Many employers and HR departments grossly underestimate the time it takes to process payroll or do not know how to process payroll efficiently. With tax calculations, tax filing, and fund allocation, the time to process payroll for some employers can add up quickly. The reality: payroll is too time intensive and complicated (especially if your business has locations in more than one state) to do without help.

In addition, understanding payroll processing is vital to ensure your business continues to thrive. If done incorrectly, you could find yourself facing costly fines, legal issues, upset employees, and a reputation-damaging fallout.

The good news is payroll software can help businesses automate payroll processes, prevent compliance headaches, and ensure you don’t pay employees incorrectly. (If you are ever confused about any of the terms used, check out our handy payroll glossary.)

What is Payroll Processing?

Payroll processing is the calculation, management, and disbursement of employee wages. This process involves collecting employee time and attendance data, calculating wages based on hours worked and wage rates of each individual employee, preparing payroll tax forms, distributing paychecks to employees, and remitting payroll taxes to the government on behalf of the employer.

Before You Can Process Payroll

Paying your team shouldn’t be a hassle. A payroll processing solution can make it easier to ensure everyone is getting paid quickly and correctly, saving time and avoiding costly mistakes.

Before you can process payroll, you must obtain the vital trio of tax identification numbers:

- Employer Identification Number (EIN)

- State/Local Tax ID

- State Unemployment ID

Businesses can obtain an EIN from the IRS, while state and local tax IDs, as well as state unemployment IDs, are issued by the respective state tax agencies and labor departments. Registration is typically done online through state government portals.

In addition to tax IDs, businesses must correctly classify workers as employees or independent contractors to comply with tax and labor laws. Employers also need to follow state wage laws, including minimum wage requirements, overtime rules, and payday regulations, which vary by state.

How to Process Payroll in 9 Easy Steps

Follow these steps for seamless payroll processing:

1. Choose the Right Pay Schedule

A payroll schedule can have a significant impact on an employee’s financial health and overall job satisfaction, making it an important factor for employers to consider. The most common pay schedule options are biweekly, semi-monthly, or monthly.

Here are 10 things to know about pay periods.

Biweekly pay schedules mean that an employee will be paid every two weeks and are often used in organizations with a higher turnover rate, as it can reduce the administrative burden of tracking vacation days and personal time off.

Bureau of Labor Statistics data shows biweekly is the most commonly used pay structure, and more frequently used in the education, health services, and leisure and hospitality industries.

| Pros of biweekly pay schedules | Cons of biweekly pay schedules |

| Consistent pay dates for easier budgetingLower administrative burden than weekly pay Standard for overtime calculations | Three-paycheck months can complicate budgeting Pay periods may not align with month-end Higher processing costs than monthly schedule |

Semi-monthly pay schedules involve paying employees twice a month on specific dates, typically the 15th and the last day of the month. This may be beneficial for employers who want to make sure employees are paid consistently, as well as for those in industries where payroll taxes are significantly higher when paid out on a monthly basis.

This type of pay arrangement is common in professional services industries like consulting and accounting firms, as well as in government agencies. These industries often have more salaried employees and stable workforces, making the fixed payment dates of semi-monthly schedules align well with their operational needs.

| Pros of semi-monthly pay schedules | Cons of semi-monthly pay schedules |

| Simpler accounting since pay periods match monthly reporting cycles Lower administrative costs due to fewer payroll runs than biweekly More predictable cash flow for both employer and employees | Initial setup can be complex for payroll systems Holidays and weekends can affect scheduled pay dates Less frequent pay than biweekly may impact employee cash flow |

Monthly pay schedules mean that an employee is paid only once per month, typically at the same time each month. This type of payroll schedule may be beneficial for employers who can accurately estimate the number of hours each employee works on a consistent basis.

BLS data shows monthly is the least used type of payment schedule. The industry that uses the payment schedule the most is financial services, at 18%.

When deciding on a pay schedule, companies should consider their budget and the potential benefits to employees. Different types of pay schedules may be more advantageous for different types of employees, so it’s important to assess the needs of each employee and decide on a payment schedule that best fits their situation.

Additionally, employers should make sure they comply with all applicable laws and regulations when setting up their pay schedules.

Make it easy with Paycor’s free downloadable 2026 payment calendar templates.

