous Fees

Visit this page to access year-end fees—and other miscellaneous fees

2025 Federal Bill Updates

Bookmark this article for the latest information on the 2025 Federal Budget Bill and how it impacts your year-end processes.

Third Party Sick Pay Set-Up

Reference this article to follow steps for 3PS set-up.

End-of-Year Pay Run Dates

Refer to this chart for dates to process payroll based on Paycor holiday closures.

Level Up for 2026: Tools to Win the Year

Cut Hiring Costs with WOTC

Save up to $9,600 per eligible hire with automated WOTC screening powered by Paycor + Equifax. Boost DEI and reduce turnover—without extra effort.

Fast, Compliant Hiring Starts Here

Add AssureHire background checks to Paycor Onboarding for quick, secure screening.

Personalized HR Support, Real Results

Discover dedicated HR partners, safety experts, and wellness tools—all in one place.

Featured Resources

The HR COE is an action plan based on Paycor’s proprietary data and research. Think of it as your roadmap to achieving HR excellence in talent management, workforce management, benefits and the employee experience.

Article

Read Time: 1 min

Employee Letter of Recommendation Template [Free + Downloadable]

Need to write an employee recommendation letter? Download and use our customizable, free letter of recommendation template for employees.

Article

Read Time: 19 min

What is Recruitment Automation? Process, Benefits, & Ideas

Ready to automate the recruitment process? Learn recruitment automation is, including the process, benefits, and workflow of recruiting automation.

Article

Read Time: 16 min

How to Develop a Talent Acquisition Strategy [2026]

What is a talent acquisition strategy, exactly?Here’s what you need to know, including how to develop a talent acquisition strategy that works in 2026.

Article

Read Time: 19 min

The 5 Steps of a Successful Hiring Process

Want to know how a hiring process works? Learn about and use these 5 hiring process steps to design your recruiting and hiring procedures.

Paycor Support Center

Unable to find the answers you need here? Navigate to our expanded knowledge base for additional resources for you and your employees. Most answers to your urgent requests can be found in our Get Help section.