Employee benefits administration is the process of creating, managing, and updating an organization’s employee benefits program. Benefits administration typically falls under the responsibility of human resources and involves managing health insurance, retirement accounts, vacations, paid time off, and parental leave.

Providing employees with the right mix of voluntary and mandatory benefits is critical to attracting and retaining talent and creating engaged employees. 54% of workers polled by Gallup rate increased pay or improved benefits as very important to consider in a new job.

To reverse the stat, pay and benefits was also the single most common reason employees left jobs in 2024. Employees are less likely to look for another job when benefits fit their needs. Better benefits reduce stress and offer peace of mind that both the individual and their family is covered in case of emergency. With less stress, employee engagement and satisfaction increases.

For effective employee benefits planning, organizations often start by determining what kind of insurance coverage and copays the organization will offer, defining the budget, and selecting vendors. HR personnel are then tasked with enrolling new employees via open enrollment and administering the employee benefits management process.

What Does a Benefits Administrator Do?

A benefits administrator, sometimes called a group benefits administrator, is the person responsible for overseeing a company’s benefits programs. This includes planning and administering benefits for the organization.

Typically, this person works within a company’s human resources department and is responsible for ensuring the well-being and satisfaction of employees within an organization by managing benefits such as health, dental, vision, disability, and life insurance, as well as retirement plans and flexible spending accounts.

The tasks of benefits administrators often orbit around the open enrollment process, which is the employer-selected period of time when employees can choose or change their selected benefit option. The benefits administrator also ensures the employee benefits management process is a seamless one by helping to institute education programs, self-service benefits tools, or choosing a benefits administration solution.

In addition, a benefits administrator must ensure compliance with government regulations and have a strong understanding of plan designs, contract language, and the current competitive trends in benefits programs.

RELATED: [Webinar] Benefits Compliance, Simplified

The Importance of Employee Benefits

Believe it or not, your benefits package can have a serious impact on your ability to recruit, engage, and retain talent. That’s why selecting the right benefits package is one of the most important things you’ll do for your employees over the life of your business. Choose the right benefits and your employees might never want to leave. Offer the wrong ones… you might as well install a revolving door.

And benefits doesn’t just refer to health and dental. With multiple generations in the workplace, it’s crucial to offer a wide range of unique benefits to appeal to the diverse workforce. Ideas include flexible time, flexible savings accounts for childcare, caregiver support benefits, student loan repayment assistance, pet insurance, and mental health support.

RELATED: Read our guide and learn how to reduce turnover with employee benefits.

Long story short: Choose your benefits wisely.

Unfortunately, selecting the right benefits mix is not a “cut and paste” proposition, as there is no one-size-fits-all solution. Your workforce is diverse, so your employees will need and want different options.

The 4 Basic Employee Benefits Every Employer Should Offer

So, we’ve established that benefits matter, but which benefits should you offer? At the foundation, employees want benefits that cover their healthcare expenses and future retirement funds. This includes:

1. Health Insurance

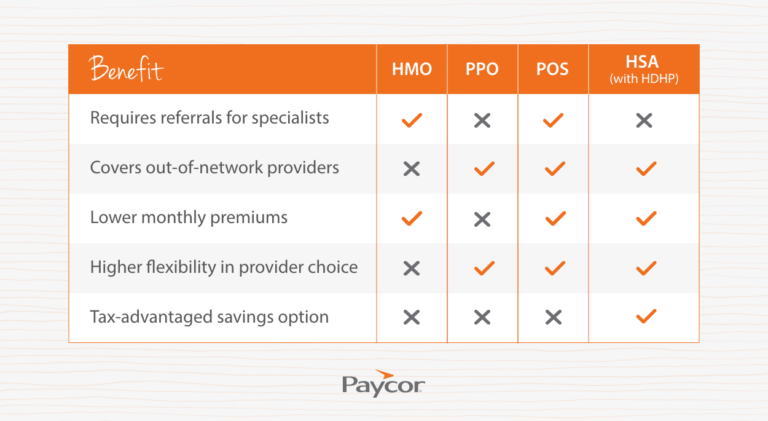

Health insurance is your bread and butter. In fact, it’s the single benefit that, taken by itself, might attract or scare off potential hires. Although required by law for employers with more than 50 full-time equivalent employees, each company might elect to include or exclude certain coverages. Looking to add or switch providers? You typically have four options: Health Maintenance Organization (HMO), Preferred Provider Organization (PPO), Point of Service (POS), and Health Savings Account (HSA).