How Paycor Helps

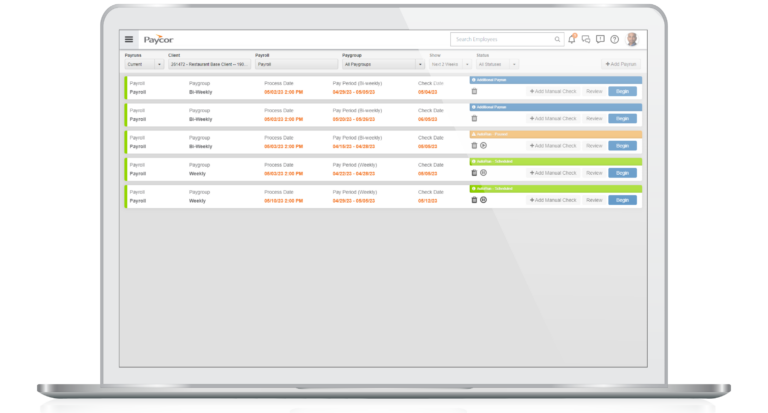

Paycor understands the importance of payroll. Our streamlined process saves you precious time and energy each pay cycle by setting up future pay runs in advance.

2. Set Up Organizational Structure

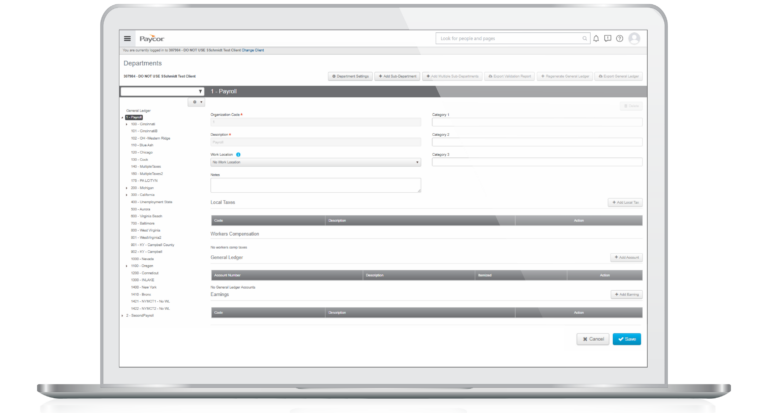

Keeping financial records is an essential part of running any organization. Setting up general ledger accounts will give you a clearer picture of where your company’s money goes and why—regardless if payrolls are processed manually or with payroll software. In addition, general ledger accounts provide accurate financial reporting and a detailed audit trail that can be invaluable during tax audits, payroll audits, or financial reviews.

Next, it’s key to have the right framework in place. Divide departments according to location for optimal efficiency and payroll compliance—especially with different tax regulations and withholding requirements involved when crossing state lines.

Ensure you clearly map out earning codes specifying different pay rates for various job roles and circumstances. In addition to paying, setting up your organizational structure means you need to list all deductions, like benefits plans and 401(k) contributions.

The final building block of your company structure is to list all taxes and withholdings, from the local to the federal level. Any tax credits should also be included.

How Paycor Helps

Paycor takes the guesswork out of complicated business processes by setting up clients with everything they need during implementation. Plus, we provide a pre-built list of earnings codes, deductions, and taxes so our clients don’t have to start from scratch.

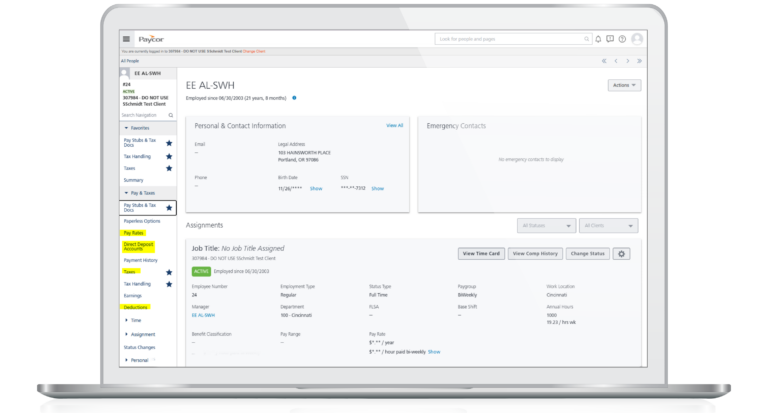

3. Add and Maintain Employee Pay Information

Once the foundation is in place and your team’s structure solidified, it’s time to make everyone feel appreciated. Setting up payroll for individual employees is a crucial component of establishing a successful organizational structure. Get started by determining and implementing the appropriate pay rates based on levels of expertise, seniority, and experience, ensuring fair compensation for each employee.

