DOL Overtime Rule

The Department of Labor requires some employees receive overtime pay if they work more than 40 hours in a workweek. Here’s what you need to know.

The DOL’s Overtime Rule

The Department of Labor’s Fair Labor Standards Act (FLSA) requires employers to pay employees overtime if they work more than 40 hours in a workweek. The overtime rate is 1.5 times the employee’s regular pay rate. While this is a federal standard, there are exceptions and different types of overtime requirements that can vary by city and state.

Also, the law doesn’t require overtime pay for everyone. Some workers, especially those in executive, administrative, and professional roles (EAP), often called “white-collar” workers, can be exempt. To be exempt, an employee needs to meet three basic requirements:

Their salary must be above a certain minimum amount (currently $35,568)

They must get a fixed weekly salary that doesn’t change based on how much or how well they work

Their main job duties must involve executive, administrative, or professional work

Recent Court Rulings

In 2024, the DOL issued regulations that would’ve raised the salary threshold for exemption and automatically updated the threshold every three years. But a Texas federal judge vacated the 2024 Overtime Rule saying the agency exceeded its authority and thus re-established the salary threshold at the 2019 level of $35,568 per year ($684/week). EAP employees are considered exempt and not eligible for overtime pay if their salary is higher than the threshold.

How Paycor Helps

Paycor’s Department of Labor solution offers you real-time compensation, timekeeping and reporting through one unified solution. You can also use our HR Support Center solution to update your handbooks and company policies, or even get help from a certified HR professional. With our Department of Labor Solution, you get:

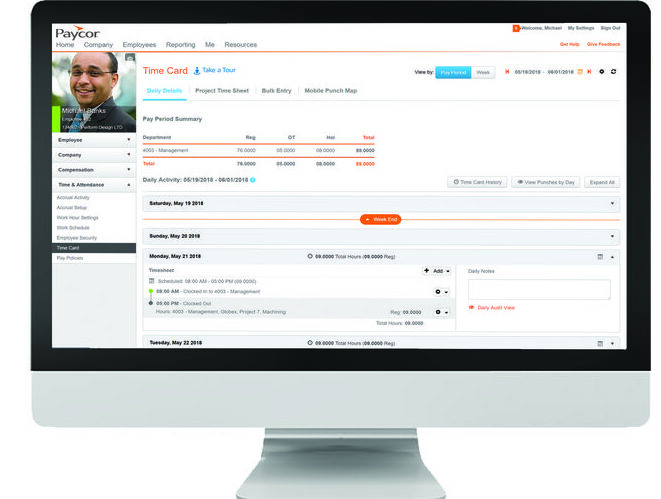

Time & Attendance

Paycor’s time solutions help you accurately manage your employee’s hours through a unified system with payroll. Employers need a time solution put in place for their affected employees, so they have the accuracy, decision support, and audit trail required to effectively handle this proposed regulation.

Reporting

Employers will need to track and report data related to hours worked and compensation regularly. Paycor’s Reporting and Analytics help you get the data you need and allows you to report on compensation and hours worked data together. No need to download multiple files and copy and paste reports. Just a few clicks and you’ll have the data you need.

HR Support

Paycor’s HR Support Center will help you ensure your have up-to-date policies and employee documentation related to these updates. You can upgrade to On Demand and get help from a Certified HR Professional whenever you need it. It’s like hiring an HR team at a fraction of the cost.

This information is not intended as legal advice. You should seek specific legal advice before acting with regard to the subjects mentioned herein. Any calculations contained herein are for example purposes only.

Resources

Explore our resource center to uncover articles, guides, webinars, infographics and more — all designed to help healthcare leaders unlock the true power of HR.

On-Demand Webinar

The DOL’s Final Overtime Rule: What It Means to You

The U.S. Department of Labor (DOL) released their final rule, updating the Fair Labor Standards Act (FLSA)’s overtime pay requirements. The rule increases the minimum salary threshold to $43,888 on July 1, 2024, and then to $58,656 on January 1, 2025.

Guides + White Papers

Read Time: 0 min

The DOL’s Overtime Rule: Quickstart Guide for Employers

Do you know which employees are eligible for overtime pay? Get our quickstart guide to find out!

See How the Right Technology and Expertise Can Help You Make a Difference

Tell us a little about your organization and what you want to accomplish, and we’ll recommend a custom solution in just a few minutes.

Contact Us

We’re here to help. Talk to us today!