For employers, the choice often comes down to cost control versus providing competitive benefits. HMO and POS plans tend to be more affordable but limit provider flexibility, while PPO plans offer more freedom at a higher cost. HSAs can be a great way to share financial responsibility with employees while providing tax advantages. The right mix depends on your workforce’s needs and budget.

2. Dental Insurance

In fully-funded employer plans, the business covers 100% of employees’ costs. In partially-funded employer plans, the business shares the costs with its employees (most of the time in the ballpark of an 80/20 employer/employee split.) In fully-funded employee plans, employees pay the entire cost of their dental insurance while the business pays the payroll deductions and administrative costs.

3. Flexible Spending Accounts (FSAs)

FSAs allow employees to save pre-tax income to cover basic medical expenses. Employees love this option because FSAs can be used for copayments, coinsurance, deductibles, prescription medications, and dental and vision care. FSAs fund or enable employees to carry over $500 each year.

4. 401(K)s

Working Americans are struggling to save 10-20% of their paychecks. In fact, 1/5 of Americans don’t save any of their annual income at all, according to CNBC. If your company can offer a benefit like a 401(k) with an employer match, it can be a valuable tool for recruiting and retaining talent.

Unique Employee Benefits To Stand Out in a Competitive Market

Keep in mind that most of your competitors also have these benefits. So to stand out from the crowd you need to design your benefits plan to be inclusive of a diverse workforce by offering traditional and non-traditional types of benefits. Non-traditional benefits that most employees appreciate include perks such as student-loan repayment programs, paid time off to volunteer, caregiver support, paid gym memberships, or financial wellness resources.

Nontraditional benefits are on the rise, according to HR Dive’s Identity of HR survey. Employers should consider emerging offerings that address evolving employee needs, such as fertility benefits, pet insurance, and sabbaticals.

Some other popular non-traditional benefit offerings include:

- Flex schedules

- Remote work opportunities

- Financial wellness resources and tools

- Discounts or free tickets to local attractions and events

- Mental health wellness programs

- Family planning support

- Unlimited PTO

How HR Leaders Can Improve Employee Benefits Administration

If you’re not new to employee benefits, you know there is always room for improvement. If you’re curious about where to start on improving your current employee benefits management process, we’ve got a few tips for you.

- Conduct a benefits needs assessment: Assess the current benefits plan and identify what improvements or changes need to be made. Review benefits utilization, employee feedback, and benchmarking data.

- Get your employees talking: Chances are most of your employees already know what they want or would like to see, they just need a forum to share what’s on their mind. Taking the time to stop and listen to your employees could prove to be an eye-opening experience.

- Educate employees on benefits plans: According to an Equitable study, more than half of workers regret their open enrollment decisions. You can prevent this by communicating benefits offerings clearly and consistently to employees, including during the onboarding process, open enrollment, and throughout the year. Offer multiple channels of communication for open enrollment support, such as newsletters, company intranet, and social media to ensure everyone is informed.

- Measure and track the effectiveness of the benefits program: Regularly measure and track the effectiveness of the benefits program to ensure it’s meeting its goals, such as increasing employee satisfaction, attracting top talent, and improving retention rates.

- Provide employees with education and training: Don’t stop at simply offering the benefit. Also offer employee training on how to best utilize benefits, such as retirement planning, financial wellness, and how to maximize healthcare benefits.

- Leverage technology: Use benefits administration technology to streamline processes, reduce errors, and increase efficiencies. Additionally, offer digital access to benefits information and provide tools for employees to manage their benefits more effectively.