Make sure to factor in employee benefits and deductions like 401(k), insurance, and more. Common deductions include health insurance premiums, dental and vision coverage, Health Savings Account (HSA) contributions, Flexible Spending Account (FSA) contributions, life insurance premiums, and short-term disability insurance. Taking the guesswork out of this process can help ensure everyone gets their just rewards.

Lastly, you need to calculate all employee taxes and withholdings. This includes federal income tax and federal unemployment tax to state and local tax and more.

Here’s a basic example:

| Item | Amount |

| Gross Pay | $5,000.00 |

| Pre-tax Deductions | |

| Health Insurance | -$350.00 |

| Dental Insurance | -$45.00 |

| Vision Insurance | -$20.00 |

| 401(k) Contribution (6%) | -$300.00 |

| HSA Contribution | -$100.00 |

| Tax Withholdings | |

| Federal Income Tax | -$650.00 |

| State Income Tax | -$250.00 |

| Social Security | -$310.00 |

| Medicare | -$72.50 |

| Post-tax Deductions | |

| Life Insurance | -$25.00 |

| Long-term Disability | -$35.00 |

| Net Pay | $2,842.50 |

How Paycor Helps

Paycor takes care of deductions, taxes, and withholdings so your staff can breathe easy knowing their wages are accurate. Our software provides in-product compliance updates and notifies you of key tax changes to help employers save time and reduce errors.

4. Collect and Verify Employee Information

To ensure your team is paid accurately and promptly, here are the necessary documents to process payroll for your business payroll software.

- W-4

- Applicable state withholding certificates (in addition to the federal W-4)

- W-9 (for independent contractors)

- I-9

- Employee addresses

- Social Security Numbers (SSNs)

- Bank information (if using direct deposit)

- Workers’ Compensation ID Number (in certain states)

- Medical insurance forms

- Retirement plan documents

- Businesses planning to process payroll manually should also consult the IRS’s Publication 15 (Circular E) for all tax responsibilities.

How Paycor Helps

Because Paycor is also an HR Information System (HRIS), Paycor eliminates the hassles of document collection and storage. Additionally, Paycor is SOC2 compliant and secure.

5. Calculate Employee Hours

When it comes to payroll, an ever-changing variable is the number of hours your employees have worked. Knowing this information will be key in getting started and successfully processing each cycle.

Fortunately, many HR software systems connect scheduling and timekeeping tools so you don’t have to manually calculate hours in each run. In addition, they stay on top of federal and state laws regarding overtime tracking and payment.

How Paycor Helps

If you use Paycor Time & Attendance software, you’ll avoid having to manually calculate employee hours or fidgeting with salaried employees’ wages. Instead, simply import timesheets from their time card, and you’re all set.

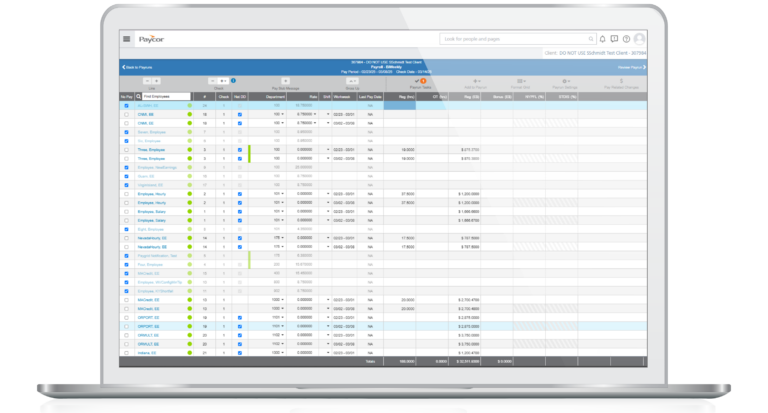

This is also an opportunity to make necessary changes to an employee’s earnings for this pay period. This means editing employee hours, configuring earnings, and deductions, or making one-time additions like bonuses, commissions, or expense reimbursements.

6. Review Your Payroll for Accuracy

You’re almost ready to start your pay run. With manual calculations, you’ll need some luck on your side in order for things to add up perfectly.

The most important numbers to know are employees’ net pay (their gross pay minus all necessary deductions, taxes, and withholdings) and the company’s total cash requirements (cash requirement, employee tax liability, and employer tax liability).

Common payroll mistakes to avoid include:

- Misclassifying employees as exempt or non-exempt, leading to incorrect overtime calculations

- Incorrect tax withholding rates or outdated W-4 information

- Missing or incorrect deductions for benefits and garnishments

- Using the wrong pay period dates for calculations

- Failing to account for paid time off or leave adjustments

How Paycor Helps

Thanks to automated calculations, there’s no need to worry about messing up the numbers. Plus, you can easily establish boundaries so any mistakes are quickly identified.

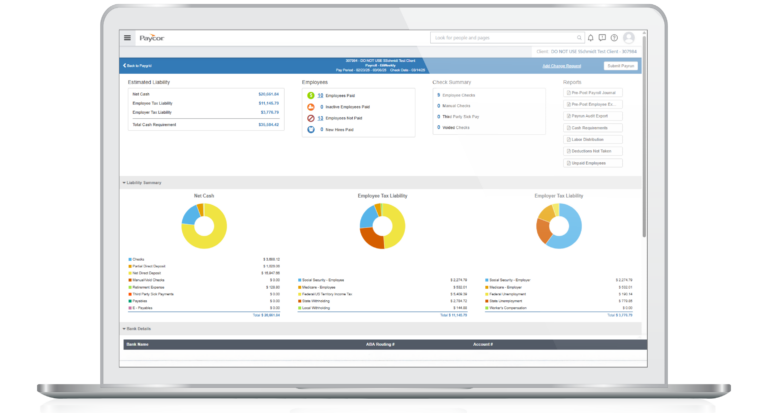

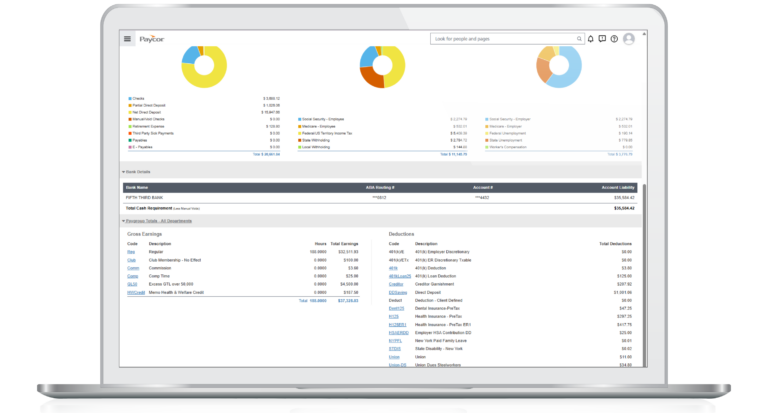

Streamline your payroll processes with our easy-to-use dashboard, which offers all the data you need to quickly and accurately review top-level figures with our payroll software.

7. Run Payroll Reports

If you’re in the know about your finances, then you understand more than a mere overview is needed to truly uncover what’s going on. Generating payroll reports from manual payroll systems can be quite tedious and time-consuming. But if that process gets streamlined with automation, it could reveal all sorts of hidden insights for better decision-making.

For example, regular overtime reports help track labor law compliance and identify departments that consistently exceed standard hours, which may indicate understaffing or inefficient processes. Labor cost distribution reports break down payroll expenses by department, location, or project, enabling more accurate budget forecasting and resource allocation.