Wondering how your current benefits plan stacks up against the marketplace? Take our benefits benchmark quiz.

Choosing the Best Benefits Administration Software: 7 Features To Look For

Simply put, finding the right HR benefits technology will significantly improve your work life. But deciding which benefits management software you want to implement can quickly become overwhelming. From ACA and rising healthcare costs to open enrollment and plan selection, employers are faced with a lot of decisions.

1. Streamlined Open Enrollment

Open enrollment is a major challenge for HR professionals and employees. It’s often time-consuming, inefficient, and confusing for employees, leading them to make poor and costly benefit selections.

It happens every year, but there’s a way to reduce your headaches if you’re still using manual open enrollment. Go paperless. The best benefit software platform will automate open enrollment, giving you back time to focus on HR strategy and workforce planning. Instead of employees asking you the same old questions about what’s available and how much it will cost, they can check out their options and learn about plan specifics online.

2. Everything in the Same Place

When you’re comparing apples to oranges during your search for the perfect benefits solution, it’s important to ask each provider where the employee data is stored. If the answer is, “It’s stored in a couple different databases,” show them the door.

Entering the same data into multiple databases can be dangerously error-prone, not to mention terribly time-consuming. The best solution should offer a single database that houses all of your open enrollment and benefits data and documentation. Having mobile device capability is also an important feature. The more information your employees have at their fingertips, the fewer questions you’ll have to spend your precious time answering.

3. Trust the Numbers

Having a benefits system is important but it’s not enough. To maximize the value of your offerings, you’ll need a provider that can track data on plan choices, the number of workers who have enrolled, and more. When you know which benefit packages your employees truly want, you’ll ensure you’re getting the biggest bang for your buck by avoiding costly, underutilized offerings.

4. Communication is Key

Ask your employees one simple question: “What’s missing from your current benefits program?” You might find that poor employee education and lack of communication are a recurring theme.

With so many options to choose from, employees can easily become overwhelmed and just keep the same plan year after year simply because that’s the easiest option. A consistent year-round communications program to help employees understand the benefit choices they have and the value they get will go far. If your provider offers communications consultation or even manages communications for your company, even better!

5. Decision Support Tools

Find a benefits administration solution that offers interactive decision support functionality to help employees make knowledgeable and personalized choices. The tool should have the capability to ask questions about impending medical procedures or important life events, such as a new baby on the way. Depending on the answers, the support tool will recommend a plan customized to the employee’s situation. Decision support tools help everyone: Employees get the education they need, and HR is relieved of the seemingly endless barrage of employee questions.

6. Connect to Carriers

You shouldn’t have to manually enter benefits elections and employee updates. A solution that offers carrier connect services can directly send and receive data between your benefits platform and your insurance provider, which significantly eliminates repetitive manual work.

7. Protect Employee Data

Hackers love getting their hands on employee data. Think about all of the information you have in your systems: Full names, addresses, bank account and Social Security numbers. All of this is data a hacker can easily use for identity theft. You need to ensure the provider you select uses multi-factor authentication, when data is idle and in transit. Your supplier should also have a dedicated risk assessment team focused on cybersecurity.

Paycor offers robust data protection with full redundancy and live backups for reliability. Encryption secures data against physical and cybersecurity threats. Our dedicated risk assessment team remains hard at work keeping your company data secure.

Choosing a benefits administration provider isn’t a simple task but knowing what to look for can improve your chance of finding the right solution for your business. See how Paycor’s Benefits Advisor transforms open enrollment and simplifies the complexity of benefits with automated workflows, reporting, and more.

How Paycor Helps

If you’re struggling to keep up with the ever-changing market of benefits plans or you’re looking for a partner to support your needs, we’d love to help. Paycor benefits administration software helps businesses of all sizes with benefit plans and HR solutions, offering trusted guidance to a sometimes-overwhelming process.

Ready to level up your benefits management game? Take a free guided product tour to learn more.