How Paycor Helps

Paycor offers a variety of instant reports (and analytics) for those who want to dig deep into the numbers and make sure that every detail is correct. The following reports are available at the click of a button:

- Net cash totals

- Employee tax withholding totals (covering Social Security, Medicare, and federal, state and local taxes)

- Employer tax liability totals (covering Social Security, Medicare, COBRA premium assistance, federal unemployment, state unemployment, workers’ compensation and local liability)

- Pay group totals

- Pre-post payroll journal

- Additional pre-post reports (on labor distribution, cash requirement, deductions not taken, unpaid employees, and pay run export audit)

8. Deliver Employee Pay

When payday arrives, it’s time to get the financial operations going in full swing – from printing and mailing checks, sending direct deposits, taking care of taxes, and withholding monies due.

Note: Banks need 48 hours to complete direct deposits so you’ll want to process pay runs at least two business days in advance of the check date. Lastly, some states require employees to be given a physical pay stub.

For employees without traditional bank accounts, employers can offer payroll cards (similar to debit cards) that are automatically loaded each pay period. Another option is to provide pay through digital payment platforms that don’t require traditional bank accounts, though employers must ensure these methods comply with state wage payment laws and don’t burden employees with excessive fees.

How Paycor Helps

With Paycor, you can simply click submit and let us take care of the rest. We provide full-page pay stubs along with direct mailing services, plus a garnishment processing system to make sure all your paperwork is taken care of. Feel secure knowing that when it comes to dealing with payroll we’ve got it covered.

9. Maintain Payroll Records for Compliance

Congratulations! You’ve accomplished an important payroll task, but there are still a few more steps before you can rest. To prove your work to the Department of Labor (DOL), and stay compliant with various state laws, make sure to carefully track things like hours worked per week, overtime hours accrued by salaried employees or hourly employees, and their wages.

The Fair Labor Standards Act (FLSA) requires employers to keep payroll records for at least three years, while records used to compute wages (time cards, work schedules, etc.) must be kept for two years. Many employers opt to maintain both digital and physical copies of crucial payroll documents, with digital records stored in secure, backed-up systems and physical records kept in fireproof storage. It’s also important to establish a clear document retention and disposal policy that complies with state-specific requirements, as some states mandate longer retention periods than federal law.

Manual vs. Automated Payroll Processing: Which is Right for You?

Some companies may outsource their payroll processing or work with payroll service providers. However, payroll processing is typically done in one of two ways: manually or automated.

Manual payroll is the traditional method of payroll processing, where an accountant or human resources staff member manually inputs employee information, hours worked, hourly rate, and other pertinent information into a spreadsheet or database. This type of payroll processing is time-consuming and prone to errors, so more and more businesses are starting to automate payroll with payroll automation software solutions.

Paycor is Here to Help You Run Payroll

Paycor builds HR software for leaders. For 30+ years, we’ve been listening to and partnering with business leaders, so we know what they need: HR technology that saves time, powerful analytics, and expert HR advice to help them solve problems and achieve their goals. Discover the Paycor difference.

Running Payroll FAQs

Read on for quick answers to frequently asked questions regarding payroll processing.

How Do You Run Payroll Efficiently?

Effective payroll processing starts with proper preparation, including organized employee records, standardized time tracking, and clear processing procedures.

How Long Does It Take to Process Payroll?

This depends largely on the company’s size and complexity. It can take several hours to days each pay period if conducted manually. Automating the process with payroll software reduces the time it takes to mere minutes.

What Does Full-Cycle Payroll Processing Mean?

The length of a payroll cycle varies depending on the type of organization. Some organizations may have weekly or bi-weekly pay cycles, while others may have monthly or quarterly cycles. Payroll systems also involve a variety of processes and procedures that need to be followed during this time.

These include employees properly logging their time, calculating gross pay, factoring in any payroll deductions, and then delivering their net pay through a paper check or direct deposit. Once the calculations are complete, taxes and deductions must be calculated and taken out, including Social Security, Medicare, federal payroll taxes, state income taxes, FICA, and any other deductions that are required by law. The remaining balance is the employee’s net pay for the period.

What Does End-to-End Payroll Processing Mean?

End-to-end payroll processing offers organizations a more streamlined and efficient way to manage their employee life cycles. With an integrated approach, it’s possible to connect payroll data with other personnel management elements like performance tracking, benefits administration, training programs, and worker scheduling—ultimately creating improved communication between employers and employees as well as enhancing recordkeeping capabilities while providing deeper analytical insights into workforce operations.